Key Takeaways:

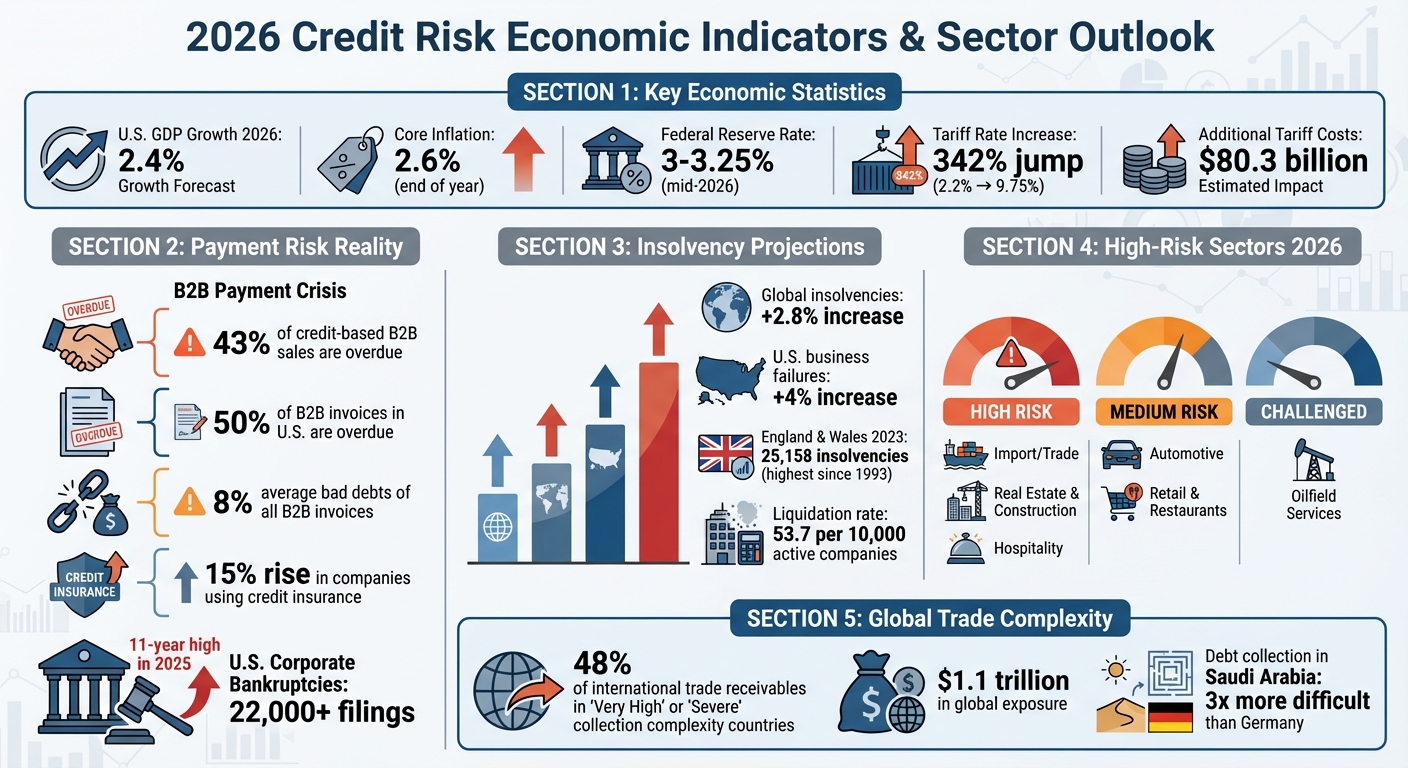

- Economic conditions like inflation, interest rates, and trade policies directly affect credit insurance and payment risks.

- 43% of credit-based B2B sales in the U.S. are overdue, with bad debts averaging 8% of invoices.

- In 2026, U.S. GDP is expected to grow by 2.4%, but insolvency risks remain due to high borrowing costs and uneven sector performance.

- Global trade faces challenges from tariff increases (up 342% by 2025) and geopolitical uncertainties, such as the upcoming USMCA review.

- High-risk sectors include automotive, retail, real estate, and import-dependent industries.

What You Can Do:

- Use credit insurance to safeguard against payment defaults and maintain cash flow.

- Monitor macroeconomic indicators like GDP, inflation, and interest rates for risk assessment.

- Conduct regular financial health checks on buyers, especially in volatile sectors or regions.

- Leverage tools like FRISK® or PAYCE® Scores to identify high-risk entities early.

- Stay informed about regulatory changes like tariffs to adjust credit policies promptly.

Why It Matters: Economic shifts in 2026 demand careful credit risk management to protect your business. Trade credit insurance provides a safety net, allowing you to extend credit confidently while navigating uncertainties like geopolitical tensions, inflationary pressures, and sector-specific challenges.

2026 Credit Risk Economic Indicators and Sector Outlook

Credit Insurance as a Risk Mitigation Tool for International Trade

sbb-itb-b840488

Macroeconomic Indicators That Affect Credit Insurance

Three major economic factors – GDP growth, inflation, and interest rates – play a crucial role in how credit insurance is priced and how claims are assessed. These indicators shape the financial environment businesses operate in, influencing both opportunities and risks.

GDP Growth and Business Solvency

Steady GDP growth typically signals healthier business cash flows and fewer insolvencies. For instance, the U.S. GDP is projected to grow by 2.4% in 2026, which is above the expected potential growth rate. This optimistic outlook suggests reduced insolvency risks across many sectors. As KBRA highlights:

Better-than-expected U.S. economic growth and somewhat reduced geopolitical uncertainty have positioned credit favorably heading into 2026.

However, this growth isn’t uniform. While industries like technology and pharmaceuticals benefit from AI-driven advancements, others – such as automotive – are grappling with challenges like trade tensions and declining demand. This uneven performance underscores the importance of analyzing sector-specific trends rather than relying solely on national GDP figures. Such disparities also pave the way for additional challenges, including inflationary pressures.

Inflation and Payment Delays

Inflation can lead to payment delays as businesses face rising costs that outpace their revenues. To manage cash flow, some companies delay payments to suppliers, a practice known as protracted default. This issue is widespread – about 50% of B2B invoices in the U.S. are overdue, with bad debts accounting for an average of 8% of all B2B invoices.

Mike Seff, Senior Vice President of Specialty Lines at Intact Insurance Specialty Solutions, describes the current climate:

The current environment of geopolitical conflict, policy volatility, inflationary pressure, supply chain fragmentation and shifting consumer dynamics has created a perfect storm of unpredictability.

Looking forward, there’s concern that inflation, which has been easing, could stall or even reverse. Moody’s warns that such a scenario could lead to "inflation expectations becoming de-anchored, driving yield volatility and distorting credit pricing". In response to this uncertainty, businesses are increasingly turning to credit insurance. In fact, there’s been a 15% rise in companies moving away from in-house risk retention, opting instead for strategic credit insurance to safeguard their financial stability.

Interest Rates and Credit Costs

High interest rates compound the challenges businesses face. They make borrowing more expensive and credit harder to secure, creating a dual threat: customers struggle to finance their operations, and businesses may face stricter lending terms when seeking growth funding. This environment underscores the importance of strong credit risk strategies, including trade credit insurance, to maintain liquidity. For example, in 2023, company insolvencies in England and Wales hit 25,158, the highest level since 1993, with a business liquidation rate of 53.7 per 10,000 active companies.

Ray Massey, Underwriting Director at Tokio Marine HCC, explains:

Interest rates have increased substantially… these issues are limiting the ability of companies to take out new loans or roll over existing debt. Against this backdrop, counterparty risk should be monitored closely and appropriate action (such as tightening credit terms or leveraging trade credit insurance) should be considered.

The effects of high interest rates often take time to ripple through the economy, meaning insolvency risks can remain elevated even after rates stabilize. Trade credit insurance offers a buffer in such scenarios by improving liquidity. It enables businesses to borrow more against outstanding invoices, ensuring access to working capital when traditional lending options become more restrictive.

2026 Economic Outlook for Credit Risks

US Economic Growth and Insolvency Projections

The U.S. economy is projected to maintain moderate growth in 2026, with GDP estimates ranging between 1.8% and 2.4%. Seth Carpenter, Chief Global Economist at Morgan Stanley, emphasizes that "the U.S. remains the most likely economy to drive material upside to global growth". However, economic momentum may slow in the second half of the year as federal reimbursements taper off and investments in AI decline.

Even with positive growth forecasts, insolvency risks are expected to remain a concern. Core inflation is predicted to settle at 2.6% by the end of the year, while the Federal Reserve’s policy rate is anticipated to stabilize between 3% and 3.25% by mid-2026. This scenario means businesses refinancing older debt will continue to face elevated borrowing costs. Moody’s cautions that "it would not take a particularly big shock for [the default rate] to rise instead [of declining] during 2026".

Adding to the uncertainty is the Federal Reserve’s leadership transition in the second quarter of 2026. If inflation unexpectedly stalls or reverses, it could lead to increased yield volatility, complicating credit pricing across the market. In this environment, maintaining disciplined credit practices will be crucial for both strategic and operational stability.

These domestic challenges are compounded by risks tied to global trade and industry-specific pressures expected in 2026.

Global Trade and Geopolitical Risks

Trade policy uncertainty is shaping up to be one of the most pressing credit risks for U.S. businesses in 2026. By July 2025, effective tariff rates had surged from 2.2% to 9.75%, resulting in an additional $80.3 billion in costs. Dean Kaplan, President of The Kaplan Group, explains:

A 342% jump in effective tariff rates (2.2% → 9.75%) generated $80.3 billion in new costs by July 2025, creating acute working capital strain in import-dependent sectors.

Further complicating matters is the scheduled review of the USMCA in July 2026. While a U.S.-China trade agreement has been reached, the potential for renewed tensions still looms, posing a threat to corporate credit stability. Additionally, political polarization is disrupting long-standing policy norms, making international relations increasingly fragmented and transactional.

Experts stress the importance of proactive strategies to manage credit risks. Businesses with significant import or export exposure are urged to enhance buyer visibility – going beyond historical payment data to conduct regular health checks on customers facing geopolitical or supply chain challenges. These tariff-driven pressures are also contributing to the specific challenges many sectors are grappling with.

Sector-Specific Risks in 2026

In addition to broader trade and geopolitical uncertainties, certain industries are facing unique challenges that add complexity to credit risk management. The nature of these risks varies significantly by sector.

The automotive industry, for example, is expected to see a slowdown in demand due to the exhaustion of pent-up demand and affordability concerns. In consumer retail and restaurants, spending patterns are shifting, with lower-income households under increasing financial strain. This shift is leading to weaker sales volumes and a growing preference for private-label products.

Real estate and construction continue to struggle with high mortgage rates and poor housing affordability, while commercial real estate is emerging as a critical risk area due to ongoing high debt costs. Import-reliant industries are still dealing with significant working capital pressures from tariff increases. The hospitality sector is also under strain, particularly in midscale and economy hotels, as consumer spending slows. Meanwhile, oilfield services remain challenged by reduced capital expenditures and upstream consolidation.

| Industry | Primary Credit Risk Driver | Outlook |

|---|---|---|

| Automotive | Affordability concerns and pricing pressure | Cautious |

| Retail & Restaurants | Lower-income consumer strain | Stable to Weak |

| Real Estate & Construction | High mortgage rates and housing costs | Pressured |

| Import/Trade | Tariff-driven cost increases | High Risk |

| Hospitality | Reduced consumer spending | Weak |

| Oilfield Services | Limited capital expenditures | Challenged |

Investment in equipment is also expected to slow, with growth moderating to 2%–2.5% in 2026, down from 7.9% in 2025. According to S&P Global, "the full impact of tariffs will trickle through into 2026 and further constrain pricing power in the key U.S. market". To navigate these challenges, businesses should focus on diversifying their customer base and carefully evaluating geographic exposure to volatile regions. Early warning signs, such as currency instability or sanctions risks, should be closely monitored.

Using Economic Data to Reduce Credit Risks

Forecasting Economic Trends for Risk Assessment

Incorporating macroeconomic forecasts into risk evaluations is no longer optional – it’s essential. Alongside historical payment data, businesses must consider broader economic indicators to assess credit risks effectively. For instance, sectors like Banks and Utilities are particularly vulnerable during periods of low GDP growth and high interest rates, while Pharmaceuticals tend to weather such conditions more steadily. Hrvoje Tomicic of S&P Global Market Intelligence highlights this point, stating that "the importance of monitoring and embedding macro-economic factors into credit risk assessments is critical".

AI tools have become a game-changer in this space, offering early warning signals of credit events as much as 6 to 8 months before significant issues arise for major firms. These tools can flag potential trouble areas, such as currency instability, supply chain disruptions, or cybersecurity vulnerabilities – each of which often serves as a precursor to broader financial challenges.

Mike Seff, Senior Vice President of Specialty Lines at Intact Insurance Specialty Solutions, underscores the importance of proactive credit management: "Those that treat trade credit as a managed risk rather than a background function will be best positioned to navigate the next wave of global uncertainty". This proactive approach involves requesting updated financial data from buyers, performing regular financial health checks, and adjusting credit terms based on macroeconomic indicators. These practices align seamlessly with the use of trade credit insurance, which provides an additional layer of protection against liquidity risks.

Using Trade Credit Insurance for Cash Flow Protection

While forecasting sharpens risk assessments, trade credit insurance offers a practical safety net for businesses navigating uncertain times. By insuring receivables, companies can often increase their borrowing capacity against outstanding invoices. This is especially useful during periods of working capital strain caused by regulatory shifts or downturns in specific sectors.

Advanced tools like FRISK® and PAYCE® Scores enhance credit monitoring, identifying high-risk entities months before they face bankruptcy. This is critical, as U.S. corporate bankruptcies hit an 11-year high in 2025, with over 22,000 Chapter 11 and Chapter 7 filings. Trade credit insurance mitigates the financial impact of such unpredictable defaults, which historical payment trends alone may not reveal.

According to Marsh, "trade credit insurance is emerging as a key enabler. It provides businesses with the reassurance they need to thrive in an uncertain economic environment". This assurance allows companies to expand into new markets or take on new customers without exposing themselves to outsized risks – an advantage that becomes even more important as GDP growth slows and sector-specific challenges mount.

Monitoring Regulatory and Policy Changes

Regulatory shifts can disrupt cross-border transactions in an instant, as demonstrated by recent spikes in tariff rates, which have created significant working capital challenges. Businesses need systems in place to monitor these changes and adjust their credit policies accordingly, building on the economic trend analysis mentioned earlier.

The Credit Managers’ Index (CMI) is a valuable tool for tracking these dynamics. By surveying U.S. credit and collections professionals monthly on factors like sales, new credit applications, and accounts placed for collection, the CMI helps businesses benchmark their credit conditions against national trends. This allows credit managers to identify when their industry is under disproportionate stress, such as through increased payment delays.

For companies engaged in international trade, country-specific risk comparison tools are indispensable. These tools evaluate exposure to volatile regions, particularly those facing currency instability or sanctions.

Moody’s offers a sobering perspective: "The year ahead will be shaped less by the business cycle and more by structural change and changing political dynamics". This calls for businesses to look beyond traditional forecasting methods and monitor emerging risks like political polarization, trade policy shifts, and inward-focused economic strategies. Training accounts receivable teams to identify red flags – such as frequent payment extension requests or sudden changes in ordering behavior – enables companies to act quickly before regulatory changes escalate into credit losses.

Business Strategies for 2026

Adjusting Credit Policies Based on Market Conditions

In today’s stricter regulatory environment, credit risk teams must rely on solid evidence and portfolio-level analytics to justify their decisions. Historical payment patterns are no longer enough; businesses need independent benchmarks to validate credit decisions as regulatory scrutiny intensifies.

Laura Saville from Credit Benchmark explains this shift:

Success in 2026 will favor institutions that can demonstrate – with objective, credible evidence – that their view of risk stands up to challenge.

For mid-market and private credit exposures, closing intelligence gaps is now a priority. Independent benchmarking has become a key element of governance. Credit policies for 2026 must adapt to structural changes like AI-driven productivity shifts, geopolitical tensions, and climate-related expenses, alongside traditional economic cycles. Businesses offering customized goods should start credit risk management early in their production processes. Similarly, companies involved in cross-border trade need to adjust credit terms to account for cultural factors that influence payment behavior and negotiation styles.

Additionally, credit models should reflect the impact of rising tariffs, as increased costs directly affect payment terms. For instance, U.S. tariffs climbed to 17% in 2025, with pass-through rates exceeding 50%. By integrating these factors, companies can refine their strategies. Platforms like CreditInsurance.com provide tools and insights to support these adjustments.

Using CreditInsurance.com Resources for Planning

To help businesses adapt to evolving credit policies, CreditInsurance.com offers a range of resources designed to mitigate risks like non-payment, customer insolvency, and political uncertainty. These tools also enable businesses to grow by improving credit lines and financing options. The platform provides practical case studies, a glossary to simplify complex terms, and guidance on how insured receivables can enhance financing.

For companies navigating 2026’s volatile landscape, these resources address misconceptions about credit insurance and help businesses choose the right coverage based on insured sales or coverage amounts. This is particularly important given that 48% of international trade receivables are tied to countries with "Very High" or "Severe" collection complexity, representing approximately US$1.1 trillion in global exposure. Additionally, the platform highlights geographic risks, noting that debt collection in Saudi Arabia is nearly three times more challenging than in Germany.

Expanding Growth with Insured Receivables

Incorporating insured receivables into credit strategies can significantly boost borrowing capacity, providing much-needed cash flow during uncertain times. This approach aligns with the U.S. GDP growth forecast of 2.4% for 2026, a period marked by cautious investor sentiment due to policy uncertainty.

Credit insurance allows businesses to offer more competitive credit terms to both new and existing customers, opening doors to new markets and sectors. With delinquency rates for payments over 30 days past due remaining above pre-pandemic levels throughout 2025, protecting against unexpected defaults is more crucial than ever. Insolvency proceedings remain a major challenge, driving 46% of collection complexity in Asia and up to 58% in Western Europe.

Beyond protection, insurers provide valuable insights into factors like buyer stability, portfolio risks, and market volatility – areas that internal teams may overlook. For example, economic losses from extreme weather events totaled approximately US$318 billion in the year leading up to 2026. In response, insurers are adjusting premiums and coverage options to account for climate-related risks. By treating trade credit as a managed risk rather than a secondary concern, businesses can better navigate global uncertainties while pursuing growth opportunities.

Conclusion

In 2026, businesses face credit risks driven more by structural changes than by traditional economic cycles. Factors like political polarization and the rapid integration of AI are reshaping the global landscape. As Jonathan Steenberg, Economist at Coface, aptly explains:

2026 should offer a respite rather than an improvement. The number of insolvencies will not fall: it will simply stop accelerating. If rates were to ease less quickly than anticipated, then stabilisation would immediately disappear.

This evolving environment is not just redefining risk – it’s also fueling a rise in insolvencies.

Global projections suggest business insolvencies will climb by 2.8% worldwide, with U.S. failures increasing by 4%. Even a modest 25-basis-point rise in business lending rates above current expectations could push global insolvency growth to between 4% and 5%. Years of heavy borrowing have left corporate balance sheets highly sensitive to interest rate changes, making it critical for businesses to closely monitor lending conditions.

In light of these challenges, adopting advanced credit protection strategies is no longer optional – it’s essential.

Trade credit insurance has become a key tool for businesses aiming to grow in uncertain times. By safeguarding against payment delays and insolvency risks, companies can confidently extend credit to new customers and explore uncharted markets. Silvia Ungaro from Atradius highlights this point:

Understanding what drives credit insurance costs gives businesses valuable insight into risk, so they can trade with confidence in any market.

To navigate this complex landscape, businesses must stay vigilant. This means keeping an eye on interest rate trends, evaluating vulnerabilities in high-risk industries like construction and textiles, and preparing for sudden tariff changes. With delinquency rates still above pre-pandemic levels, immediate action is critical. The companies that succeed will be those that pair real-time economic insights with robust credit protection measures.

CreditInsurance.com offers the tools and resources businesses need to tackle these challenges head-on. From exploring policy options to leveraging insured receivables for better financing, these resources help transform economic data into actionable credit strategies. In a world where policy uncertainty continues to drive market volatility, clear insights and solid protection are the foundation for sustainable growth.

FAQs

Which 2026 economic indicators should I track for credit risk?

In 2026, several economic factors will play a crucial role in shaping credit risk. Among the most important are geopolitical stability, inflation expectations, and advancements in technology, particularly the growth driven by AI. These elements could significantly influence market dynamics and credit conditions.

The U.S. Federal Reserve’s decisions on interest rates, along with ongoing inflation patterns, will also be key to watch. These policies directly affect the credit markets, making them essential for understanding potential risks.

Other important indicators include the projected GDP growth of 2.4%, an unemployment rate hovering around 4.6%, and corporate debt levels. Together, these metrics provide insight into the financial health of businesses, helping to fine-tune credit policies as needed.

How do tariffs and USMCA changes affect buyer nonpayment risk?

Tariffs and changes to the USMCA (United States-Mexico-Canada Agreement) are shaking up trade by introducing uncertainty and fluctuating costs. Tariffs can drive up expenses and disrupt supply chains, leaving buyers under financial pressure. On top of that, adjustments to USMCA rules may lead to payment delays as companies work to align with new compliance requirements. Together, these challenges increase the risk of insolvency, particularly in industries heavily dependent on cross-border trade. In such a volatile environment, tools like trade credit insurance become essential for managing the risk of nonpayment.

When should I tighten credit terms versus add credit insurance?

Tighten credit terms when economic signals point to higher risks, like increasing insolvencies or volatile markets. This means adjusting credit policies – reducing limits, setting shorter payment deadlines, or ramping up financial reviews – to minimize potential losses.

Another safeguard is adding credit insurance. This protects your business from non-payment by covering up to 90% of unpaid invoices. It helps maintain steady cash flow and supports growth, even when market conditions are unpredictable. Using both strategies together can provide a strong layer of protection.