Understanding Credit Insurance: A Guide to Smart Choices

When it comes to safeguarding your financial future, finding the right protection plan for your credit obligations is crucial. Many people overlook the importance of securing their loans or credit lines against unexpected life events, but that’s where a tool like our credit protection comparison can make a real difference. It’s all about giving you clarity on what’s available without the hassle of endless research.

Why Compare Coverage Options?

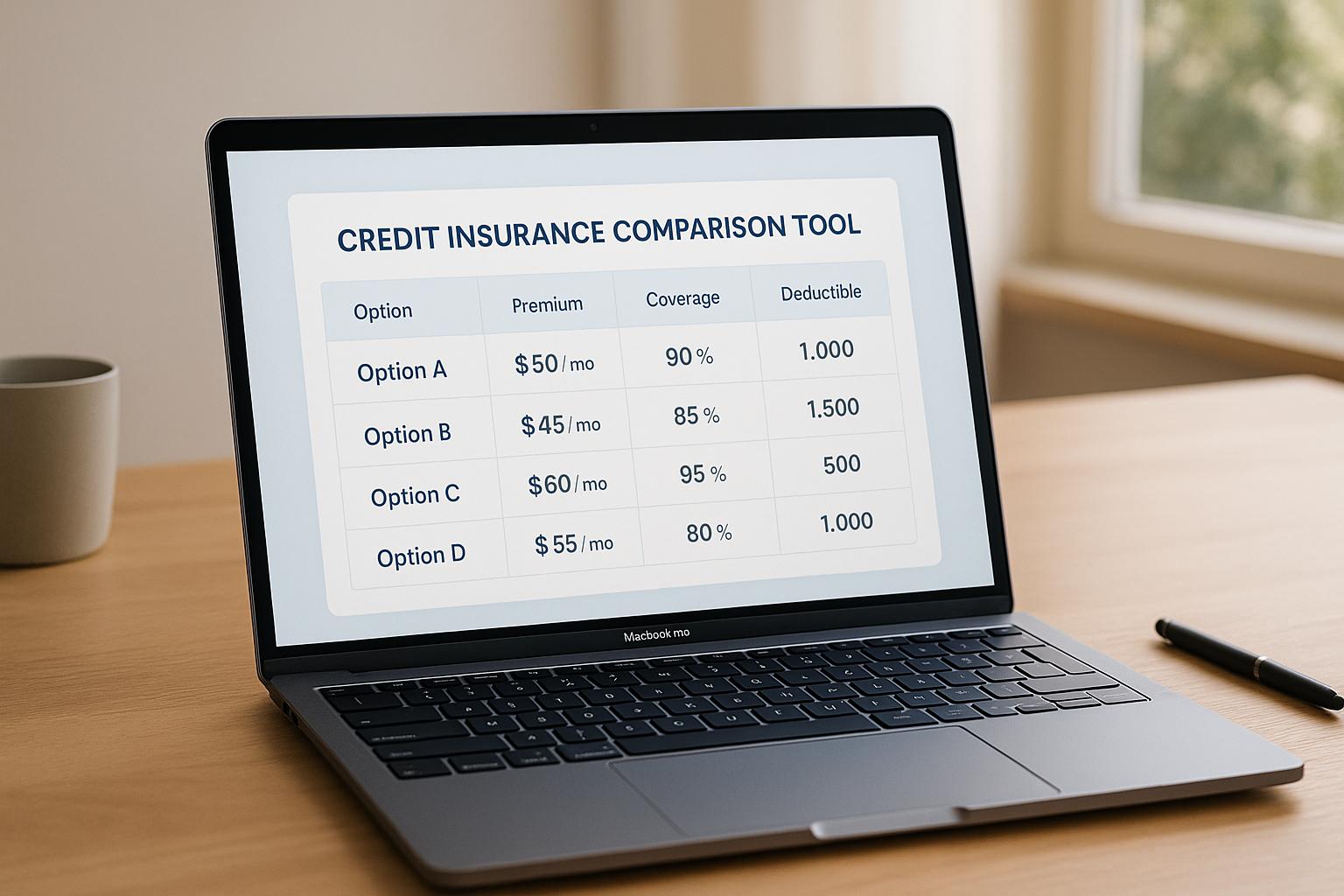

Every lender and insurer offers different terms, premiums, and benefits, which can feel like navigating a maze. Whether you’re a small business owner protecting trade credit or an individual securing a personal loan, understanding your options helps you avoid overpaying or underinsuring. A quick comparison sheds light on how much coverage you’re getting for your money and whether the policy term suits your goals.

Making Informed Decisions

Beyond just numbers, think about peace of mind. Knowing you’ve got a backup plan if things go sideways—be it job loss or health issues—can be invaluable. Tools that break down complex insurance data into simple, digestible formats empower you to take control. So, explore your choices today, and take that first step toward financial security with confidence.

FAQs

How accurate are the plans generated by this tool?

The plans you see are illustrative examples based on common industry trends and the inputs you provide. They’re designed to give you a general sense of what’s out there—think of them as a starting point. Costs and coverage can vary widely between providers, so I’d recommend reaching out to insurers directly for precise quotes tailored to your situation.

What factors influence credit insurance premiums?

Premiums for credit insurance depend on a few key things. The coverage amount is a big one—higher amounts usually mean higher costs. Then there’s the policy term; longer terms often come with slightly steeper rates due to extended risk. Your priority also plays a role—opting for fuller coverage will bump up the price compared to a cost-focused plan. Lastly, real-world factors like your credit profile or the insurer’s policies can shift things, which is why connecting with a provider is a smart next step.

Can I trust credit insurance to protect my finances?

Credit insurance can be a solid safety net if you’re worried about unpaid debts impacting your finances, especially for big loans or credit lines. It often covers scenarios like job loss, disability, or even death, ensuring payments are made on your behalf. That said, it’s not a one-size-fits-all solution—some plans have exclusions or limits you’ll want to double-check. Use our tool to get a feel for what’s possible, but always read the fine print or chat with an advisor to make sure it aligns with your needs.