Understanding ESG in Credit Risk

Incorporating Environmental, Social, and Governance (ESG) factors into credit risk assessments is no longer optional. ESG risks – like extreme weather events or regulatory changes – can directly impact a borrower’s cash flow and default probability. Traditional credit models often fail to account for these risks, but integrating ESG into your credit frameworks ensures a more complete risk profile.

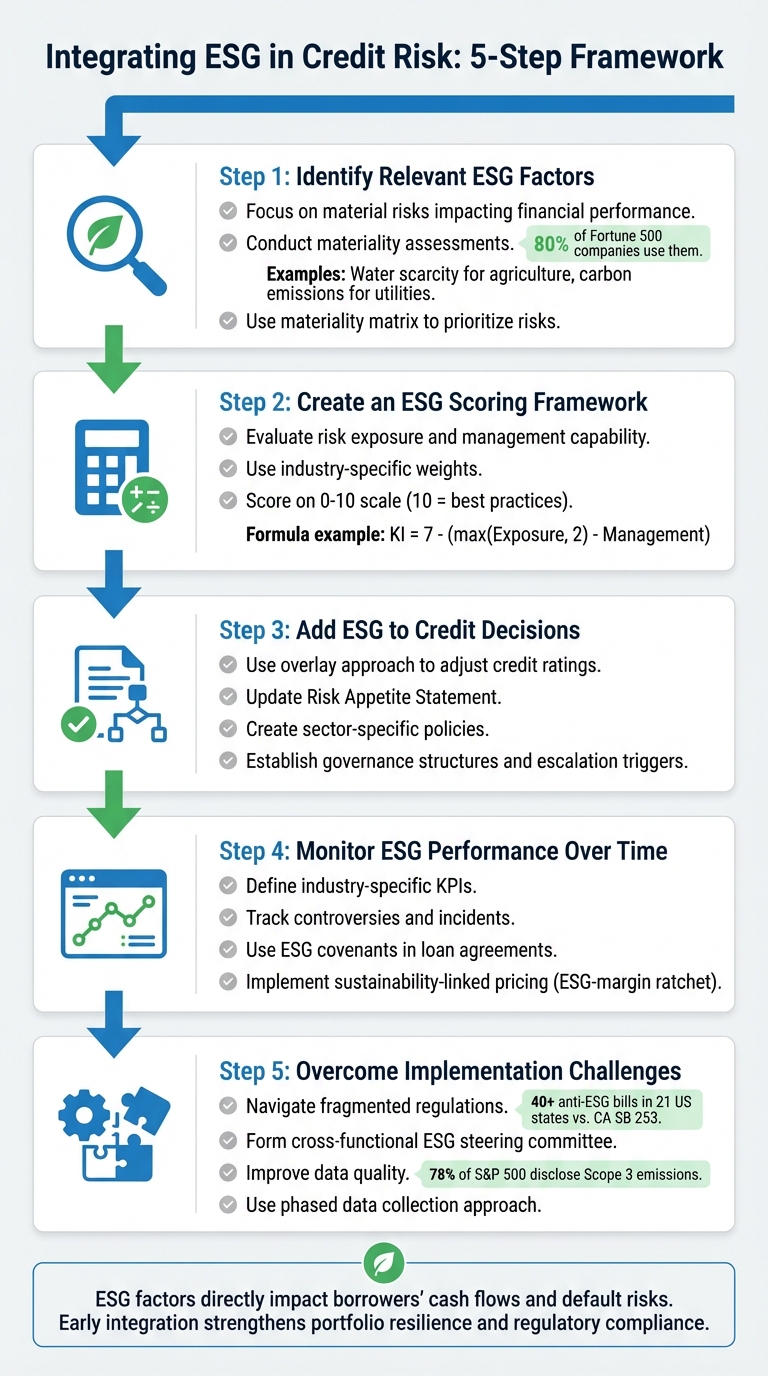

Here’s a quick breakdown of the process:

- Identify Relevant ESG Factors: Focus on material risks that impact financial performance, like water scarcity for agriculture or carbon emissions for utilities.

- Build an ESG Scoring Framework: Quantify ESG risks using industry-specific weights and scoring methods.

- Integrate ESG into Credit Decisions: Adjust credit ratings based on ESG scores and update credit policies.

- Monitor ESG Performance: Continuously track ESG metrics and borrower compliance using KPIs and covenants.

- Address Challenges: Overcome regulatory inconsistencies and data quality issues with phased data collection and cross-functional teams.

5 Steps to Integrate ESG Factors into Credit Risk Assessment

Integrating Sustainability Criteria into Credit Risk Assessment (Olaf Weber) | 2024 CSFN Conference

Step 1: Identify Relevant ESG Factors

When it comes to ESG (Environmental, Social, and Governance) factors, their relevance to credit analysis depends on how they financially impact a business. The key is understanding which factors are truly material – those that can directly influence a borrower’s business model, revenue, profitability, or operational performance. For instance, a coal mining company faces vastly different ESG risks compared to a software firm. Even manufacturers in different states may encounter unique regulatory challenges. This initial assessment lays the groundwork for seamlessly integrating ESG considerations into credit evaluations.

What Materiality Means in ESG

In the context of ESG, materiality refers to identifying issues that significantly affect a business and its stakeholders. For credit risk purposes, it’s crucial to focus on factors that directly impact cash flow and the ability to repay debt. For example, water scarcity is a major material risk for agricultural companies, while climate-related property damage is a pressing concern for insurance firms. On the other hand, technology and financial services companies often prioritize data privacy and cybersecurity.

Today’s standards emphasize the importance of double materiality. This means assessing not only how ESG issues impact a company’s financial performance but also how the company’s operations affect the environment and society. For instance, the EU’s Corporate Sustainability Reporting Directive incorporates this dual perspective through the European Sustainability Reporting Standards. This approach helps credit analysts evaluate both immediate financial risks and longer-term reputational or regulatory challenges that could lead to credit events.

Consider this: approximately 80% of Fortune 500 companies now include materiality assessments in their ESG and sustainability reporting. Take Unilever as an example. The company loses over $300 million annually due to water scarcity but has also saved $1.2 billion through sustainable sourcing practices. This demonstrates how a single ESG factor – such as managing environmental resources – can pose a significant risk while also offering substantial opportunities.

How to Conduct an ESG Materiality Assessment

Once you’ve identified material ESG factors, the next step is a systematic evaluation.

Start by benchmarking borrowers against their peers. Use the SIC (Standard Industrial Classification) system to categorize business activities and assign risk scores for each segment. Engaging with stakeholders is also critical to pinpoint the factors that most affect financial performance and reputation. For instance, a manufacturing company operating across diverse sectors will face different ESG exposures in each business unit, requiring a tailored, segment-specific approach.

To organize your findings, create a materiality matrix. Plot ESG factors based on their importance to the company (X-axis) and to stakeholders (Y-axis). Use the size of the data points to reflect their overall influence. This visual tool helps credit teams quickly identify which ESG risks require deeper analysis during underwriting and which can be managed through standard covenant structures. It’s an efficient way to prioritize risks and streamline the decision-making process.

Step 2: Create an ESG Scoring Framework

Once you’ve identified the key ESG factors relevant to your organization, the next step is to quantify them using a scoring system that aligns with your existing credit models. This scoring framework allows you to evaluate ESG risks and opportunities without needing to completely overhaul your current risk assessment approach.

One effective method is to use an overlay system that generates a composite ESG score. This score can then be used to adjust traditional credit ratings. As Sandeep Sarkar from Deloitte explains:

Integrating ESG factors into credit analysis strengthens a financial institution’s ability to assess the downside risk of its credit investments in light of the transition and physical risks associated with climate change.

This process lays the groundwork for incorporating ESG factors quantitatively into credit models.

Designing Your Scoring Method

To build an effective scoring method, evaluate each ESG pillar separately by focusing on two key areas: risk exposure and management capability.

- Risk exposure measures the level of ESG risk a borrower faces based on their industry and business segments.

- Management capability assesses how well the borrower is prepared to manage those risks through policies, systems, and oversight.

For example, MSCI ESG Research uses a formula called the "Key Issue Score" to quantify these factors:

KI = 7 – (max(Exposure, 2) – Management).

This formula ensures that borrowers with higher risk exposure need stronger management practices to achieve a favorable score. Take an oil and gas company, for instance – it inherently faces high environmental risks, so it must demonstrate robust climate risk management systems to avoid a poor rating.

Next, assign industry-specific weights to ensure the scoring reflects sector priorities. For example, carbon emissions may carry more weight for power utilities, while data privacy might be a key focus for tech firms. Group borrowers into industry categories and benchmark them against their peers to ensure fair comparisons.

MSCI scores individual data points on a 0–10 scale, where 10 represents the best practices and 0 indicates a lack of management systems. You can follow this approach or develop your own scale, but consistency across all borrowers is crucial. Additionally, consider adding a disclosure modifier to reward borrowers who provide transparent and verifiable data.

Integrating ESG Data Into Risk Models

Once you’ve established a scoring method, the next step is to incorporate these metrics into your broader credit assessment framework.

Start by normalizing the ESG pillar scores into a single rating that can be used to adjust traditional credit metrics. This final ESG score reflects a borrower’s sustainability profile and directly impacts their credit rating.

For example, in May 2021, the Securities and Exchange Board of India (SEBI) introduced the Business Responsibility and Sustainability Report (BRSR). This initiative requires the top 1,000 listed entities to provide standardized ESG disclosures. Such reporting frameworks give financial institutions access to reliable, quantitative data, making it easier to integrate ESG factors into credit evaluations. If your borrowers are in regions with similar disclosure requirements, sourcing consistent data becomes far more straightforward.

To make ESG integration seamless, involve your credit risk team in the due diligence process. Avoid creating isolated workflows by defining clear escalation triggers. For instance, borrowers with low environmental management scores might require enhanced due diligence before loan approval. By embedding ESG considerations into the underwriting process, you ensure they become a standard part of credit evaluations rather than an afterthought.

For more resources, visit CreditInsurance.com.

Step 3: Add ESG to Credit Decision Processes

Once you’ve developed your ESG scoring framework, the next step is to weave these assessments into your credit workflows. By doing so, ESG factors become a natural part of credit evaluations rather than existing as a separate compliance task. This integration connects the dots between quantitative ESG scores and the practicalities of credit decision-making.

One effective method is the overlay approach – using ESG scores to adjust current credit ratings. For instance, a borrower with strong financial performance but poor environmental practices might see its rating adjusted downward. This approach blends tried-and-true credit models with insights into sustainability.

Update Credit Policies to Include ESG

With ESG scores now part of your risk models, it’s important to revise your credit policies to reflect this integration. Start by updating your Risk Appetite Statement to account for environmental and social risks. Then, create sector-specific policies tailored to industries like oil and gas, mining, agriculture, and power utilities. Additionally, define clear escalation triggers to flag credit proposals that pose higher ESG risks, ensuring swift action when needed.

Set Up Governance Structures

Strong governance is key to ensuring ESG factors are consistently applied. Embedding ESG into your governance framework is essential. As noted:

To fully address major market and idiosyncratic risk in debt capital markets, underwriters, credit rating agencies and investors should consider the potential financial materiality of ESG factors in a strategic and systematic way.

Assign responsibility for ESG oversight to a senior executive or a dedicated board committee. Involve credit risk management teams to ensure that ESG assessment templates are used consistently across the board. Rahul Agarwal from Crisil Global Research & Risk Solutions emphasizes:

A best practice would be for risk management and the three lines of defence to collaboratively identify, quantify, manage and monitor these material risks.

This governance framework ensures that insights from your ESG scoring system directly influence every credit decision.

For more tips on integrating risk management into your credit processes, visit CreditInsurance.com.

sbb-itb-b840488

Step 4: Monitor ESG Performance Over Time

Incorporating ESG factors into credit decisions isn’t a one-and-done process – it requires continuous monitoring throughout the credit lifecycle. ESG factors can evolve rapidly. A borrower’s environmental practices, labor relations, or governance standards might change significantly over time. According to the United Nations-backed Principles for Responsible Investment (UN-PRI), these factors have a direct impact on a borrower’s cash flow and their ability to meet debt obligations. Without regular monitoring, lenders could miss critical warning signs of declining creditworthiness. By maintaining ongoing oversight, lenders can use their ESG scoring framework to quickly spot shifts in risk.

Define ESG Performance Metrics

To effectively monitor ESG factors, it’s essential to set clear, industry-specific KPIs that capture evolving risks. For instance, a mining company might be assessed based on its impact on biodiversity and how it handles toxic waste. Meanwhile, a power utility’s performance could be tied to its carbon emissions and water usage. Standardized scoring methods can help benchmark these metrics and ensure consistency.

It’s also important to track controversies – such as environmental accidents, labor disputes, or governance scandals – that could immediately lower a borrower’s management score. To ensure fairness, assign weights to ESG factors based on the relevance of those risks to each sector and the clarity of the available data. Borrowers who provide verified ESG data should be rated higher than those with limited or unclear disclosures.

Use Covenants to Enforce ESG Standards

Covenants tied to ESG performance are an effective way to hold borrowers accountable and strengthen risk management. Positive covenants might require borrowers to meet specific standards, such as complying with environmental regulations or submitting regular sustainability reports. Negative covenants, on the other hand, could restrict actions like mergers or asset sales that might harm the borrower’s ESG profile.

Sustainability-linked pricing is another tool that can align financial incentives with ESG goals. This approach, often called an "ESG-margin ratchet", adjusts interest rates based on the borrower’s ESG performance. Meeting ESG targets could lower the interest rate, while failing to meet them might result in higher costs. Additionally, clear thresholds should be established for ESG risks that trigger extra due diligence or escalate credit evaluations.

For industries with higher environmental risks – such as agriculture, mining, oil and gas, and power utilities – specific credit policies should address issues like biodiversity loss, water scarcity, or carbon emissions. Lastly, ensure that ESG risk management is overseen by the board of directors or a senior leadership team, embedding accountability at the highest level.

Step 5: Overcome Challenges in ESG Integration

Once you’ve laid the groundwork for integrating and monitoring ESG factors, the next step is tackling the challenges that come with it. Incorporating ESG considerations into credit risk assessments isn’t without hurdles. The regulatory landscape is fragmented, data quality remains uneven, and methodologies for evaluating ESG’s impact on creditworthiness are still evolving. However, there are practical ways to address these issues and create a more dependable ESG-informed credit process.

Navigate Regulatory Requirements

The ESG regulatory environment is a patchwork that often pulls businesses in opposing directions. For example, by April 2025, over 40 anti-ESG bills had been enacted across 21 U.S. states, barring the use of ESG scores in lending or state contracts. At the same time, California’s SB 253 climate disclosure law, effective January 1, 2025, applies to around 75% of Fortune 1000 companies. This leaves companies juggling conflicting mandates across state lines.

Meanwhile, the European Union has taken a different approach. The European Commission’s 2025 "Omnibus" proposal aims to narrow the scope of the Corporate Sustainability Reporting Directive (CSRD), limiting it to companies with more than 1,000 employees. Additionally, the European Banking Authority’s ESG risk management guidelines became effective on January 11, 2026.

To manage these complexities, consider forming a cross-functional ESG steering committee with representatives from finance, legal, risk, and supply chain teams. This group can monitor regulatory changes and ensure your compliance processes stay on track across jurisdictions. Align your internal reporting systems with global frameworks like the Taskforce on Climate-related Financial Disclosures (TCFD) and the International Sustainability Standards Board (ISSB) to maintain consistency across regions. Matteo Tonello, Head of Benchmarking and Analytics at The Conference Board, emphasizes:

Regulatory compliance should not be the sole driver of corporate ESG strategy… ESG reporting can be an important tool for risk management, business resilience, and value creation.

These regulatory challenges also highlight the importance of improving data collection for ESG assessments.

Improve ESG Data Quality and Access

Inconsistent or poor-quality data is one of the biggest barriers to ESG integration. For instance, while 78% of S&P 500 companies disclosed Scope 3 emissions in 2024 – up from 64% in 2021 – tracking emissions across the entire value chain remains a daunting task. Similarly, social and governance risks are still largely assessed through qualitative methods and expert judgment.

A phased approach to data collection can help. Start by focusing on reliable Scope 1 and Scope 2 emissions data before diving into the complexities of Scope 3 reporting. In sectors like real estate, standardize data collection efforts around property location and energy efficiency certifications. Introduce verification measures to incentivize borrowers who provide transparent and accurate data.

Regulatory frameworks like the CSRD and the European Sustainability Reporting Standards (ESRS) can also serve as valuable resources for filling in data gaps. When using ESG scores from external credit assessment institutions, demand clarity on their methodologies to ensure consistency. Additionally, digital tools and AI software can streamline data aggregation and provide real-time insights into regulatory changes. Preparing documentation for independent verification early is another smart move, as such verifications are increasingly required by both state and international regulations.

Conclusion

Incorporating ESG factors into credit risk management is no longer optional – it’s a necessity for staying financially resilient and competitive. This guide outlines five key steps to help you navigate this process: identify relevant ESG factors, build a scoring framework, integrate ESG into credit decisions, monitor ongoing performance, and address any challenges that arise during implementation. Each of these steps enhances your ability to anticipate defaults, mitigate climate-related disruptions, and keep pace with evolving regulations like the European Banking Authority guidelines.

Acting early on ESG integration offers a clear advantage. ESG factors have a direct impact on borrowers’ cash flows and default risks. Addressing both transition risks – such as policy shifts toward decarbonization – and physical risks from extreme weather events strengthens your credit portfolio. The United Nations-backed Principles for Responsible Investment highlights this connection:

"To fully address major market and idiosyncratic risk in debt capital markets, underwriters, credit rating agencies and investors should consider the potential financial materiality of ESG factors in a strategic and systematic way".

Taking action now also positions your institution to tap into growing sustainable finance opportunities while avoiding future penalties. For example, in May 2021, India’s Securities and Exchange Board required the top 1,000 listed companies to disclose ESG data through the Business Responsibility and Sustainability Report. This marks a broader global trend toward mandatory ESG transparency. Financial institutions that delay risk falling behind as investors, regulators, and customers increasingly prioritize ESG accountability.

To stay ahead, revisit your risk appetite frameworks, develop sector-specific scorecards, and use both public disclosures and internal due diligence to refine your approach. These adjustments, combined with the tools and frameworks discussed earlier, ensure a consistent and practical path from initial assessment to ongoing monitoring. While challenges like data quality persist, the steps outlined here provide actionable solutions you can start implementing today.

FAQs

How do ESG factors influence a borrower’s credit risk?

ESG factors – Environmental, Social, and Governance – play a big role in shaping a borrower’s credit risk, as they directly influence both financial stability and public perception. For instance, neglecting environmental responsibilities can lead to hefty fines or regulatory penalties, while poor governance might open the door to fraud or operational mismanagement.

On the flip side, businesses with strong ESG practices tend to demonstrate better risk management, stronger compliance, and greater long-term resilience. These qualities often translate to lower default risks and higher creditworthiness. Companies that embrace ESG principles are also typically more prepared to navigate regulatory shifts and meet evolving market demands, making them a safer bet for lenders.

What are the main challenges of incorporating ESG into credit risk assessments?

Incorporating ESG factors into credit risk assessments comes with a fair share of hurdles. For starters, regulatory demands around ESG are on the rise, yet many institutions find themselves without the necessary expertise or resources to meet these standards effectively. This gap complicates compliance efforts and creates additional strain on existing systems.

On top of that, inconsistent ESG reporting standards and gaps in available data make it tough to draw meaningful comparisons between companies or industries. This lack of uniformity undermines the reliability of analyses and adds layers of uncertainty to decision-making processes.

Another major challenge lies in weaving ESG metrics into existing credit models without throwing off their accuracy. Achieving this balance requires meticulous calibration and rigorous testing to ensure the models continue to perform as intended. Adding to the complexity, the importance of ESG risks can vary widely depending on the industry or region in question, making it tricky to pinpoint which factors genuinely influence creditworthiness.

These challenges underscore just how intricate it is to integrate ESG considerations into credit risk frameworks effectively.

How do ESG factors impact credit risk assessments?

ESG factors have become an important part of credit risk assessments, offering an extra layer of insight into potential risks. These factors go beyond traditional financial analysis by measuring risks tied to environmental, social, and governance aspects, which can directly impact a borrower’s ability to meet financial obligations.

Lenders rely on ESG scores to fine-tune credit ratings, establish borrowing limits, adjust pricing, and make informed approval decisions. Incorporating these criteria helps businesses better evaluate long-term risks and opportunities connected to their borrowers, providing a fuller picture of creditworthiness.