An export packing list is a detailed document that outlines the contents of your shipment, including item descriptions, weights, dimensions, and packaging details. Unlike a domestic packing list, it includes international-specific information like HS codes and metrics required for customs clearance and freight calculations.

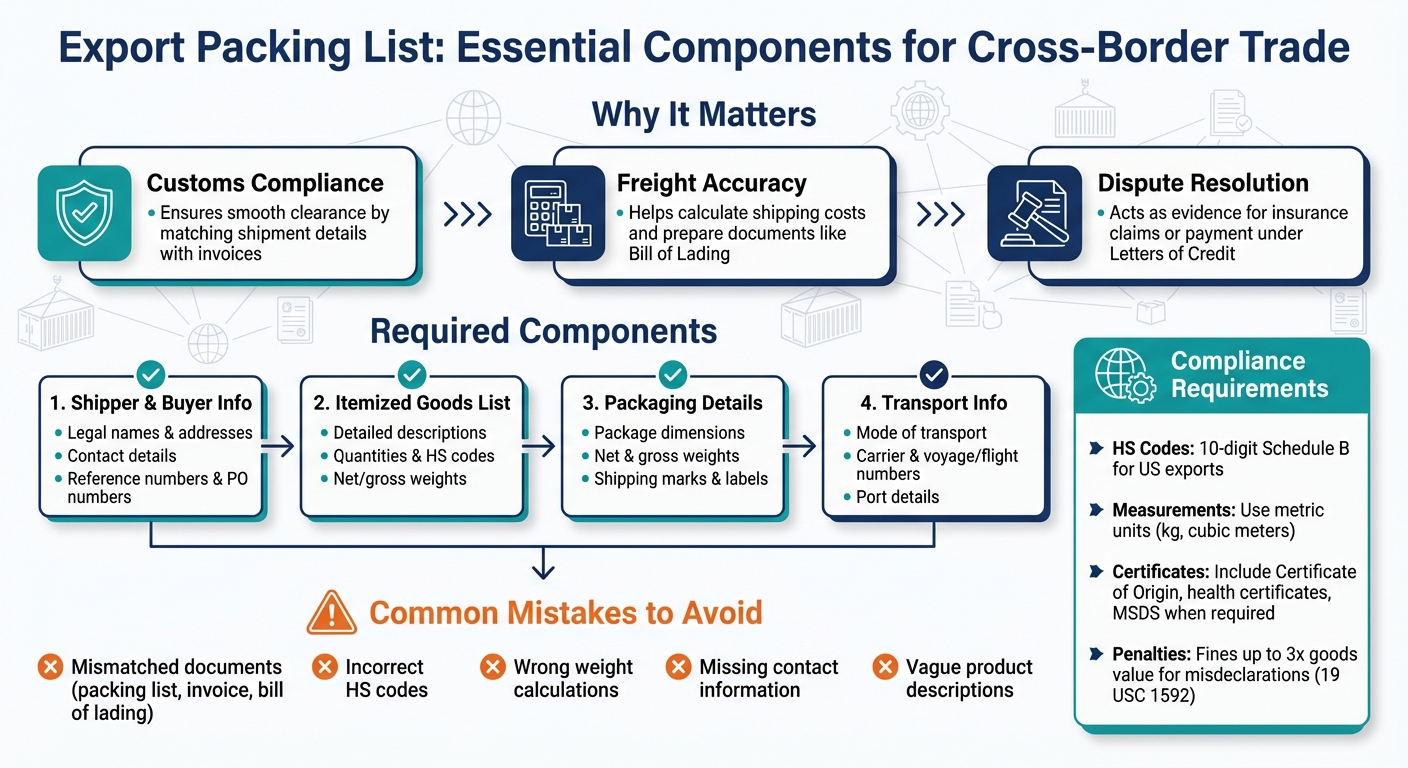

Why It Matters:

- Customs Compliance: Ensures smooth clearance by matching shipment details with invoices.

- Freight Accuracy: Helps calculate shipping costs and prepare documents like the Bill of Lading.

- Dispute Resolution: Acts as evidence for insurance claims or payment under Letters of Credit.

Key Components:

- Shipper & Buyer Info: Legal names, addresses, and contact details.

- Itemized Goods List: Detailed descriptions, quantities, HS codes, and weights.

- Packaging Details: Dimensions, net/gross weights, and shipping marks.

- Transport Info: Mode of transport, carrier, and port details.

Avoid Mistakes:

- Ensure all documents (packing list, invoice, and bill of lading) match.

- Use correct HS codes and double-check weights and quantities.

- Include special handling notes, if applicable.

A well-prepared packing list prevents delays, fines, and shipment issues, making it a critical tool for successful international trade.

Essential Components of an Export Packing List for International Trade

Required Components of an Export Packing List

Shipper and Buyer Information

An effective export packing list starts with clear and accurate identification of both the shipper and the buyer. Include the full legal name and physical address for both parties – PO boxes are not acceptable. Be sure to add contact details like telephone numbers, fax numbers, and email addresses.

It’s also essential to include reference numbers. Add the shipper’s reference number and the buyer’s purchase order (PO) number. These details help freight forwarders and customs officials track shipments efficiently. For U.S. exports, this information is used to identify the U.S. Principal Party in Interest (USPPI), which is the entity that benefits most from the transaction.

Consistency across documents is critical. As ExportHelp points out:

"It is also important that the details on the packing list (such as shipper’s/importer’s details, number of items involved, etc.), match exactly what is stipulated on the commercial invoice and bill of lading/airway bill."

Any mismatches between the packing list, commercial invoice, and bill of lading can lead to customs delays or fines. Double-check all documents to ensure they align perfectly.

Itemized List of Goods

A detailed itemized list is a core part of any export packing list. This section should describe the contents of each package – whether it’s a box, pallet, or crate – using specific terms. For example, instead of saying "shoes", write "10 pairs of men’s leather shoes, size 42."

For shipments with multiple packages, organize the list by package (e.g., "Box 1 of 5", "Box 2 of 5"). Each entry should include the product description, quantity per package, the correct HS (Harmonized System) code, net weight, gross weight, and any visible shipping marks or labels. Use metric units for weight and dimensions, as most customs authorities outside the U.S. require these measurements.

To avoid customs issues, ensure the itemized list matches the commercial invoice exactly. Linking each line item to the corresponding invoice or item number can make cross-referencing easier. Before sealing the shipment, verify that the packing list matches the actual contents to prevent discrepancies that could result in delays, fines, or confiscation.

Packaging and Transport Details

This section builds on the itemized list by detailing the packaging and transport specifics. Clearly state the type of packaging used – such as boxes, crates, drums, pallets, or cartons – and include the total number of packages. Provide both the net weight (goods only) and the gross weight (goods plus packaging materials) in kilograms. Include the dimensions (length, width, height) of each package and the total shipment volume in cubic meters.

Shipping marks and numbers are also essential. List all external markings, such as "Fragile", "Handle with care", or "This side up", along with any barcodes or reference numbers. For containerized shipments, include container and seal numbers.

Transport details are equally important. Specify the mode of transport (air, ocean, rail, or truck), carrier name, voyage or flight numbers, port of loading, port of discharge, and the final delivery location. For shipments with multiple packages, label each package and attach one waterproof copy of the packing list on the outside, with an additional copy inside. These details not only help freight forwarders calculate shipping costs and prepare bills of lading but also support insurance claims if the cargo is damaged or lost during transit.

sbb-itb-b840488

How to Format and Ensure Accuracy

Use Clear and Readable Templates

Using a well-organized template can make your export packing list easier to understand and process. Opt for a format that clearly separates sections, incorporating tables for item details, weights, and dimensions. Don’t forget to include your company’s branding, such as a logo, contact information, and fields for signatures, to add a professional touch.

The type of shipment determines the best template to use. For example, a simple template works for single-product shipments, while consolidated templates are better for LCL (Less than Container Load) or airfreight. For full container loads, container-specific templates are ideal. Tools like IncoDocs and Shipping Solutions can simplify the process by generating packing lists and commercial invoices at the same time, ensuring everything stays consistent.

Keep Documents Consistent

Once you’ve chosen a template, make sure all your documents align perfectly. Your packing list, commercial invoice, and bill of lading must match in every detail. Any inconsistencies in quantities, descriptions, or weights could lead to customs delays or even cargo inspections.

Before finalizing your shipment, physically check that the items match what’s listed on your packing list. Also, include reference numbers – such as the commercial invoice number, PO number, and bill of lading or airway bill number – on all related documents. This cross-referencing helps customs officials and freight forwarders track your shipment more efficiently.

Follow US Formatting Standards

If you’re preparing packing lists for U.S. exports or imports, stick to the MM/DD/YYYY date format (e.g., 02/15/2026) and show currency amounts with a dollar sign and proper formatting (e.g., $15,000.00). While most international customs authorities use metric units, U.S. shipments often require both metric and imperial measurements. Providing both for weights and dimensions minimizes conversion errors and can help speed up customs clearance on both ends. These formatting practices ensure smoother compliance with international trade requirements.

Meeting International Trade Standards

Assign Correct HS Codes

Assigning the correct Harmonized System (HS) code is a critical step in international trade. In the U.S., exports require a 10-digit code under the Schedule B system, while imports use the Harmonized Tariff System (HTS). The first six digits of these codes are standardized globally among all World Customs Organization members.

"The 6-digit Harmonized System Subheading will be the same whether you are importing or exporting into any country of the World Customs Organization. This ensures that all countries uniformly classify their products." – International Trade Administration

To simplify the process, the U.S. Census Bureau offers a free online Schedule B search tool to help exporters find the correct codes. For more complex products, such as composite goods or sets, consult the Customs Rulings Online Search System (CROSS) for legally binding decisions on similar items. Using incorrect HS codes can lead to customs delays or inaccurate tariff charges, so precision is key.

Additionally, ensure that all required certificates and special handling details are properly documented.

Include Certificates and Special Handling Notes

Every shipment must meet the specific requirements of the destination country. This may include certificates like a Certificate of Origin, health certificates, or Material Safety Data Sheets (MSDS), depending on your buyer’s customs needs.

Special handling instructions should also be clearly communicated. Use labels such as "Fragile", "Handle with care", or "This side up" to ensure proper handling. For hazardous materials, include the correct UN numbers, like UN3480 for lithium batteries. If your shipment uses wood packaging materials, confirm compliance with ISPM 15 standards. These details not only protect your goods but also help avoid complications during customs inspections.

Finally, include a proper Destination Control Statement when required.

Add Destination Control Statements

For certain controlled items, including those listed on the Commerce Control List outside of EAR99 or regulated by ITAR, you must include a Destination Control Statement (DCS). This statement ensures that goods are only exported to approved destinations.

"A Destination Control Statement… is required for exports from the United States for items on the Commerce Control List that are outside of EAR99… or controlled under the International Traffic in Arms Regulations (ITAR)." – U.S. International Trade Administration

For shipments involving a single commodity valued over $2,500 or requiring an export license, you must file Electronic Export Information (EEI) through the Automated Export System (AES) as outlined in 15 CFR Part 30. Double-check that weight, value, and quantity totals match across all documents to avoid shipment delays.

Common Mistakes and How to Avoid Them

Frequent Errors in Export Packing Lists

Mistakes in export packing lists can lead to serious complications. Some of the most frequent errors include mismatched details between the packing list, commercial invoice, and bill of lading. Vague product descriptions and incorrect weight calculations are also common. Confusion between net weight (just the product), tare weight (packaging only), and gross weight (combined total) can result in disputes with carriers or rejected insurance claims. Another issue is missing contact information, which can delay shipments and rack up extra fees.

One of the most critical errors involves incorrect HS code classification. Using the wrong Schedule B codes may lead to AES rejections or, in extreme cases, fraud allegations. Additionally, if your packing list doesn’t align perfectly with a Letter of Credit, banks might refuse payment. David Noah, President of Shipping Solutions, emphasizes the risks:

"At best, your compliance can cost you and your company your reputation. At worst, your ‘adjustment’ can lead to fines and penalties".

These issues highlight the importance of diligently verifying all details before shipping.

Steps to Verify Accuracy

To avoid these common pitfalls, take time to carefully verify your documents. Cross-check shipper and buyer details, item quantities, and weights across the packing list, commercial invoice, and bill of lading. Physically inspect the cargo and confirm its contents before sealing containers.

When shipping to the U.S. or UK, include both metric and imperial measurements (e.g., kilograms and pounds, millimeters and inches). For hazardous materials, ensure that only trained personnel handle the documentation to avoid safety and legal issues. Number each package clearly to make it easier to trace items during inspections.

Consequences of Non-Compliance

Failing to address these errors can disrupt your entire shipping process and result in steep financial penalties. Non-compliance may lead to extended customs inspections, fines, rejected insurance claims, demurrage fees, and even cargo confiscation. ExportHelp.org underscores the risks:

"Any mistake on the packing list may cause a delay in clearance at the port of destination. Customs Authorities in the target country have the right to delay the clearance of the shipment until the importer provides a packing list reflecting the real contents".

Repeated mistakes can also lead to your company being "red-flagged", increasing the likelihood of inspections for future shipments. Taking the time to ensure accuracy now can save you from much bigger headaches down the line.

Conclusion

Summary of Key Practices

Creating a thorough export packing list is crucial for smooth international trade. This document should include detailed shipper and buyer information, an itemized list of goods with precise descriptions, and accurate packaging details. It’s critical that the packing list aligns perfectly with your commercial invoice and bill of lading – any inconsistencies can lead to customs delays or heightened scrutiny. To avoid issues, always use both metric and imperial measurements and include the correct Harmonized System (HS) codes for every product, which simplifies customs classification.

Every document in the export process plays a unique role, and maintaining consistency across them ensures your shipment proceeds without unnecessary complications.

Building Success in Cross-Border Trade

Accurate and detailed documentation is the backbone of successful international trade. Properly prepared documents prevent delays, fines, and potential disruptions to your business. Customs officials use the packing list to verify shipments against declarations, freight forwarders depend on it to calculate shipping costs and file Electronic Export Information (EEI), and buyers rely on it to confirm they’ve received the correct goods. If you’re shipping under a Letter of Credit, the packing list must match the exact wording of the LC to guarantee payment.

The stakes are high – under U.S. law (19 USC 1592), fines for misdeclarations can reach up to three times the value of the goods. By meticulously following best practices and double-checking every detail before shipping, you can build a reputation as a reliable partner in global trade. Strong documentation not only shields your business from financial risks but also positions you as a dependable player in the international market.

The Importance of an Export Packing List for Your International Shipments

FAQs

Who needs an export packing list?

Anyone shipping goods out of the United States must have an export packing list. This document is essential not only for exporters but also for freight forwarders, customs officials, and consignees. It provides key details about the shipment, including its contents, packaging, weights, and measurements. These details help ensure efficient customs clearance and proper handling of the goods during transit.

Do I need to include HS codes on the packing list?

Including HS codes on your packing list is a must. These codes enable customs authorities to classify goods correctly, apply appropriate tariffs, and facilitate a smoother customs clearance process. By listing HS codes accurately, you can minimize delays and reduce the risk of compliance issues in cross-border trade.

What should I do if the packing list doesn’t match the invoice?

If the packing list doesn’t align with the invoice, take a close look at the shipment details to identify and resolve any inconsistencies. Make the necessary corrections and reach out to the appropriate parties, such as suppliers or freight forwarders, to address the issue. Double-check that all information is accurate before moving forward with the shipment or customs clearance to prevent unnecessary delays or problems.