Expanding into global markets requires understanding risks tied to specific countries – like political instability, economic challenges, or regulatory changes. These risks can affect trade, payments, and overall business success. The right tools can simplify this process, offering clear insights into market conditions and helping businesses make informed decisions. Here’s a quick look at some of the best tools for assessing country-specific risks:

- Economic and Political Risk Evaluator (EPRE): Covers 164 countries, analyzing variables like economic stability, political risks, and security.

- Control Risks RiskMap: Focuses on global trends, providing annual forecasts and insights into risks like geopolitical shifts and organized crime.

- Coface Business Risk Dashboard: Evaluates credit risks and business climates for over 160 countries, ideal for trade-focused industries.

These tools help businesses assess risks using detailed ratings, real-time updates, and tailored insights. Choosing the right solution depends on your business needs, the regions you operate in, and the type of risks you prioritize.

Best Tools for Country-Specific Risk Analysis

Economic and Political Risk Evaluator (EPRE)

Oxford Economics‘ EPRE platform offers an in-depth look at risk across 164 countries by evaluating 11 variables grouped into four categories: Economic/Financial (sovereign risk, exchange rate volatility, trade credit), Political (stability, ideology, international relations), Business/Market (operating conditions, costs, demand), and Security/Social (security conditions, social cohesion). One standout feature is its ability to adjust risk factor weightings, allowing businesses to align the analysis with their specific priorities. It also supports compliance with IFRS 9 and CECL standards while offering detailed country profiles for added context.

Control Risks RiskMap

Control Risks RiskMap provides a global perspective with its annual forecast tool, which focuses on risk ratings and emerging trends. For 2026, the platform identifies three major global risk themes: transactional geopolitics, organized crime, and the competition for compute. This tool is particularly useful for staying ahead of global shifts and understanding how these trends may affect various regions.

Coface Business Risk Dashboard

Coface’s platform delivers two key assessments for over 160 countries: the Country Risk Assessment, which gauges the average credit risk of businesses in a given country, and the Business Climate Assessment, which evaluates the regulatory and operational environment. This dual analysis is especially helpful for trade-focused industries and credit managers, as it assesses both buyer creditworthiness and broader market conditions.

sbb-itb-b840488

Country risk analysis

What to Look for When Choosing a Tool

Finding the right risk analysis tool means matching its features to the specific needs of your business and the markets you operate in.

Geographic Coverage and Risk Categories

Start by ensuring the tool covers all the regions where your business operates. Top platforms track risks across anywhere from 241 countries to over 260 jurisdictions. It’s equally important to confirm that the tool monitors the types of risks that matter most to your business.

Many platforms divide risks into categories like macroeconomic stability (e.g., currency fluctuations), business environment (e.g., regulatory challenges), and political risks (e.g., government instability). Advanced tools also include insights into financial crimes, corruption, and newer threats like organized crime or geopolitical conflicts. If your business operates in high-risk or emerging markets, look for a tool that offers detailed ratings across multiple risk dimensions. This level of detail helps you understand not just if a country is risky but why it poses a risk.

Update Frequency and Forecasting Capabilities

The timing of updates can be critical. Some tools provide annual forecasts, which are useful for strategic planning, while others offer real-time alerts to notify you of risks as they arise. For example, Control Risks updated ratings for 27 countries in their 2026 forecast, which can guide yearly budgeting but might miss sudden political or regulatory shifts. On the other hand, platforms like Sigma360 monitor over 100 billion global risk signals in real time, allowing businesses to react quickly to emerging situations.

If your industry moves fast – like technology or commodities trading – real-time alerts are essential. For longer-term decisions, consider platforms that distinguish between short-term risks (6–12 months) and medium-term assessments, which evaluate deeper issues like economic imbalances or institutional stability.

Beyond regional coverage and update frequency, you’ll also need to weigh factors like pricing and how well the tool integrates into your existing systems.

Cost and Integration Features

Most tools offer tiered pricing plans. For instance, CountryRisk.io provides a 14-day free trial, while Maplecroft offers custom packages. Basic plans often support small teams (up to five users), while enterprise-level plans include unlimited access and advanced integration options.

Integration is another key factor. Many platforms provide REST APIs for real-time data feeds, downloadable data in formats like CSV or Excel for periodic updates, and interactive dashboards for visual analysis. If your team relies on automated workflows, such as feeding risk data into an ERP or CRM system, it’s worth reviewing the platform’s API documentation and testing compatibility during a trial period. Some tools also allow white-labeling or the inclusion of custom risk parameters, which can be a huge advantage for businesses with unique assessment needs.

Tool Comparison

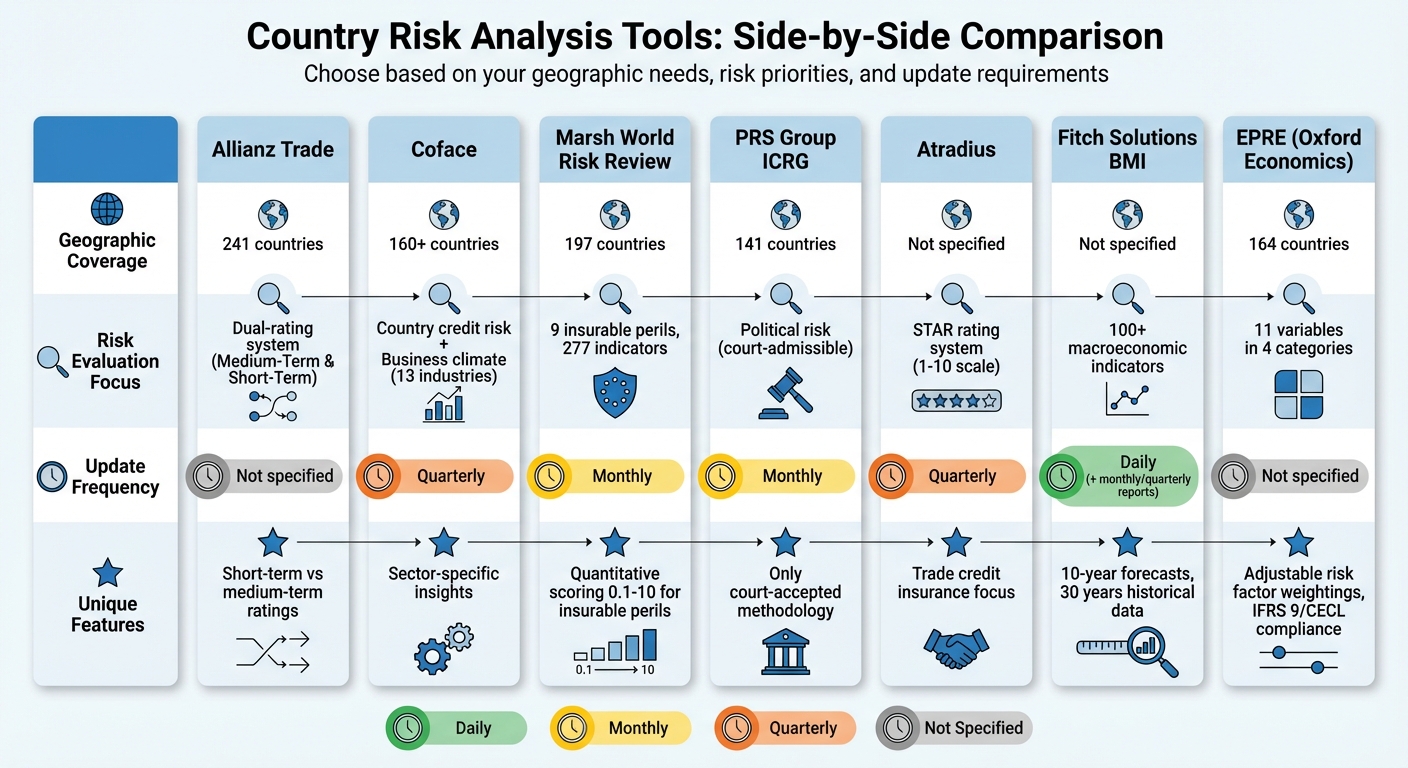

Country Risk Analysis Tools Comparison: Coverage, Features, and Update Frequency

Here’s a closer look at how these tools stack up against each other, focusing on their geographic reach, risk evaluation methods, and update schedules.

The platforms vary significantly in their coverage. For instance, Allianz Trade provides risk assessments for 241 countries. Meanwhile, Marsh World Risk Review covers 197 countries, and PRS Group‘s ICRG tracks data for 141 countries.

When it comes to risk evaluation, each tool has its own approach. Coface emphasizes country credit risk and business climate, analyzing over 160 countries and offering sector-specific insights for 13 industries. Allianz Trade uses a dual-rating system: a Medium-Term Rating (Country Grade) for structural risks and a Short-Term Rating (Country Risk Level) for immediate financial threats. Marsh, on the other hand, specializes in nine insurable perils – like currency inconvertibility, expropriation, and war – using a model with 277 indicators. Atradius employs its STAR rating system (Sovereign Transfer and Arbitrary Risk) on a 1 to 10 scale, focusing on trade credit insurance and cross-border payment risks.

Update frequency is another differentiator. Fitch Solutions BMI updates its data daily, supplemented by monthly and quarterly reports. Both Marsh and PRS Group update their tools monthly, while Atradius and Coface release quarterly updates. Fitch Solutions BMI also provides 10-year forecasts for over 100 macroeconomic indicators, supported by 30 years of historical data.

Some tools offer unique benefits. For example, PRS Group’s ICRG stands out as the only political risk methodology accepted by commercial courts for risk valuation. It also contributes to Transparency International‘s corruption scores. As PRS Group explains:

"ICRG is the only political risk methodology and data series to be accepted by the courts in commercial disputes involving the valuation of political risk".

For businesses managing global portfolios, Marsh’s quantitative scoring system – ranging from 0.1 (lowest risk) to 10 – offers a straightforward way to measure risks like terrorism, war, and civil unrest. Additionally, Fitch Solutions BMI has been recognized by FocusEconomics for its accuracy in macroeconomic forecasting, with one business strategy expert calling it "best-in-class for reports, specifically country-wide macro reports".

Ultimately, the right tool depends on your priorities – whether you need extensive geographic coverage, court-admissible political risk data, industry-specific insights, detailed insurable peril analysis, or dependable long-term forecasts.

Conclusion

Picking the right country-specific risk analysis tool comes down to your business needs and priorities. The tools we’ve discussed each bring something different to the table – whether it’s broad geographic coverage, industry-specific insights, or real-time updates. Features like dual-rating systems, quantitative scoring models, and tailored methodologies provide the information you need to navigate global markets with clarity.

Start by evaluating your specific risk exposure. Are you most concerned about currency inconvertibility, political unrest, or sovereign credit risk? Also, think about how often you need updates – monthly for unstable markets or quarterly for more predictable regions. Free resources like the U.S. Commercial Service‘s Country Commercial Guides can serve as a great starting point, offering foundational insights before you invest in more specialized tools that align with your risk profile.

For those looking to tie risk analysis directly to credit protection, CreditInsurance.com offers guidance on managing challenges like non-payment, political instability, and customer insolvency. Combining these insights with trade credit insurance gives you a strong safety net. By pairing risk intelligence with financial protection, you can confidently manage the uncertainties of international trade while exploring new market opportunities.

FAQs

Which tool fits my industry and countries?

When it comes to country-specific risk analysis, the right tool largely depends on your industry and specific business requirements. Here are a few options to consider:

- IHS Markit‘s Country Risk Model: This tool is ideal if you’re looking for in-depth data on sovereign debt, currency fluctuations, and political risks.

- Coface’s Country Risk Handbook: This provides macroeconomic insights and sector-specific details, making it a great choice for businesses seeking a broader economic perspective.

- Sigma360’s Country Risk Ratings: Perfect for those who need real-time, multi-risk assessments to stay updated on changing conditions.

Your choice should align with the level of detail and type of analysis your business needs.

Do I need real-time alerts or forecasts?

Real-time alerts and forecasts play a key role in making informed decisions and assessing risks effectively. They offer timely and reliable insights, helping businesses and individuals navigate the constantly shifting landscape of country-specific challenges. Platforms like those from AKE Group and S&P Global emphasize the value of staying updated with precise forecasts and regular updates to reduce exposure to financial and political uncertainties.

How do I use risk data with credit insurance?

To make the most of risk data with credit insurance, start by examining country-specific factors like political stability, economic trends, and currency exchange challenges. This helps identify potential risks such as non-payment or insolvency. By using this information, businesses can fine-tune credit limits and payment terms to minimize exposure. Credit insurance acts as a safety net, covering losses from unexpected non-payment events. This allows companies to extend credit with confidence, manage financial risks effectively, and pursue international expansion with greater security.