Understanding Credit Insurance Costs for Your Business

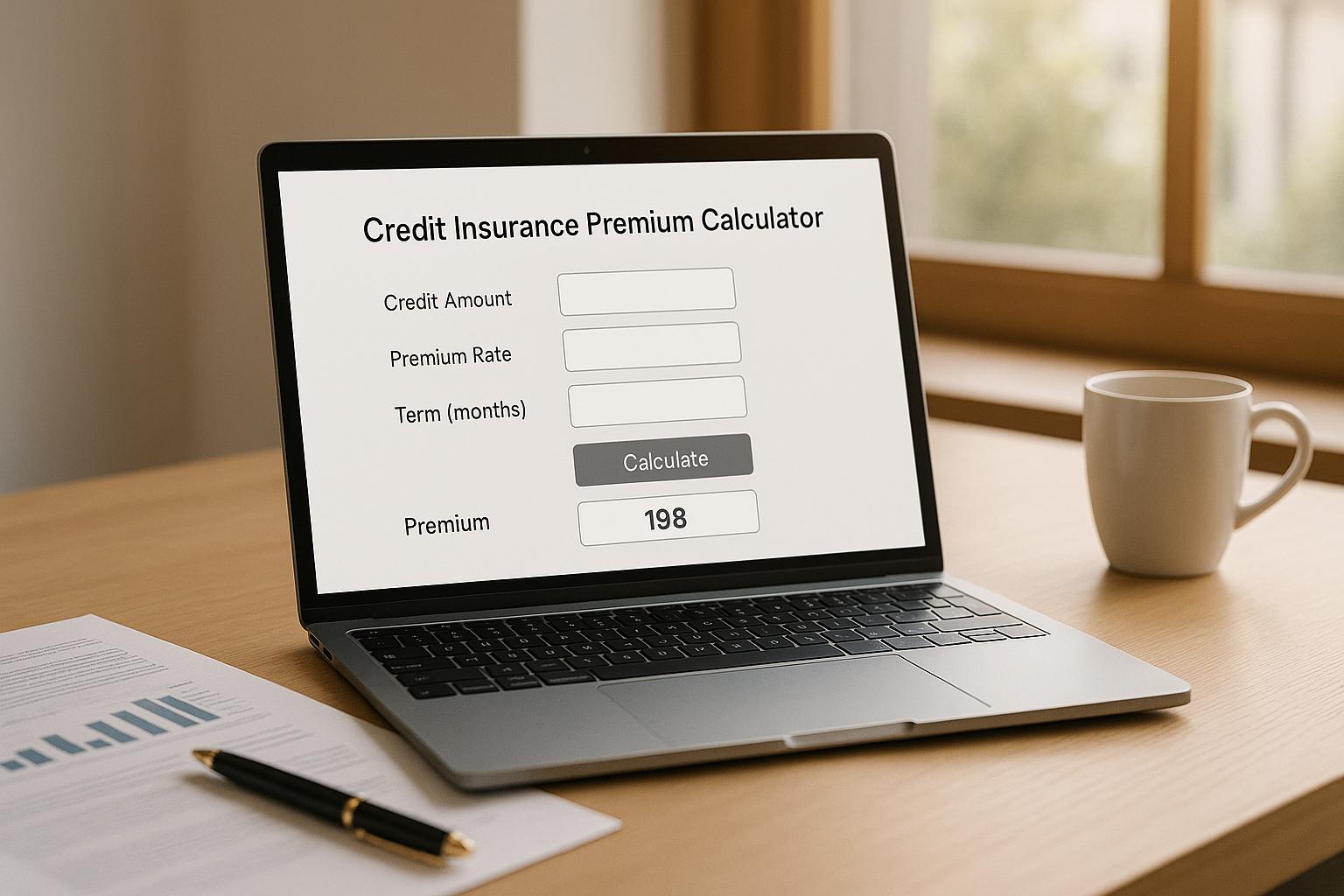

Navigating the world of business protection can feel overwhelming, especially when it comes to estimating expenses like trade credit protection. Many companies overlook the importance of safeguarding against customer defaults, but having a clear idea of potential costs can make all the difference. That’s where a tool to gauge credit risk coverage expenses comes in handy. It offers a quick way to see what you might pay based on your unique situation—without needing to dive into complex insurance jargon or wait for quotes.

Why Estimate Your Premium?

For small and medium-sized businesses, budgeting for unexpected losses is crucial. If a major client fails to pay, it can disrupt cash flow or even threaten operations. By getting a sense of what protection might cost, you can weigh the benefits against your financial plans. Factors like annual revenue, industry type, and payment terms all play a role in shaping the final figure. Beyond just numbers, this kind of insight helps you have informed conversations with insurers. Whether you’re in manufacturing or retail, taking a moment to explore these costs empowers smarter decision-making for your company’s future.

FAQs

How accurate is this credit insurance premium estimate?

Our calculator provides a solid starting point based on standard industry rates and risk factors. We use a base rate of 0.5% of your revenue, adjust for your sector, coverage level, and credit terms. That said, actual premiums can vary depending on the insurer’s policies, your credit history, and other specifics. Think of this as a helpful guide, not a final quote—reach out to providers for exact numbers.

Why does my industry affect the insurance premium?

Different industries carry different levels of risk when it comes to credit. For example, construction often has higher default risks due to project delays or economic swings, so premiums might be adjusted upward. Retail or manufacturing might see different tweaks based on historical data. Our tool factors in these nuances to give you a more tailored estimate.

Can I adjust the inputs to see different scenarios?

Absolutely! Feel free to play around with the numbers—change your revenue, coverage level, or credit terms to see how the estimate shifts. It’s a great way to understand how different factors impact the cost and plan for what suits your business best. No limits, no sign-ups, just instant results.