Trade credit insurance (TCI) shields businesses from the financial risks of unpaid invoices due to buyer insolvency, bankruptcy, or delayed payments. It reimburses 75%–95% of losses and even covers political risks like government actions or conflict, making it especially useful for international trade.

Here’s why TCI matters:

- Risk Mitigation: Protects cash flow by covering most losses from buyer defaults.

- Market Expansion: Enables businesses to confidently enter new or high-risk markets.

- Improved Financing: Insured receivables are seen as lower-risk collateral by banks.

- Credit Management Support: Insurers monitor buyer creditworthiness, saving businesses time and resources.

TCI works by evaluating buyers, setting credit limits, and reimbursing claims when defaults occur. Businesses can choose between policies covering all clients or specific high-value accounts, depending on their needs. By reducing financial uncertainty, TCI supports growth and stability for businesses of all sizes.

How trade credit insurance secures your business

Types of Risks Covered by Trade Credit Insurance

Trade credit insurance (TCI) protects businesses from two main types of risks: commercial risks and political risks. Let’s break down how each of these risks can affect your business and how TCI helps reduce potential losses.

Commercial Risks: Insolvency and Protracted Default

Commercial risks revolve around a buyer’s inability to pay, often due to financial troubles. Insolvency happens when a buyer’s liabilities outweigh their assets, leaving them unable to meet payment obligations. In cases of bankruptcy – a formal legal process where a buyer is declared unable to repay debts – businesses can typically file claims with their insurer immediately.

Another common issue is protracted default, or "slow pay", where a buyer delays payment without officially declaring insolvency. In these cases, insurers generally require a waiting period of three months from the original due date before claims can be filed.

The financial toll of these risks is significant. Payment defaults account for roughly 25% of all company failures. For instance, in 2019, 17,196 company insolvencies were recorded, and late payment debt among UK SMEs reached £23.4 billion. To mitigate these losses, trade credit insurance policies often cover 90% to 95% of the invoice value, offering businesses a much-needed financial cushion.

Political Risks: Government Actions and Instability

Political risks stem from external factors outside a buyer’s control, often tied to government actions or large-scale instability. These risks affect international transactions and can prevent even creditworthy buyers from making payments.

One example is currency inconvertibility, where a buyer has funds in their local currency but cannot exchange or transfer them due to government-imposed restrictions. Another is expropriation, when a government seizes a buyer’s assets or property. Other forms of interference include the cancellation of import/export licenses or the enactment of laws that ban specific goods. Additionally, events like war, riots, or terrorism can disrupt operations and payment channels.

Unlike commercial risks, claims related to political events can often be filed immediately. Short-term export credit insurance typically covers 90% to 95% of losses from these risks. For manufacturers of custom-made products, pre-shipment endorsements provide added protection, covering production costs if a political event – such as a license cancellation – occurs before goods are shipped. Ken Click, Business Development Specialist at EXIM, explains:

"If an exporter has insured a shipment already in transit… and the buyer’s country imposes a ban or regulation preventing the entry of the exporter’s products after the exporter’s shipment date, the exporter is covered".

How Trade Credit Insurance Works

Grasping how trade credit insurance functions is key to safeguarding your business from buyer defaults. The process revolves around three main steps: evaluating your buyers, setting credit limits, and filing claims when necessary. Knowing these steps can help you manage risks effectively.

Evaluating Buyer Creditworthiness

Insurers start by analyzing your buyers using the Five Cs of Credit: Character (reputation and reliability), Capacity (cash flow and debt levels), Collateral (assets available), Capital (financial health), and Conditions (economic and political factors). This evaluation determines whether a buyer qualifies for coverage and how much coverage they can receive.

To make these assessments, insurers rely on proprietary databases filled with data on millions of companies, combined with insights from local market experts. For instance, Allianz Trade employs 1,700 credit analysts across 62 countries to deliver region-specific evaluations.

Typically, business credit scores fall between 1 and 100, with scores above 75 indicating strong credit reliability. Increasingly, insurers use tools like machine learning and AI to process real-time payment data, flagging high-risk buyers early. After this evaluation, a risk grade is assigned, and insurers set a maximum credit limit for each buyer.

Setting Credit Limits and Activating Coverage

Once buyers are evaluated, insurers establish a credit limit – the maximum amount they’ll cover if a buyer defaults. This starts with a review of your customer portfolio to determine which buyers need coverage. Some policies even guarantee that credit limits won’t decrease during the policy term, even if a buyer’s financial health worsens.

Coverage becomes active when you ship goods and report the invoice, ensuring protection for that transaction. Premiums are often only due after shipments are reported, and multi-buyer policies typically cost less than 1% of your insured sales volume.

Throughout the policy period, insurers continuously monitor your buyers’ financial status, providing updates if their creditworthiness changes. This allows you to adjust credit terms or decide whether to extend additional credit. Once limits are in place and coverage is active, the next step is understanding how claims work in case of a buyer default.

Filing Claims After Buyer Default

If a buyer doesn’t pay within the agreed credit terms, you must notify your insurer right away. Insurers will first try to recover the debt through negotiations or formal collection efforts. In cases of bankruptcy, they’ll handle communication with receivers or liquidators.

If recovery isn’t possible, you can file a formal claim for the covered loss. After approval, insurers typically reimburse 85% to 95% of the invoice value for short-term transactions. The Export-Import Bank of the United States (EXIM) offers reimbursement rates between 90% and 100%, depending on the buyer type and the goods involved.

However, claims may be denied if you don’t follow policy rules, such as reporting shipments on time or paying premiums. It’s also crucial to stay within the credit limits set by your insurer, as losses exceeding these limits won’t be covered. Remember, insurance won’t cover known defaults, so securing coverage before issues arise is essential.

sbb-itb-b840488

Benefits of Trade Credit Insurance

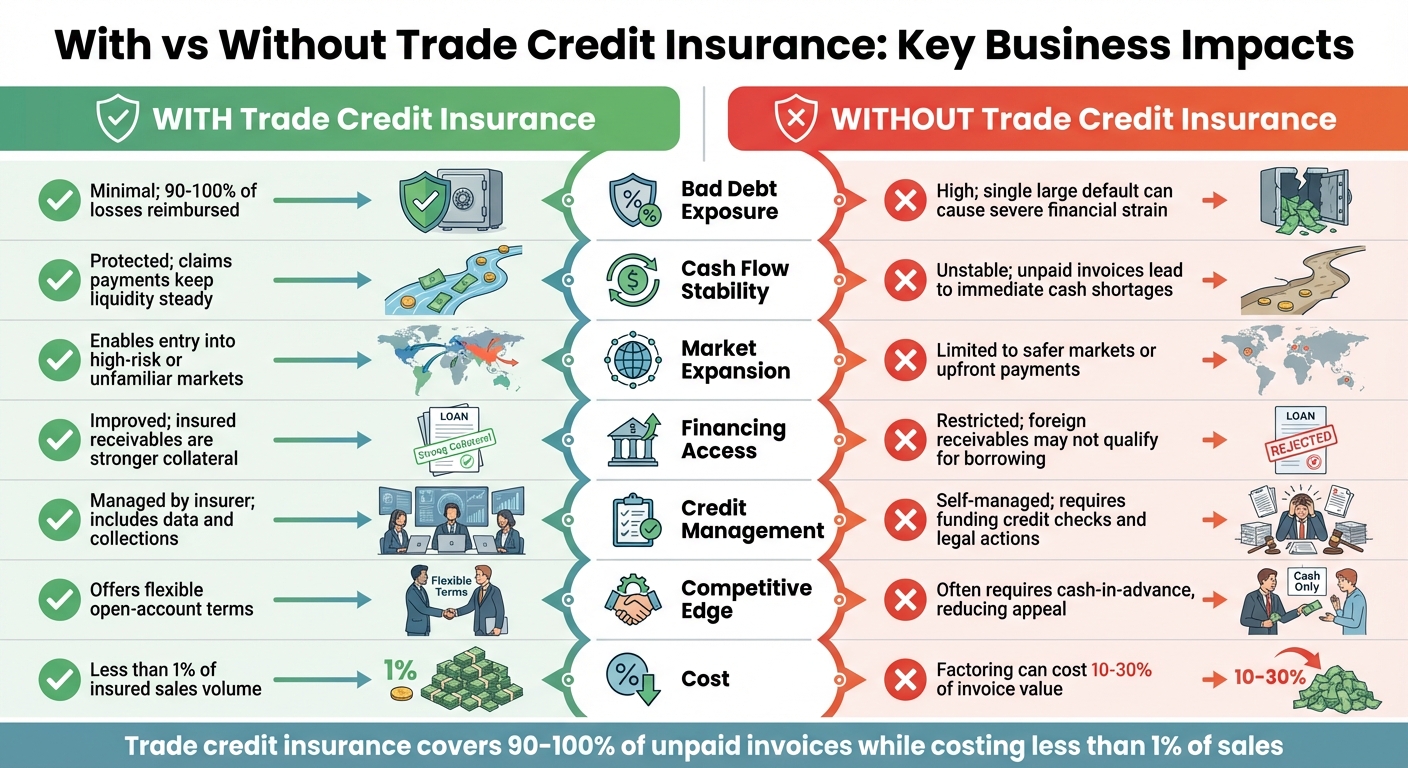

Trade Credit Insurance Benefits: Protected vs Unprotected Business Comparison

Trade credit insurance doesn’t just mitigate risks – it provides a host of operational and financial benefits that can make a real difference to your business. By reimbursing 90%–100% of unpaid invoices, it ensures your cash flow remains steady even if a major client defaults. This means you can continue paying your employees and suppliers, keeping operations running smoothly without disruption.

Beyond protecting against losses, trade credit insurance gives you a competitive edge. It allows you to offer open-account terms to international buyers, which are far more appealing than requiring cash-in-advance. This flexibility can help you secure larger orders and expand into new markets, even those with political or economic uncertainties that might otherwise seem too risky.

Another advantage is the operational support it provides. Acting like an outsourced credit management team, trade credit insurance monitors the financial health of your buyers, drawing from a global database of over 240 million companies. This proactive credit management saves you the time, expense, and complexity of conducting international credit checks and chasing down legal collections across borders.

From a financing perspective, trade credit insurance can improve your options significantly. Banks often view insured receivables as lower-risk collateral, which can enhance your borrowing terms. As Jason Benson, Global Head of Structured Working Capital at J.P. Morgan, notes:

"Trade credit insurance may also enhance a company’s access to financing, as banks may view insured receivables as lower risk".

This means you can include foreign receivables in your borrowing base, freeing up working capital that might otherwise be inaccessible.

Comparison: With and Without Trade Credit Insurance

Here’s a side-by-side look at how trade credit insurance impacts key aspects of your business:

| Feature | With Trade Credit Insurance | Without Trade Credit Insurance |

|---|---|---|

| Bad Debt Exposure | Minimal; 90%–100% of losses reimbursed | High; a single large default can cause severe financial strain |

| Cash Flow Stability | Protected; claims payments keep liquidity steady | Unstable; unpaid invoices can lead to immediate cash shortages |

| Market Expansion | Enables entry into high-risk or unfamiliar markets | Limited to safer markets or upfront payments |

| Financing Access | Improved; insured receivables are seen as stronger collateral | Restricted; foreign receivables may not qualify for borrowing |

| Credit Management | Managed by insurer; includes data and collections | Self-managed; requires funding credit checks and legal actions |

| Competitive Edge | Offers flexible open-account terms | Often requires cash-in-advance, reducing appeal |

| Cost | Less than 1% of insured sales volume | Without coverage, factoring can cost 10%–30% of invoice value |

Trade credit insurance not only protects your business but also opens up opportunities for growth and efficiency that would be much harder – or riskier – to achieve otherwise.

Selecting the Right Trade Credit Insurance Policy

Finding the right trade credit insurance policy depends on how your business operates, especially in terms of customer concentration and transaction patterns.

Start by evaluating your customer concentration. If your business relies heavily on a few key clients, a Single Buyer policy might be the best fit. On the other hand, if your customer base is diversified, a Whole Turnover policy can provide broader coverage for all your accounts.

Your financing goals also play a big role. If you’re planning to use the policy to secure better terms with your bank, it’s a good idea to consult your lender first. Jason Benson, Global Head of Structured Working Capital at J.P. Morgan, offers this advice:

"Sellers should know their clients better than anybody. If a company isn’t doing its due diligence, it may be purchasing more insurance than is otherwise needed, or its insurance may be more expensive than it should be."

Banks often prefer policies with non-cancellable limits because they provide dependable collateral for loans. While these policies typically cost more than cancellable limits, they offer greater stability.

For businesses with high transaction volumes, policies with discretionary credit limits can streamline operations by allowing quick approval for smaller exposures. To make the underwriting process smoother, prepare a detailed submission pack. Include 12 months of accounts receivable aging, key buyer exposures, average payment terms, and a record of bad debt history. This information helps insurers price the policy more accurately.

Sales-Based vs. Coverage-Based Plans

When it comes to pricing structures, you’ll likely choose between Sales-Based and Coverage-Based plans. Here’s how they compare:

| Feature | Sales-Based (Turnover) | Coverage-Based (Exposure) |

|---|---|---|

| Pricing Method | Rate applied to total insured sales volume (typically 0.15%–0.80%) | Rate applied to a specific credit limit or exposure (can exceed 1.2% for high-risk accounts) |

| Best For | Businesses with predictable, high-volume sales across many buyers | Businesses managing high-value, infrequent transactions or single buyers |

| Features | Simple reporting; automatic coverage for all shipments; bank-friendly | Focused on specific risks; reduced administrative workload |

| Limitations | Limited flexibility to exclude low-risk buyers; can be costly if margins are tight | Requires frequent adjustments as exposure changes; smaller accounts may remain uncovered |

If you’re looking for simplicity and broad protection, portfolio policies covering your entire turnover are often the way to go. These policies usually cost less than 1% of insured sales volume and are easy to manage, making them a good option for businesses aiming to secure financing. On the other hand, coverage-based plans are better suited for targeting specific high-value or high-risk accounts. While they allow you to avoid paying premiums on lower-risk customers, they require more hands-on management and leave smaller receivables unprotected.

Conclusion

Trade credit insurance (TCI) acts as a safety net for your business, protecting against buyer defaults and ensuring a steady cash flow. If a customer can’t pay due to insolvency or prolonged default, TCI typically covers 75% to 95% of the unpaid invoice amount. For international transactions, it also provides protection against risks like political instability, government embargoes, war, or currency transfer restrictions.

By insuring receivables, your business gains access to better financing terms, as banks view these assets as high-quality collateral. This reduces your bad debt reserves and frees up cash, helping you maintain operational stability. With this financial security, your business is better positioned to pursue growth opportunities and enter new markets.

TCI empowers businesses to grow confidently. It allows you to offer attractive open account terms to international buyers without relying on costly Letters of Credit. You can explore high-risk markets, accept larger orders, and build relationships with new customers – all with reduced financial uncertainty.

Choosing the right policy is crucial. Whether you need a whole turnover policy for comprehensive protection or a plan focused on specific high-value accounts, your coverage should align with your business needs, customer base, and growth goals. With 25% of companies reportedly failing due to customer non-payment, having the right policy in place can safeguard your operations and open doors to new opportunities.

For more insights and resources tailored to your needs, visit CreditInsurance.com and take the next step toward securing your financial future.

FAQs

How does trade credit insurance help businesses manage risks in uncertain markets?

Trade credit insurance provides businesses with a safety net for their cash flow, shielding them from losses caused by unpaid invoices. Whether it’s due to buyer insolvency, bankruptcy, or political upheaval, this coverage ensures companies are protected from the financial strain of non-payment.

Beyond protection, trade credit insurance plays a key role in fostering business growth. It allows companies to extend more attractive credit terms to their buyers, secure improved financing opportunities, and confidently explore new markets without bearing as much financial risk.

How can a business choose the right trade credit insurance policy?

Start by taking a close look at what your business actually needs. Do you need coverage for all your trade receivables, or are you more concerned about protecting specific key accounts or individual risks tied to certain customers? This decision is the foundation of finding the right policy.

From there, think about the type of policy that fits your risk profile. Options include whole turnover coverage (for broad protection), single risk coverage (focused on specific accounts), or excess of loss coverage (ideal for managing larger, unexpected losses). If your business spans multiple countries, make sure the policy also addresses political risks and is tailored to the regions where you operate.

Cost and flexibility are also key factors. Look for a policy that fits within your budget – most trade credit insurance policies cost less than 1% of sales. At the same time, ensure it offers flexibility, like adjustable credit limits, to adapt to your business’s changing needs.

By weighing these elements carefully, you can find a policy that not only protects your business but also supports its growth.

How does trade credit insurance help businesses secure better financing options?

Trade credit insurance plays a key role in helping businesses secure better financing by minimizing the risks tied to accounts receivable. When receivables are insured, companies can confidently offer more flexible credit terms to their customers and even negotiate higher credit limits with lenders. Why? Because financial institutions feel more secure extending credit or working capital when they know the receivables are protected, lowering their exposure to potential losses.

On top of that, trade credit insurance strengthens a company’s financial footing. It not only makes accessing funds for growth opportunities easier but also provides a safety net against risks like non-payment or customer insolvency.