When businesses face financial trouble, two tools often come into play: debt restructuring plans and credit insurance policies. Restructuring helps adjust payment terms after financial distress, while credit insurance protects against non-payment risks before they occur. Together, they influence cash flow, risk management, and recovery strategies.

Key takeaways:

- Debt restructuring renegotiates repayment terms to stabilize businesses but can disrupt insurance claims and coverage.

- Credit insurance safeguards cash flow but may reduce coverage for high-risk buyers during restructuring.

- Insurers play a key role in recovery processes, requiring transparency and early engagement from businesses.

Quick Overview:

- Restructuring impacts credit insurance through legal stays, repayment adjustments, and priority financing.

- Insurers may adjust limits or deny coverage during financial uncertainty.

- Businesses should involve insurers in restructuring plans to avoid liquidity crises.

Understanding how these tools interact is vital for managing financial risks effectively.

1. Debt Restructuring Plans

Debt restructuring plans allow businesses under financial pressure to renegotiate payment terms, ensuring they can continue operations while improving the likelihood of creditor recovery. These plans often involve changes like reducing interest rates, extending repayment schedules, or even lowering the principal amount owed. While these adjustments aim to stabilize the business, they also directly impact how credit insurance operates during the restructuring process.

Coverage Implications

When a company files for Chapter 11 bankruptcy, an automatic stay is triggered. This legal mechanism halts all collection efforts, foreclosures, and repossessions, giving the debtor time to develop a reorganization plan. However, for businesses with credit insurance, this pause can disrupt the insurer’s ability to recover unpaid debts, complicating the claims process during the restructuring phase.

Another challenge arises from preference risks. Payments made to creditors within 90 days before the bankruptcy filing – or up to one year for company insiders – can be reclaimed by the court to ensure fairness in distributing the debtor’s assets. These clawbacks can affect insured claims, creating additional hurdles for insurers and policyholders.

Additionally, ipso facto clauses – contract terms that terminate agreements automatically upon bankruptcy – are generally unenforceable under the Bankruptcy Code. This means contracts with the debtor often remain active, even if the credit insurance policy was assumed to end when insolvency occurred.

These issues highlight how restructuring can complicate credit insurance coverage and force businesses to rethink their liquidity and risk management strategies.

Liquidity and Risk Management

Restructuring significantly alters how a distressed business manages its cash flow. During Chapter 11, companies can secure Debtor-in-Possession (DIP) financing, a type of senior debt that takes priority over existing obligations, including secured loans. While DIP financing is critical for keeping operations running and preserving creditor recovery, it often reduces the recovery percentages for pre-existing creditors due to its priority status.

The situation becomes even more intricate with supply chain finance arrangements. A stark example is the collapse of British construction giant Carillion in 2018. The company had been using £350 million in reverse factoring, categorizing it as "other payables" instead of debt. This misclassification obscured its financial health, and when the financier withdrew support, Carillion faced an immediate liquidity crisis. Credit insurers play a crucial role in monitoring such off-balance-sheet financing arrangements to prevent these sudden collapses.

As Norton Rose Fulbright noted:

Whilst no two financial restructurings are the same, a common key driver in any distressed scenario is the ongoing liquidity of the company.

For credit insurers, this underscores the need to keep a close eye on all forms of financing, not just traditional debt, to anticipate potential risks.

Recovery and Claims Processes

Debt restructuring also reshapes the claims process for credit insurance. If the debtor successfully adheres to revised payment terms, filing a formal claim may not be necessary – a win-win for both the insurer and the business. However, if the restructuring fails and the debtor moves into full insolvency, the payment default becomes final. At that point, the insurer must settle the claim up to the policy limit.

Restructuring often results in better recovery outcomes compared to bankruptcy liquidation. Creditors may agree to a "haircut", writing off part of the interest or principal, to avoid the more severe losses that liquidation could bring. Engaging with credit insurers early can help avoid unexpected reductions in coverage limits and ease cash flow pressures. Businesses should also review their policies for "change of control" provisions, as debt-for-equity swaps can convert policies into "runoff" mode, limiting coverage to pre-restructuring activities.

In short, effective debt restructuring can help creditors recover more while maintaining the integrity of credit insurance coverage.

| Restructuring Mechanism | Impact on Credit Insurance | Recovery Implications |

|---|---|---|

| Automatic Stay | Halts collection efforts during bankruptcy | Delays claim resolution and recovery |

| DIP Financing | Takes precedence over existing obligations | Reduces recovery percentages for prior creditors |

| Preference Clawback | Reverses payments made within specified timeframes | Can impact total recovery if payments are reclaimed |

| Cram-down | Court enforces the plan despite creditor objections | May require creditors to accept reduced claim values |

2. Credit Insurance Policies

Credit insurance policies play a distinct role compared to traditional creditors during financial restructuring. Unlike standard creditors, who must navigate the automatic stay and reorganization process, credit insurers take a more active approach. This proactive stance influences credit limits, liquidity management, and claim handling during times of financial distress.

Coverage Implications

When financial difficulties arise, credit insurers closely monitor the creditworthiness of companies. They may adjust credit limits or require prepayments for new transactions to mitigate risk. As Norton Rose Fulbright explains:

A reduction or cessation of the TCI limits can have a negative impact on short-term liquidity. It can even limit a company’s ability to maintain its operations if it does not have sufficient liquidity to make prepayments on essential goods and services.

This creates a critical distinction: while insurers remain responsible for payment defaults on deliveries made before any policy changes, they can reduce or stop coverage for new transactions during restructuring.

Additionally, Directors and Officers (D&O) policies may trigger a "change of control" provision in cases like Chapter 11 filings or debt-for-equity swaps exceeding 50% equity. This often converts the policy into runoff mode, limiting coverage. Insurers may also invoke "insured vs. insured" exclusions to deny claims brought by bankruptcy trustees against directors, as trustees may be considered "insured" entities in such cases. To address this, companies should negotiate provisions that recognize the "debtor in possession" as an insured entity and ensure exclusions are narrowly defined during policy renewals.

Liquidity and Risk Management

Restructuring brings additional challenges to liquidity management, particularly as financial risks evolve. For example, supply chain financing, usually non-recourse for suppliers, can become problematic if financiers withdraw their support. This scenario leaves insurers and financiers exposed to liquidity crises. To avoid surprises, senior lenders and credit insurers should establish detailed reporting requirements that account for all supply chain finance liabilities, not just those listed on the balance sheet.

Distressed companies can also review their casualty insurance programs to recover "trapped cash" tied up in over-collateralized deductible programs. These programs often require letters of credit as collateral, which can strain a company’s revolving credit lines during financial stress. Independent actuarial reviews can help identify over-securitized areas and assist in negotiating the release of excess collateral, providing much-needed liquidity.

Recovery and Claims Processes

Credit insurance claims follow specific rules that support risk management and recovery efforts. For instance, credit enhancements like Letters of Credit (LCs) operate under the "independence principle", meaning the issuer’s obligation to pay is based solely on document presentation, not the debtor’s performance.

When an insurer pays a claim, they become a "transferee" under Bankruptcy Rule 3001. To be formally substituted for the original creditor, the insurer must file evidence of the transfer. Creditors, in turn, must submit a "Proof of Claim" (Form 410), attaching necessary documentation to validate the claim. A properly filed Proof of Claim serves as prima facie evidence of its validity.

The 2023 collapses of Silicon Valley Bank and Signature Bank highlighted the resilience of credit enhancements in protecting recovery. The FDIC established bridge banks and issued Financial Institution Letter FIL-10-2023, ensuring that these banks would honor all contracts from the failed institutions. This meant beneficiaries of LCs could still pursue recovery, with obligations backed by the Deposit Insurance Fund.

To maintain trade credit limits during restructuring, directors should provide credit insurers with the same detailed financial updates and restructuring reports shared with lending banks. Engaging credit insurers early – such as including them in "all lenders" meetings – can prevent unexpected credit limit reductions and secure their support for the turnaround plan.

For more detailed guidance on managing credit insurance during restructuring, visit CreditInsurance.com.

sbb-itb-b840488

Pros and Cons

Debt Restructuring vs Credit Insurance: Key Differences and Impacts

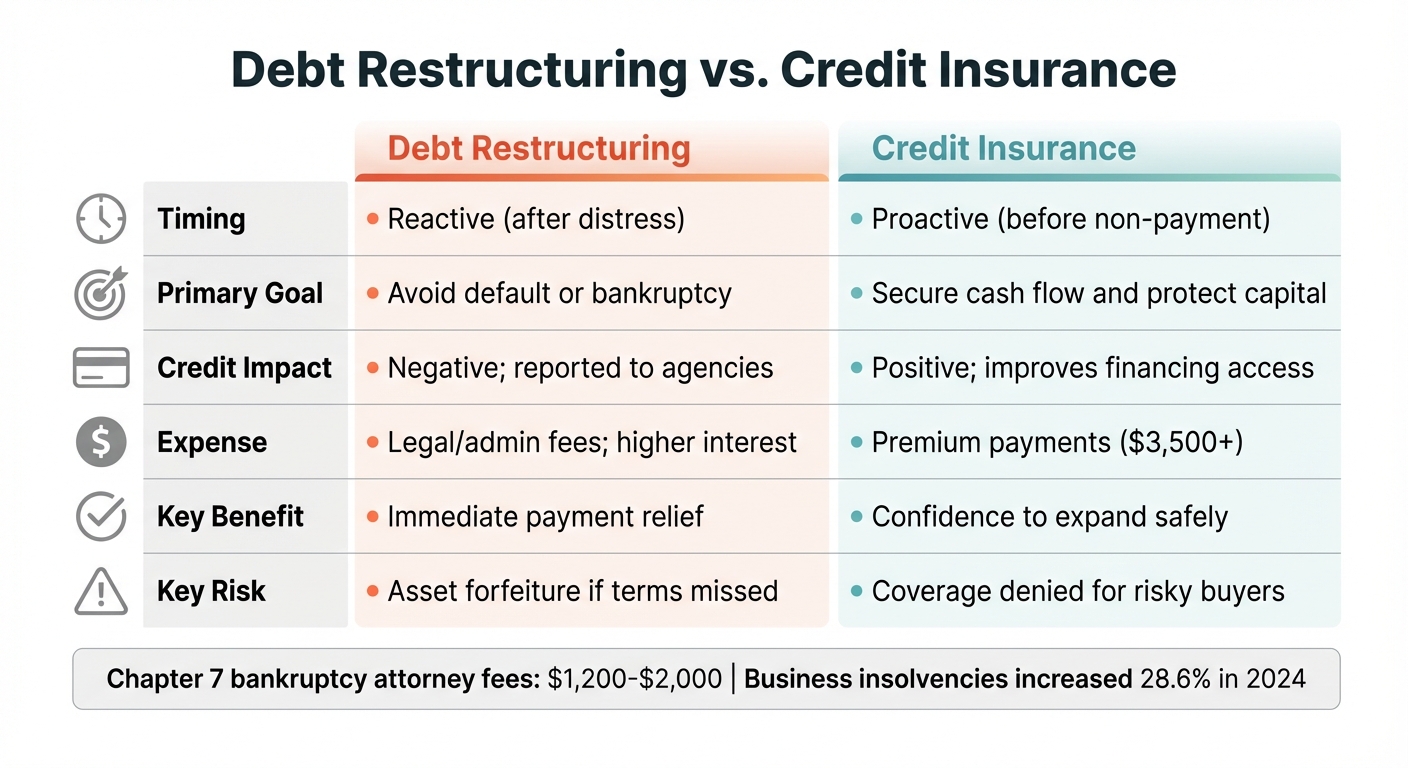

When businesses face financial challenges, they often weigh two options: debt restructuring, which adjusts existing obligations after financial distress, and credit insurance, which protects against future non-payments. Both approaches come with their own benefits and drawbacks, directly influencing liquidity, creditworthiness, and overall operational flexibility. Let’s break them down.

Debt restructuring provides immediate relief by renegotiating payment terms with creditors. For instance, attorney fees for Chapter 7 bankruptcies can range from $1,200 to $2,000, making restructuring a more affordable alternative for many businesses. As Investopedia explains:

Lenders don’t want borrowers to default on their loans because of all the costs of bankruptcy. The majority of the time, lenders will agree to negotiate with underwater borrowers to restructure the loan.

That said, this approach comes with its challenges. It can harm credit scores and often involves lengthy negotiations. Additionally, if the new terms aren’t met, secured creditors may still claim assets, complicating future claims handling.

On the other hand, credit insurance takes a proactive approach by safeguarding against potential non-payments. Premiums usually start at around $3,500 annually, offering protection that stabilizes cash flow and enhances financing opportunities. Insured receivables often boost lender confidence, which is especially valuable in volatile times. For example, business insolvencies rose by 28.6% in 2024 compared to 2023, underscoring the importance of such protection. However, credit insurance has its own limitations. Insurers may deny coverage for high-risk buyers or reduce credit limits during periods of financial uncertainty. Atradius highlights:

The only disadvantage of a trade credit insurance policy is its cost. However, with premiums typically starting around $3,500, this quickly becomes insignificant the moment a key customer fails to pay.

Here’s how the two strategies compare:

| Feature | Debt Restructuring | Credit Insurance |

|---|---|---|

| Timing | Reactive (after distress) | Proactive (before non-payment) |

| Primary Goal | Avoid default or bankruptcy | Secure cash flow and protect capital |

| Credit Impact | Negative; reported to agencies | Positive; improves financing access |

| Expense | Legal/admin fees; higher interest | Premium payments ($3,500+) |

| Key Benefit | Immediate payment relief | Confidence to expand safely |

| Key Risk | Asset forfeiture if terms missed | Coverage denied for risky buyers |

Ultimately, businesses must carefully coordinate between restructuring efforts and credit insurance to maintain stable financing. Engaging credit insurers early – while providing the same level of financial transparency shared with lending banks – can help prevent unexpected reductions in coverage limits. This kind of proactive planning ensures smoother operations and minimizes risks during challenging times.

Conclusion

Credit insurers play a crucial role as "invisible stakeholders", influencing whether suppliers offer trade credit or demand immediate cash payments. When restructuring plans and credit insurance strategies fail to align, it can create serious liquidity problems. For instance, silent reductions in trade credit insurance limits can lead to insolvency, even if a company’s restructuring plan seems sound.

To prevent such outcomes, companies should integrate credit insurers into the restructuring process, treating them like lending banks. Sharing the same financial data and including insurers in all-lender meetings can help ensure that coverage limits align with the liquidity assumptions of the restructuring plan. This transparency benefits both parties: insurers avoid payouts by supporting a company’s recovery, and businesses strengthen their financial stability.

This dynamic highlights the critical connection between debt restructuring and credit insurance in maintaining business continuity. For those navigating these challenges, platforms like CreditInsurance.com provide helpful resources to better understand the relationship between trade credit insurance and restructuring strategies. By involving credit insurers early on, businesses can better manage liquidity concerns and reduce the risk of insolvency.

FAQs

How does a debt restructuring plan impact credit insurance coverage?

Debt restructuring can impact your credit insurance coverage in various ways. This might include changes to policy terms, adjustments to coverage limits, or a shift in how insurers assess risk. Insurers often re-evaluate the financial stability of a restructured entity to determine the updated level of risk.

Staying in touch with your credit insurance provider throughout the restructuring process is crucial. Open communication helps you understand any adjustments to your policy and ensures you’re still protected against risks like non-payment or insolvency while managing financial changes.

How do credit insurers support businesses during financial restructuring?

Credit insurers are an essential part of guiding businesses through the challenges of financial restructuring. They help ensure trade credit coverage remains intact, giving suppliers and partners the confidence to continue extending credit even during periods of uncertainty. By taking on the responsibility of managing accounts receivable risk, these insurers provide businesses with the stability they need to concentrate on recovery and future growth.

Beyond this, credit insurers often work closely with lenders to create financing solutions that provide businesses with much-needed liquidity during restructuring. This kind of support safeguards cash flow, minimizes risks related to non-payment, and fosters trust among key stakeholders, including suppliers and financial institutions.

How can businesses manage liquidity challenges when combining debt restructuring with credit insurance?

Debt restructuring, like renegotiating payment terms or reducing outstanding balances, can help improve cash flow. However, it might also lead to temporary liquidity gaps. Pairing this process with credit insurance can be a smart move. It shields you from customer defaults, reduces the need for hefty bad-debt reserves, and frees up working capital to keep your business running smoothly.

Getting your credit insurer involved early in the restructuring process is crucial. They can adjust coverage to match the new payment terms, extend protection to additional buyers, and keep a close eye on customer creditworthiness to minimize unexpected risks. This proactive step helps ensure your business maintains steady liquidity while navigating the complexities of debt renegotiation.

On top of that, insured receivables can play a role in cash-flow planning or even be used as collateral for financing, giving you access to immediate funds when you need them most. CreditInsurance.com offers tools and resources to help businesses seamlessly integrate credit insurance into their financial strategies, making transitions during restructuring far more manageable.