Credit insurance protects businesses from unpaid invoices and fraud in B2B transactions. It covers 85%-95% of losses when buyers fail to pay due to insolvency, bankruptcy, or fraud. Beyond financial protection, it helps prevent fraud by verifying buyers through global databases, real-time monitoring, and risk assessments. This insurance is especially useful for international trade, where fraud risks like invoice manipulation, fake buyers, and non-payment scams are common.

Key Takeaways:

- Coverage: Reimburses up to 95% of invoice amounts for non-payment or fraud.

- Fraud Prevention: Detects red flags like fake domains, mismatched addresses, and altered invoices.

- Real-Time Alerts: Warns businesses of risky buyers and changing financial health.

- Added Benefits: Supports cash flow, enables better credit terms, and aids in debt recovery.

Credit insurance is a practical tool for safeguarding your business, improving decision-making, and ensuring stability in global markets.

Credit Insurance Fraud Prevention Statistics and Coverage Benefits

Common Types of Cross-Border Payment Fraud

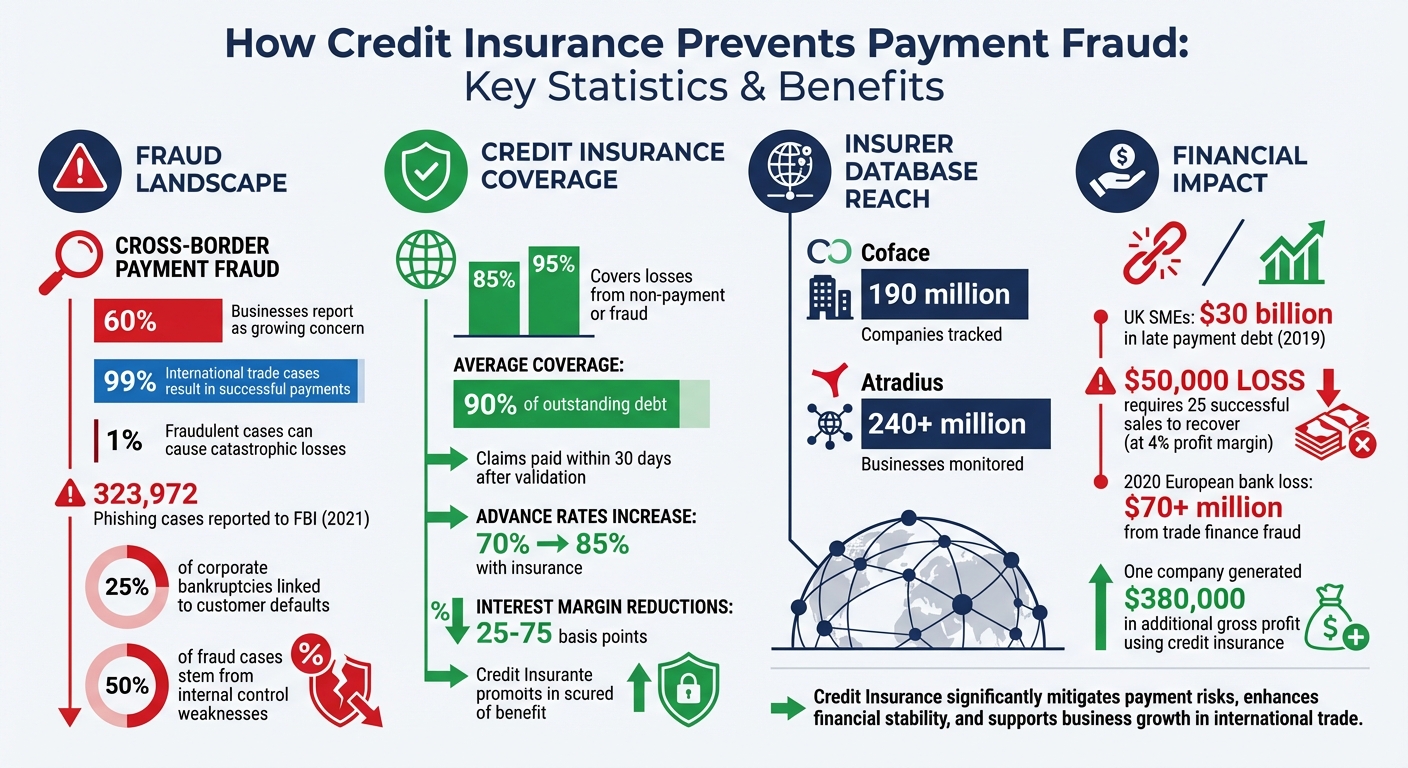

Engaging in international transactions opens doors to global markets but also exposes businesses to significant fraud risks. About 60% of businesses report that cross-border payment fraud has become a growing concern. While 99% of international trade cases result in successful payments, the remaining 1% of fraudulent cases can cause catastrophic losses for businesses that aren’t prepared. Let’s break down the most common types of fraud that threaten cross-border payments.

Invoice Fraud and Fake Buyer Schemes

One of the most prevalent scams involves fraudsters posing as legitimate companies. They often tweak email addresses, such as changing @company.com to @compaany.com, or create convincing fake websites to deceive their targets. Some criminals go even further by stealing the identity of reputable companies, using their financial information to secure credit terms from unsuspecting sellers.

A particularly dangerous tactic is the "long game" strategy. Here, scammers build trust by completing smaller, upfront-paid transactions, only to vanish after placing a large order on credit. A striking example occurred in November 2014, when OW Bunker, a major player in the shipping fuel market, collapsed due to internal fraud at its Singapore subsidiary, Dynamic Oil Trading. This sudden bankruptcy caused insured fuel traders to file trade credit insurance claims, while uninsured suppliers faced crippling losses.

Another common method is invoice manipulation. Hackers gain access to email systems, intercept legitimate invoices, and alter bank account details to reroute payments into their own accounts. In 2021, phishing schemes were the most reported cybercrime in the FBI‘s database, with 323,972 cases recorded.

Non-Payment Scams

Fraudsters often exploit non-payment schemes, taking advantage of the complexities of cross-border transactions. In some cases, buyers refuse to pay after receiving goods, knowing that pursuing legal action across borders is costly and time-consuming. The geographical distance and differing legal systems create an information gap, making it difficult for businesses to verify a buyer’s legitimacy until it’s too late.

Another tactic involves "pre-bankruptcy orders", where buyers intentionally order goods they can’t pay for, or falsely claim they never received the shipment. These schemes exploit the legal and logistical challenges of international trade. Dealing with unfamiliar business practices and legal systems across countries adds another layer of complexity.

Fraud can also occur within correspondent banking, where multiple intermediaries handle payment transfers. This creates additional opportunities for criminals to intercept or manipulate transactions.

Correspondent Banking Exploits

The multi-step nature of international payments, often involving several banks, opens the door to fraud. Criminals might send "Fake Company" requests through compromised emails, redirecting payments to unrelated accounts. For instance, in 2020, a major European bank suffered a loss of over $70 million when cybercriminals used stolen credentials to infiltrate its trade finance systems and approve fraudulent transactions.

"Vigilance is your best key to fraud prevention, so establishing policies and procedures up front to protect payments activity will go a long way." – Michael Salerno, Vice President, International Banking, FNBO

Fraudsters also exploit Letters of Credit, manipulating them through discrepancy waivers or reassigning proceeds to unauthorized third parties. These scams are successful because they target the intricate and often opaque processes of international banking, where verifying details across borders can be a daunting task.

sbb-itb-b840488

How Credit Insurance Prevents Payment Fraud

Credit insurance goes beyond reimbursing losses – it actively helps identify and prevent fraud. Insurers rely on advanced tools and extensive global databases to catch warning signs that might escape the notice of individual companies. Here’s how it works:

Real-Time Credit Assessments and Buyer Verification

Credit insurers verify new customers using vast global databases. For instance, Coface manages data on 190 million companies, while Atradius tracks over 240 million businesses worldwide. These databases cross-check buyer details with financial records, payment histories, and public information to confirm the legitimacy of the entity.

This process is particularly effective at uncovering schemes involving lookalike domains or fake websites. When an insurer denies coverage for a buyer due to heightened risk, it often indicates they’ve uncovered signs of financial instability, negative news, or discrepancies that suggest potential fraud.

"The buyer rating is also a useful tool for you. You can use it as a guide to support your own due diligence and help you avoid potentially risky customers." – Atradius

Risk Scoring and Fraud Alerts

Insurers assign risk ratings to customers based on real-time data from numerous sources. These ratings assess how likely a buyer is to pay on time by analyzing patterns such as mismatched addresses, unusual order sizes, or skipped credit checks.

Unlike a one-time credit check, credit insurers offer continuous monitoring. If a buyer’s risk profile changes or other policyholders report payment issues, you’ll receive an alert. This system acts as an early warning, helping you identify potential problems before extending credit or shipping goods.

"The best credit insurers actively support your trading throughout the year and provide an early warning system should changes in the risk status of customers occur." – Coface

Coverage for Fraud-Related Losses

In cases where fraud leads to non-payment, credit insurance typically covers 80% to 95% of the invoice. Most claims are paid within 30 days after the debt is verified. This protection applies when buyers fail to pay due to insolvency or prolonged default, even if fraud is involved.

However, coverage has its limits. Policies won’t compensate for fraud that could have been identified through basic Know Your Customer (KYC) checks. To ensure claims are honored, businesses need to maintain clear documentation, including purchase orders, proof of delivery, and communication records. Additionally, most policies require businesses to stop shipping once an account becomes significantly overdue, as continuing to ship could void coverage.

"Trade credit insurance doesn’t just cover non-payment by insolvent customers. It can also help flag suspicious transactions and prevent fraud-related losses." – Kirk Elken, Co-founder, Securitas Global Risk Solutions

These measures, both proactive and reactive, are essential for building a robust fraud prevention strategy tailored to your business needs.

How to Implement Credit Insurance for Fraud Prevention

Assess Your Risks and Select a Policy

Start by identifying where your business is most vulnerable to fraud. Sectors like chemicals, construction materials, and tires are especially prone to fraud because these goods are easy to liquidate. Internal control weaknesses account for nearly 50% of fraud cases, so it’s critical to implement safeguards like dual controls. This ensures no single employee has full authority over financial transactions. Examine your policy closely for exclusions, such as losses from delivering goods to companies that don’t match the invoice details – a tactic often used in identity theft schemes.

Your risk assessment should differentiate between "Hard Fraud", where claims are entirely fabricated, and "Soft Fraud", where legitimate claims are exaggerated for financial gain. Ensure your policy addresses both external fraud (buyer-related) and internal fraud (dishonest employees). If your current trade credit insurance doesn’t cover these risks, consider additional options like business fraud insurance or fidelity bonds. Platforms like CreditInsurance.com can guide you through the various coverage options to find one that aligns with your specific fraud risks.

Once you’ve identified your risks and chosen the right policy, make full use of your insurer’s digital tools to keep these threats in check.

Use Insurer Tools for Fraud Detection

After selecting a policy tailored to your needs, actively engage with the tools your insurer provides to monitor and verify customer credibility. Start by sharing a complete list of your account customers with your insurer. This allows them to perform an initial review, establish credit limits, and flag high-risk accounts early on. Many insurers offer online platforms like Atradius Insights or Coface’s EasyLiner, which you can use to perform credit risk checks before extending credit to new buyers.

Pay attention to warning signs such as mismatched email domains, discrepancies between shipping and billing addresses, or financial statements that seem too good to be true. If a new client’s financials look unusually positive, take the extra step of contacting the auditors listed on the documents to confirm their authenticity. Be cautious of high-pressure tactics, like urgent requests for immediate order releases, which are often red flags for fraud. Also, watch for suspicious payment patterns, such as "layering" (using multiple money orders from various banks for one payment) or "structuring" (making several deposits just under the $10,000 reporting threshold), as these could indicate fraudulent activity or money laundering.

Review and Update Coverage Regularly

Even with strong detection measures, staying ahead of fraud requires regular updates to your coverage. Buyer financial health can shift quickly, and defaults are a major factor in about 25% of business failures. Regularly reporting payment behaviors to your insurer helps refine risk assessments using public records and financial data. As your business grows, make sure to include new markets and customers in your policy, and request adjustments to credit limits as trading volumes or risk levels change.

"Credit insurance has transformed the way we do business and make decisions." – Ori Ben-Amotz, CFO, Hadco

Take advantage of the trading reports and sector analysis your underwriter provides to stay informed about broader market risks and emerging fraud tactics. Additionally, keep your team up to date by revising employee training programs to include the latest fraud indicators, ensuring they remain alert to new threats.

Benefits of Using Credit Insurance for Fraud Prevention

Credit insurance isn’t just about protecting against non-payment – it’s also a powerful tool for fraud prevention and financial stability.

Better Risk Management and Fraud Detection

Credit insurance providers use advanced tools, global databases, and real-time analytics to keep a constant eye on your buyers’ financial health. This means they can catch warning signs like fake domains, mismatched addresses, or falsified financial documents before you ship an order. For example, in March 2025, Securitas Global Risk Solutions declined coverage for a long-time client’s new customer after uncovering fraudulent activity. The fraudsters had submitted fake financials for 2023 and 2024 and used a spoofed email domain that closely mimicked a legitimate CFO’s email. This discovery prevented a shipment to a fraudulent buyer, saving the client from a costly loss.

This level of due diligence is especially valuable in international trade, where verifying buyers can be tricky. Origin Enterprises, for instance, relied on Coface’s expertise to assess both potential and existing customers. Group Treasurer John O’Connell shared:

"Coface are a valuable source of information about potential and existing customers and will go out and meet a customer if necessary. That adds significant value for us."

By identifying risks early, businesses can avoid financial instability and focus on sustainable growth.

Higher Recovery Rates and Stable Cash Flow

When fraud or non-payment does occur, credit insurance steps in to cover, on average, 90% of the outstanding debt. This ensures steady cash flow and prevents the domino effect of one bad debt impacting your entire operation. Think about it: without insurance, a $50,000 loss at a 4% profit margin would require 25 successful sales just to recover the lost funds.

Even better, claims are typically settled within 30 days after validation, providing quick financial relief. This is crucial, especially when you consider that in 2019, small and medium enterprises in the UK were burdened with approximately $30 billion in late payment debt, affecting over half of them.

Increased Credit Lines and Business Growth

Banks see insured receivables as reliable collateral, which can lead to improved financing terms. With credit insurance in place, businesses can increase their advance rates from 70% to as much as 85%, and even enjoy interest margin reductions ranging from 25 to 75 basis points. Sergio Vignone, a Credit Manager, explained:

"As traders, we obtain working capital from our bank and then we receive our money when the customer pays. The banks themselves make credit insurance a condition for access to trade finance."

In fact, many banks now require credit insurance to approve trade financing. For example, one chemical wholesaler used trade credit insurance to secure a credit line for international receivables. The company’s Managing Director and CFO noted that the insurance gave banks the confidence they needed to extend credit while also supporting internal decision-making. In another case, a business leveraged credit insurance to safely extend higher credit limits to a key trading partner, generating approximately $380,000 in additional gross profit. This not only reduced bad debt reserves but also freed up funds for reinvestment and growth opportunities.

Conclusion

Credit insurance plays a crucial role in protecting businesses from cross-border payment fraud by identifying and addressing risks before they escalate. Through a combination of real-time buyer verification, advanced fraud detection tools, and financial safeguards, it helps stop scams in their tracks, ensuring cash flow remains uninterrupted. Insurers are trained to spot warning signs like spoofed email domains, falsified financial statements, and mismatched shipping details. And when fraud does occur, policies can cover up to 90% of losses, providing a critical safety net for financial stability.

Beyond fraud prevention, credit insurance enhances your business operations by enabling more favorable financing terms, offering confidence to expand into new markets, and even providing professional debt collection services when necessary. As Kirk Elken, Co-founder of Securitas Global Risk Solutions, explains:

"Credit insurance is more than just protection from unpaid invoices – it’s part of a broader fraud prevention strategy."

With 25% of corporate bankruptcies linked to customer defaults and insolvency, the need for a proactive approach to risk management has never been clearer. Credit insurance shifts the focus from reacting to financial losses to actively preventing them, helping businesses grow securely and sustainably.

Take control of your risk management strategy today. Visit CreditInsurance.com for resources, tailored solutions, and expert advice on finding the right coverage for your business. Whether you’re managing domestic clients or venturing into international markets, the right policy can protect your receivables and support long-term growth. Safeguard your trade and embrace a comprehensive approach to fraud prevention with credit insurance.

FAQs

Does credit insurance cover invoice manipulation scams?

Credit insurance helps businesses safeguard themselves against unpaid invoices, particularly in cases of non-payment or customer insolvency. However, it generally does not extend to covering all types of fraud, such as invoice manipulation scams. Its primary aim is to reduce risks tied to financial defaults rather than addressing every fraudulent scenario.

What documents do I need to file a fraud-related claim?

To submit a fraud-related claim, you’ll usually need to gather and provide specific documentation. This may include proof of the fraudulent transaction, communication records, invoices, and any related correspondence or reports. For precise details on what’s required, it’s best to reach out directly to your credit insurance provider or consult their claim submission guidelines.

When should I stop shipping to keep coverage valid?

To keep your credit insurance coverage intact, halt shipments once the payment terms have expired and the claim filing window – usually up to 180 days from the invoice date – has closed. Shipping beyond this timeframe could put your coverage at risk.