Customer segmentation is a game-changer for businesses looking to manage credit risk effectively. By dividing customers into groups based on factors like payment history, credit scores, and industry, you can make smarter decisions about who gets credit, how much, and under what terms. Here’s why it matters:

- Identify Risks Early: Spot high-risk customers before they default and adjust credit policies accordingly.

- Improve Collections: Focus resources on recovering overdue payments from risky accounts, not low-risk ones.

- Optimize Capital: Reserve less for low-risk accounts and free up funds for growth.

Without segmentation, businesses risk treating all customers the same, leading to poor underwriting, higher bad debt, and cash flow issues. By grouping customers into tailored risk categories, you can predict defaults more accurately, streamline approval processes, and even use advanced tools like AI for better insights. Pair segmentation with credit insurance for added protection against unforeseen risks.

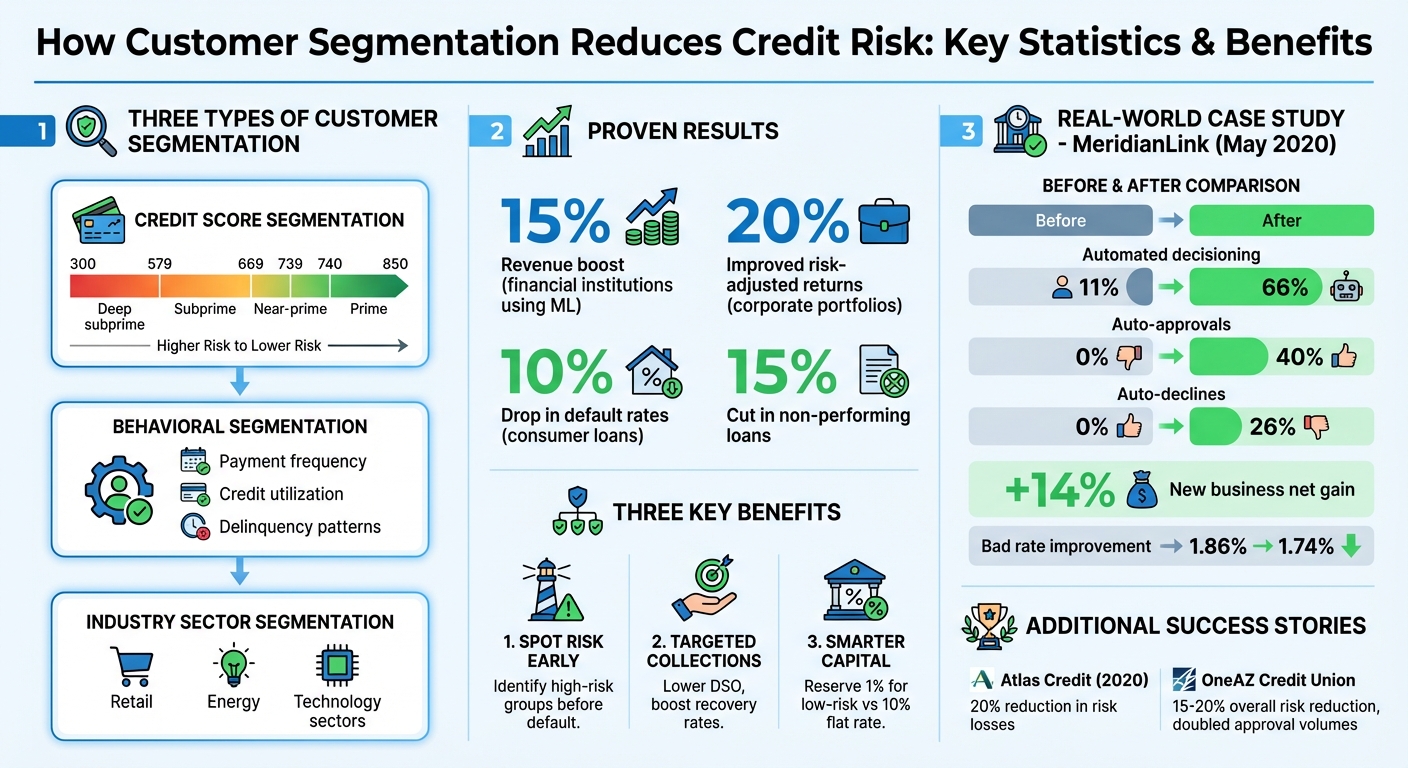

Customer Segmentation Impact on Credit Risk: Key Statistics and Benefits

04 Credit Risk Management Strategy: Segmentations in Credit Risk Strategy

What Is Customer Segmentation?

Customer segmentation in credit risk is all about grouping your portfolio into smaller, more manageable clusters based on shared risk characteristics. Instead of treating all customers the same, you classify them using factors like credit scores, payment habits, and the industries they belong to. This method breaks down a large portfolio into distinct risk groups, each with its own financial behavior, making it easier to manage risk during the underwriting process.

Customer segmentation typically involves three key areas. Credit score segmentation divides borrowers into categories such as prime, near-prime, subprime, and deep subprime, based on credit scores ranging from 300 to 850 – higher scores generally indicate lower risk. Behavioral segmentation focuses on how customers use credit, looking at factors like payment frequency, credit utilization, delinquency patterns, and defaults. Lastly, industry sector segmentation classifies accounts by their economic sectors – like retail, energy, or technology – taking into account the unique challenges and cycles each sector faces, such as regulatory changes or sensitivity to market shifts.

Customer segmentation involves categorizing customers by industry, location, revenue, account size, and number of employees to reveal where risk and opportunity live within the portfolio.

- Tracey Panek, Finance Content Marketing Manager at Dun & Bradstreet.

This structured approach enables more accurate risk profiling, helping you predict which customers are likely to pay on time and which ones might need closer attention.

Benefits of Customer Segmentation

Organizing your portfolio through segmentation isn’t just about structure – it directly helps you reduce risk and improve financial outcomes. In credit risk management, this precision is key to preventing defaults and maintaining steady cash flow.

Here are three major ways segmentation can benefit your business:

- Spotting risk early: By identifying high-risk groups before they default, you can adjust credit policies proactively.

- Targeted collections: Instead of spreading resources thin across all overdue accounts, you can focus on "high-risk/high-balance" segments. This approach lowers Days Sales Outstanding (DSO) and boosts recovery rates.

- Smarter capital allocation: Segmentation allows you to fine-tune bad-debt provisions. For example, rather than reserving 10% across all overdue accounts, you might find that only 1% is needed for specific low-risk, high-value segments. This frees up capital for other priorities like lending.

The results speak for themselves. Financial institutions using machine learning to refine segmentation have reported up to a 15% boost in revenue and a 10% drop in default rates for consumer loans. For corporate portfolios, advanced segmentation has improved risk-adjusted returns on capital by 20% and cut non-performing loans by 15%.

Problems Without Customer Segmentation

Skipping segmentation can lead to a host of problems, from poor underwriting practices to higher bad debt. Without it, businesses often rely on inaccurate risk assessments, treating all customers as if they pose the same level of risk. This one-size-fits-all approach can result in extending generous credit to risky accounts while unfairly restricting creditworthy customers. As Tracey Panek points out:

Believe it or not, there are still credit professionals whose idea of portfolio management is a spreadsheet of aging receivables.

.

Without segmentation, it’s easy to overlook critical red flags buried in aggregate data. For instance, a portfolio might appear healthy overall, but certain industries or regions could be struggling. This lack of visibility leads to inefficient underwriting, where every application requires manual review instead of automated approvals for low-risk accounts. This slows down the process, frustrates reliable customers, and wastes valuable time.

Ultimately, failing to segment your portfolio can result in higher bad debts, unpredictable cash flow, and over-reserved capital that could have been used more effectively elsewhere.

How Customer Segmentation Reduces Credit Risk

Segmenting your portfolio isn’t just about organizing customer data – it’s about turning that structure into impactful strategies that help lower credit risk. By grouping customers into tailored risk categories, you can make smarter credit decisions that directly address specific challenges. Let’s break down how this works in practice.

Better Risk Prediction and Profiling

When you segment your customers, you can create credit scorecards tailored to each group instead of relying on one-size-fits-all models. For instance, designing unique scorecards for prime and subprime customers allows you to capture behavioral nuances and relationships that generic models often overlook.

Using techniques like unsupervised clustering and supervised machine learning (such as Random Forest), you can group similar customers and apply predictive algorithms that better align with actual customer behavior. A great example of this in action comes from May 2020, when MeridianLink teamed up with a financial institution to improve auto loan underwriting. By customizing scorecards and simplifying policy rules from 19 to 7, they achieved some impressive results:

- Automated decisioning jumped from 11% to 66%.

- 40% of applications were automatically approved, while 26% were instantly declined.

- New business saw a 14% net gain.

- The funded loan bad rate dropped from 1.86% to 1.74%.

These refined risk profiles not only tightened credit controls but also improved cash flow management, making it easier to predict and manage risk effectively.

Lower Bad Debt and Cash Flow Problems

Accurate risk segmentation allows for proactive debt management, helping you identify and address high-risk accounts early. By understanding which segments are most likely to default, you can adjust terms accordingly – whether that means stricter payment conditions, requiring collateral, or lowering credit limits. Meanwhile, low-risk customers can enjoy better terms, improving satisfaction without increasing risk.

This approach also helps streamline cash flow. By focusing collection efforts on high-risk, high-balance accounts, you can reduce Days Sales Outstanding (DSO) and recover cash faster. As Tracey Panek from Dun & Bradstreet puts it:

The longer it takes customers to pay, the less likely they will pay at all.

Segmentation also enables risk-based pricing. You can charge higher interest rates to higher-risk segments while offering competitive rates to low-risk customers, helping to protect your margins while maintaining a balanced portfolio.

More Efficient Resource Allocation

One of the biggest advantages of segmentation is how it allows teams to focus on what matters most. Automated approvals for low-risk customers and quick declines for high-risk ones free up underwriters to concentrate on more complex cases.

Segmentation also improves how capital is allocated. For example, instead of holding a flat 10% reserve for all late accounts, you might find that low-risk segments only need a 1% reserve. This frees up capital for other uses, like lending or operational growth. As Panek explains:

Through segmentation, you can see that the dollars actually at risk could be considerably lower than when the surface data was examined.

Additionally, sharing segmentation insights with sales and marketing teams aligns efforts across departments. Instead of chasing high-revenue accounts with potential cash flow issues, these teams can target low-risk customers with underutilized credit lines. This ensures everyone is working toward the same goal: growing the business while managing risk effectively.

sbb-itb-b840488

Customer Segmentation Methods for Credit Risk Management

This section covers key methods for segmenting customers in credit risk management. Each method offers distinct benefits, and many businesses combine several approaches to create a more accurate understanding of their customers’ risk profiles.

Behavioral Segmentation

Behavioral segmentation focuses on grouping customers based on their actual credit behavior. This includes tracking payment history, credit utilization, and account activity to provide a realistic view of financial habits. Unlike static characteristics, this method reflects dynamic behaviors, making it highly effective in predicting potential payment issues and identifying accounts that may need closer attention.

For instance, Navy Federal Credit Union uses behavioral segmentation to classify customers into five tiers: Excellent, Very Good, Good, Fair, and Poor. These tiers are based on factors such as credit scores, debt-to-income (DTI) ratios, and loan-to-value (LTV) ratios to determine loan eligibility and pricing. By analyzing dynamic factors like motivation and financial activity, lenders can identify whether customers are "active", "inactive", or "delinquent", enabling them to craft targeted strategies for recovery or retention.

Credit Score and Demographic Segmentation

Credit score segmentation divides borrowers into clear risk categories, typically ranging from 300 to 850. This allows businesses to adjust credit policies based on the likelihood of default. Common segments include Prime (above 720), Near-prime (660–719), Subprime (620–659), and Deep subprime (below 620). This method provides a straightforward way to assess default risk across industries.

Adding demographic data – such as age, income, occupation, and education – enhances this approach by capturing financial stability indicators. For example, LendingClub uses a proprietary model to segment borrowers into seven grades (A through G), each with five subgrades, resulting in 35 distinct ratings. These grades are based on credit history, income, and loan purpose. Similarly, Bank of America applies credit risk segmentation in its "Preferred Rewards" loyalty program, offering tiered benefits like higher interest rates and reduced fees based on combined balances and credit profiles.

While these traditional methods are effective, advanced techniques can take segmentation to the next level.

AI and Machine Learning Segmentation

AI and machine learning introduce advanced algorithms capable of uncovering complex patterns in large datasets – patterns that traditional models might miss. Tools like K-means clustering, Random Forest, and gradient boosting analyze extensive data to create highly specific micro-segments based on detailed behavioral archetypes rather than broad demographic categories.

The impact of these technologies is clear. In 2020, Atlas Credit adopted a machine learning model to enhance automation, nearly doubling its loan approval rates while cutting risk losses by up to 20%. Similarly, OneAZ Credit Union collaborated with Experian to develop a custom credit model that incorporated alternative credit data. This AI-driven strategy nearly doubled approval volumes while reducing overall risk by 15% to 20%. Julie Lee from Experian explains:

Machine learning models can now quickly incorporate your internal data, alternative data, credit bureau data, credit attributes and other scores to give you a more accurate view of a consumer’s creditworthiness.

AI also enables the integration of alternative data sources, like utility payments, rent history, and mobile phone usage, to assess "credit invisible" customers – those without traditional credit histories. This is crucial, as approximately 28 million American adults have no mainstream credit file, and 21 million are unscorable using conventional models. AI-powered tools like Lift Premium™ can evaluate up to 96% of U.S. adults, compared to about 81% with traditional methods.

How to Implement Customer Segmentation in Credit Risk Management

Implementing customer segmentation in credit risk management involves a systematic approach that blends data collection, analytical methods, and continuous monitoring. The aim? To turn raw customer data into actionable insights that enhance underwriting decisions and shield your business from financial setbacks.

Collecting and Analyzing Customer Data

The process starts with gathering data from various sources. This includes internal records like payment histories, transaction data, loan applications, and demographic details, as well as external inputs such as credit bureau reports, macroeconomic trends, and alternative credit data sources. While credit scores remain a cornerstone – used by 99% of lenders employing credit risk models – advanced strategies dig deeper, incorporating a broader range of metrics.

To build effective customer segments, focus on variables that predict risk. These might include:

- Quantitative metrics: credit scores, debt-to-income (DTI) ratios, loan-to-value (LTV) ratios.

- Qualitative factors: industry type, geographic location, and customer loyalty.

Data preparation is crucial. Address issues like missing values, outliers, and inconsistent formats to ensure clean, usable datasets. Techniques like SMOTE (Synthetic Minority Oversampling Technique) can help balance class distributions, especially when dealing with imbalanced data.

Once cleaned, apply cluster analysis methods – such as k-means or hierarchical clustering – to create actionable customer segments. Combining internal receivables data with third-party risk scores gives a clearer picture of potential delinquencies, helping identify low-risk, strategic accounts. Additionally, segmenting by account size and revenue can further refine your focus, paving the way for more efficient underwriting.

Adding Segmentation to Underwriting Processes

After defining your customer segments, the next step is integrating these insights into your underwriting processes. For example, segmentation data can guide applicant classification. In one case study involving 59,477 customer records, a Random Forest classifier achieved an impressive 99.91% accuracy in distinguishing high-risk customers from low-risk ones.

Fine-tune decision thresholds based on segment characteristics. For instance, you might lower the risk classification threshold for certain segments to better identify potential defaults, even if it means a slight increase in false positives. This approach allows for risk-adjusted terms, such as offering shorter payment deadlines to high-risk customers or higher credit limits to loyal, low-risk ones. Segmentation also enables portfolio-level management, helping you spot trends across industries or locations rather than evaluating accounts in isolation.

Sharing these insights with your sales team can help them focus on low-risk accounts, driving safer growth. Additionally, segmentation can improve bad-debt provisioning. Traditional methods often allocate a flat 10% reserve for late accounts, but segmentation might reveal that some low-risk groups only need a 1% reserve. This frees up capital for other uses. As Billy Gast from MX aptly puts it:

Having the data is just the beginning – you have to do something with it. Those who can effectively drive that next action will see tremendous results.

Despite these advancements, no system is foolproof. Residual risks remain, even with precise segmentation and automated underwriting.

Using Credit Insurance for Added Protection

Even the best segmentation strategies can’t account for every risk. Economic downturns, industry disruptions, or sudden customer insolvency can impact even the most carefully classified low-risk groups. This is where credit insurance becomes an invaluable safety net.

Credit insurers have access to data on millions of buyer relationships and transactions, offering insights that go beyond what individual businesses can gather internally. As Allianz Trade explains:

Companies like credit insurers that specialize in payment risk can reduce this uncertainty since they have unique oversight of millions of buyer relationships and covered transactions, not just a select few.

This external perspective complements your internal segmentation efforts by adding broader trade insights and early warnings.

For businesses looking to integrate credit insurance into their risk management strategies, platforms like CreditInsurance.com provide resources and solutions. By pairing segmentation with credit insurance, you can confidently extend credit to borderline segments that show potential but still carry some risk. The insurance acts as a backup, mitigating financial losses from defaults within even low-risk segments. Combining these two approaches – detailed segmentation and insurance coverage – enables you to expand your customer base while keeping risk under control.

Conclusion

Customer segmentation has transformed credit risk management by leveraging behavioral trends, payment histories, and industry-specific factors. This approach equips businesses with the tools to better predict defaults, fine-tune pricing strategies, and allocate resources wisely. By relying on data-driven insights, organizations can enhance their risk management processes and make more informed strategic decisions.

One of the key advantages of segmentation is its ability to streamline capital allocation. With a clearer understanding of low-risk accounts, businesses can reduce the reserves needed for those accounts, freeing up resources to offer competitive credit terms to reliable customers. At the same time, high-risk segments can be managed with stricter controls, ensuring that risk exposure remains in check.

The good news? You don’t need to overhaul your entire system to implement segmentation. Start by gathering customer data from internal records and external sources, then use cluster analysis to identify actionable segments. These insights can be incorporated into underwriting processes by introducing risk-adjusted terms and tiered approval workflows. Additionally, sharing segmentation data across departments can help focus efforts – such as targeting low-risk accounts for growth opportunities and prioritizing collections for high-risk segments. This integrated strategy not only improves efficiency but also strengthens overall safeguards.

However, even the most refined segmentation strategies can’t eliminate all risks. External factors like economic downturns or industry disruptions can still affect even the safest-looking segments. That’s where additional measures, such as credit insurance, come into play. While segmentation sharpens internal risk assessments, credit insurance provides an essential external safety net. It shields businesses from customer insolvency, prolonged payment delays, and political risks, allowing for more confident market expansion.

For those ready to take their risk management to the next level, CreditInsurance.com offers resources and solutions to help you explore how credit insurance complements segmentation. With the right combination of internal strategies and external protections, businesses can navigate uncertainties and thrive in competitive markets.

FAQs

How does customer segmentation help reduce credit risk?

Customer segmentation plays a key role in managing credit risk by grouping customers based on shared traits like payment habits, credit history, or financial stability. This helps businesses better predict the chances of default and tailor lending strategies to fit each group.

By pinpointing high-risk and low-risk customers, companies can make smarter decisions, enhance the accuracy of underwriting, and take proactive steps to reduce potential losses. This method not only lowers financial risks but also helps businesses maintain steady growth.

How does customer segmentation help manage credit risk effectively?

Customer segmentation is a powerful tool for managing credit risk, as it categorizes borrowers into groups based on shared traits and risk levels. This approach helps businesses gain a clearer picture of customer behavior and financial dependability.

One popular method involves clustering algorithms like K-means, which analyze details such as transaction habits (recency, frequency, and monetary value), credit scores, income levels, and payment histories. For more nuanced analysis, advanced techniques like decision trees come into play. These tools examine complex relationships between variables, offering a more precise way to predict default risks.

Using these insights, businesses can fine-tune credit scoring models, create lending strategies tailored to specific risk profiles, and minimize defaults. This not only strengthens credit risk management but also ensures a more efficient allocation of resources.

How does customer segmentation help businesses manage credit risk with credit insurance?

Customer segmentation plays a key role in managing credit risk by grouping customers based on factors such as industry, location, revenue, or payment habits. These groupings help businesses spot trends in risk and opportunity, allowing them to fine-tune credit policies and use credit insurance more strategically.

By zeroing in on higher-risk or high-priority customer groups, businesses can safeguard themselves with credit insurance against possible defaults. At the same time, they can confidently extend credit to lower-risk groups to encourage growth. Combining credit insurance with segmentation not only strengthens risk management but also sharpens underwriting precision, ensuring coverage matches the unique needs of each group.