When choosing trade credit insurance, your decision boils down to two main options: Whole Turnover Insurance or Single Buyer Insurance. Here’s the quick takeaway:

- Whole Turnover Insurance covers most or all of your customers, spreading risk across your entire client base. It’s cost-effective (typically under 1% of insured sales) and ideal for businesses with diverse revenue streams.

- Single Buyer Insurance focuses on protecting against non-payment from one specific customer. It’s tailored for businesses heavily reliant on a single client or contract, though it comes with higher premiums.

Key Differences:

- Whole Turnover: Lower cost, broader protection, more admin work.

- Single Buyer: Targeted risk coverage, higher premiums, less ongoing management.

For diversified businesses, Whole Turnover Insurance makes sense. If one client dominates your revenue, Single Buyer Insurance is the safer choice.

Whole Turnover Trade Credit Insurance

How Whole Turnover Policies Work

Whole turnover trade credit insurance covers most – or all – of your credit sales, rather than focusing on specific accounts. When you opt for this type of policy, the insurer assigns credit limits for your customers and keeps a close eye on their financial health. This coverage typically protects against commercial risks like customer insolvency, bankruptcy, or long-term payment delays (known as protracted default, when invoices go unpaid after a specified waiting period). For U.S. exporters, it often extends to political risks, such as currency conversion problems or government actions that block payments.

If a claim is made, and after the required waiting period and reporting steps are completed, the insurer reimburses between 90% and 100% of the loss.

Benefits of Whole Turnover Coverage

One of the biggest advantages of whole turnover coverage is how it spreads risk across multiple customers. This diversification often makes these policies more affordable, typically costing less than 1% of insured sales. In some export programs, the cost ranges from $0.55 to $1.35 for every $100 of invoice value. This affordability makes it a practical option, even for mid-sized businesses in the U.S.

Beyond loss protection, these policies can help shape smarter credit decisions by supporting competitive payment terms. Additionally, insured receivables are seen as stronger collateral by banks. This can significantly improve borrowing terms, with advance rates on receivables rising to as much as 90% for both domestic and export sales. Without coverage, advance rates might only reach 70–80%, or even drop to 0% for exports. For businesses looking to secure working capital for growth, this enhanced financing potential can be a game-changer.

Drawbacks and Best Fit Scenarios

Whole turnover policies aren’t ideal for every business. Insurers often require minimum annual turnover or premium commitments, which can put this option out of reach for very small companies. Another consideration is the need for ongoing compliance – businesses must regularly report sales data and flag overdue accounts. Failing to meet these requirements can jeopardize claims.

This type of coverage works best for manufacturers, distributors, and wholesalers who sell on open account terms to a wide range of B2B customers. It’s particularly effective when no single buyer represents a large share of revenue. U.S. exporters operating in various international markets also benefit, as the policy combines protection against both commercial and political risks. If your business has a diverse customer base where no single client dominates sales, whole turnover coverage provides broad protection at a competitive cost.

For more information, resources like CreditInsurance.com offer helpful tools to assess whether your revenue distribution and customer base are a good match for this approach. Up next, we’ll explore single buyer policies to see how they handle risk differently.

Single Buyer Trade Credit Insurance

How Single Buyer Policies Work

Single buyer insurance is designed to protect businesses from the risk of default by a specific customer or contract. This type of policy is particularly helpful when a single account makes up a significant portion of your revenue or when a large contract poses a notable financial risk. Insurers assess the buyer’s creditworthiness by reviewing credit reports, financial statements, payment history, and, for export deals, the political and economic stability of the buyer’s country.

This coverage mirrors the protections offered by whole turnover policies, addressing both commercial and political risks. Typically, it provides coverage of up to 90% for private buyers and as much as 100% for sovereign buyers. For bulk agricultural commodity exports, coverage can reach 98%, with pre-shipment protection extending to roughly 95% of the contract value. These policies are highly flexible, with terms ranging from short-term agreements (up to 12 months) to single-contract protection lasting as long as 36 months. This adaptability allows businesses to tailor coverage to their specific needs, but it also comes with certain trade-offs.

Benefits of Single Buyer Coverage

The primary advantage of single buyer insurance is its ability to offer focused protection for a key customer or contract. By safeguarding against the potential default of a critical account, businesses can protect their cash flow and strengthen their overall financial risk management strategy. This targeted approach is also easier to manage compared to the administrative burden of monitoring multiple accounts under broader policies.

Single buyer policies are flexible in their structure. For instance, businesses can add deductibles to reduce premium costs, and in some cases, policy fees can be incorporated into customer contracts. The coverage is suitable for both domestic and international buyers, making it a versatile option whether your key customer is local or overseas.

Drawbacks and Best Fit Scenarios

One of the main downsides of single buyer policies is the concentrated nature of the coverage – it only protects against risks associated with one specific customer, leaving you exposed to potential losses from others. Additionally, premiums for single buyer policies are often higher on a per-dollar basis compared to whole turnover policies because of the heightened focus on a single risk. While whole turnover policies generally cost less than 1% of insured sales, single buyer policies can have more varied pricing. Some insurers may also require a refundable deposit ranging from $500 to $2,000. If the financial health of the insured buyer declines, it could lead to higher premiums or reduced coverage.

This type of coverage is best suited for situations where a single customer accounts for a large portion of your revenue or when you’re entering into a significant contract where a default could have serious financial repercussions. It’s particularly useful for manufacturers, distributors, and exporters involved in large projects, long-term supply agreements, or deals with individual buyers. If you’re dealing with a new or uncertain buyer or exploring a new market, single buyer insurance allows you to secure that specific relationship without committing to a broader policy.

For businesses unsure about whether to choose single buyer coverage or a more comprehensive approach, CreditInsurance.com offers tools to help evaluate which option aligns best with your revenue and risk profile. Understanding the specific advantages and limitations of single buyer policies provides a solid foundation for comparing them to whole turnover coverage in the next section.

Trade Credit Insurance is a solution designed to protect your business from the risk

sbb-itb-b840488

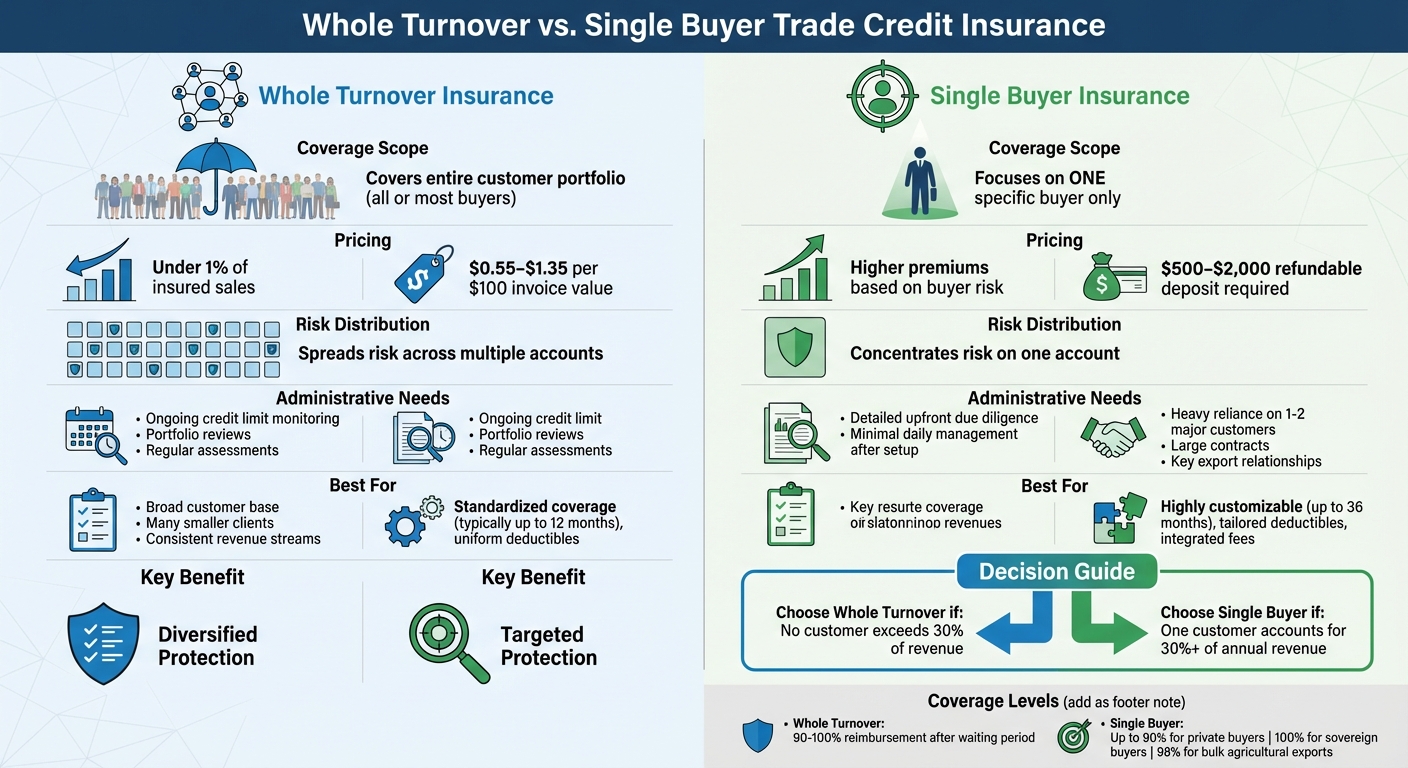

Whole Turnover vs. Single Buyer: Direct Comparison

Whole Turnover vs Single Buyer Trade Credit Insurance Comparison

Comparison Table

Understanding how each policy operates on its own is helpful, but seeing them compared side by side makes the differences even clearer. The table below outlines the key features to help you decide which coverage is best for your business.

| Feature | Whole Turnover Trade Credit Insurance | Single Buyer Trade Credit Insurance |

|---|---|---|

| Coverage Scope | Covers your entire customer portfolio (all or most buyers) | Focuses on one specific buyer only |

| Pricing Structure | Generally costs under 1% of insured sales; approximately $0.55–$1.35 per $100 of invoice value | Higher premiums tied to the credit risk of the single buyer; may also require a refundable deposit of $500–$2,000 |

| Risk Distribution | Spreads risk across multiple accounts, minimizing the impact of a single default | Concentrates risk on one account, increasing the impact if that buyer defaults |

| Administrative Needs | Requires ongoing tasks like credit limit monitoring, portfolio reviews, and assessments | Involves detailed due diligence on one buyer, with minimal daily administration after setup |

| Suitable Business Types | Best for companies with a broad customer base, many smaller clients, and consistent revenue streams | Ideal for businesses heavily reliant on one or a few major customers, large contracts, or export relationships |

| Policy Flexibility | Standardized coverage periods (typically up to 12 months) with uniform deductibles | Highly customizable terms, including coverage up to 36 months, tailored deductibles, and integrated fees |

This table highlights the major differences, but there are additional factors to weigh when making your decision.

What to Consider When Choosing

Beyond the table, here are some key points to help guide your choice.

If a single customer accounts for more than 30% of your annual revenue, single buyer coverage is often the better option. On the other hand, if your revenue comes from a wide range of customers with no dominant account, whole turnover coverage usually makes more sense.

For businesses with steady, recurring sales, whole turnover coverage is a natural fit. However, if your business relies on sporadic, large contracts, single buyer coverage aligns better with your needs.

Consider your internal resources for managing credit. Whole turnover policies require active management of credit limits and tracking multiple accounts, which can be resource-intensive. In contrast, single buyer policies demand thorough research upfront but involve less day-to-day oversight once established.

Cost is another factor. Whole turnover policies are typically more affordable, often under 1% of insured sales. Single buyer policies, due to their concentrated risk, come with higher premiums. To manage these costs, you can explore options like deductibles or incorporating policy fees into your customer contracts. Larger businesses with higher sales volumes may also benefit from lower rates on both types of policies.

Finally, insuring a single troubled debtor is generally not a viable strategy. This reinforces the importance of understanding your customer base and ensuring a balanced risk distribution.

How to Choose the Right Policy

Analyzing Your Customer Base and Revenue

Once you’ve compared coverage options, the next step is to assess your revenue concentration to find the best policy for your business. Start by calculating how much of your annual sales come from your largest customer, your top three, top five, and top ten customers. This breakdown will show whether your revenue is spread across many buyers or concentrated in just a few.

If no single customer contributes more than 10% of your sales and you serve a large number of buyers, your portfolio is likely diversified. In this case, a whole turnover policy might be the better fit, as it spreads risk across your entire receivables portfolio.

On the other hand, if one customer accounts for 30% or more of your annual revenue, a single buyer policy could be more practical. Losing that key account could have a serious impact on your cash flow, so focused protection becomes crucial. For example, a U.S. exporter with $10 million in annual shipments to a single overseas distributor might prioritize coverage that addresses both the specific customer and country-related risks.

Also, think about your mix of domestic and export sales. If you deal with a wide range of international buyers across different countries, a whole turnover policy can protect against both commercial and political risks across your entire portfolio. But if your business depends heavily on one or two major export relationships, single buyer coverage allows you to focus protection where it’s most needed.

With this understanding, the next step is to evaluate the costs and administrative requirements of each policy type.

Cost and Administrative Requirements

The costs for these policies can vary significantly. Whole turnover policies generally cost less than 1% of insured sales, with rates typically ranging from $0.55 to $1.35 per $100 of invoice value for select U.S. export programs. In contrast, single buyer policies come with higher premiums due to the concentrated nature of the risk. Additionally, single buyer policies often require a refundable deposit, which can range from $500 to $2,000.

Administrative demands also differ. Whole turnover policies require ongoing management, such as maintaining credit limits for all your customers, conducting regular portfolio reviews, and submitting updates to your insurer. This level of oversight can be resource-intensive and may require dedicated staff or systems. Single buyer policies, however, involve more detailed due diligence upfront – like gathering financial statements and trade history for the specific buyer – but are less demanding to manage on a daily basis once they’re in place.

Consider your company’s capacity for credit management. If your team lacks the resources to actively manage multiple credit limits, a single buyer policy may be a more manageable option.

Another factor to keep in mind is how the policy could impact your financing. Many banks view insured receivables as stronger collateral, which could help increase your borrowing potential or improve loan terms. Whole turnover policies often align well with asset-based lending because they cover the entire receivables pool. Single buyer coverage, however, can be ideal when financing is tied to a specific large contract.

Resources Available at CreditInsurance.com

To help you make an informed decision, CreditInsurance.com offers a range of tools and educational materials. These resources provide clear explanations of how whole turnover and single buyer trade credit insurance work, including what each policy covers and how they can be applied in real-world scenarios for U.S. businesses.

The website also features tools to analyze your customer concentration and evaluate your exposure to the risk of non-payment. This can help you determine whether a portfolio-level or single buyer policy is the better fit for your business.

Additionally, CreditInsurance.com connects businesses with experienced brokers and carriers who can provide tailored quotes for both types of policies. These specialists can help you compare pricing models, understand what factors influence premiums, and navigate the implementation process – all at no additional cost.

Conclusion

Key Takeaways

When deciding between whole turnover insurance and single buyer insurance, it all comes down to your customer base and revenue distribution. If your sales are spread across a wide range of customers, whole turnover insurance is a smart choice. It typically costs less than 1% of insured sales, spreads risk across multiple buyers, and offers broad protection. On the other hand, if a single customer accounts for a significant chunk of your revenue, single buyer insurance provides targeted coverage. While it comes with higher premiums and a refundable deposit ranging from $500 to $2,000, it offers focused protection that can shield your business from major financial setbacks.

The administrative demands and cost structures also differ between these two options. Whole turnover policies require ongoing management of your entire customer portfolio, while single buyer policies involve a more detailed upfront evaluation of the specific buyer. Coverage levels are also distinct – single buyer policies can cover up to 90% for private buyers and 100% for sovereign buyers.

What to Do Next

To make the right decision, start by analyzing your revenue concentration. Determine how much of your annual sales rely on your top customers. This will help you figure out whether you need portfolio-wide coverage or targeted protection for key accounts. Also, consider your ability to manage the administrative tasks tied to credit limits and policy requirements. This practical evaluation is just as important as choosing the coverage itself.

For additional support, visit CreditInsurance.com. Their tools can help you assess customer concentration and connect you with experienced brokers who can provide customized quotes. By choosing a policy that matches your revenue structure, you can protect your cash flow and set the stage for steady business growth.

FAQs

How do I decide between whole turnover and single buyer insurance?

When deciding between whole turnover insurance and single buyer insurance, it’s all about aligning with your business needs and how much risk you’re comfortable taking on.

Whole turnover insurance provides coverage for all your receivables, making it a solid choice if your business deals with a wide range of customers and enjoys steady sales across multiple accounts. This type of insurance offers broad protection, which can be particularly helpful if you’re managing a diverse client base.

On the flip side, single buyer insurance zeroes in on transactions with a specific customer. This option is ideal if your business depends on a high-value or potentially risky client, giving you peace of mind for those critical relationships.

To make the right choice, weigh factors like your sales volume, the credit terms you extend, and how financially stable your customers are. Your growth plans matter too – whole turnover insurance can be a smart move if you’re aiming for broad expansion, while single buyer insurance works well for safeguarding key partnerships. Taking the time to assess these aspects will guide you toward the coverage that best supports your business.

How does single buyer insurance manage political risks compared to whole turnover insurance?

Single buyer insurance is designed to protect businesses from political risks tied to a specific buyer. These risks can include non-payment caused by government actions, trade restrictions, or political instability. On the other hand, whole turnover insurance provides a wider safety net, covering political risks across your entire customer base.

This targeted nature of single buyer insurance makes it a great fit for businesses working with high-risk buyers in regions prone to political unrest. Meanwhile, whole turnover insurance works better for companies looking to safeguard all their accounts receivable under one comprehensive policy.

What do I need to manage whole turnover insurance effectively?

To handle whole turnover insurance efficiently, it’s important to maintain accurate and updated records of your customers’ credit details while keeping a close eye on their financial stability. Organized documentation of policies, claims, and any related communications plays a key role in ensuring smooth operations.

You should also set clear credit limits and have well-defined approval processes in place. Regularly collaborating with your insurer to review and adjust your coverage ensures it remains aligned with your business needs. These practices not only safeguard your business but also help streamline the management of your insurance policy.