International accreditation frameworks simplify global credit insurance practices by providing standardized guidelines for credit evaluation and risk management. Here’s a quick look at the five most notable frameworks:

- Eurosystem Credit Assessment Framework (ECAF): Standardizes credit quality evaluations across borders, focusing on reducing collateral credit risk in monetary operations.

- Insurance Core Principles (ICPs): Ensures insurers maintain adequate funds to meet claims and adopt risk-based supervision.

- Common Framework for the Supervision of Internationally Active Insurance Groups (ComFrame): Targets large, cross-border insurance groups, focusing on governance, risk management, and capital adequacy.

- International Accreditation Forum (IAF) Standards: Promotes global recognition of accredited certifications, reducing the need for multiple certifications across countries.

- Global Credit Certificate (GCC): A professional qualification for credit professionals, emphasizing practical credit analysis skills.

These frameworks streamline credit assessments, unify practices across jurisdictions, and address modern challenges like climate risks and data-driven evaluations. Each has specific applications and limitations, offering unique value to credit insurers and professionals.

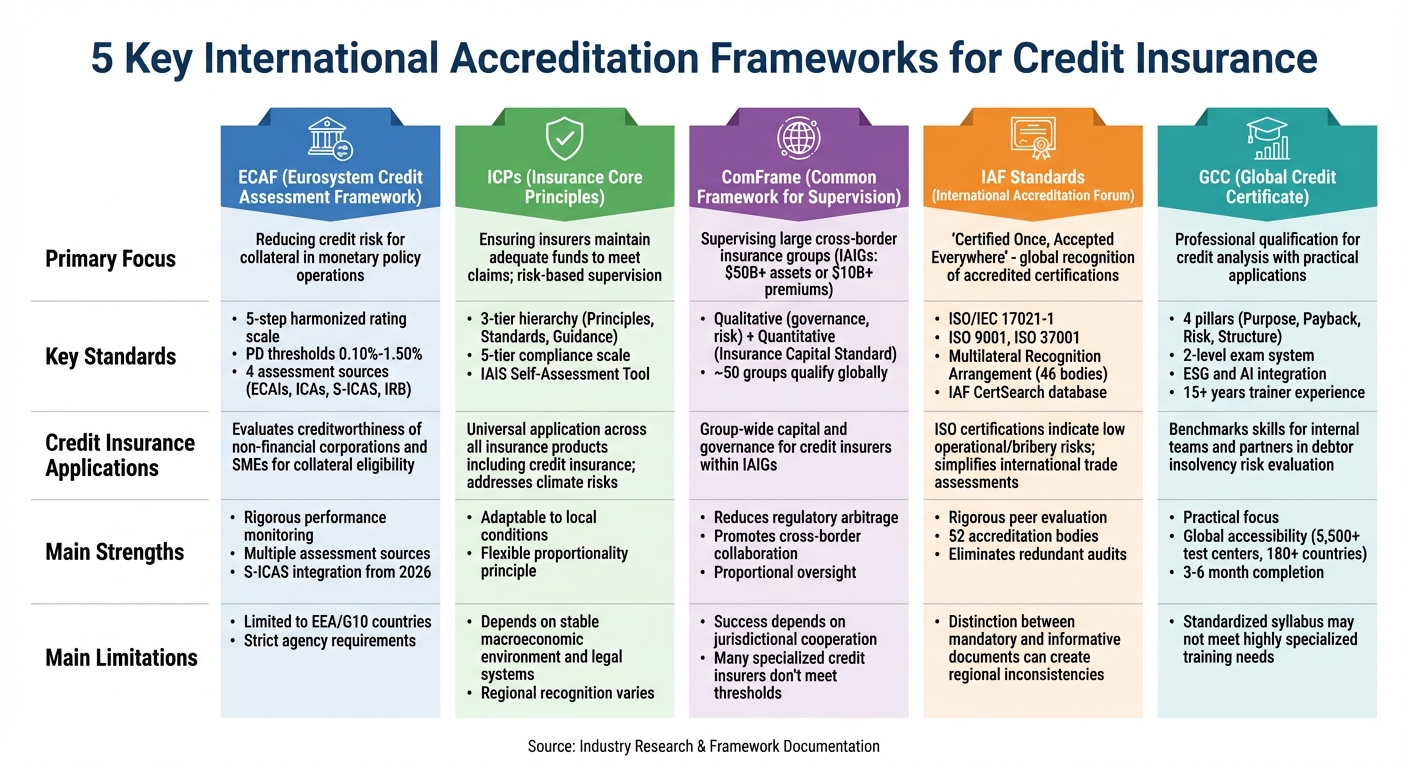

Comparison of 5 International Accreditation Frameworks for Credit Insurance

1. Eurosystem Credit Assessment Framework (ECAF)

Primary Focus

The Eurosystem Credit Assessment Framework (ECAF) is designed to standardize credit quality evaluations across borders, aiming to reduce collateral credit risk in monetary operations. According to the European Central Bank (ECB), the framework:

"mitigates the credit risk of collateral used in monetary policy operations, together with appropriate valuation and risk control measures".

This framework applies to both marketable assets, such as government bonds, and non-marketable assets, like loans granted to companies.

ECAF uses a harmonized rating scale to map credit ratings into five credit quality steps based on one-year probability of default (PD). For example, a PD of up to 0.10% corresponds to credit quality step 2, while up to 0.40% aligns with step 3 – the minimum requirement for most eligible collateral. Asset-backed securities typically need to meet at least credit quality step 2. These evaluations rely on robust credit assessment sources, detailed below.

Key Standards or Sources

ECAF incorporates four main sources for credit assessment:

- External Credit Assessment Institutions (ECAIs): Includes agencies like Moody’s and S&P.

- National Central Banks’ In-house Credit Assessment Systems (ICASs).

- Statistical In-house Credit Assessment Systems (S-ICASs).

- Counterparties’ Internal Ratings-Based (IRB) systems.

Currently, seven national central banks, including the Deutsche Bundesbank and Banque de France, operate approved ICASs. Starting January 1, 2026, S-ICASs will also be accepted under the general collateral framework. ECB analysts Cláudia Duarte, Janina Engel, Oleg Reichmann, and Tomislav Džaja highlight the importance of this addition:

"The introduction of NCBs’ statistical in-house credit assessment systems (S-ICASs) from 2026… will strengthen the internal credit assessment capabilities of the Eurosystem and broaden the available set of potential collateral".

This change is particularly aimed at supporting small and medium-sized enterprises that lack external credit ratings.

Applicability to Credit Insurance

ECAF’s quantitative benchmarks play a crucial role in ensuring consistent underwriting practices in credit insurance. The framework helps determine whether a guarantor meets the necessary credit quality standards for credit insurance and guarantees. If a guarantor fails to meet these standards, ECAF allows either the rejection of the assets or the application of additional haircuts, which reduce the liquidity available to banks. To ensure accuracy, all accepted systems are subject to annual performance monitoring, and providers must submit static pool data for verification.

Strengths and Limitations

One of ECAF’s key strengths is its ability to harmonize diverse rating sources and national systems. For instance, ICASs combine qualitative insights from expert analysts with quantitative data, while S-ICASs rely primarily on statistical models based on financial ratios and payment behavior. The latter approach is also less resource-intensive. Additionally, S-ICASs include methodological considerations related to climate change.

However, the framework does face limitations. S-ICAS assessments are restricted to domestic firms with exposures recorded in the AnaCredit dataset, which narrows their applicability. External credit assessment institutions must also meet strict minimum coverage requirements and maintain pricing schemes aligned with commercial terms. For asset-backed securities, the "second best" rule mandates at least two credit assessments from approved ECAIs, adding complexity to the approval process.

sbb-itb-b840488

2. Insurance Core Principles (ICPs)

Primary Focus

The Insurance Core Principles (ICPs) are a globally recognized framework for insurance supervision developed by the International Association of Insurance Supervisors (IAIS). These principles aim to safeguard policyholders by ensuring insurers maintain adequate funds to meet claims. On December 5, 2024, major updates were introduced, focusing on valuation, capital adequacy, and climate-related risks.

Key Standards or Sources

The ICP framework operates on a three-tier hierarchy:

- Principle Statements: Outline the essential regulatory elements.

- Standards: Define the fundamental requirements.

- Guidance: Offers clarity on implementation steps.

Compliance is evaluated using a five-tier scale: Observed, Largely observed, Partly observed, Not observed, and Not applicable. To help members assess their compliance, the IAIS provides a Self-Assessment Tool. However, these evaluations require expert judgment, and the IAIS recommends that experienced professionals with a background in insurance supervision carry out the assessments. These structured standards significantly influence credit insurance practices.

Applicability to Credit Insurance

ICPs ensure that insurers, including those offering credit insurance, adopt risk-based supervision and proportional oversight. These principles are applied universally across all jurisdictions and insurance products, including credit insurance. Risk-based supervision directs regulatory resources toward insurers or product lines that pose the highest risk to policyholders or financial stability. Meanwhile, the proportionality principle allows supervisors to tailor oversight based on the specific risks associated with an insurer’s operations and products.

In the case of credit insurance, the ICP framework covers both conventional risks and newer challenges, such as climate-related impacts. Historically, credit insurance has proven to be a reliable safety net. For instance, a 2020 survey highlighted how credit insurance coverage supported substantial lending activity in the global economy.

Strengths and Limitations

One of the strengths of the ICP framework is its ability to adapt to local conditions. Supervisors have the flexibility to modify requirements to suit the unique circumstances of their jurisdictions, avoiding a rigid, one-size-fits-all approach. However, the effectiveness of ICPs depends on foundational elements like a stable macroeconomic environment and dependable legal and accounting systems.

For example, the U.S. trade credit insurance market was valued at $2.02 billion in 2023 and is expected to grow by 10.6% annually through 2030. This illustrates how regulatory recognition can differ across regions. In the European Union, credit insurance is explicitly recognized as a risk mitigant under Article 506, with lower credit conversion factors (20%) compared to the United States, where performance guarantees face a higher credit conversion factor of 50%.

3. Common Framework for the Supervision of Internationally Active Insurance Groups (ComFrame)

Primary Focus

ComFrame is designed for the largest and most complex insurance groups that operate across multiple countries. Created by the International Association of Insurance Supervisors (IAIS), this framework was developed to address regulatory shortcomings revealed during the 2007–09 financial crisis. Its goal is to provide regulators with a shared "common language" for supervising cross-border insurance operations. To qualify as an Internationally Active Insurance Group (IAIG), a company must meet specific criteria: a three-year rolling average of total assets exceeding $50 billion or gross written premiums over $10 billion, along with operations in at least three jurisdictions, with at least 10% of premiums generated outside the home country. According to the IAIS, roughly 50 insurance groups globally meet these standards.

Key Standards or Sources

Building on the foundation of the Insurance Core Principles (ICPs), ComFrame incorporates both qualitative and quantitative standards to ensure consistent oversight. Qualitative standards focus on governance, risk management, and resolution, while quantitative measures, like the Insurance Capital Standard (ICS), assess group-wide capital adequacy. Representing over 200 jurisdictions and 97% of global premiums, the IAIS continues to refine ComFrame. The most recent updates, made in December 2024, address challenges like climate risks, valuation practices, and capital adequacy.

Applicability to Credit Insurance

Although ComFrame primarily targets IAIGs, its principles are relevant to all insurers. Credit insurers within qualifying groups must adhere to the full set of group-wide capital and governance requirements. However, many specialized credit insurers fall short of the $10 billion premium threshold and are not directly subject to these standards.

Strengths and Limitations

ComFrame offers a thorough approach to global insurance oversight, similar to the quantitative benchmarks in ECAF and the risk-focused standards in ICPs. It fosters collaboration among regulators, reducing regulatory arbitrage and addressing supervisory gaps. The proportionality principle ensures that oversight is scaled to an insurer’s risk and size. However, its success depends heavily on effective cooperation across jurisdictions. Supervisors may choose either a direct approach (focusing on the parent company) or an indirect approach (focusing on individual entities) to implement these standards.

4. International Accreditation Forum (IAF) Standards

Primary Focus

The International Accreditation Forum (IAF) operates under a guiding principle: "Certified Once, Accepted Everywhere." This philosophy aims to create a unified global system for conformity assessment. The goal? To minimize risks for businesses and their customers by ensuring that accredited certificates are trustworthy and recognized across borders. As the IAF explains:

"Our primary function is to develop a single worldwide program of conformity assessment which reduces risk for businesses and their customers by assuring them that accredited certificates and validation and verification statements may be relied upon."

A key element of this effort is the Multilateral Recognition Arrangement (MLA). This agreement ensures that the 46 participating accreditation bodies recognize each other’s accreditations as equivalent. For businesses, this means they don’t have to secure multiple certifications to operate internationally. On January 1, 2026, the IAF joined forces with the International Laboratory Accreditation Cooperation (ILAC) to form Global Accreditation Cooperation Incorporated, creating a single global authority. This merger solidifies the framework that supports the standards outlined below.

Key Standards or Sources

At the heart of the IAF framework is ISO/IEC 17021-1, the standard that governs the auditing and certification of management systems. Certifications like ISO 9001 (quality management) and ISO 37001 (anti-bribery management) are rooted in this standard and are widely used by credit insurers to evaluate operational and financial risks.

To assist with transitions, the IAF issued MD30:2025 in December 2025, providing guidance for the updated ISO 37001:2025 standard. Additionally, the IAF CertSearch database plays a vital role as the only global platform for real-time validation of accredited management system certifications. This tool helps businesses avoid relying on counterfeit or expired certificates.

Applicability to Credit Insurance

For credit insurers, certifications like ISO 9001 and ISO 37001 serve as reliable indicators of low operational and bribery risks. Thanks to the IAF MLA, a certificate issued in one country is recognized as equally valid in another. This global acceptance simplifies the risk assessment process for international trade.

In December 2025, the Vietnam Institute of Accreditation (VACI) joined the IAF MLA as a signatory for Product Certification and Management System Certification. This development provides direct benefits to credit insurers assessing Vietnamese debtors, enhancing trust and efficiency in cross-border transactions.

For more insights on using international accreditation frameworks in credit risk assessments, visit CreditInsurance.com.

Strengths and Limitations

The IAF framework is backed by a rigorous peer evaluation process, ensuring that its network of 52 accreditation bodies maintains high levels of competence and impartiality. Tools like CertSearch further streamline operations by reducing redundant audits and breaking down technical barriers to trade.

However, the framework distinguishes between Mandatory Documents (MD Series), which are required, and Informative Documents (ID Series), which are advisory. This distinction can lead to minor inconsistencies in how standards are applied across regions, especially when local laws don’t mandate specific requirements.

5. Global Credit Certificate (GCC)

Primary Focus

The Global Credit Certificate (GCC), offered by the Global Institute of Credit Professionals (GICP), is a professional qualification centered on credit analysis and its practical application in real-world scenarios. As described by the institute:

"The Global Credit Certificate (GCC) is a professional qualification for whose roles relate to credit. It teaches the principles of credit analysis with a focus on practical, real-life applications."

This program is tailored for professionals working in risk management, credit departments, corporate banking, and investment management. Those who successfully complete both levels of the program earn the MICP designation (Member of the Global Institute of Credit Professionals), signifying their expertise on an international level.

Key Standards or Sources

The GCC curriculum is structured around four key pillars: Purpose, Payback, Risk, and Structure. It incorporates global best practices in credit analysis while addressing modern challenges, including Environmental, Social, and Governance (ESG) factors and the influence of technologies like Artificial Intelligence on creditworthiness. The qualification is divided into two levels:

- Level 1: An 80-question multiple-choice exam conducted over three hours, focusing on foundational credit knowledge.

- Level 2: A 50-question exam, with 80% of the questions based on case studies to emphasize practical application.

To ensure high-quality instruction, all trainers are required to have at least 15 years of experience at major financial institutions.

Applicability to Credit Insurance

For professionals in credit insurance, the GCC serves as a valuable benchmark for evaluating the skills of both internal teams and external partners involved in risk assessment. The program’s emphasis on quantitative risk analysis and credit department operations aligns closely with the expertise needed to evaluate debtor insolvency risks. According to the Global Institute of Credit Professionals:

"With an enhanced skillset, candidates will be equipped to make better credit decisions and communicate more effectively across the institution."

The program’s global accessibility is another strong point, with exams available at over 5,500 Pearson VUE testing centers across 180+ countries. Most participants complete the qualification within three to six months, making it a flexible yet rigorous option for international teams. By providing a standardized framework, the GCC complements other global standards and enhances professional competency in credit risk evaluation.

Strengths and Limitations

The GCC stands out for its practical focus, integration of ESG and AI considerations, and global accessibility, making it highly relevant in today’s credit landscape. Its curriculum supports consistent professional development across borders. However, the standardized syllabus may not meet the needs of organizations requiring highly specialized training, which could be seen as a drawback for some.

An overview of the insurance core principles from the Secretary General of the IAIS.

Framework Comparison Table

Here’s a quick overview of the Eurosystem Credit Assessment Framework (ECAF), summarizing its main features. This table complements the detailed breakdown provided earlier in Section 1.

| Framework | Primary Focus | Key Standards | Credit Insurance Applications | Main Strengths | Main Limitations |

|---|---|---|---|---|---|

| Eurosystem Credit Assessment Framework (ECAF) | Reducing credit risk for collateral involved in Eurosystem monetary policy operations. | Uses a harmonized rating scale with five credit quality steps; Probability of Default (PD) thresholds range from 0.10% to 1.50%. | Evaluates the creditworthiness of non-financial corporations and small and medium-sized enterprises (SMEs) to determine collateral eligibility. | Includes rigorous performance monitoring and integrates multiple credit assessment sources (ECAIs, ICAS, S-ICAS, and IRB systems). | Limited geographical scope, mainly within the EEA or non-EEA G10 countries; imposes strict requirements for rating agencies. |

ECAF plays a critical role in maintaining the quality of collateral for credit insurance practices. This summary provides a solid foundation for examining how it compares to other international frameworks in the credit insurance sector.

Conclusion

Global frameworks play a crucial role in unifying credit risk evaluations and simplifying operations in the credit insurance sector. By converting credit assessments from top agencies into comparable formats, these frameworks create a consistent foundation for evaluating credit risks across international borders.

Standardized thresholds and routine performance checks help minimize risks, ensuring that credit quality evaluations remain trustworthy and verifiable, no matter the jurisdiction.

These standards also simplify operations. Instead of managing conflicting rating systems, businesses can align their internal credit evaluations with globally accepted benchmarks. This reduces compliance challenges and speeds up cross-border transactions, making processes more efficient and adaptable to modern, data-focused methodologies.

The trend toward quantitative credit assessment is gaining momentum. For example, starting January 1, 2026, the Eurosystem expanded its framework to include Statistical In-house Credit Assessment Systems (S-ICAS). This marks a significant move toward data-driven evaluations, particularly benefiting small and medium-sized enterprises (SMEs).

For companies seeking tailored credit insurance solutions, CreditInsurance.com offers a wealth of educational resources and expert advice. Their guidance can help you protect your receivables and explore financing options that support your growth.

FAQs

What are the benefits of international accreditation frameworks in credit insurance?

International accreditation frameworks, such as those established by the International Association of Insurance Supervisors, set globally accepted standards for overseeing and regulating credit insurance providers. When insurers align with these frameworks, they showcase robust risk management practices and adherence to international guidelines, fostering trust with regulators, banks, and businesses alike.

Here’s why these frameworks matter:

- Regulatory confidence: Policies backed by accreditation may be recognized by banks as effective credit-risk mitigants. This recognition can lead to lower capital requirements, giving banks more flexibility to extend loans.

- Enhanced credibility: Accreditation signals that insurers meet rigorous quality standards, making it easier for businesses to use insured receivables as a reliable tool for securing financing.

- Streamlined global operations: Uniform standards help simplify cross-border transactions, facilitating smoother international trade and business growth.

At CreditInsurance.com, businesses can find tools and guidance to harness these frameworks effectively, bolstering their credit insurance strategies while minimizing financial uncertainties.

What is the Eurosystem Credit Assessment Framework (ECAF) and how does it help small and medium-sized businesses?

The Eurosystem Credit Assessment Framework (ECAF) serves as a tool to evaluate credit claims used as collateral in Eurosystem credit operations. By offering a clear and standardized credit rating system, ECAF plays a key role in helping small and medium-sized businesses access financing with greater ease. This framework ensures that these businesses can secure funding more consistently, supporting growth and stability within the financial system.

What makes the Global Credit Certificate (GCC) valuable for credit professionals?

The Global Credit Certificate (GCC) is a well-regarded credential designed for credit professionals aiming to showcase their skills in managing credit risk, understanding international accreditation systems, and addressing intricate financial challenges. It highlights a professional’s capability to implement best practices in areas like credit insurance and accounts receivable management.

Earning the GCC can elevate a professional’s reputation, open up new career opportunities, and strengthen trust with clients and stakeholders. This certification holds particular value in industries where managing financial risks – such as non-payment or insolvency – is essential for maintaining business stability and success.