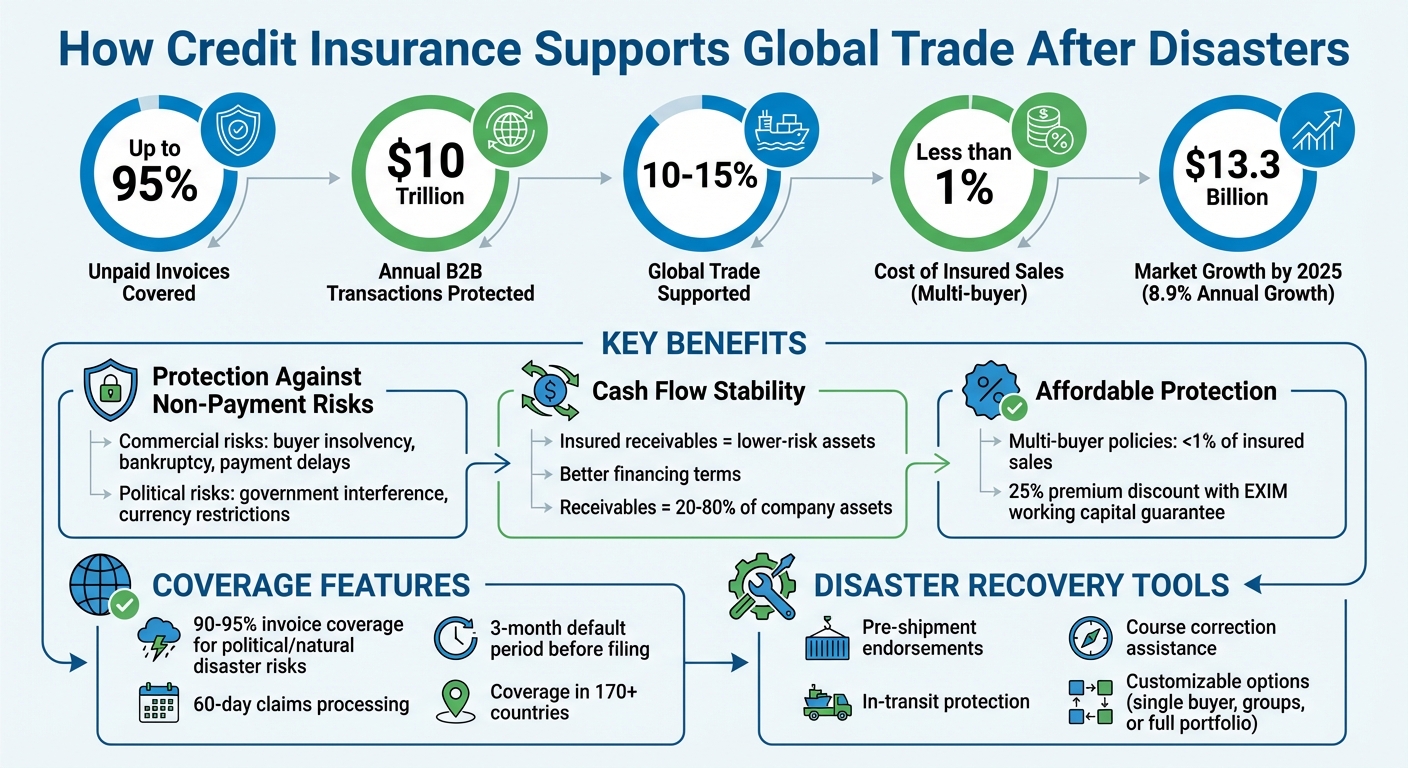

When disasters like hurricanes or floods disrupt global trade, unpaid invoices and halted supply chains can cripple businesses. Credit insurance provides a safety net by covering up to 95% of unpaid invoices, ensuring companies can maintain cash flow and avoid financial collapse. It protects against risks like buyer insolvency and political disruptions, supporting around 10-15% of global trade or $10 trillion annually.

Key Points:

- Coverage Scope: Protects against non-payment due to disasters, buyer bankruptcy, or political risks.

- Cash Flow Stability: Insured receivables help businesses secure financing and continue operations.

- Affordable Protection: Policies often cost less than 1% of insured sales.

- Customizable Options: Tailored coverage for individual buyers, groups, or entire portfolios.

- Disaster Recovery Tools: Includes pre-shipment endorsements and in-transit protection for exporters.

Credit insurance isn’t just about risk protection – it’s a tool for resilience, helping businesses recover faster and keep trade moving during uncertain times.

Credit Insurance Impact on Global Trade: Key Statistics and Coverage Benefits

Trade Credit Insurance Explained: Safeguard Your Business from Payment Risks

sbb-itb-b840488

How Credit Insurance Reduces Risks After Disasters

Natural disasters don’t just disrupt lives – they send financial shockwaves that can ripple through businesses and economies. Credit insurance steps in as a safety net, helping businesses navigate these turbulent times and ensuring trade continues even when traditional payment systems falter.

Protection Against Non-Payment Risks

One of the biggest challenges businesses face after a disaster is the risk of non-payment. Credit insurance helps tackle this by protecting exporters from both commercial risks – like buyer insolvency, bankruptcy, or prolonged payment delays – and political risks, such as government interference, currency restrictions, expropriation, or sudden regulatory changes. For companies operating in disaster-affected areas, this coverage ensures that delayed payments don’t spiral into bigger financial issues.

It’s worth noting, though, that credit insurance focuses solely on financial risks related to unpaid debts. Physical damage to goods caused by disasters is covered by separate policies, such as marine or casualty insurance.

Maintaining Cash Flow During Disruptions

When disasters hit, cash flow often becomes a critical issue. Credit insurance not only protects businesses from unpaid invoices but also helps stabilize liquidity during these uncertain times. As Jerry Paulson, Senior Vice President at HUB International, puts it:

"Trade credit insurance helps solve this dilemma by covering the risk of unpaid invoices caused by a customer’s insolvency, mitigating the risk of buyer defaults while freeing up capital and improving cash flow."

With insured receivables considered lower-risk assets, businesses can often secure better financing terms – an essential lifeline during recovery. This access to capital becomes crucial for rebuilding operations, finding new suppliers, or extending credit to customers who may be struggling themselves. Interestingly, multi-buyer policies typically cost less than 1% of the total insured sales volume, making them an affordable way to protect cash flow and ensure stability.

Supporting Business Continuity

Credit insurance doesn’t just provide immediate financial relief; it also helps businesses maintain long-term stability. With coverage in place, companies can confidently offer favorable payment terms to buyers in disaster-hit regions, preserving important trade relationships. Additionally, credit insurers provide detailed credit data, helping businesses identify trustworthy partners and avoid high-risk accounts. Given that global B2B transactions amount to roughly $10 trillion annually, these insights are invaluable in managing risk and ensuring operations stay on track, even in the face of uncertainty.

Credit Insurance Features for Disaster Recovery

When disasters hit, traditional insurance often doesn’t fully address the challenges businesses face. Credit insurance steps in with specialized features to help companies manage immediate financial gaps and navigate long-term recovery when natural disasters disrupt global trade.

Coverage for Political and Natural Disaster Risks

Credit insurance for disaster recovery goes beyond the basics, offering specific endorsements and streamlined claims processes. Typically, these policies cover 90% to 95% of the invoice amount for risks related to political or natural disasters, with sovereign buyers sometimes qualifying for full coverage. Exporters can file claims after a three-month default period, and most claims are processed within 60 days.

One standout feature is the Pre-Shipment endorsement, which is especially useful for manufacturers of custom-made goods. This endorsement, offered through EXIM, provides political risk coverage for exporters whose shipments are delayed due to political disruptions. It helps cover manufacturing costs and protects unfinished goods if political events prevent shipments from leaving the U.S.

Custom Solutions for High-Risk Markets

Exporters can customize their credit insurance to suit their needs – whether covering a single buyer, a select group of customers, or their entire portfolio. Depending on the risk profile of the region, businesses can choose comprehensive coverage or focus solely on political risks . This flexibility ensures trade can continue even when markets become unpredictable due to disasters.

For businesses operating in high-risk or disaster-prone regions, agencies like EXIM provide coverage in over 170 countries, including emerging markets where private insurers may not operate. Multi-buyer policies are typically affordable, costing less than 1% of insured sales. Additionally, companies using EXIM’s working capital guarantee may qualify for a 25% discount on premiums.

Support for Exporters Facing Delays and Cancellations

When disasters disrupt shipments, credit insurance offers in-transit protection. For example, if a government bans entry for goods already in transit (as long as they were shipped before the ban), the coverage remains valid. Insurers also provide "course correction" assistance during active disruptions. Instead of merely processing claims, they work with exporters to reroute shipments to alternative buyers in other countries, reducing losses and keeping trade moving.

These features demonstrate how credit insurance can be a lifeline for businesses dealing with disaster-related challenges. Real-world examples further highlight its role in supporting recovery efforts.

Credit Insurance in Action: Disaster Recovery Examples

Case Study: Recovery After a Natural Disaster

In September 2022, Hurricane Ian hit Florida, leaving Eastern Metal Supply (EMS) grappling with facility damage that jeopardized its exports. Thanks to credit insurance that covered international non-payment, EMS was able to continue operations and sustain its export growth despite the challenges.

Similarly, after Hurricanes Harvey and Irma in 2017, the Export-Import Bank of the United States (EXIM) stepped in to support businesses located in federally designated disaster areas. EXIM offered a six-month assistance period to help affected companies recover. Charles J. Hall, who was then Acting Chairman and President of EXIM, emphasized the bank’s commitment:

"Small businesses often have difficulty resuming operations… We’re here to help them get back up and running as soon as possible by providing them with flexibility on deadlines relating to the use of our products".

Beyond offering immediate trade protection, credit insurance plays a crucial role in helping businesses secure the financing needed to rebuild after a disaster.

Using Insured Receivables to Secure Financing

Credit insurance not only safeguards businesses from losses but also opens doors to essential post-disaster financing. Lenders are more willing to extend credit when receivables are insured, as they see these as lower-risk assets. This allows businesses to include foreign receivables and inventory in their borrowing base, creating additional financial flexibility.

Export credit insurance can cover up to 95% of sales invoices. Considering that receivables often account for anywhere between 20% and 80% of a company’s total assets, these policies can serve as valuable collateral. This enables businesses to negotiate better interest rates and secure higher credit limits – critical tools for recovery and rebuilding .

Conclusion

Natural disasters can bring global trade to a standstill, but credit insurance offers a critical safety net by covering up to 95% of unpaid invoices when buyers default. This protection helps businesses avoid devastating losses and maintain the cash flow they need to stay operational. Sarah Murrow, President and CEO of Allianz Trade Americas, captures its importance perfectly:

"Trade credit insurance is vital to keeping liquidity in supply chains. It is the glue that keeps world trade going".

The numbers speak volumes: credit insurance safeguards $10 trillion in B2B transactions every year, underpinning approximately 15% of global trade. It’s not just about mitigating risk – it’s about enabling businesses to thrive by offering competitive terms even in uncertain times.

For companies recovering from disasters, credit insurance provides three key benefits: protection against non-payment risks, better access to financing through insured receivables, and ongoing credit monitoring that acts as an early warning system for potential issues.

With the trade credit insurance market expected to grow to $13.3 billion by 2025 – an annual growth rate of 8.9% – this financial tool is becoming even more essential as businesses contend with fragmented supply chains and geopolitical challenges. It plays a pivotal role in helping exporters and manufacturers regain stability and resume operations quickly. For those wanting to explore how credit insurance can safeguard their business, resources like CreditInsurance.com offer valuable guidance on making the most of these solutions.

FAQs

How can credit insurance help businesses recover from natural disasters?

Credit insurance is an essential safety net for businesses recovering from natural disasters. It safeguards your cash flow by covering unpaid invoices when customers can’t pay, ensuring you have the resources to keep your operations running smoothly.

It also helps when seeking financing. By showcasing financial stability to lenders, credit insurance can make securing funds easier. This financial backing allows businesses to recover lost revenue, rebuild disrupted supply chains, and maintain important global trade relationships during the recovery process. With credit insurance in place, you can focus on rebuilding without the constant worry of financial instability.

What risks does credit insurance cover in global trade?

Credit insurance plays a crucial role in supporting businesses engaged in global trade by offering protection against a range of risks. For instance, it covers commercial risks like customer insolvency, bankruptcy, or prolonged non-payment. Additionally, it shields companies from political and economic risks, including war, civil unrest, government expropriation, currency restrictions, and the cancellation of import/export licenses.

This type of coverage helps businesses navigate disruptions more effectively, allowing them to recover faster and maintain steady operations, even when unexpected challenges arise.

Is credit insurance affordable for businesses recovering from disasters?

Credit insurance offers businesses an affordable way to safeguard their financial stability, even during tough times. Premiums are typically calculated as a small percentage – ranging from 0.075% to 0.35% – of the total receivables covered. For instance, if a business insures $1,000,000 in invoices, the annual cost would fall between $750 and $3,500. This percentage-based structure ensures accessibility for companies of all sizes, without requiring a large upfront investment.

For businesses recovering from natural disasters, credit insurance can be a game-changer. It helps cushion the financial blow of unpaid invoices, keeps cash flow steady, and can even improve access to working capital or support extending credit to new customers. With its affordability and adaptability, credit insurance becomes a vital tool for maintaining operations and aiding recovery during challenging periods.