Blockchain is reshaping how credit histories are managed and verified. Here’s why it matters:

- Secure and Tamper-Proof Records: Blockchain creates permanent, unchangeable transaction records, reducing fraud and errors.

- Fixing the Global Credit Gap: With a $5.2 trillion funding gap for small businesses, blockchain integrates alternative data (like utility payments) to help businesses with limited credit histories.

- Decentralized Access: Lenders and stakeholders can verify credit information directly, bypassing centralized systems prone to breaches like the 2017 Equifax incident.

- Streamlined Auditing: Automated, real-time audits lower costs and improve efficiency.

- Privacy Control: Features like selective disclosure let users share only necessary data, protecting sensitive information.

While blockchain offers transparency and efficiency, challenges like privacy laws, scalability, and regulatory gaps remain. Hybrid systems – combining blockchain with off-chain data storage – are emerging as a practical solution for balancing innovation and compliance.

Cole Snell on: Private Credit with AI and Blockchain | Ep 1189

sbb-itb-b840488

How Blockchain Improves Credit History Transparency

Blockchain directly addresses the key flaws in traditional credit systems. By assigning each credit transaction a unique cryptographic hash, blockchain ensures that any tampering is immediately detectable. This is a major contrast to centralized databases, which are prone to errors that can unfairly impact credit scores.

Permanent Records for Fraud Prevention

One of blockchain’s standout features is its approach to data storage. Instead of relying on a single server, it distributes identical copies of credit records across a network of computers. For a fraudster to alter any information, they would need to manipulate every copy on the network – a near-impossible task.

Each transaction is time- and date-stamped and linked in chronological order, forming what experts often refer to as a "single source of truth". This means financial institutions can access an unbroken chain of credit history without worrying about deleted or altered entries.

"Blockchain also makes your record of KYC and KYB checks unalterable, due to the immutable structure of the underlying distributed ledger technology."

This level of security eliminates the risk of erasing or hiding poor credit history – a common issue in traditional systems where records can sometimes be manipulated or lost. Moreover, this robust system allows all credit stakeholders to access data directly and securely.

Decentralized Access for Stakeholders

Blockchain not only ensures the integrity of credit records, but it also empowers stakeholders with direct, secure access to the data. By removing centralized credit bureaus, blockchain enables lenders, insurers, and other parties to verify credit information through smart contracts, bypassing the need for third-party intermediaries. This approach significantly reduces vulnerabilities, like those exposed during the 2017 Equifax breach, which compromised the personal information of 147 million people.

The system also incorporates self-sovereign identity (SSI), which gives customers control over their private keys and allows them to grant temporary access to specific data. For instance, a lender could confirm that a credit score exceeds 700 without viewing the customer’s entire financial history – a concept known as selective disclosure. In January 2025, researchers at National Chung Hsing University introduced the Customer Self-Sovereign Identity (CSSI) Framework. This framework allows customers to securely store their credit data and assets on a blockchain, granting access only with explicit authorization. This reduces errors and eliminates information gaps in manual verification processes. Additionally, blockchain’s transparency streamlines auditing procedures.

Simplified Audits and Compliance

Blockchain’s immutable logs make audit processes more straightforward. Auditors can verify data integrity in real time by comparing current records with stored cryptographic hashes.

In November 2025, researchers at Xi’an Jiaotong University introduced the VeriCred Framework, which combines automated machine learning with blockchain technology for auditing. The system uses a "C-NAS" neural architecture search to predict credit risk, while securely recording all data and performance metrics on a distributed ledger. This setup provides regulators with clear visibility into how credit decisions are made. Furthermore, smart contracts automate the enforcement of credit agreements and regulatory compliance, minimizing manual intervention and reducing the chances of human error.

Applications of Blockchain in Credit Verification

Financial institutions and businesses are increasingly turning to blockchain to address challenges in lending, trade finance, and credit evaluation. This shift stems from blockchain’s ability to create secure, tamper-proof records without relying on centralized intermediaries.

Blockchain for Credit Scoring and Lending

Blockchain is reshaping credit assessment by using smart contracts to replace traditional credit bureaus, allowing borrowers and lenders to interact directly and securely. As researcher Amir Kafshdar Goharshady states:

"Our approach removes third-parties such as credit reporting agencies from the lending process and replaces them with smart contracts".

By securely capturing alternative data – like rent, utility, and subscription payments – blockchain expands credit access for underbanked populations. This broader data integration opens formal credit markets to a larger segment of the global population.

Smart contracts also simplify the lending process. When conditions like collateral verification are met, these contracts can automatically approve loans and release funds, cutting down on paperwork and reducing errors. Blockchain’s transparency further shines through innovations like the zScore framework. Introduced in February 2025, this system combines AI neural network models with real-world credentials brought on-chain via zkTLS to evaluate credibility in decentralized economies. It goes beyond basic payment history, analyzing on-chain behavior to create a more detailed credit profile.

These advancements naturally extend to trade finance, where blockchain’s reliability enhances transaction processes.

Trade Finance and Time-Stamped Credit Records

In trade finance, blockchain provides immutable, time-stamped records of invoices and transactions, offering dependable credit histories for B2B lending. Each time-stamped invoice serves as legal proof of assignment, reducing the risk of double financing.

This transparency eliminates the need for costly manual processes. Financial institutions can access real-time insights into a supplier’s transaction history, enabling better funding decisions without on-site audits or lengthy reconciliations. The decentralized ledger also provides a clear payment history for debtors, helping stakeholders assess risks and verify trade documents’ authenticity without relying on intermediaries.

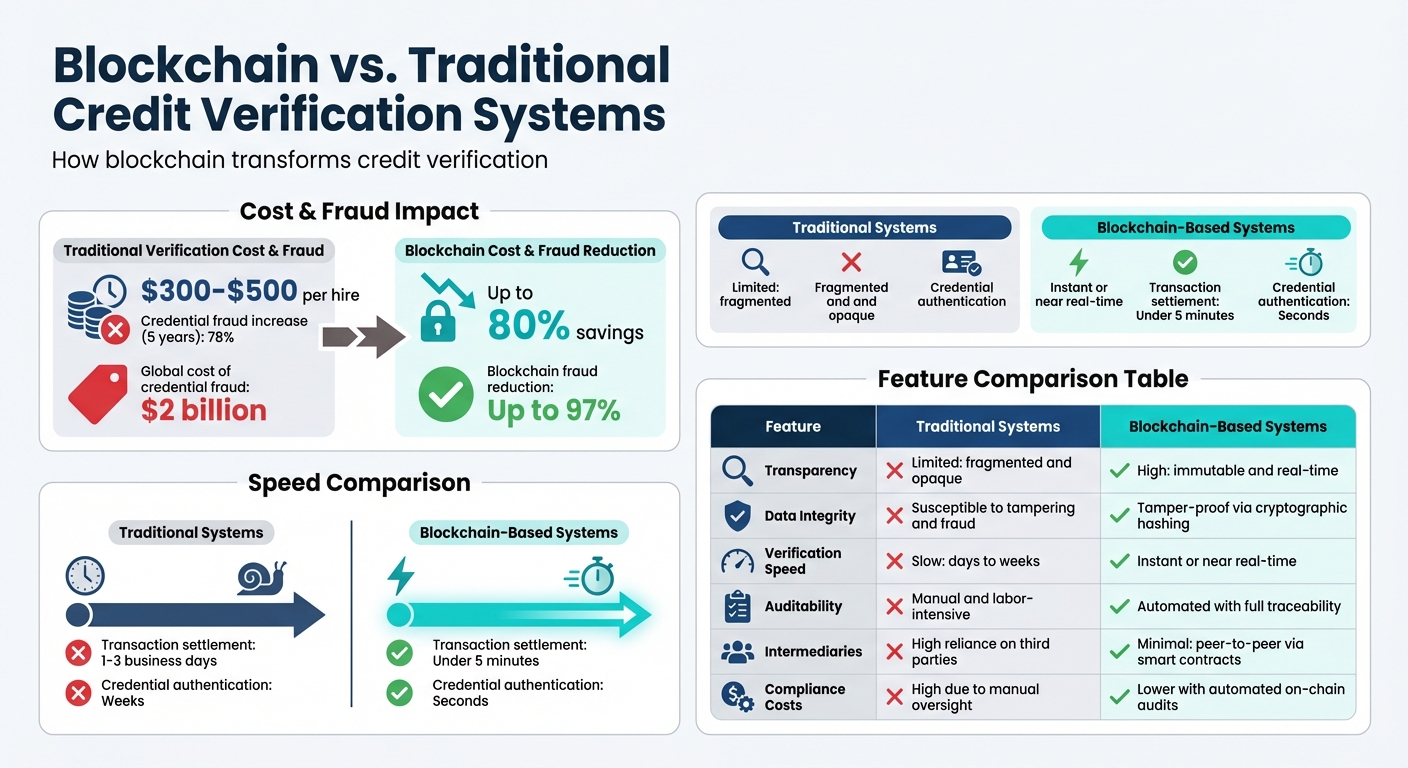

Blockchain vs. Traditional Credit Verification Systems

Blockchain vs Traditional Credit Verification Systems Comparison

The gap between blockchain and traditional credit verification systems isn’t just about technology – it’s about transforming how financial institutions handle risk, expenses, and compliance. Traditional systems rely heavily on fragmented, paper-based records and manual processes, which limit visibility into financial transactions and networks. In contrast, blockchain introduces real-time audit trails where every action is recorded transparently on a distributed ledger. Unlike centralized databases, blockchain spreads verification across a network, creating a system that’s harder to manipulate and more accessible.

Take costs, for example. Traditional credit verification processes typically run between $300 and $500 per hire, but blockchain can slash these expenses by up to 80%. Meanwhile, credential fraud – a problem that has surged by 78% over the past five years – has cost the global economy around $2 billion. Blockchain tackles this issue head-on, reducing fraudulent credential attempts by up to 97% through cryptographic verification methods.

Speed is another area where blockchain outshines its traditional counterpart. Public blockchains can settle transactions in under five minutes, compared to the 1–3 business days required for traditional North American card transactions. Similarly, blockchain reduces credential authentication timelines from weeks to mere seconds. As the World Bank aptly puts it:

"Trust is built into the code, giving citizens proof that public promises are kept".

Key Differences Between Blockchain and Traditional Systems

The operational contrasts between these systems are stark. Traditional verification systems rely on proprietary databases and third-party intermediaries, while blockchain offers a shared ledger that acts as a single, reliable source of truth for all authorized users. Centralized systems are vulnerable to unauthorized changes and opaque processes, often described as "black-box" operations. Blockchain, on the other hand, provides tamper-proof records where any attempt to alter data leaves a clear trail.

| Feature | Traditional Systems | Blockchain-Based Systems |

|---|---|---|

| Transparency | Limited: fragmented and opaque | High: immutable and real-time |

| Data Integrity | Susceptible to tampering and fraud | Tamper-proof via cryptographic hashing |

| Verification Speed | Slow: days to weeks | Instant or near real-time |

| Auditability | Manual and labor-intensive | Automated with full traceability |

| Intermediaries | High reliance on third parties | Minimal: peer-to-peer via smart contracts |

| Compliance Costs | High due to manual oversight | Lower with automated on-chain audits |

Blockchain also redefines privacy. Through selective disclosure, users can verify specific attributes – like a credit score or degree – without exposing unnecessary personal details. Traditional systems, by contrast, often require users to share excessive amounts of sensitive information with centralized authorities. This shift toward user-controlled data not only enhances privacy but also ensures that verification processes remain accurate and secure.

Blockchain Pilots in Credit Verification

Blockchain is no longer just a theoretical concept in credit verification – real-world pilot projects are proving its potential. By leveraging blockchain’s security and transparency, these initiatives are testing how decentralized systems can replace traditional credit infrastructure. While the results highlight blockchain’s promise, they also expose challenges in implementation. Let’s dive into some case studies to see how blockchain is being put to work in credit platforms.

Case Studies of Blockchain-Based Credit Platforms

The Goldfinch Protocol, launched in July 2021, is a decentralized credit platform that takes a fresh approach to lending. Unlike most crypto lending systems, which require borrowers to use digital assets as collateral, Goldfinch allows borrowing without crypto collateral. Instead, loans are backed by off-chain assets and income streams governed by legal agreements. The platform’s consensus-driven model eliminates the need for centralized credit bureaus. Backers provide “first-loss” capital, while auditors ensure proper due diligence.

Goldfinch has already made an impact, extending credit lines to lending businesses in 28 countries. Borrowers include PayJoy in Mexico, QuickCheck in Nigeria, Divibank and Addem Capital in Latin America, Greenway (via Almavest) in India, and Cauris, which operates across Africa, Asia, and Latin America. Each borrower’s repayment history is recorded on the blockchain, building a transparent credit reputation. The Goldfinch documentation explains this concept clearly:

"Creating a negative on-chain credit history is comparable for future credit opportunities to creating a negative off-chain credit score or record." – Goldfinch Documentation

Digital Identity and KYC Sharing

Digital identity solutions are another key piece of the blockchain credit puzzle, simplifying verification and reducing redundant Know Your Customer (KYC) processes. Goldfinch introduced the Unique Identity (UID), which it describes as the first-ever NFT designed for identity verification. This allows users to prove they’ve completed KYC/KYB checks without storing personal data directly on the blockchain.

Another example is the KYChain pilot, launched in January 2020. This initiative enables users to share certified and up-to-date identity information with multiple financial institutions through an immutable ledger. By allowing selective disclosure of identity attributes, KYChain reduces the need for repetitive KYC procedures. This approach also enhances privacy, a crucial advancement following the 2017 Equifax breach.

Challenges and Future Directions

While blockchain offers potential for improving credit transparency, its implementation comes with significant obstacles. One of the biggest challenges lies in reconciling blockchain’s immutable nature with U.S. privacy laws, such as the Fair Credit Reporting Act (FCRA) and the California Consumer Privacy Act (CCPA). These laws give individuals the right to modify or delete their personal data – something blockchain’s permanent record-keeping makes almost impossible. As Donald L. Buresh, Ph.D., Esq., from Morgan State University puts it:

"The immutability of blockchain conflicts with legal requirements to modify or delete personal data".

This legal tension highlights the need for further exploration into both technical and regulatory solutions.

Privacy and security concerns also pose serious risks. Blockchain’s permanence makes stored data susceptible to future advances in decryption technology. Researchers Amir Kafshdar Goharshady, Ali Behrouz, and Krishnendu Chatterjee warn:

"Any data saved on the blockchain is permanent… If/when the cryptographic primitives are broken, the data becomes accessible to unauthorized parties".

This could expose sensitive credit information over time. Even encrypted records are not entirely safe – public records like bankruptcy filings, which must remain unencrypted for legal reasons, can be cross-referenced with blockchain data to reveal a user’s identity.

Beyond privacy, technical limitations hinder blockchain’s scalability in credit verification systems. Current consensus mechanisms such as Proof-of-Work struggle to handle the high transaction volumes required for nationwide credit systems. Emerging solutions like sharding (dividing data into smaller, manageable pieces for parallel processing) and Layer-2 nested blockchains (processing transactions off the main ledger) offer ways to improve efficiency. Additionally, transitioning from Proof-of-Work to Proof-of-Stake reduces the computational burden by selecting validators based on their stake in the network rather than solving complex cryptographic puzzles.

Regulation is progressing, but gaps remain. The Digital Asset Market Clarity Act of 2025 (CLARITY Act) and the GENIUS Act represent steps toward federal oversight. Similarly, stablecoin legislation enacted in July 2025 introduced clear requirements for reserve assets and monthly public disclosures. However, the U.S. Government Accountability Office notes:

"A formal coordination mechanism for addressing blockchain-related risks… could help federal financial regulators collectively identify risks and develop timely and appropriate responses".

Until such mechanisms are established, blockchain credit platforms must navigate a fragmented regulatory landscape across state and federal levels.

To overcome these challenges, hybrid solutions are emerging as a practical approach. By keeping sensitive personal data off-chain and using blockchain for time-stamped hashes or pointers, developers can allow for data deletion when required by law. This method enables selective disclosure while maintaining compliance with privacy regulations. These hybrid models strike a balance between blockchain’s transparency and the need for privacy, paving the way for a new era in credit verification that respects both innovation and consumer rights.

Conclusion

Blockchain is reshaping credit verification by offering greater transparency, reducing fraud, and streamlining processes. Its immutable ledger ensures that credit data, once recorded, remains unaltered, providing a secure and tamper-proof audit trail. Automated smart contracts simplify traditionally manual tasks, while incorporating alternative data – like rent and utility payments – broadens credit access for the 1.7 billion adults globally who remain unbanked.

However, challenges such as privacy concerns, scalability issues, and regulatory hurdles persist. These can be addressed through thoughtful adoption of decentralized data management and hybrid solutions, ensuring a balanced approach to implementation. Careful planning and compliance with regulations are critical to achieving success.

For businesses, embracing decentralized data systems, leveraging alternative data sources, and utilizing smart contracts can enhance efficiency and reduce risks of data breaches. At the same time, strict adherence to data protection laws is essential to maintain trust and compliance.

Navigating this complex landscape requires both education and expert advice. Designing and implementing such systems isn’t straightforward, but platforms like CreditInsurance.com offer valuable resources to guide businesses. By providing insights into emerging technologies and financial risk management, these platforms help organizations make informed decisions about integrating blockchain into their credit assessment processes.

FAQs

What credit data should remain off-chain?

Sensitive credit information – like personal financial records, private identifiers, or any data that could jeopardize privacy or security – should be kept off-chain. This approach protects individuals from privacy breaches and minimizes the chances of data being exposed in a security incident.

How can blockchain credit records follow U.S. privacy laws?

Blockchain credit records align with U.S. privacy laws through the use of cryptographic techniques and tailored blockchain solutions. These methods ensure compliance with specific legal requirements while protecting individual privacy and maintaining a level of transparency. Recent studies on on-chain privacy and legal frameworks emphasize how these technologies balance regulatory adherence with data security.

Can blockchain systems scale for nationwide credit reporting?

Yes, blockchain systems have the potential to handle nationwide credit reporting. However, implementing such a large-scale system comes with hurdles. Challenges like ensuring interoperability between different systems, maintaining robust security, addressing privacy concerns, and managing high energy consumption need to be tackled. Overcoming these obstacles is crucial for the effective and efficient use of blockchain technology in credit reporting.