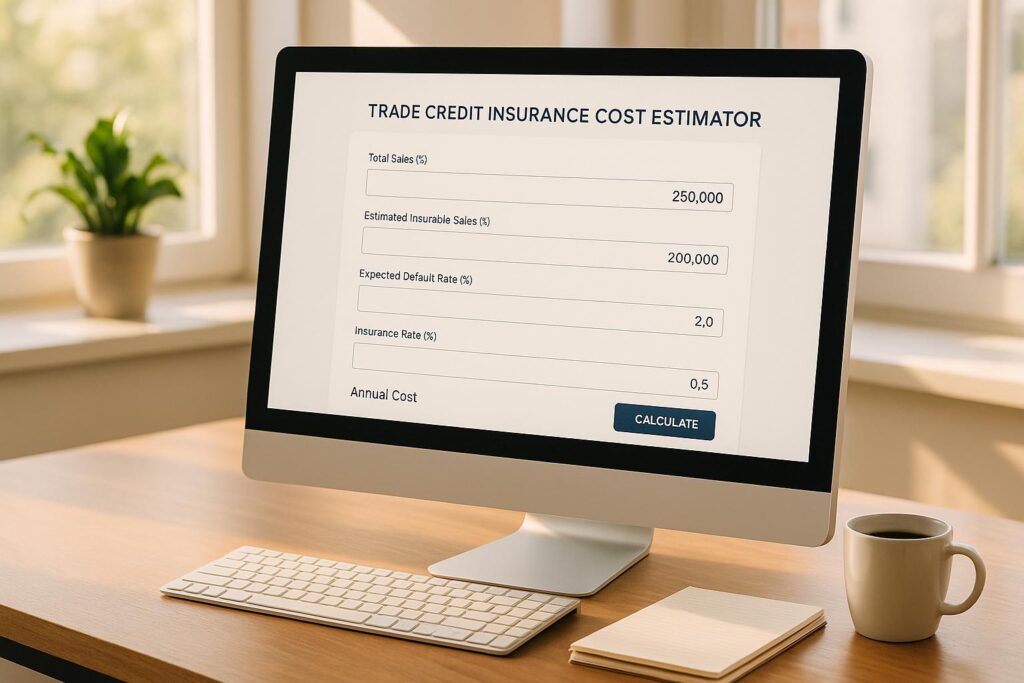

Trade Credit Insurance Cost Estimator

Estimate your trade credit insurance costs with our free tool. Input revenue and risk details to get a tailored annual premium breakdown!

Accounts Receivable Protection Guide

Safeguard your cash flow with our free Accounts Receivable Protection Guide. Get tailored tips to minimize payment delays and bad debts today!

Credit Risk Assessment Calculator

Evaluate client creditworthiness with our free Credit Risk Assessment Calculator. Get accurate risk scores and insights for smarter decisions!

Credit Insurance Savings Estimator

Estimate your financial protection with credit insurance! See how much you could save on loans during unexpected events with our free tool.

Case Studies: Credit Insurance Driving Business Growth

Explore how credit insurance empowers businesses to stabilize cash flow, expand markets, and mitigate financial risks through real-world case studies.

Credit Insurance Risk Assessment

Worried about financial risks? Use our free Credit Insurance Risk Assessment Tool to see if credit insurance is right for you. Get results in seconds!

Credit Insurance Comparison Tool

Compare credit insurance plans easily with our free tool. Enter your needs and get tailored options for coverage and cost in seconds!

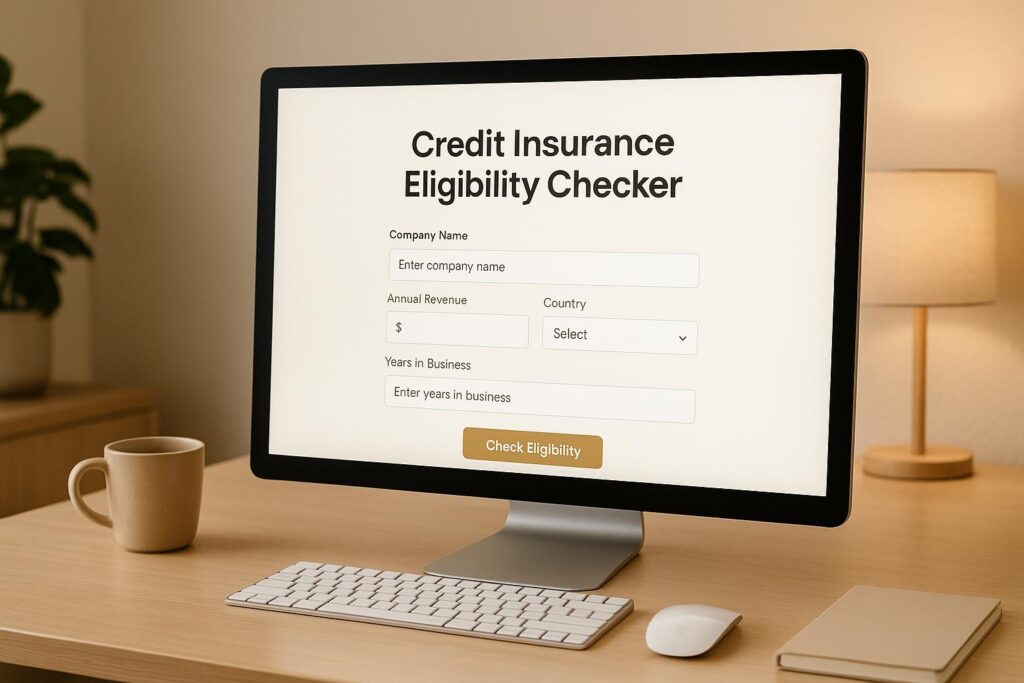

Credit Insurance Eligibility Checker

Wondering if you qualify for credit insurance? Use our free Eligibility Checker to get instant results and helpful insights!

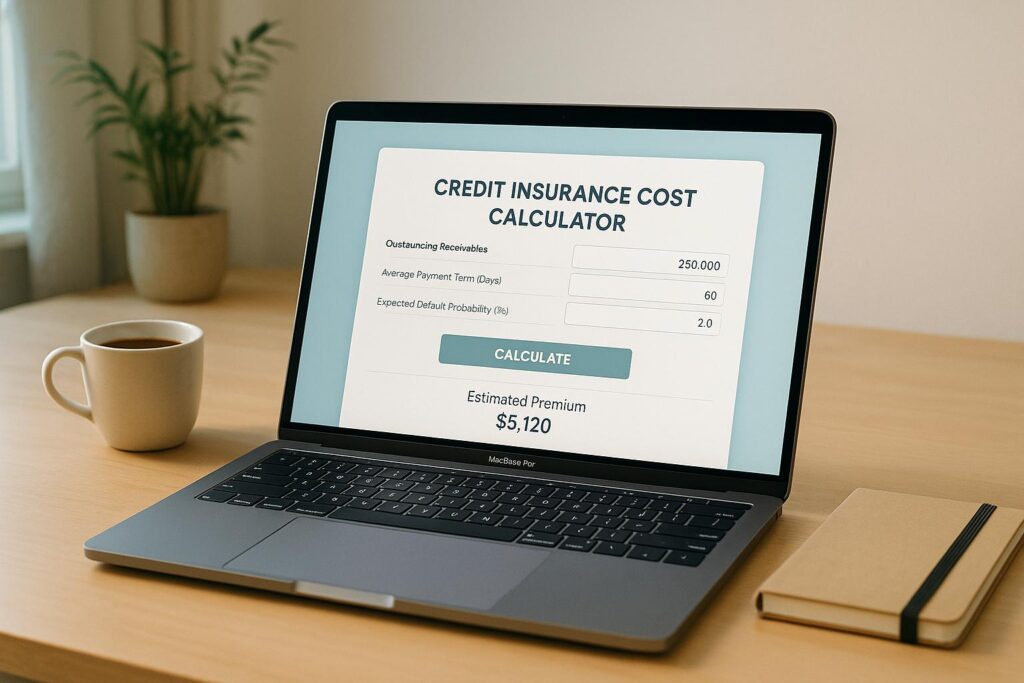

Credit Insurance Cost Calculator

Curious about credit insurance costs? Use our free calculator to estimate your monthly premium based on loan amount and term. Get instant results!

Complete Guide to Delayed Payment Recovery for MSMEs

Learn the legal steps and strategies for recovering delayed payments under MSME laws. Expert tips for manufacturers, service providers, and traders.