Retail vs. Wholesale Credit Insurance in Recessions

How retail and wholesale credit insurance respond in recessions: contrasts in risk spread, claims, credit limits, and mitigation strategies.

Blockchain in Supply Chain Finance: Case Studies

Blockchain fixes opaque supply chain finance by creating a single, verifiable ledger that slashes disputes, speeds credit, and unlocks working capital.

Ultimate Guide to Underwriter-Broker Collaboration

How brokers and underwriters collaborate to protect receivables, set credit limits, manage claims, and improve financing with clear communication and data tools.

How Predictive Analytics Identifies Industry Risks

Predictive analytics uses internal and external data to spot defaults up to 12 months early, cut bad debt, and tailor credit insurance.

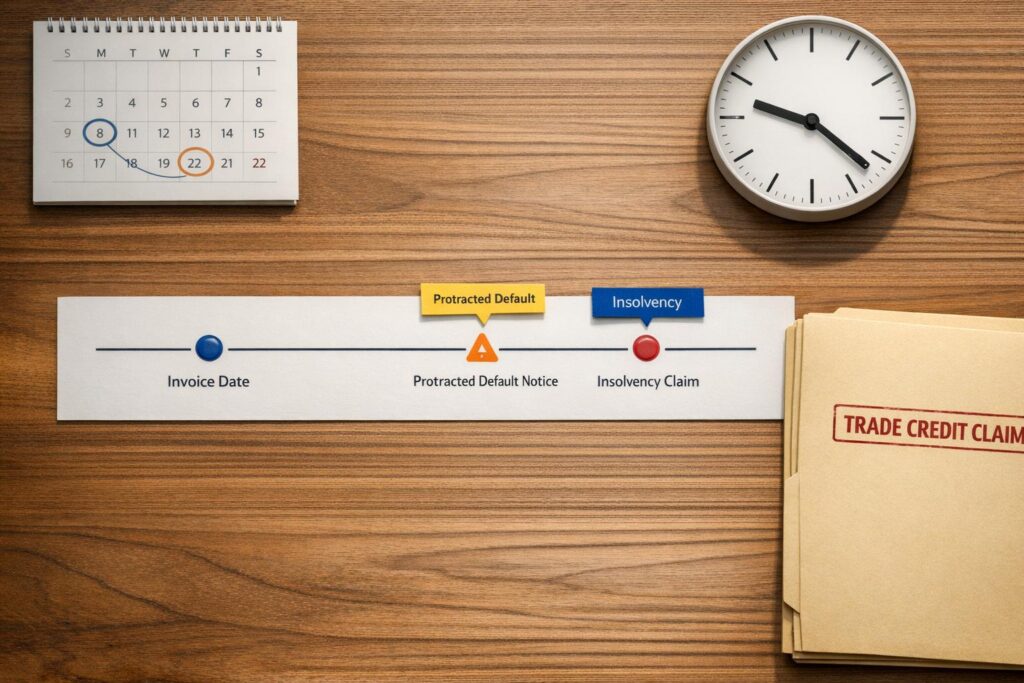

Trade Credit Claims: Notification Timeline Guide

When to notify insurers of trade credit claims: deadlines by claim type (insolvency, protracted default), required documents, and steps to avoid denials.

Top Risks of Undiversified Credit Portfolios

Undiversified credit portfolios magnify borrower, sector, and regional shocks; diversification and credit insurance cut tail losses and ease capital pressure.

Ultimate Guide to Ethical Predictive Credit Analytics

How to build fair, transparent credit models: bias testing, explainable AI, data privacy (machine unlearning), audits, and regulatory compliance for lenders.

Credit Insurance: How It Works for B2B Sales

Protect B2B sellers from unpaid invoices—credit insurance covers insolvency, defaults and political risks, reimbursing up to 90–95% while stabilizing cash flow.

Import Insurance Rules: What Businesses Must Know

Importers must treat trade credit and political-risk insurance as essential safeguards to protect receivables, comply with U.S. rules, and secure financing.

Ultimate Guide to Automated Claims Validation

AI, OCR, and RPA streamline claims validation to reduce costs, speed settlements, improve fraud detection, and guide phased implementation for insurers.