Digital trade compliance is about following rules for cross-border digital products and services like SaaS, cloud platforms, and data transfers. Each region has unique regulations that businesses must navigate to avoid fines, service disruptions, or operational setbacks. Here’s a quick breakdown:

- United States: Focuses on export controls (e.g., AI, semiconductors), sanctions (OFAC), and sector-specific privacy laws (HIPAA, CCPA). Cross-border data flows are generally allowed, but cybersecurity rules are strict.

- European Union & UK: GDPR governs data protection, with new laws like the EU Data Act and UK DUAA adding complexity. The Digital Services Act (DSA) and Digital Markets Act (DMA) regulate online platforms. Export controls target dual-use tech, and cybersecurity rules (e.g., NIS2) demand strong risk management.

- Asia-Pacific: A patchwork of data localization laws (China, India, Vietnam) and platform regulations complicates compliance. Export controls focus on sensitive technologies, and cybersecurity rules vary widely across countries.

Non-compliance risks include fines, service blocks, and payment delays. Tools like trade credit insurance can help mitigate financial exposure, ensuring stable cash flow amid regulatory challenges. Tailoring compliance strategies to each region’s rules is critical for smooth operations and growth in global markets.

1. United States

Data Protection and Localization

In the United States, data protection follows a sector-specific approach rather than a single overarching law. Federal regulations like HIPAA (for health data), GLBA (for financial data), and COPPA (for children’s data) govern specific industries. On top of that, state-level laws, such as California’s Consumer Privacy Act (CCPA) and its amendment under the CPRA, as well as measures in Colorado and Virginia, add layers of complexity for businesses operating in the digital space.

Unlike some regions, the U.S. generally supports cross-border data flows and avoids enforcing mandatory data localization. This stance is reinforced through trade agreements like the USMCA. However, companies dealing with U.S. government or defense contracts may face indirect localization requirements. Procurement rules and national security provisions often demand the use of U.S.-based data centers for certain projects. This intricate regulatory framework also sets the stage for evolving export controls and cybersecurity requirements.

Export Controls and Sanctions

U.S. export controls go beyond physical goods to include software, cloud services, encryption technologies, and even technical data. The Bureau of Industry and Security (BIS) manages the Export Administration Regulations (EAR), which regulate emerging technologies like artificial intelligence, advanced semiconductors, and quantum computing. These technologies are assigned specific Export Control Classification Numbers (ECCNs), which may require licensing for export.

Additionally, the Office of Foreign Assets Control (OFAC) enforces economic sanctions targeting specific countries, entities, and individuals. These sanctions apply to digital products, SaaS platforms, and online marketplaces, covering U.S. persons, U.S.-origin technology, and transactions in U.S. dollars. Non-U.S. providers that process payments through the U.S. or rely on American technology must also comply to avoid penalties. Regulators are increasingly using advanced analytics and AI to detect violations, which has led to the adoption of automated sanctions screening systems with real-time updates and testing capabilities. Beyond these controls, U.S. authorities emphasize strong cybersecurity measures and operational resilience.

Cybersecurity and Operational Resilience

As digital trade operates on a global scale, U.S. cybersecurity regulations play a critical role in protecting international business operations. These requirements are shaped by industry-specific mandates and the NIST Cybersecurity Framework, which serves as a widely used voluntary standard. Entities involved in critical infrastructure face additional obligations under CISA’s Cyber Incident Reporting for Critical Infrastructure Act, while public companies must now comply with SEC rules to disclose cybersecurity incidents and demonstrate board-level oversight.

Regulators are also pushing for the adoption of digital compliance platforms that integrate directly with agencies like U.S. Customs and Border Protection to streamline processes and minimize delays. For businesses, this means establishing strong, risk-based controls, having detailed incident-response plans, and regularly testing their cybersecurity measures. Companies must also maintain comprehensive records to address risks tied to third-party vendors and cloud services. These steps are crucial to meet regulatory expectations and ensure operational resilience in an increasingly interconnected world.

2. European Union and United Kingdom

Data Protection and Localization

The European Union enforces strict data protection rules through the General Data Protection Regulation (GDPR), which governs how personal data is processed and transferred across borders. Starting September 12, 2025, the Data Act will introduce additional requirements for data access and sharing related to connected products and services. Businesses operating in the EU must establish a lawful basis for processing data, conduct Data Protection Impact Assessments (DPIAs) for high-risk activities, and, if based outside the EU, appoint a local representative.

In the United Kingdom, despite Brexit, a GDPR-like framework persists under the UK GDPR and the Data Protection Act 2018. However, the UK is rolling out the Data Protection and Digital Information Act (DUAA) in phases through late 2025 and early 2026. This legislation updates rules on automated decision-making, data related to children, and international transfers. Additionally, the UK is introducing Smart Data schemes, which will enforce sector-specific data-sharing requirements in industries like finance, energy, and telecommunications.

While neither the EU nor the UK demands broad data localization for all industries, certain sectors – such as financial services and critical infrastructure – may face specific rules requiring local data storage or accessible copies within the region. U.S. companies must carefully navigate these sector-specific regulations and ensure their cloud infrastructure supports EU and UK data residency when required by regulators or key customers.

These robust data protection frameworks lay the groundwork for further regulatory developments in the digital economy.

Platform and E-commerce Regulations

The EU has introduced two major regulatory frameworks targeting online platforms: the Digital Services Act (DSA) and the Digital Markets Act (DMA). The DSA requires platforms to implement systems for addressing illegal content, provide transparency in advertising practices, and conduct risk assessments for very large platforms. Meanwhile, the DMA focuses on "gatekeepers" – large platforms with significant market influence – placing restrictions on self-preferencing, mandating data access and interoperability, and prohibiting certain bundling practices.

Recognizing gaps in existing consumer protection laws, the EU is preparing the Digital Fairness Act (DFA) to combat dark patterns, deceptive consent practices, and unfair terms in digital marketplaces. The EU has emphasized that the DSA and DMA are key components of its regulatory framework and are not subject to trade negotiations with the United States, making compliance mandatory for market access.

The UK, on the other hand, is developing its own framework through the Digital Markets, Competition and Consumers (DMCC) regime alongside online safety reforms. While not identical to EU regulations, the UK’s approach shares a focus on competition, fairness, and consumer rights. U.S. businesses must prepare for compliance with these distinct yet aligned frameworks on both sides of the English Channel.

Cybersecurity and Operational Resilience

Cybersecurity is another critical area of regulation in the EU and UK. The EU’s NIS2 Directive expands cybersecurity obligations to a broader range of "essential" and "important" entities, including digital infrastructure providers. NIS2 requires companies to implement risk-based technical and organizational measures, such as incident handling, business continuity planning, supply-chain security, secure development, and encryption. Major incidents must be reported promptly.

In the UK, the Network and Information Systems (NIS) framework includes sector-specific rules emphasizing operational resilience, particularly for financial services. While the UK’s requirements differ from NIS2, they similarly prioritize business continuity, third-party risk management, and timely incident reporting. For U.S. businesses – especially those in cloud services, SaaS, fintech, and logistics – compliance involves conducting documented cyber-risk assessments, maintaining tested incident-response plans, and managing vendor risks effectively. Regulators also expect companies to provide required logs without delay.

Export Controls and Sanctions

Both the EU and UK maintain strict export control regimes that cover dual-use items, such as encryption software, advanced computing tools, and technologies with potential military or surveillance applications. These regulations impact digital trade by restricting remote access to controlled software in sanctioned countries, cloud services supporting sensitive activities, and the transfer of technical know-how to restricted users – even if no physical goods are involved.

The EU sanctions framework is among the toughest globally, with recent expansions targeting countries like Russia and Iran. Enforcement has intensified in 2025, increasing personal liability risks for executives and leveraging advanced analytics. The UK operates a parallel sanctions regime under the Sanctions and Anti-Money Laundering Act, which aligns with EU and U.S. approaches but features independent listings and licensing requirements.

Exporters must carefully screen customers and end-users against EU and UK sanctions lists, assess associated risks, and immediately suspend access when sanctions are updated. Companies facing financial risks from regulatory disruptions or customer insolvencies tied to compliance failures may consider trade credit insurance through providers like CreditInsurance.com to safeguard receivables while enabling higher credit limits for EU and UK clients.

3. Asia-Pacific

Data Protection and Localization

Navigating data protection and localization rules in the Asia-Pacific region can feel like solving a complex puzzle. Each major economy has its own set of regulations, creating a patchwork of compliance requirements. For example, China’s Personal Information Protection Law (PIPL) and Data Security Law demand that foreign companies assess security risks before transferring data across borders and require "important data" to be stored locally.

India’s Digital Personal Data Protection Act allows cross-border transfers to approved countries but retains significant government access powers. Earlier drafts included stringent localization mandates, which industry groups estimated could lead to infrastructure costs running into hundreds of millions of dollars. Vietnam’s Cybersecurity Law, combined with Decree 53, requires foreign digital service providers meeting certain user or revenue thresholds to store data locally and maintain a local presence. On the other hand, Singapore’s Personal Data Protection Act (PDPA) offers a more relaxed framework, permitting cross-border transfers through contractual safeguards instead of broad localization requirements, though specific industries may still face stricter obligations.

These varying regulations force U.S. companies to adopt market-specific hosting strategies. This might mean setting up dedicated local data centers in some countries while relying on regional hubs, like Singapore, in others. While effective, this approach can fragment global cloud operations and lead to higher fixed costs.

Platform and E-commerce Regulations

The rise of data localization mandates has been accompanied by stricter platform and e-commerce rules. Across the Asia-Pacific region, what were once voluntary guidelines are now binding obligations. For example, China’s E-commerce Law holds digital platforms accountable for product quality, intellectual property protection, and consumer rights. It also introduces rules focusing on algorithm transparency and content moderation.

India’s Consumer Protection (E-commerce) Rules require marketplaces to verify sellers, combat counterfeit goods, disclose ranking criteria, and maintain robust grievance redress mechanisms. Foreign digital platforms operating in the region must also comply with strict mandates for rapid content takedowns and local representation. Compounding these challenges, vague definitions of "harmful" content call for sophisticated moderation systems and clear legal escalation processes to avoid missteps.

Cybersecurity and Operational Resilience

Cybersecurity regulations in the region emphasize protecting critical infrastructure through multi-layered security measures. In China, companies must undergo security reviews, audits, and local testing. Singapore and Australia require prompt incident reporting and regular audits, while Japan enforces rigorous risk management and testing protocols. For U.S. businesses, integrating these region-specific requirements into their global risk management and continuity plans is essential to maintaining operational resilience.

Export Controls and Sanctions

Export controls in the Asia-Pacific region focus heavily on dual-use technologies like semiconductors, AI, and encryption tools. Japan and South Korea align their restrictions with the Wassenaar Arrangement, but local rules can classify activities like remote access, software updates, or cloud processing as exports. U.S. exporters must carefully screen their customers and stay updated on regulatory changes to avoid non-payment risks and political complications. To mitigate financial exposure, tools like trade credit and receivable insurance from CreditInsurance.com can be invaluable. These challenges highlight the importance of flexible and region-specific compliance strategies for businesses operating in this diverse and dynamic region.

sbb-itb-b840488

Global Shifts, New Rules: Redefining Trade Compliance for Leaders

Comparison: Advantages and Disadvantages

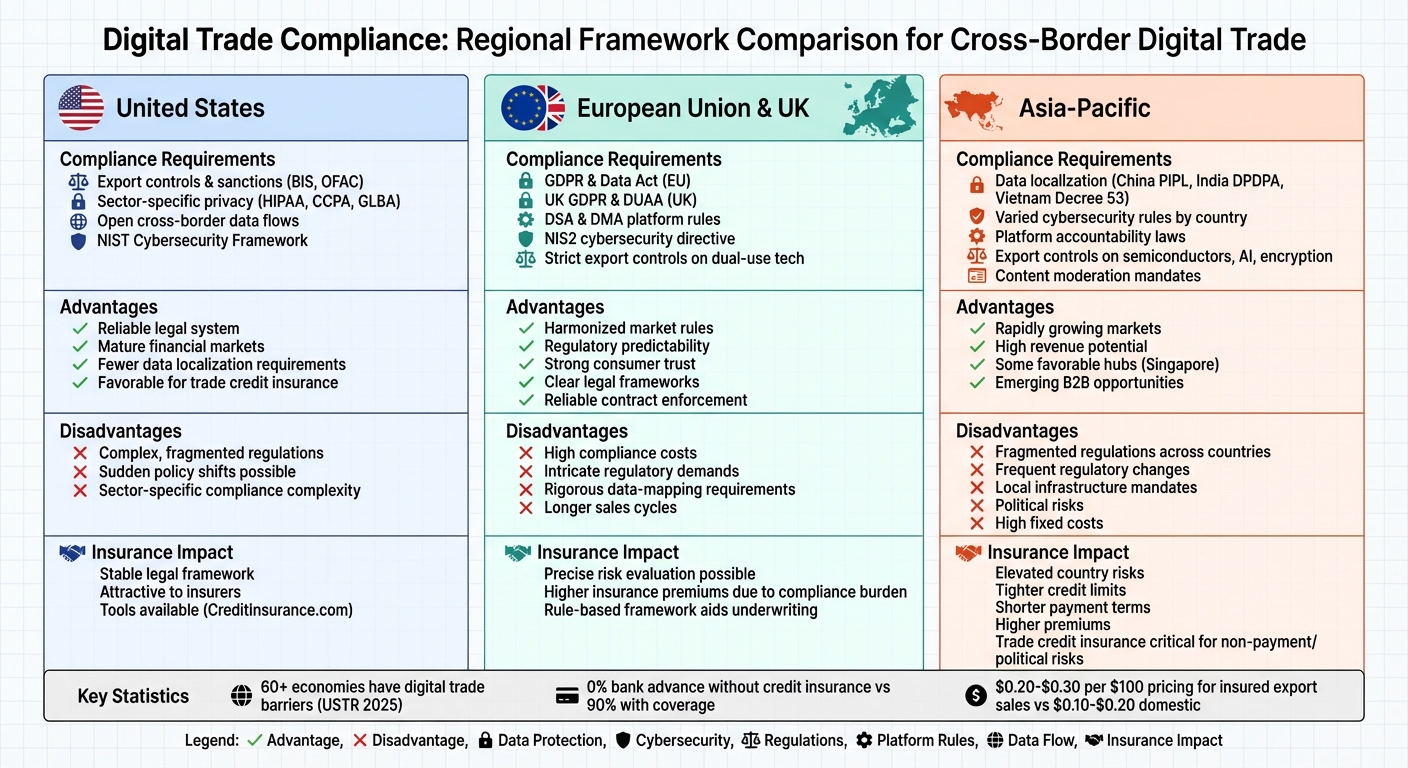

Digital Trade Compliance Requirements by Region: US, EU/UK, and Asia-Pacific Comparison

The table below highlights how compliance frameworks shape credit risk and insurance for U.S. exporters, focusing on the trade-offs each region presents when managing cross-border operations.

| Region | Compliance Requirements | Advantages for Cross-Border Trade | Disadvantages & Credit Risk Factors | Insured Receivables Impact |

|---|---|---|---|---|

| United States | Strong export control and sanction frameworks, coupled with sector-specific privacy rules, allow relatively open cross-border data flows. | A reliable legal system and mature financial markets create a favorable environment for trade credit and accounts receivable insurance, with fewer data-localization hurdles compared to developing markets. | Complex regulations can lead to sudden compliance risks or policy shifts, impacting pricing and payment terms. | A stable legal framework makes U.S. receivables appealing to insurers, though rapid regulatory changes may require adjustments in underwriting. Tools like CreditInsurance.com assist in managing higher-risk foreign exposures. |

| European Union & UK | Extensive digital regulations, including privacy rules like GDPR and strict data-transfer protocols. | Harmonized market rules, regulatory predictability, and strong consumer trust enhance legal clarity, support detailed credit analysis, and ensure reliable contract enforcement. | High compliance costs and intricate regulatory demands – such as rigorous data-mapping – can increase operational expenses and lengthen sales cycles. | While rule-based frameworks aid in precise risk evaluation, the compliance burden can raise insurance premiums for receivables. |

| Asia-Pacific | A varied landscape, from open trade hubs (e.g., Singapore) to strict data-localization and content-control rules in countries like China, India, and Vietnam. | Rapidly growing consumer and B2B markets offer significant revenue potential, with some hubs providing favorable digital trade conditions that justify insurance-backed receivables. | Fragmented and changing regulations, coupled with local infrastructure mandates and political risks, drive up fixed costs and uncertainty for digital exporters. | Elevated country and regulatory risks often result in tighter credit limits, shorter payment terms, or higher premiums. Trade credit insurance becomes critical to manage non-payment and political risks in such markets. |

This comparison highlights the importance of tailoring compliance and insurance strategies to each region’s specific conditions.

The U.S. Trade Representative’s 2025 National Trade Estimate reports that digital trade barriers remain an issue in over 60 economies. Data localization and restrictions on cross-border data flows are particularly challenging in markets like China, India, Indonesia, and Turkey. Economic studies show that restrictive data-governance policies can significantly decrease cross-border digital trade volumes.

For exporters, understanding these differences is crucial to optimizing compliance efforts and credit insurance coverage. Without credit insurance, banks typically offer no advance on export sales. However, with coverage, exporters can secure advances of up to 90%. Insured sales also command higher pricing – around $0.20 to $0.30 per $100 compared to $0.10 to $0.20 for domestic sales – reflecting the additional credit and political risks inherent in cross-border trade.

Conclusion

Digital trade compliance is far from a one-size-fits-all approach. As regulations diverge across the U.S., EU/UK, and Asia-Pacific, exporters of digital products and services must create region-specific controls while maintaining a cohesive global framework. These days, data localization rules, platform obligations, and export controls on AI and cloud services have become just as influential as traditional tariffs in determining market access.

To succeed, you need a precise, risk-focused strategy. Start by mapping out your revenue exposure and the regulatory complexity of each market. Tools like the USTR National Trade Estimate can help pinpoint where data localization, content restrictions, or strict enforcement pose the greatest challenges. Apply the strongest compliance controls in high-risk regions – such as the EU/UK and certain Asia-Pacific markets – while tailoring your approach for lower-risk areas. Automating routine tasks like sanctions screening, export classification, and customs documentation can save valuable time, allowing your team to focus on more complex decisions. Integrating these automated processes into your ERP, CRM, and e-commerce systems ensures real-time compliance.

Beyond regional controls, integrating financial risk management with compliance is crucial. No matter how robust your regulatory safeguards are, commercial and political risks in cross-border digital trade will persist. Credit insurance, for example, can provide exporters with financing advances of up to 90% on export sales – compared to zero without coverage. Platforms like CreditInsurance.com can help align financial risk tools with operational and regulatory strategies, ensuring steady cash flow even when compliance challenges delay payments or disrupt contracts.

Compliance should be treated as an ongoing process. Regulators across all regions are stepping up enforcement, using advanced analytics to spot violations and tightening rules around AI, ICT services, and data transfers. Appointing a Chief Compliance Officer and forming a cross-functional committee – including legal, IT, finance, and sales representatives – can strengthen your approach. Regular internal audits, tracking metrics like screening accuracy and filing error rates, and offering targeted training will help your team identify risks such as data localization breaches or restricted-party transactions. Dashboards that provide real-time updates can ensure compliance efforts stay aligned with your broader business goals.

Ultimately, blending compliance technology with financial risk management is the key to tackling the challenges of digital trade. In today’s environment, compliance isn’t just about avoiding penalties – it’s a strategic capability that impacts market access, supply chain resilience, and global scalability. Companies that invest in robust, tech-driven compliance programs and smart financial risk tools will be better equipped to navigate regulatory hurdles, safeguard cash flow, and seize growth opportunities across borders.

FAQs

What are the biggest digital trade compliance challenges in the Asia-Pacific region?

The Asia-Pacific region is a complex puzzle when it comes to digital trade compliance, thanks to its wide-ranging regulatory requirements. For starters, companies have to deal with data localization and privacy laws that often mandate sensitive information be stored or processed within the borders of specific countries. These rules can vary greatly from one nation to another, creating a maze that businesses must carefully navigate. On top of that, export controls and sanctions differ significantly across the region, making it critical for companies to stay informed about local regulations to avoid missteps.

Another layer of complexity comes from the need to meet regional cybersecurity standards, which are becoming stricter in response to rising digital threats. These regulations aim to safeguard against cyber risks but add another compliance hurdle for businesses operating across borders. Successfully managing these challenges is essential – not just to keep trade running smoothly but also to steer clear of potential legal troubles and financial penalties.

What impact do U.S. export controls have on digital trade?

U.S. export controls, governed by the Export Administration Regulations (EAR) and International Traffic in Arms Regulations (ITAR), oversee the export of specific technologies, products, and services. These regulations aim to safeguard national security and uphold foreign policy objectives. However, they can pose hurdles for businesses engaged in cross-border digital trade.

Navigating these rules often means dealing with extra administrative tasks, potential delays, and limitations on certain types of transactions. To avoid penalties and keep international operations running smoothly, companies need to thoroughly assess their products and services to ensure they comply with export control requirements.

How can businesses effectively manage compliance risks in different regions?

To manage compliance risks across different regions, businesses need to prioritize understanding and following local regulations. This starts with conducting in-depth research into the legal and regulatory requirements unique to each region and keeping up with any updates or changes.

Leveraging tools specifically designed for trade compliance, collaborating with regional experts, and establishing strong internal policies are practical steps to ensure adherence to regulations. On top of that, credit insurance can be a valuable resource for managing financial risks like non-payment or customer insolvency. It also supports business growth by making cross-border transactions more secure and reliable.