In industries experiencing fast growth, like tech, renewable energy, and manufacturing, offering trade credit with payment terms (Net 30–90 days) can boost sales but exposes businesses to serious risks. Unpaid receivables often become a large, unsecured asset on the balance sheet, and a single customer default can disrupt cash flow, erode profits, and even breach loan agreements. Credit insurance provides a safety net, covering up to 90% of receivables when customers fail to pay due to insolvency or bankruptcy.

Here’s why credit insurance matters:

- Protects Cash Flow: Shields businesses from financial losses caused by customer defaults.

- Supports Growth: Enables offering flexible credit terms to customers without excessive risk.

- Monitors Risk: Insurers provide real-time financial insights on customers to prevent surprises.

- Improves Financing: Insured receivables serve as stronger collateral for better loan terms.

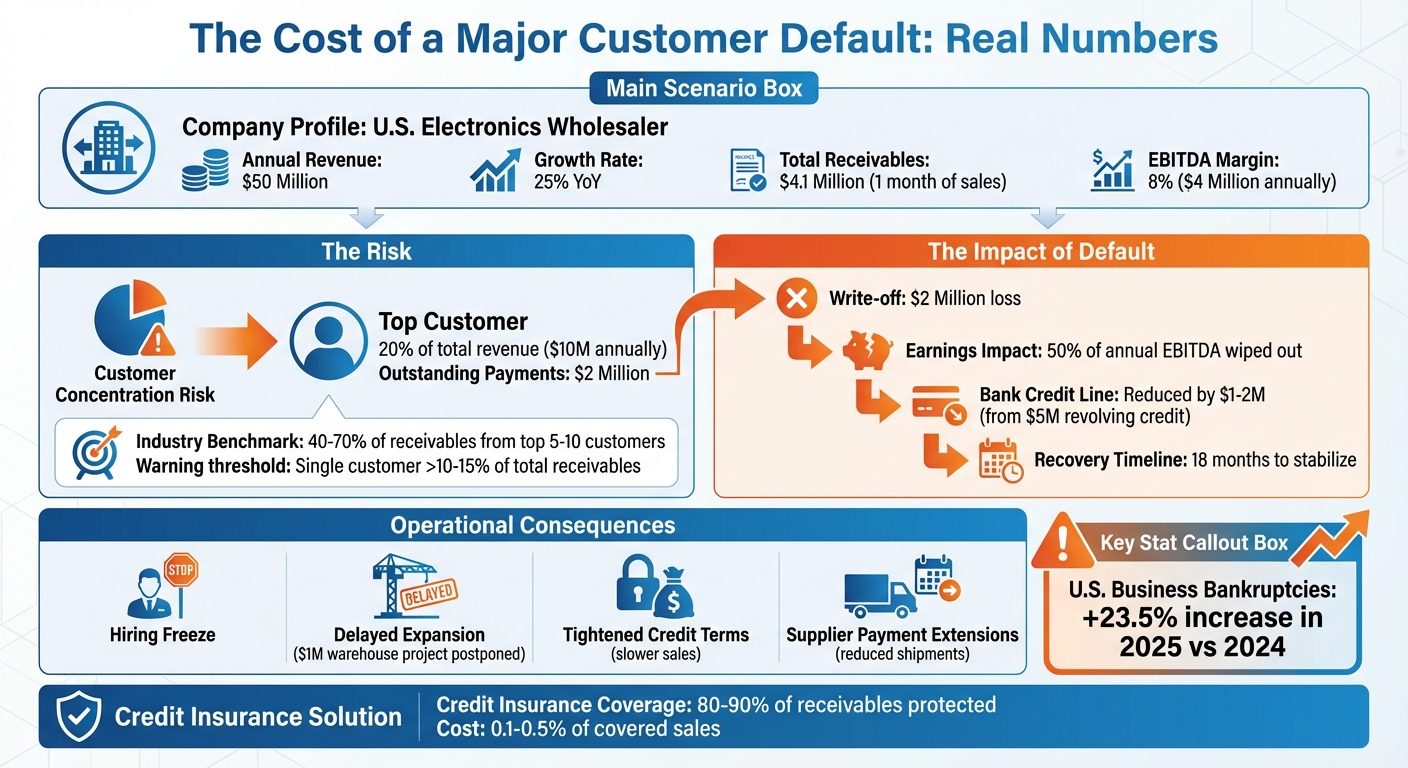

For example, a wholesaler with $50M in revenue could lose $2M if a key customer defaults, wiping out half a year’s profits. Credit insurance minimizes this risk, ensuring stability during growth and safeguarding against economic uncertainties like rising bankruptcy rates (23.5% increase in 2025). By protecting receivables, businesses can confidently expand, secure better financing, and maintain operations even under challenging conditions.

Protect the Future of your Business & Drive Growth Through Trade Credit Insurance

Financial Risks That Come With Rapid Growth

Credit Insurance Impact: Protecting $50M Wholesaler from $2M Customer Default

Higher Credit Exposure and Customer Concentration

When businesses grow quickly, their accounts receivable balances often balloon. More sales naturally lead to more unpaid invoices, tying up working capital that could be used for daily operations or further expansion. This rapid scaling often requires increased credit limits and faster customer onboarding, which can amplify the risk of defaults.

Another challenge is customer concentration – when a small number of clients account for a large portion of receivables. In industries like wholesale, manufacturing, and technology services, it’s not uncommon for the top 5 to 10 customers to represent 40–70% of total receivables. This creates a precarious situation where the financial health of just a few customers can significantly impact the business. CFOs and credit managers must monitor key metrics like the percentage of receivables tied to their largest customers, days sales outstanding (DSO), and overdue invoices (e.g., those past 30 or 60 days). If a single customer accounts for over 10–15% of total receivables or more than 20–25% of monthly revenue, the business faces a serious risk if that customer fails to pay. Such concentrated exposure makes the potential fallout from a major default even more severe.

What Happens When a Major Customer Defaults

A default from a major customer can trigger an immediate cash-flow crisis. Payments that were expected to arrive don’t, but obligations like payroll, supplier invoices, and loan payments still need to be met. Many banks tie their lending agreements to financial covenants, such as leverage ratios or bad-debt thresholds. A significant write-off can breach these covenants, which may lead to reduced credit limits or higher interest rates.

Take, for example, a U.S. electronics wholesaler generating $50 million in annual revenue with a growth rate of 25% year over year. This company carries about $4.1 million in receivables, equivalent to one month of sales. One national retail customer accounts for 20% of total revenue ($10 million annually) and has $2 million in outstanding payments. If this retailer files for bankruptcy and fails to pay, the wholesaler would need to write off the full $2 million. With an EBITDA margin of 8% (about $4 million annually), this single loss would wipe out half a year’s earnings. Additionally, their bank, which provides a $5 million revolving credit line secured by receivables, might reduce the available credit by $1–2 million due to weakened collateral.

The ripple effects are significant. To maintain liquidity and meet financial covenants, the company might freeze hiring, delay a planned $1 million warehouse expansion, tighten credit terms for other customers (potentially slowing sales), and negotiate extended payment terms with suppliers. These suppliers, in turn, might cut back on shipments. Even with strong market demand, such a default can force the business to shift its focus entirely to stabilizing operations for as long as 18 months.

Difficulty Monitoring Customer Financial Health

As companies grow rapidly, keeping track of customer financial health becomes increasingly difficult. The surge in customer numbers and transactions often outpaces the capacity of credit teams. Many teams rely on outdated financial statements, basic credit checks, or references collected during onboarding, with no systematic updates as credit limits grow and order sizes increase.

This issue is even more pronounced with private U.S. customers, particularly middle-market and closely held firms, which often don’t provide timely financial updates. This lack of transparency leaves suppliers in the dark about critical trends like leverage, liquidity, and profitability.

Economic volatility adds another layer of complexity. Factors like inflation, rising interest rates, and sector-specific downturns can erode customer financial health faster than internal processes can detect. For example, interest-rate hikes increase borrowing costs, tightening cash flow and delaying payments. In industries like retail, construction, or manufacturing, downturns can lead to a surge in insolvencies and bankruptcies, even among previously reliable customers. Supply chain disruptions and rising costs further squeeze margins. If buyers can’t pass these costs on, they may delay payments, effectively using suppliers as short-term lenders. For suppliers that have offered generous credit terms to drive growth, these shifts can quickly turn a healthy portfolio into one with high-risk concentrations, where multiple customers in the same sector begin delaying payments or defaulting simultaneously.

"Trade credit insurance allows you to take on additional work safely and securely, whether it’s a new customer or expansion from existing customers." – David Edgell

How Credit Insurance Reduces These Risks

Protecting Cash Flow and Limiting Bad Debt Losses

Credit insurance steps in to cover 80–90% of eligible receivables when customers fail to pay due to insolvency, bankruptcy, or prolonged default. This ensures businesses can maintain steady cash flow, even in the face of major customer defaults, allowing them to meet critical obligations like payroll, supplier payments, and loans. For example, it helps offset the impact of large defaults, stabilizes earnings, and ensures compliance with financial covenants. By reducing the need for hefty bad-debt reserves, businesses can redirect capital toward growth initiatives, such as expanding inventory, hiring staff, or entering new markets.

Additionally, insured receivables are seen as more reliable collateral by banks. This can lead to enhanced borrowing terms, including higher credit limits, lower interest rates, and more favorable loan conditions. With this financial safety net, companies can confidently extend credit to customers, knowing their receivables are protected.

Supporting Sales Expansion With Confidence

When receivables are insured, businesses – especially those in high-growth phases – can offer more attractive credit terms, such as extended payment periods or higher credit limits, without taking on excessive risk. For instance, a wholesale distributor entering a new regional market can safely extend credit to unfamiliar retailers by leveraging credit insights provided by the insurer. Similarly, manufacturers bidding on large contracts in sectors like construction or energy can proceed with confidence, knowing that customer financial troubles won’t disrupt their cash flow.

This reduced exposure enables companies to pursue growth opportunities more aggressively. Credit insurance not only mitigates risk but also strengthens a company’s ability to expand sustainably. Many businesses find that this approach delivers a measurable return on investment, making it a strategic tool for growth.

Access to Credit Data and Risk Monitoring

Insurers bring another layer of value by offering access to extensive databases that track the financial health of millions of companies globally. These databases are continuously updated with buyer risk ratings and detailed sector analyses. For policyholders, this means real-time insights into customer financial stability, underwriting support, and early alerts about potential issues like payment delays or credit downgrades – factors that might otherwise go unnoticed by internal teams.

With this data, businesses can make quicker and more consistent credit decisions. Sales teams benefit from clear, insurer-backed guidelines for extending credit and adjusting limits, replacing guesswork with informed decision-making. If an insurer flags a customer’s worsening financial condition, businesses can take proactive steps, such as tightening credit terms, reducing exposure, or focusing on more reliable customers. For companies experiencing rapid growth and managing a diverse customer base, this ongoing risk monitoring acts as both a safety net and a strategic advantage, ensuring that expansion efforts are built on a secure financial platform.

sbb-itb-b840488

Credit Insurance Applications by Industry

Credit insurance plays a key role in reducing risks while addressing the specific challenges faced by different industries.

Project-Based Industries: Construction and Energy

Industries like construction and energy often deal with large, milestone-based contracts, which bring unique payment risks. Imagine a general contractor defaulting halfway through a $10 million project – this could leave subcontractors with significant losses at a time when their own costs are at their peak. Credit insurance helps cushion these losses, whether they stem from project delays, contractor bankruptcies, or supply chain issues. With U.S. business bankruptcies increasing by 23.5% in 2025 compared to 2024, these risks are becoming harder to ignore.

Additionally, credit insurance supports these firms by helping them assess customer financial stability and secure better vendor credit lines. This allows companies to confidently commit to major material purchases. In the energy sector, credit insurance provides the flexibility to extend credit on high-value milestone payments without locking up capital in reserves. This kind of protection is vital for industries where large-scale operations face complex challenges.

Volume-Driven Sectors: Retail and Wholesale

Retailers and wholesalers operate on slim margins and high transaction volumes, making them particularly vulnerable to cumulative losses from multiple small customer defaults. For instance, a bad debt rate of just 5–10% across thousands of invoices can significantly impact profitability. Credit insurance helps alleviate this pressure by allowing wholesalers to offer competitive terms – such as 60-day payment periods – and extend credit to new buyers quickly. It also enables businesses to customize terms for diverse buyer profiles.

By reducing the need for large bad debt reserves, companies can free up capital to expand inventory or negotiate better supplier terms. This is especially beneficial during periods of rapid growth, as it helps maintain operational stability. These advantages are even more pronounced for businesses operating internationally.

Export-Oriented and Innovation-Driven Industries

Exporters face risks that are less common in domestic trade, such as political instability, currency restrictions, and government-imposed payment moratoriums. Credit insurance covers these political risks in addition to standard commercial risks, enabling exporters to offer attractive payment terms in foreign markets without worrying about non-payment.

For companies in innovation-driven sectors – such as those exporting tech products or specialized equipment – credit insurance provides access to global risk data. This helps identify trustworthy buyers in unfamiliar markets, making expansion into emerging markets safer and more practical. These markets often offer significant growth opportunities but come with limited buyer information. Furthermore, insured export receivables can unlock better financing options tailored for international transactions, making it easier for businesses to pursue foreign growth opportunities. These examples highlight how credit insurance plays a crucial role in protecting diverse business models across industries.

Adding Credit Insurance to Your Growth Plan

Incorporating credit insurance into your business strategy starts with a clear understanding of your receivables and the risks you face. The aim is to transform insurance from a protective measure into a proactive tool that supports growth while safeguarding your financial health.

Evaluating Your Receivables and Identifying Key Risks

Start by generating an aging report to assess your exposure. Pay close attention to your top 10–20 customers, ranked by outstanding balances and annual sales volume. If one customer accounts for more than 10–15% of your monthly revenue, you’re facing a concentration risk that warrants immediate action. Also, keep an eye on customers with consistently overdue payments.

Next, calculate the potential impact of a default. What would happen if one of your top three customers failed to pay? How many months of EBITDA would you lose? Would it put you at risk of breaching any covenants with your bank? With U.S. business bankruptcies rising 23.5% in 2025 compared to 2024, these scenarios aren’t just hypothetical. This analysis helps you determine whether you need comprehensive portfolio coverage or focused protection for key accounts. For exporters, it’s essential to also evaluate accounts in countries with higher political or transfer risks. This thorough risk assessment allows for precise and effective policy customization.

Customizing a Policy for Your Business

Tailor your credit insurance policy to meet your unique needs. Decide whether a whole-turnover policy (covering your entire customer base) or a key-account policy (focused on specific high-value accounts) makes the most sense for your business.

You’ll also need to select coverage limits, deductibles, and optional add-ons that align with your risk tolerance and growth goals. Typical coverage ranges from 80–95% and costs around 0.1–0.5% of covered sales. For businesses experiencing rapid growth or frequent changes in sales patterns, an annual insured sales-based pricing model can be a flexible option, as it allows for regular adjustments and carrier-supported decisions. This cost is often offset by benefits like reduced bad-debt expenses, increased working capital, and better financing terms. Once your policy is tailored, industry experts can help guide its implementation and ensure it aligns with your objectives.

Using CreditInsurance.com as a Resource

CreditInsurance.com provides valuable tools and resources to help U.S. businesses navigate credit insurance. Their free online tools – such as the Accounts Receivable Risk Assessment Tool and the Business Non-Payment Risk Analyzer – allow you to input customer data, credit scores, and payment histories to receive risk scores and actionable recommendations.

The platform also offers educational content that breaks down policy structures, pricing models, and strategies for using insured receivables to secure better credit lines and financing terms. Through articles, glossaries, and case studies, it simplifies complex concepts and demonstrates practical applications across various industries. Additionally, CreditInsurance.com connects businesses with specialists who can conduct portfolio reviews tailored to your industry and growth strategy. These experts can help identify risks you may have overlooked and suggest what portion of your receivables should be insured.

Conclusion

For businesses experiencing rapid growth, accounts receivable can be both a valuable asset and a potential weak spot. Credit insurance transforms this vulnerability into an opportunity by covering 75–95% of losses from customer defaults, insolvency, or political disruptions. This ensures that a single unpaid invoice won’t throw your growth plans off course.

Beyond protecting against losses, credit insurance enables businesses to expand with confidence. It allows you to offer competitive terms to new customers, approve larger orders, and explore new domestic or international markets. With ongoing credit monitoring and risk insights from your insurer, you’re equipped to make quicker, more informed decisions. This dual benefit of protection and growth support is particularly valuable in industries like construction and energy, wholesale and retail, and for companies focused on exports or innovation. By stabilizing cash flow and improving financial credibility, credit insurance can also enhance your standing with lenders.

Insured receivables improve collateral quality, helping businesses secure larger borrowing bases and better loan terms – especially important when economic conditions tighten. With bankruptcy rates on the rise, protecting earnings and minimizing exposure to concentrated customer risk has become more critical than ever.

To make the most of these advantages, take a closer look at your receivables. Identify key risks and consider how a major default could impact your business. Then, evaluate whether a whole-turnover or key-account policy aligns with your growth goals. CreditInsurance.com provides resources, tools, and expert guidance to help you design and implement the right coverage for your needs. Incorporating credit insurance into your strategy not only safeguards your growth but also strengthens your financial foundation, offering stability in today’s unpredictable economic climate. It’s a strategic investment in both risk management and sustainable growth.

FAQs

How can credit insurance help stabilize cash flow for high-growth businesses?

Credit insurance acts as a safety net for businesses, protecting them from financial risks such as customer non-payment or insolvency. By ensuring you still get paid for goods or services even if a customer defaults, it helps minimize unexpected revenue shortfalls that could disrupt your cash flow.

Beyond protection, credit insurance empowers businesses to extend larger credit lines to customers with greater confidence. It also opens doors to improved financing opportunities and allows receivables to serve as a dependable source of working capital. This added stability helps create a more predictable cash flow, enabling businesses with growth ambitions to focus on scaling without being derailed by financial uncertainties.

How does credit insurance benefit businesses in high-growth industries?

Credit insurance plays a crucial role for businesses in fast-paced, high-growth industries by protecting them from financial risks such as customer non-payment or insolvency. With this safety net in place, companies can extend credit to their customers with greater confidence, opening the door to more sales and growth opportunities.

This type of coverage also brings other benefits. It helps stabilize cash flow, lowers risks for lenders, and can even make it easier to secure financing. By shielding businesses from potential financial setbacks, credit insurance supports long-term stability and keeps operations steady – even when the economy hits a rough patch.

How can businesses determine if credit insurance is right for them?

Businesses looking to determine whether credit insurance is right for them should start by evaluating their vulnerability to financial risks, such as unpaid invoices or customer insolvencies. Key considerations include the volume of sales made on open accounts, the consistency of customer payments, and the potential impact of cash flow disruptions on their ability to operate or grow. If these risks pose a threat to daily operations or long-term expansion, credit insurance could serve as a helpful safety net.