Cloud-based credit insurance is transforming how businesses protect themselves against unpaid invoices and financial risks. By integrating cloud technology, artificial intelligence (AI), and real-time data, insurers and businesses can now manage credit risks faster and more effectively than ever before. Here’s what you need to know:

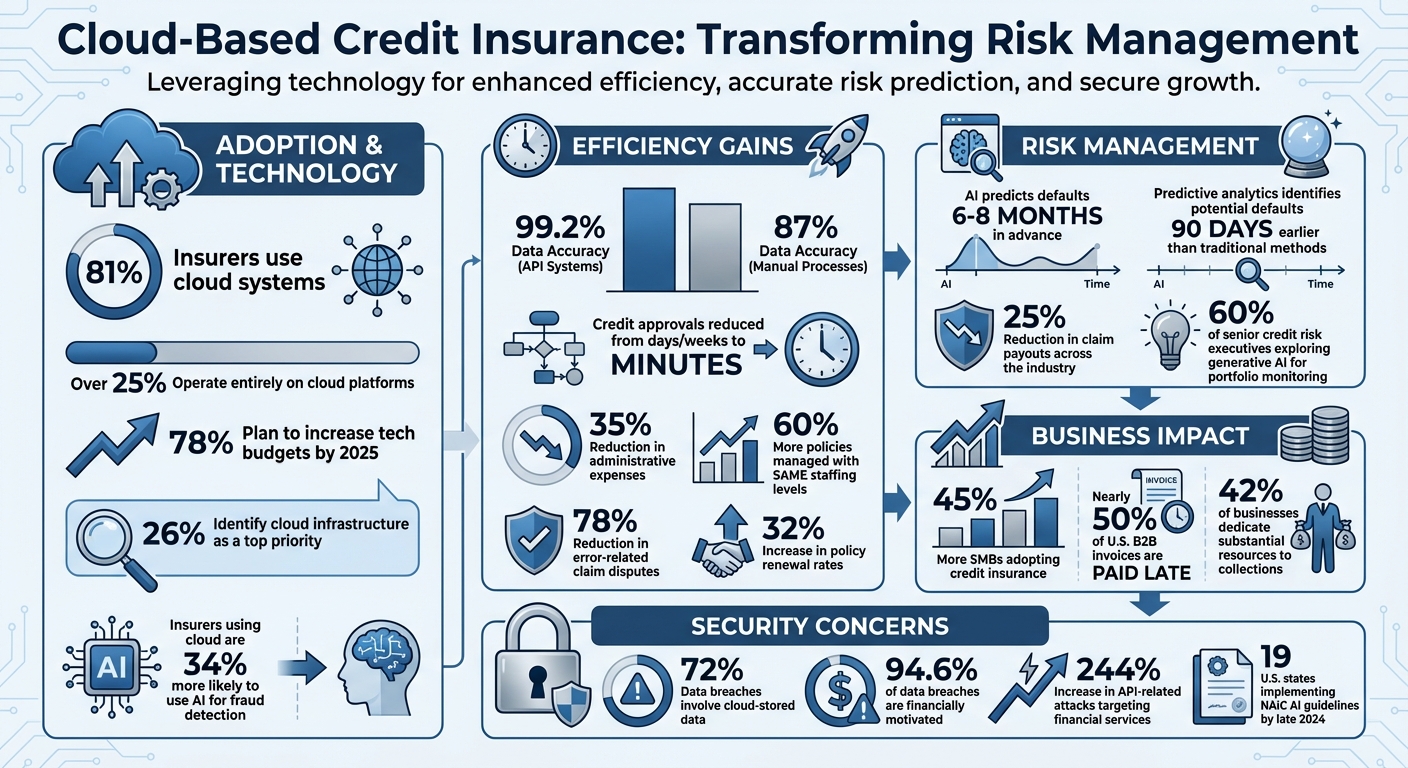

- Cloud Platforms: Over 81% of insurers now use cloud systems, enabling faster claims processing, reduced IT costs, and real-time credit adjustments.

- AI & Predictive Analytics: AI tools monitor financial health, detect fraud, and predict risks months in advance, making policies more responsive to changing conditions.

- API Integration: APIs connect credit insurance platforms to ERP and banking systems, automating processes like credit approvals and claims management.

- Security & Compliance: Advanced encryption, zero-trust frameworks, and strict U.S. regulations ensure data protection and regulatory adherence.

- Business Benefits: Insured receivables improve cash flow, reduce late payment risks, and enhance access to credit lines.

With these advancements, businesses can focus on growth while minimizing financial uncertainty. The article dives deeper into how these tools work and their impact on U.S. businesses.

Cloud-Based Credit Insurance: Key Statistics and Benefits

Moving Credit Insurance to the Cloud

Why Insurers Are Adopting Cloud Platforms

Credit insurers are moving away from outdated systems from the 1980s – platforms that struggle to keep up with the demands of today’s fast-paced, data-driven market. These legacy systems are not only costly to maintain but also lack the flexibility and real-time capabilities needed for modern tools powered by AI.

The transition to cloud technology is gaining momentum. Over a quarter of insurers now operate entirely on cloud platforms. Why? Cloud systems cut IT costs by eliminating the need for expensive, on-site hardware and offer the scalability required to handle spikes in activity, like during claims surges or policy renewal periods.

Cloud platforms also enable straight-through processing (STP), which minimizes manual tasks, reduces errors, and speeds up decision-making. Insurers using cloud-based systems are 34% more likely to use AI for fraud detection compared to those relying on traditional setups. Looking ahead, 78% of insurance organizations plan to increase their technology budgets by 2025, with 26% of industry experts identifying cloud infrastructure as a top priority. These advancements don’t just streamline operations – they allow insurers to deliver faster, more accurate service to their customers.

How Policyholders Benefit

For policyholders, these cloud-driven improvements translate into quicker and more adaptable services. Businesses purchasing credit insurance can now benefit from faster credit approvals and smoother claims processing. What used to take days – or even weeks – can now be handled in minutes, thanks to automated workflows and real-time risk assessments.

Cloud platforms also support API-first connectivity, meaning your credit insurance can integrate directly with your ERP system, whether it’s SAP, Oracle, or Microsoft. This seamless connection enables your coverage to adjust automatically as your financial situation evolves. For example, if your business experiences a shift in revenue or expenses, the system can instantly update credit limits based on live data. This level of responsiveness not only provides better protection but also gives businesses the flexibility to act quickly on new growth opportunities.

AI and Predictive Analytics in Credit Insurance

Using AI to Assess Risk

Gone are the days of relying solely on outdated quarterly reports. Today, AI leverages real-time data – like bank transactions and account balances – to gauge a buyer’s financial health. It also dives into unstructured data sources such as news mentions, earnings calls, and regulatory filings, offering a more comprehensive view of creditworthiness. A striking example came in 2024 when fintech platform Balance uncovered and thwarted a coordinated fraud ring. By using AI to analyze patterns, the platform updated fraud prevention rules instantly to block similar attacks in the future.

Large language models (LLMs) add another layer of efficiency, transforming raw bank transaction data into structured profit-and-loss statements within seconds. This swift processing simplifies decision-making and provides credit officers with actionable insights.

“By combining our world-class expertise with the wealth of our global data assets and the power of cutting-edge technologies (artificial intelligence, data science), our clients benefit from more intelligent solutions that inform their decisions and enable them to manage commercial risks in a more predictive way.”

- Guillaume Huguet, Data Lab Director at Coface

This shift toward data-driven analysis naturally supports proactive adjustments to policies, making credit insurance more responsive and dynamic.

Predictive Analytics for Policy Adjustments

Predictive analytics takes risk management a step further by forecasting solvency and default risks. This allows insurers to adjust policies and premiums proactively, often identifying early warning signs as much as six to eight months in advance. Advanced platforms can even simulate the impact of macroeconomic events – like interest rate hikes or supply chain disruptions – on a company’s financial stability. These simulations help insurers fine-tune coverage adjustments to minimize disruptions for their clients.

The adoption of generative AI is also gaining momentum. Currently, 60% of senior credit risk executives are exploring its potential for portfolio monitoring, underscoring the growing reliance on AI to manage complex risk scenarios.

How AI Benefits Businesses

AI’s capabilities extend beyond risk assessment and predictive adjustments, offering tangible benefits for businesses purchasing credit insurance. Underwriting, for instance, has become a much faster process. What once took days or even weeks can now be completed in minutes. This speed allows companies to extend credit to new customers without unnecessary delays. Meanwhile, AI’s ability to analyze both traditional and alternative risk factors – such as ecommerce sales and card network activity – has led to more precise pricing.

Continuous monitoring is another game-changer. AI systems flag accounts showing early signs of financial distress, providing businesses with better protection against unexpected losses.

“Clients no longer wait weeks for a decision; they get a timely and reliable answer… AI agents serve as a key support for credit officers, which allows officers to be more productive; they can spend their time in those places where their judgment really matters.”

- Marcus Chromik, Chief Risk Officer at Deutsche Bank

In 2025, Deutsche Bank took this a step further by implementing AI-driven tools for corporate underwriting. These tools handle data collection and preliminary financial analysis, freeing credit officers to focus on more complex and judgment-intensive tasks.

AI is reshaping credit insurance, making it faster, smarter, and more effective for both insurers and businesses alike.

Real-Time Data and API Connections

Connecting with ERP and Banking Systems Through APIs

APIs have transformed how businesses exchange information, enabling seamless integration between ERP systems like SAP, Oracle, and Microsoft. This eliminates the need for manual data entry and outdated reporting processes, making operations faster and more reliable. By leveraging cloud-based advantages, APIs improve both data accuracy and decision-making speed.

The results speak for themselves. Systems powered by APIs achieve data accuracy rates of over 99.2%, compared to just 87% for manual processes that are prone to errors. This leap in accuracy translates to real-world benefits: credit approvals that used to take days or even weeks can now be completed in minutes. Businesses also see significant cost savings, with administrative expenses reduced by up to 35%, and insurers can manage 60% more policies without increasing staff.

API connections extend beyond ERP systems, linking insurers with banking platforms and other trade systems. This integration creates a continuous flow of financial data. For e-commerce businesses, it means they can offer "credit on demand", allowing customers to access credit terms instantly at checkout. Some platforms even provide "Single Invoice Cover", which adds insurance protection to individual invoices in real time. These capabilities not only make operations smoother but also enhance proactive risk management by addressing potential issues before they escalate.

"Real-time connectivity between insurance platforms and client systems has streamlined claims processing. This integration allows insurers to handle 60% more policies with the same staffing levels."

- Resolve Team

Adjusting Credit Limits in Real-Time

Cloud platforms process live transaction data continuously, enabling businesses to update risk exposure immediately. For instance, if a customer’s financial status changes, companies receive instant alerts, allowing them to adjust credit limits on the fly.

This ability to act quickly is a game-changer. Predictive analytics, fueled by API data, can identify potential defaults 90 days earlier than traditional methods. This has led to a 25% reduction in claim payouts across the industry. Additionally, digital credit management platforms automatically flag exceptions when a customer’s exposure exceeds insured limits, reducing the need for manual intervention.

This shift from a reactive to a proactive approach is reshaping how businesses view credit insurance. Instead of merely compensating for losses after they occur, companies can now prevent them through precise risk management and better portfolio strategies.

Integrating Insurance into Business Processes

Incorporating insurance into core business workflows simplifies operations even further. Modern platforms now integrate credit insurance into the entire order-to-cash process, covering everything from onboarding and credit scoring to invoicing and claims handling.

The results are impressive. Automated, API-driven systems have reduced error-related claim disputes by 78%, and policy renewal rates have climbed by 32%, thanks to easier management through ERP and accounting software integrations. These digital tools have also made credit insurance more accessible, attracting 45% more small and medium-sized businesses to these products.

"Typically, credit insurance and insurance in general is seen as a risk mitigant, but more and more we’re seeing it as a tool for growth."

- Madeleine Whiteley, Senior Client Manager, Aon

For companies looking to adopt these integrations, a phased approach works best. Start with one department or region before scaling up to the entire organization. However, with the 244% increase in API-related attacks targeting financial services, prioritizing security is critical. Businesses should invest in robust certifications and conduct regular penetration testing to safeguard their systems.

Security and Compliance in Cloud-Based Credit Insurance

Cybersecurity Measures

Cloud-based credit insurance platforms manage highly sensitive financial and personal data, making security a top priority. These platforms rely on a data-first approach called Data Security Posture Management (DSPM), which focuses on safeguarding the data itself rather than just the systems that store it. This is critical, as 72% of data breaches involve cloud-stored data, and 30% of breached data spans multiple cloud types.

To protect this data, platforms employ a multi-layered security strategy that includes zero-trust architectures, advanced encryption methods like AES or RSA, and AI-powered threat detection. Zero-trust frameworks limit user access strictly to the data required for their role, reducing the risk of overentitlement. Encryption secures data whether it’s being stored or transmitted. Meanwhile, AI-driven systems continuously monitor user activity, identifying suspicious behavior before it leads to a breach. Given that 94.6% of data breaches are financially motivated, such proactive measures are essential.

An emerging threat in this space is "shadow data" – unmonitored copies of data created by development teams, which often fall outside of official security protocols. Agentless DSPM tools help locate and manage these hidden repositories across popular cloud providers like AWS and Azure. Additionally, platforms need to keep an eye on AI models to prevent "model drift" (a decline in performance over time) and to ensure algorithms don’t introduce bias into underwriting decisions.

"By 2026, more than 20% of organizations will deploy DSPM, due to the urgent need to find previously unknown data repositories and their geographic locations to help mitigate security and privacy risks."

These robust measures not only safeguard sensitive information but also establish a solid foundation for meeting U.S. regulatory requirements.

U.S. Regulatory Requirements

Beyond security, compliance with U.S. regulations is a critical component for cloud-based credit insurance platforms. In the U.S., insurance is regulated at the state level, creating a complex web of requirements. By late 2024, 19 states are expected to implement guidelines based on the National Association of Insurance Commissioners (NAIC) model for AI systems. New York’s 23 N.Y.C.R.R. Part 500 has also introduced enhanced cybersecurity rules to address AI-related risks.

To comply, platforms must implement board-level oversight for AI systems and external data used in underwriting. Insurers are held accountable for the actions of third-party vendors, requiring thorough due diligence and clear contractual terms. Additionally, when automated systems deny coverage, New York Insurance Law §§ 3425 and 3426 demand that insurers provide specific, written explanations to affected policyholders – even if the decisions were made by cloud-based algorithms.

To meet these standards, platforms must conduct rigorous anti-discrimination testing, using metrics like Adverse Impact Ratios and Denials Odds Ratios to ensure algorithms aren’t unintentionally discriminating against protected groups. Comprehensive documentation is also required, covering every stage of the data lifecycle – from acquisition to destruction. However, only 32% of insurance data leaders currently collaborate closely with compliance teams, highlighting a gap that cloud platforms need to address.

"Insurers retain responsibility for understanding any tools, EDCIS, or AIS used in underwriting and pricing for insurance that were developed or deployed by third-party vendors and ensuring such tools, EDCIS, or AIS comply with all applicable laws, rules, and regulations."

- New York Department of Financial Services

Business Continuity and Disaster Recovery

Cloud platforms are designed to ensure uninterrupted operations through multi-region deployments and automated failover systems. The NIST Risk Management Framework (AI RMF 1.0) offers structured guidance for managing system reliability and addressing security risks. Continuous monitoring plays a key role here, detecting issues like model drift before they lead to system failures in automated underwriting processes.

Detailed audit trails document data sources, testing procedures, and bias analyses, ensuring platforms are prepared for regulatory inspections while maintaining operational resilience. Automated incident reporting protocols address data inaccuracies quickly, keeping platforms compliant and operational. In cases where coverage must be withdrawn due to high-risk indicators, insurers work closely with suppliers to phase out policies gradually, avoiding abrupt claims issues.

Interestingly, strong cybersecurity practices don’t just protect operations – they can also enhance a company’s credit risk profile. Solid security measures reflect good corporate governance and reduce the likelihood of default. This creates a beneficial cycle: better security strengthens operations and improves access to credit insurance, ensuring seamless service delivery even in uncertain conditions.

"Strong cybersecurity practices are indicative of robust corporate governance, whereas weaknesses in this area signal a heightened risk of financial instability."

- Moody’s

sbb-itb-b840488

What This Means for U.S. Businesses

Better Risk Management and Cash Flow Protection

Cloud-based credit insurance platforms offer a lifeline for businesses grappling with one of the biggest challenges in B2B commerce: late payments. Nearly half of U.S. B2B invoices are paid late, creating significant cash flow issues for companies. On top of that, 42% of businesses dedicate substantial resources to collections – up from 37% in recent years. Credit insurance steps in to safeguard accounts receivable from risks like payment defaults, delays, and even political disruptions.

With AI-powered tools, businesses can identify warning signs of credit distress as early as eight months before a major financial event occurs. This early detection allows companies to take proactive steps, such as adjusting credit limits dynamically and identifying risks in real time. Automation also lightens the load of manual reviews, freeing up teams to focus on growth initiatives rather than chasing overdue payments. These strategies not only protect cash flow but also strengthen financial credibility, which can lead to better borrowing terms.

Access to Better Financing and Credit Lines

When receivables are insured, they become more secure and valuable as collateral. This reduced risk can lead to better borrowing terms and increased access to credit lines. Banks and lenders view insured accounts receivable as lower-risk assets, giving businesses a stronger position when seeking financing. Additionally, automating processes like online applications and real-time approvals speeds up the "lead-to-cash" cycle, reducing operational costs for finance teams.

"Modernizing trade credit can lower operational expenses for finance by making the function more efficient, freeing up personnel to do more than just manage customer payments." – Lauren Holohan, Principal at Deloitte Consulting LLP

Learning Resources for Better Implementation

While managing risks and improving financing are critical, successful implementation is just as important. CreditInsurance.com provides a wealth of educational resources to help businesses navigate this shift. These resources offer practical advice on mitigating risks like non-payment, insolvency, and political uncertainty, all while unlocking growth through larger credit lines and improved financing options.

Many insurers now provide free digital tools to simplify the process. For instance, platforms like Allianz Trade SmartView offer proprietary risk grades, helping sales teams zero in on the most creditworthy opportunities. These tools also enable businesses to analyze customer segments by geography, industry, and size, helping to identify patterns of insolvency risk. Regularly tracking metrics like Days Sales Outstanding (DSO), Average Days Delinquent (ADD), and the Accounts Receivable Turnover Ratio can further enhance proactive risk management. This shifts companies from merely reacting to debt issues to adopting a more strategic, forward-thinking approach.

Conclusion and What’s Next

Main Points

Cloud-based platforms have reshaped the landscape of U.S. credit insurance, moving away from relying solely on historical data to leveraging predictive intelligence that forecasts payment defaults up to a year in advance. By automating administrative tasks, AI allows underwriters to focus more on providing strategic advice. Real-time API connections with ERP and banking systems enable instantaneous credit limit adjustments, while incorporating non-traditional data – like cybersecurity ratings and news sentiment – offers a more detailed understanding of debtor financial health. These cloud-first developments have paved the way for a proactive approach to managing receivables risk, and the industry is set to evolve even further.

Upcoming Trends

Several trends are emerging that promise to redefine credit insurance practices. One major shift is the rise of agentic AI, which automates tasks ranging from meeting transcription to generating credit memos in real time. By mid-2024, 52% of financial institutions are prioritizing generative AI adoption in their credit operations, with 20% already implementing at least one application. Furthermore, 60% plan to use AI for portfolio monitoring by mid-2025.

"GenAI will be a powerful training and coaching tool, building on the traditional apprenticeship model to accelerate learning and development through scenario modeling and risk assessment simulations." – Michelle Collignon, Managing Director, Financial Services, EY

The use of alternative data sources is also expanding, now incorporating B2B transaction data, social media activity, cybersecurity metrics, and climate resilience modeling. These inputs help evaluate how economic and climate-related challenges might affect company balance sheets. Additionally, embedded insurance, where credit protection is seamlessly integrated at the point of sale within business ecosystems, is becoming more prevalent.

Despite these advancements, challenges remain. Stricter AI regulations, such as those shaped by the EU AI Act, will demand greater transparency and accountability in how AI systems operate. Data quality continues to be a significant concern, with 79% of credit risk executives identifying it as a major obstacle to implementing AI frameworks effectively. To scale AI successfully, businesses must first develop robust data strategies with clear definitions, ensuring models are trained on reliable inputs. Investing in talent transformation is equally critical – training staff to become AI specialists capable of interpreting and validating machine-generated risk scores will be essential for long-term success.

AI Automation in Underwriting: Improving Risk Assessment Processing

FAQs

How can cloud-based credit insurance help businesses manage financial risks more effectively?

Cloud-based credit insurance takes risk management to the next level by using real-time AI insights and predictive analytics to evaluate customer creditworthiness and foresee potential risks. It streamlines processes like underwriting and claims management, cutting down on errors and speeding up approvals.

On top of that, businesses benefit from 24/7 self-service platforms that seamlessly connect with ERP systems. These platforms provide instant access to detailed insights on accounts receivable and credit risks. With this information at their fingertips, companies can make smarter decisions, minimize the risk of non-payment or insolvency, and explore growth opportunities through better credit management.

How is AI transforming credit insurance policies?

Artificial intelligence is transforming the world of credit insurance by simplifying the way insurers handle complex data. With AI-driven models, insurers can analyze financial statements, payment histories, and alternative data in real time. This allows them to generate detailed credit scores, set precise credit limits, and even predict potential defaults before they happen.

Beyond risk assessment, AI is making processes like policy onboarding, claims management, and fraud detection faster and more accurate. Tasks that once took days can now be completed in a fraction of the time, with fewer errors along the way. On top of that, tools like predictive analytics and scenario simulations give insurers the ability to stress-test portfolios, helping them prepare for economic shifts or geopolitical events.

These advancements not only make the credit insurance system more efficient but also give businesses the confidence to extend credit while staying protected against risks like non-payment or insolvency. AI is paving the way for smarter, more reliable credit insurance solutions.

What are the benefits of API integrations in cloud-based credit insurance?

Cloud-based credit insurance platforms become far more effective when paired with API integrations. These integrations connect the platform directly with tools that businesses already rely on, such as ERP systems like SAP®, Oracle®, or Microsoft®. This connection means businesses can access real-time credit limits, risk scores, and policy details right within their current workflows. No more tedious manual data entry, and fewer chances for errors.

Automation takes things a step further by handling tasks like claims filing, policy updates, and credit decisions in mere seconds. This speeds up the entire order-to-cash process. On top of that, predictive analytics provide forward-looking insights into risks, helping businesses make quicker and more informed decisions. For U.S. companies, this translates to faster approvals, reduced costs, and the ability to scale operations while keeping all data accurate and centralized in one system.