When evaluating credit risk for insurance, numbers alone don’t tell the whole story. Qualitative risk assessment digs deeper into non-financial factors like leadership stability, industry trends, and business strategies. This approach helps underwriters and businesses make smarter decisions by identifying risks that financial data might miss.

Here’s the key takeaway: combining qualitative (judgment-based) and quantitative (data-driven) methods creates a more complete risk profile. While financial metrics measure "how much" risk, qualitative analysis explores "why" and "how" risks arise. This balance is especially useful for small businesses, startups, or industries facing unique challenges.

Key Highlights:

- Management Quality: Leadership stability and decision-making processes are critical.

- Industry Trends: Market health, competitive pressures, and regulatory changes matter.

- Operational Risks: Supply chain issues, customer concentration, and outdated strategies can signal trouble.

- Hybrid Approach: Combining data analysis with expert judgment strengthens risk evaluations.

- Practical Application: Use the "5 Cs" framework (Character, Capacity, Collateral, Capital, Conditions) to assess risks effectively.

By understanding these factors, you can refine credit insurance decisions, negotiate better terms, and reduce exposure to potential losses. Platforms like CreditInsurance.com simplify this process by offering tools and expert guidance to evaluate risks and tailor policies.

Credit Risk Qualitative and Quantitative Analysis Part-2 for Banks Asset Quality Evaluation #viral

How Qualitative Factors Affect Credit Insurance

When it comes to credit insurance, underwriters don’t just rely on financial statements. They dig deeper, looking at qualitative factors that reveal risks numbers alone can’t capture. These factors include the stability of a company’s leadership, challenges within its industry, and how resilient its business model is. These insights play a big role in shaping coverage terms, premium rates, and policy limits.

By analyzing these qualitative aspects, insurers aim to predict whether a buyer will pay their invoices on time. A company might have solid financials today, but what if a key executive resigns? What if the industry is in decline? Or the company relies too heavily on one major customer? These are risks that qualitative analysis can uncover early, giving insurers a more complete picture.

A strong understanding of these factors can result in better coverage terms. For example, companies that demonstrate stable leadership, a strong market position, and sound operations are often seen as lower risk. This perception can lead to premium rates that typically range between 0.10% and 0.20% of total sales for average risk profiles. On the flip side, weak qualitative indicators – like poor management or an unstable market – can lead to higher premiums or even coverage denials, even if the financials look good.

Management and Leadership Assessment

The quality of leadership is a cornerstone of credit risk evaluation. Insurers focus on who’s running the business, how decisions are made, and whether the leadership team has the experience to navigate tough times. This falls under the "Character" pillar of credit assessment, which evaluates whether a company is likely to meet its obligations.

Succession planning is another key consideration. For small businesses, where nearly 70% of owners have dipped into personal funds to keep operations running, the owner’s commitment and track record are especially critical. Insurers look beyond credentials, assessing integrity and the willingness to honor commitments. They verify references, consider the company’s industry reputation, and examine how it has performed during challenging times. Businesses with seasoned leaders who’ve successfully weathered downturns are generally viewed as lower risk.

But leadership is only part of the equation. The broader market environment also plays a crucial role in credit risk.

Industry and Market Conditions

The health of the industry and market conditions heavily influence a buyer’s ability to pay. Insurers examine factors like competitive pressures, regulatory changes, and economic trends to evaluate risk. This analysis ties into the "Conditions" factor of credit evaluation.

For instance, online hotel booking companies saw reduced risk in 2022 due to a surge in post-pandemic travel demand. Meanwhile, industries like sawmills and wood production faced greater challenges, with declining revenues linked to rising interest rates. These examples show how industry conditions directly affect a company’s long-term viability.

Other considerations include competitive intensity, how easily customers can switch providers, and the influence of suppliers. Industries with high barriers to entry and steady demand are typically seen as lower risk. On the other hand, sectors facing disruptions or shrinking growth need closer examination. For businesses operating internationally, additional challenges – like political instability, currency fluctuations, and trade sanctions – add complexity to risk assessments.

"Industry risk analysis helped me plan for potential challenges and set up contingency plans. In my experience, being prepared for risk can make all the difference in a business’s success."

– Sinoun Chea, CEO, ShiftWeb

Operational and Business Strategy Risks

Operational management offers another layer of insight into risk. Insurers look at supply chain vulnerabilities and customer concentration as indicators of cash flow stability and payment reliability. For example, a company that relies too heavily on one major customer could face financial trouble if that relationship ends.

They also evaluate whether a company’s business model aligns with current market conditions. A strategy that worked in the past might no longer be effective today. Insurers keep an eye on operational changes, such as expansions without proper expertise or restructuring efforts that strain resources. With 47% of U.S. B2B invoices paid late, operational efficiency and working capital management are critical factors.

Companies that demonstrate strong operational controls, a diversified customer base, and realistic growth strategies are generally seen as lower-risk candidates for coverage. These operational strengths not only improve the company’s stability but also make it a more attractive prospect for insurers.

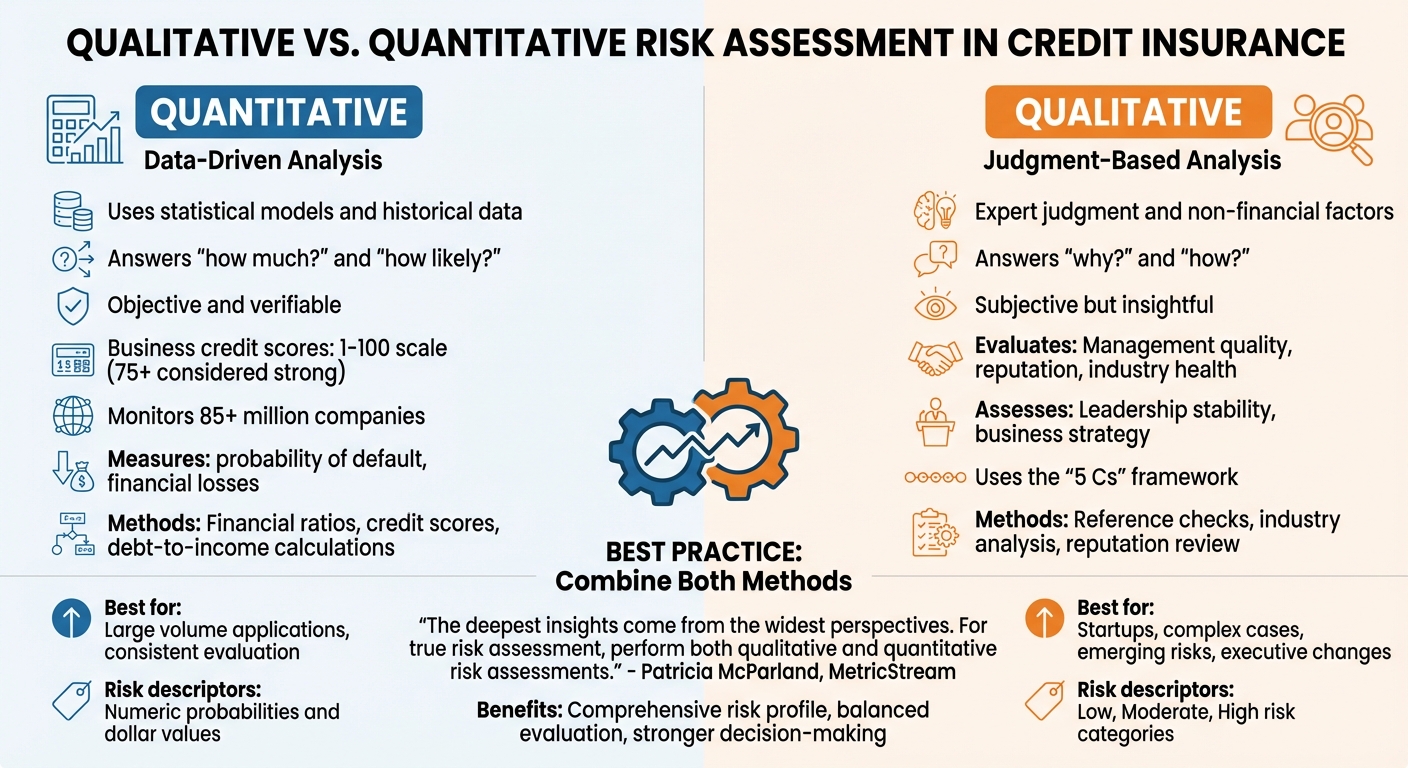

Qualitative vs. Quantitative Risk Assessment

Qualitative vs Quantitative Risk Assessment Methods in Credit Insurance

To fully understand risk, it’s important to explore how qualitative and quantitative assessments complement each other, offering a well-rounded view.

Underwriters typically assess risk using two approaches: qualitative and quantitative. Quantitative risk assessment is all about the numbers. It relies on statistical models and historical data to measure risk in concrete terms. This method answers questions like "how much?" and "how likely?" by calculating metrics such as the probability of default or potential financial losses. For instance, business credit scores – ranging from 1 to 100 – serve as a common quantitative measure, with scores above 75 often considered strong.

On the other hand, qualitative assessments dig into the "why" and "how" of potential risks. This approach relies on expert judgment to evaluate non-financial factors, using descriptors like "low", "moderate", or "high" risk. It examines elements such as management quality, reputation, and the overall state of the industry, offering insights that numbers alone can’t capture.

Subjective vs. Objective Evaluation

Quantitative analysis provides an objective lens by using hard data like financial ratios, credit scores, and debt-to-income calculations. These data points are verifiable and consistent, making this method ideal for evaluating large volumes of applications. For example, some firms monitor over 85 million companies to support their credit decision-making processes. The precision of quantitative models ensures consistency and helps identify risks efficiently.

In contrast, qualitative analysis thrives in situations where data alone falls short. It relies on expert judgment to evaluate more nuanced or emerging risks. For example, it’s especially useful when assessing startups without a payment history or when dealing with sudden changes like executive turnover. Qualitative insights also play a key role when credit reports rely on outdated information, sometimes over a year old.

By combining these approaches, organizations can create a more balanced and thorough risk evaluation.

Using Both Methods Together

Today’s credit teams often use a hybrid approach, blending quantitative and qualitative methods to build a comprehensive risk profile. Quantitative data serves as the foundation, efficiently filtering large applicant pools. Meanwhile, qualitative reviews add depth, uncovering risks that raw numbers might overlook. This layered strategy is particularly valuable for complex cases or high-stakes decisions.

"The deepest insights come from the widest perspectives. For true risk assessment, perform both qualitative and quantitative risk assessments to gain real visibility into the overall organizational and cyber risk posture."

– Patricia McParland, AVP, Product Marketing, MetricStream

Recent studies highlight how integrating these methods strengthens decision-making frameworks. By combining measurable data with qualitative insights, credit teams can address both tangible metrics and subjective factors like management upheavals or shifting industry trends. This balanced approach not only enhances risk evaluation but also supports more resilient decision-making processes.

sbb-itb-b840488

How to Conduct a Qualitative Risk Assessment

You don’t need fancy software to perform a qualitative risk assessment. Small and medium-sized businesses can follow a simple process to evaluate non-financial risks and make smarter credit insurance decisions. The key lies in gathering the right information, organizing it effectively, and applying what you learn to your coverage strategy.

Gathering and Analyzing Information

Start by using the "5 Cs" framework: Character, Capacity, Collateral, Capital, and Conditions. For qualitative assessments, focus on Character and Conditions, as these reveal insights that financial data alone cannot.

To assess Character, reach out to business references to verify the length of credit relationships and payment reliability. Dive into the buyer’s reputation by checking trade publications, social media, and public records. As Lukas Quanstrom, Co-Founder and CEO of Ontic, puts it:

"Once a potential threat has been identified, the next step is to research the threat and apply data from sources like public records, social media, dark net – so that you can learn as much as possible".

For Conditions, explore external factors that could influence payments. If you’re dealing with export customers, consider country-specific risks like currency volatility, political instability, or trade sanctions. Industry reports can also provide insight into whether your buyer’s sector is thriving or struggling. For instance, commercial real estate loan delinquencies hit 0.22% by the end of 2023, while commercial mortgage-backed securities climbed to 4.7% in early 2024.

Pay close attention to management quality. Red flags like frequent executive turnover or abrupt strategic shifts can signal trouble, even if payment history appears clean. Use CRM tools to track changes in buying patterns or transaction frequency – early indicators of potential distress.

Once you’ve gathered this qualitative data, the next step is to translate your findings into standardized risk scores.

Assigning Risk Scores

After collecting all relevant information, organize it into a clear rating system. Many formal systems use six to ten levels to differentiate risk, but smaller businesses often find it easier to start with four categories:

| Risk Category | Description | Key Indicators |

|---|---|---|

| Pass (Low Risk) | Strong management, stable industry, excellent reputation | • Consistent payments • Experienced leadership • Growing market share |

| Special Mention (Moderate Risk) | Potential weaknesses; industry challenges | • Recent management changes • Slowing sales growth • Increased competition |

| Substandard (High Risk) | Clear weaknesses; poor market conditions | • Late payments in the past year • Declining profit margins • Regulatory pressures |

| Doubtful/Loss (Critical Risk) | High likelihood of default; severe issues | • Multiple missed payments • Bankruptcy rumors • Major customer losses |

Segment your customer portfolio by geography, industry, and size to spot patterns. For example, a manufacturing company in a stable Midwestern market might earn a Pass rating, while a similar-sized business in an unstable emerging market could fall into Special Mention – even if their financial metrics are identical. Update these scores regularly, with formal reviews at least once a year. Markets evolve, management teams change, and a low-risk buyer today might become a concern tomorrow.

With your ratings in place, you can now use these insights to refine your credit insurance strategy.

Applying Results to Credit Insurance Decisions

Your qualitative risk scores directly influence how you approach credit insurance, from coverage limits to policy types. These insights ensure your decisions are both informed and balanced.

For buyers rated Pass, you can confidently request higher coverage limits from your insurer. Their stable conditions and strong reputation justify standard premium rates, typically ranging from 0.10% to 0.20% of total sales. When applying for credit insurance, insurers often ask for details about your top 15 customers and sales forecasts – your qualitative assessments make this information more compelling.

Buyers in the Special Mention category need closer monitoring. Add them to a watch list and request frequent updates from your insurer. You might keep coverage but reduce limits until their conditions improve.

For Substandard ratings, your qualitative insights become critical. If the risk stems from temporary industry challenges rather than poor management, you could maintain coverage with added security measures. On the other hand, if management issues are the root cause, you may need to significantly restrict limits or consider a "Special Products" policy tailored for higher-risk markets.

Critical Risk buyers often fall outside standard insurance coverage. However, your assessment might uncover ways to mitigate risk – such as requiring personal guarantees or liens – or determine that extending credit isn’t worth the gamble.

With 47% of U.S. B2B invoices paid late and 42% of companies dedicating more resources to chasing unpaid debts, a thorough qualitative assessment can help you sidestep these pitfalls by identifying risks before they turn into losses.

Using Qualitative Risk Assessment in Practice

Improving Credit Insurance Underwriting

Qualitative risk assessments play a key role in helping insurers set premiums and define coverage terms that accurately reflect the risk involved. Factors like management stability, industry trends, and reputation checks uncover risks that raw data alone might miss.

For example, insurers often reach out to the business references provided by key customers to verify payment reliability and assess trustworthiness – something a standard credit report can’t always reveal. As Allianz Trade explains:

"Character: It is important to determine that your trade partner has the background and credentials that indicate they are trustworthy and have a reputation for sound business practice".

This approach combines hard data with qualitative judgment, which is especially useful in cases like startups that lack a payment history. When factors such as management quality or the viability of a business model are critical, this hybrid method ensures a more accurate risk evaluation. For businesses with average risk profiles, such detailed assessments often lead to premium rates ranging between 0.10% and 0.20% of total sales.

These principles translate seamlessly into real-world decision-making, as illustrated in the examples below.

Examples and Case Studies

The practical application of qualitative assessments shines in scenarios where traditional metrics fall short. For instance, buyers operating in distressed industries or unstable regions are often flagged as higher risk due to factors like currency fluctuations or potential trade sanctions – even if their financial statements appear strong.

Management changes also provide critical insights. Ann Marie Smith from Command Credit notes:

"Qualitative risk analysis is an experience-driven, subjective method of evaluating credit risk. Rather than producing numeric probabilities or dollar values, this approach assesses risk factors using descriptive terms".

Frequent executive turnover is a red flag for analysts, signaling potential instability, even if the buyer’s current payment history looks solid.

The importance of qualitative assessments is further underscored by broader trends. For example, nearly 70% of small employer firms rely on personal funds to support their businesses, and about 40% carry debts exceeding $100,000. These realities highlight the need for a deeper, more nuanced evaluation of risk.

Using CreditInsurance.com Resources

Platforms like CreditInsurance.com make it easier to incorporate qualitative risk assessments into your decision-making process. They connect you with expert underwriters who analyze your top customers’ creditworthiness and help tailor policy options. Credit insurers have access to insights from millions of buyer relationships and transactions, offering a broader perspective than individual trade references can provide.

The platform’s quoting process is free and comes with no obligation, making it a low-risk way to explore how qualitative insights can enhance your coverage decisions. Available tools include templates for operational risk assessments, risk matrices, and decision trees, all designed to help you identify and prioritize potential threats systematically. Since qualitative methods are often quicker and more cost-effective than quantitative ones, these tools allow for regular reviews without straining resources.

Additionally, CreditInsurance.com supports you in acting on assessment findings through four key strategies: Avoidance (eliminating risk), Mitigation (reducing its impact), Transfer (shifting risk through insurance), or Acceptance. With trade credit insurance premiums potentially being tax-deductible, the platform equips you to optimize both your financial protection and efficiency.

Conclusion

Qualitative risk assessment plays a crucial role in making well-informed credit insurance decisions. While financial statements and credit scores lay the groundwork, they often miss the nuanced factors that can significantly impact risk. That’s why it’s essential to evaluate the human and strategic aspects that numbers alone can’t reveal.

The best approach to risk assessment combines statistical accuracy with qualitative insights. Use quantitative tools to filter large volumes of data, but rely on qualitative analysis to dig deeper into complex cases. Key elements like Character – a company’s trustworthiness and reputation – and Conditions – including industry trends and political factors – should take center stage when refining your evaluation process. These insights help you take smarter, more actionable steps in managing risk.

Qualitative analysis can uncover warning signs that might otherwise go unnoticed: frequent changes in leadership, unfavorable press coverage, or regulatory shifts within specific industries. With nearly half of U.S. B2B invoices (47%) being paid late and 42% of companies dedicating more resources to chasing overdue payments, staying ahead of potential risks has never been more critical. Regularly monitoring factors like market trends and management shifts can help you spot and address issues before they escalate into costly problems.

Putting these insights into action doesn’t have to be complicated. Platforms like CreditInsurance.com offer the tools and expert underwriting support to seamlessly incorporate qualitative factors into your credit decisions. With access to proprietary databases tracking millions of buyer relationships and free quoting services, you can develop a robust risk management strategy that not only protects your business but also fuels growth. And with costs typically ranging between 0.10% and 0.20% of total sales, it’s a small investment for the peace of mind and informed decisions you’ll gain.

FAQs

How does qualitative risk assessment enhance decision-making in credit insurance?

Qualitative risk assessment plays a key role in improving decision-making within credit insurance. It helps identify potential high-risk exposures while offering valuable insights into non-financial factors. By adding expert judgment and context, it works alongside quantitative analysis to help businesses prioritize risks and make better-informed choices about underwriting and pricing.

This method allows credit insurers to take a more well-rounded view of risks, providing stronger safeguards against financial challenges like customer insolvency or payment defaults. At the same time, it supports smarter credit management, opening doors to growth opportunities.

Why is management quality important in assessing credit risk?

Management quality is a key factor when it comes to evaluating credit risk. It gives insight into how well a borrower can tackle challenges and stay financially stable. Analysts look at things like the management team’s experience, their decision-making skills, and their track record to gauge how effectively they can manage financial responsibilities.

A capable leadership team often points to a reduced risk of default, while weak management can raise red flags, even if the financial numbers look strong. This qualitative assessment works alongside the hard data to offer a more well-rounded view of a borrower’s creditworthiness.

What is the ‘5 Cs’ framework, and how can it help with qualitative risk assessment in credit insurance?

The ‘5 Cs’ framework – Character, Capacity, Capital, Collateral, and Conditions – is a practical approach businesses can use to assess buyer creditworthiness from a qualitative perspective. This method allows credit insurance teams to build a well-rounded risk profile by examining several critical elements:

- Character: This factor focuses on the buyer’s reliability. It evaluates their reputation, payment history, and the stability of their management team. Essentially, it’s about determining how trustworthy and dependable they are.

- Capacity: Here, the emphasis is on the buyer’s ability to meet payment obligations. Key indicators include cash flow, revenue trends, and debt ratios, which together paint a picture of their financial health.

- Capital: This examines the buyer’s financial strength, such as equity and retained earnings, to understand their ability to absorb potential losses and remain stable.

- Collateral: This looks at tangible assets, like inventory or receivables, which could be used as security to back up payment commitments if necessary.

- Conditions: External factors are also considered, such as market trends, economic cycles, and political risks, all of which could influence the buyer’s ability to fulfill their obligations.

Using the ‘5 Cs’ framework allows businesses to spot potential warning signs, like insufficient cash flow or exposure to unstable markets. It also helps create a detailed narrative that works alongside quantitative risk models. For small and medium-sized businesses, CreditInsurance.com provides tools and resources to make applying this framework straightforward, ensuring a consistent and thorough evaluation of buyer risk.