Export credit insurance (ECI) protects businesses from risks like non-payment due to buyer insolvency or political instability. Yet, many exporters hesitate to use it, often because of myths about its cost, complexity, or necessity. Here’s what you need to know:

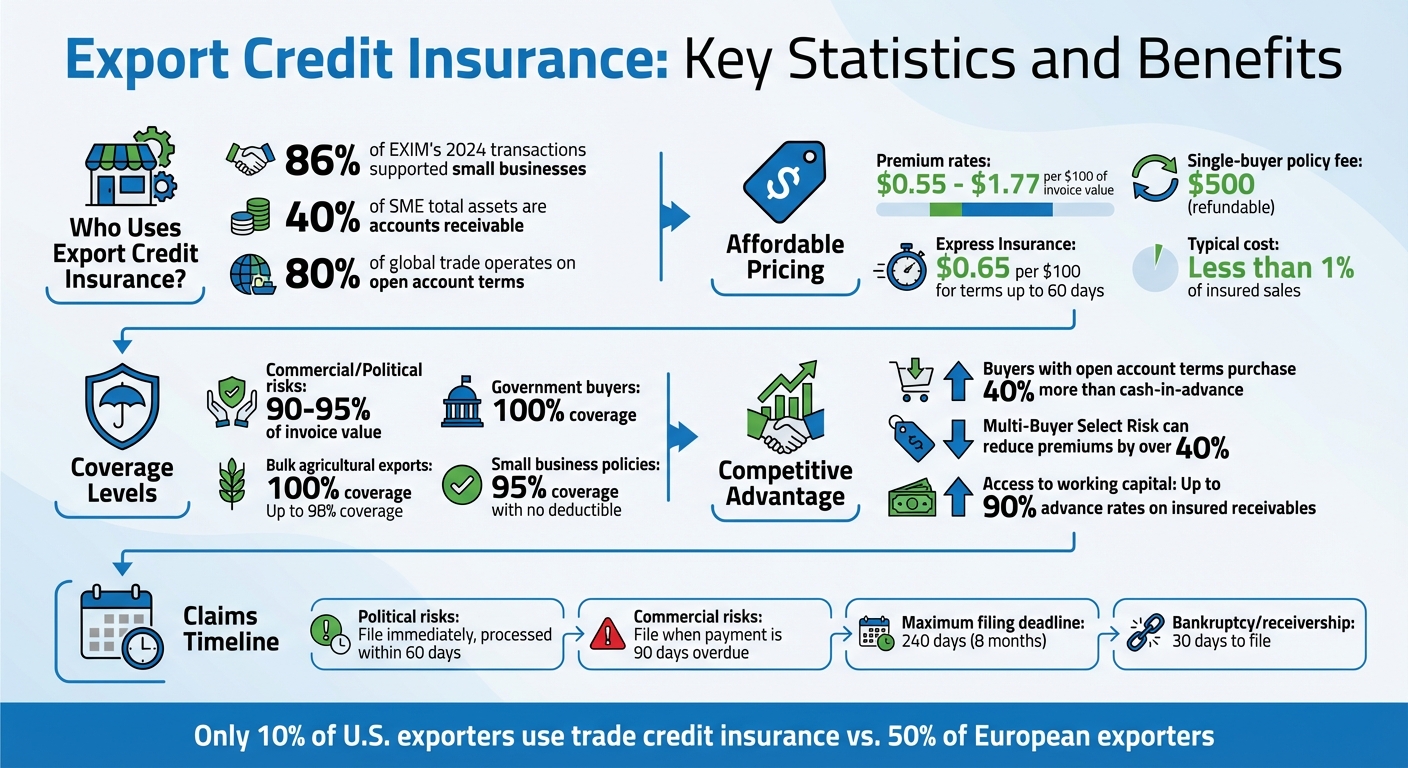

- Not just for large companies: Small businesses benefit significantly, with 86% of EXIM’s 2024 transactions supporting SMEs.

- Affordable premiums: Rates start as low as $0.55 per $100 of invoice value, with no annual minimums for government-backed policies.

- Flexible coverage: Insure specific customers, markets, or your entire portfolio. Options like single-buyer policies allow targeted protection.

- Not a guarantee: Claims depend on meeting policy terms, like filing deadlines and proper documentation.

- Improves financing: Insured receivables are more appealing to lenders, unlocking working capital and enabling growth.

Export credit insurance reduces risk, supports cash flow, and enhances competitiveness in global markets. Misconceptions aside, it’s a practical tool for businesses of all sizes.

Export Credit Insurance: Key Statistics and Benefits for Businesses

Credit Insurance as a Risk Mitigation Tool for International Trade

sbb-itb-b840488

Myth 1: Only Large Exporters Need Export Credit Insurance

There’s a common misconception that export credit insurance is only relevant for massive corporations, like Fortune 500 companies, shipping millions of dollars overseas. But that couldn’t be further from the truth. In fact, small businesses play a huge role in utilizing export credit insurance. In 2024, 86% of EXIM’s transactions supported small businesses.

Export credit insurance is accessible to businesses of all sizes. Whether you’re insuring a transaction worth a few hundred dollars or handling deals in the billions, EXIM has options for you. For small and medium enterprises (SMEs), this accessibility is crucial. With accounts receivable often making up as much as 40% of their total assets, just one unexpected default could put their entire operation at risk.

How SMEs Benefit from Export Credit Insurance

Small businesses often struggle to compete internationally because they feel forced to demand cash-in-advance payments to avoid the risk of non-payment. Unfortunately, this approach can backfire. Buyers offered open account terms tend to purchase 40% more than those required to pay upfront.

Export credit insurance changes the game for SMEs. It allows them to offer 30-, 60-, or 90-day credit terms while protecting up to 95% of the invoice value against risks like customer bankruptcy or political instability. This gives small exporters the confidence to compete globally without fearing financial losses.

Another major advantage is improved financing options. Banks are often hesitant to include uninsured foreign receivables in a company’s borrowing base. But when those receivables are insured, lenders are far more likely to count them, giving businesses access to more working capital.

And what about cost? The premiums are surprisingly affordable. Rates can start as low as $0.55 per $100 of invoice value, with many policies operating on a "pay-as-you-ship" basis. For smaller exporters, Express Insurance offers coverage at approximately $0.65 per $100 for credit terms up to 60 days. Unlike private insurers that often require annual minimum premiums of $10,000 to $15,000, government-backed policies have no such requirements.

Industries Where SMEs Use Export Credit Insurance

Export credit insurance isn’t just for traditional manufacturing companies. SMEs across a variety of industries use it to protect their international sales. Manufacturers exporting everything from diesel engine parts to wine, chocolate, and skincare products rely on this coverage. Technology companies, particularly those exporting software and digital services, also benefit from the protection it provides. Even service-based businesses, such as consulting firms, education providers, and financial services companies, use export credit insurance to safeguard their receivables.

The flexibility of these policies is another big plus for SMEs. Exporters can tailor their coverage to meet their specific needs. For example, instead of insuring all customers, they can choose single-buyer policies for high-risk clients, focus on specific markets, or cover their entire export portfolio. A single-buyer policy typically has a $500 issuance fee, which can even be refunded if the first-year premiums exceed that amount. This adaptability makes it easier for SMEs to manage risks while keeping costs under control, addressing concerns about cost barriers and coverage practices with ease.

Myth 2: Export Credit Insurance Costs Too Much

There’s a common misconception that export credit insurance eats into profit margins, but it’s far more affordable than most people think. In fact, for many multi-buyer policies, the cost is typically less than 1% of insured sales. For example, EXIM premium rates usually range between $0.55 and $1.77 per $100 of invoice value. That means if you’re shipping $10,000 worth of goods, your premium might only be around $55 to $65.

How Premiums Are Calculated

The cost of your premium depends on several factors, including the buyer’s creditworthiness, the risk level of their country, payment terms, and your total sales volume. For instance, EXIM uses a five-tier system to evaluate private buyer risk and refers to the Country Limitation Schedule to determine if a buyer’s country poses a high or low risk. Naturally, longer payment terms – like 360 days instead of 60 – will result in higher premiums since the exposure to risk increases over time.

EXIM’s pricing structure is straightforward and easy to understand. Small business exporters using EXIM’s Express Insurance, for example, pay a fixed rate of $0.65 per $100 of invoice value for payment terms up to 60 days. Plus, if you’re taking advantage of an EXIM working capital guarantee, you could qualify for a 25% discount on multi-buyer insurance premiums. Unlike private insurers, which often impose minimum annual premiums of $10,000 to $15,000, government-backed policies typically don’t have such requirements.

This level of predictability makes it easier to budget while still reaping financial and competitive advantages.

Long-Term Financial Benefits

The real power of export credit insurance lies in the broader opportunities it creates for your business. By insuring your foreign receivables, you make them more appealing to banks, which are often willing to count them as part of your borrowing base. This can unlock additional working capital, giving you the flexibility to grow your business, fulfill larger orders, or explore new markets.

Offering open account terms also gives you a competitive edge. Since 80% of global trade relies on these terms, having export credit insurance in place allows you to compete more effectively. On top of that, the premiums you pay are tax-deductible, and the coverage can reduce the bad-debt reserves you need to set aside, potentially lowering your overall tax liability. When you weigh these benefits against the small, predictable cost of a premium, the value of export credit insurance becomes undeniable.

Myth 3: You Must Insure Your Entire Customer Portfolio

Many believe that export credit insurance requires covering every single customer, but that’s not the case. You can focus your coverage on accounts or markets where the risks are higher. This targeted approach helps exporters manage resources effectively without paying for unnecessary, broad coverage.

Selective Coverage Options

Export credit insurance offers two key options for selective coverage. If you’re looking to protect sales to a single foreign customer, a Single-Buyer policy is a great fit. This is especially useful for high-value contracts or new partnerships where risks are concentrated. These policies cover up to 90% of invoice value for private buyers and 100% for sovereign buyers. Bulk agricultural exports can even achieve up to 98% coverage. Plus, there are no application fees or annual minimum premiums, and the $500 issuance fee is refundable if your first-year premiums exceed that amount.

For those managing multiple customers but not needing full coverage, the Multi-Buyer Select Risk (MBSR) policy offers flexibility. With this option, you can exclude "prime customers" who’ve paid reliably for at least three years, large multinational buyers, or sales in low-risk markets. Standard exclusions also apply, such as sales to Canada, transactions backed by letters of credit, and invoices under $10,000. By using an MBSR policy, exporters can cut premium costs by over 40%. Typically, the selected portfolio must represent at least 50% of eligible export credit sales, though insurers may adjust this requirement based on your risk distribution.

"The Multi-Buyer Select Risk (MBSR) policy option offers… Flexibility: Businesses have the freedom to choose which export credit sales to insure by excluding select lower-risk transactions or customers." – Office of Communications and Office of Small Business, EXIM

Before applying, consider using an Exclusions Worksheet to pinpoint buyers or regions with the highest risk. If you already hold a multi-buyer policy, you can explore switching to a Select Risk policy during your renewal to reduce premiums on low-risk accounts. For businesses dealing with customized or made-to-order goods, adding a Pre-Shipment endorsement can protect manufacturing costs before shipping even begins.

Case Study: Targeted Coverage for High-Risk Markets

In June 2020, a small EXIM client operating in over 80 countries used a Multi-Buyer Select Risk policy to fine-tune their coverage. They excluded large multinational corporations, long-term trusted partners, and buyers in low-risk markets from their policy. By focusing only on high-risk accounts in politically unstable and emerging markets, the company managed to lower premium payments by over 40% while still safeguarding critical sales. This strategy enabled them to offer competitive open account terms in volatile markets – an alternative to requiring cash-in-advance – without overspending on unnecessary coverage.

Myth 4: Export Credit Insurance Guarantees All Payments

Export credit insurance (ECI) isn’t a foolproof safety net for every payment. It’s a conditional policy, meaning coverage depends on meeting specific requirements – like filing claims within set deadlines and providing accurate documentation. If exporters miss these steps or fail to comply with policy terms, claims can be denied. This highlights the importance of understanding the policy’s limits to manage expectations and make informed decisions when using ECI to mitigate risks.

"Export credit insurance is not a blanket guarantee. Claims can be denied if the exporter fails to meet policy conditions and does not follow the claims process."

– Alexis Bascombe, Business Development Specialist, EXIM

Let’s break down the types of risks covered to better understand what ECI can – and cannot – protect against.

Coverage Types: Commercial and Political Risks

Export credit insurance addresses two main categories of risk: commercial risks and political risks.

- Commercial risks include buyer insolvency, bankruptcy, or failure to pay (protracted default).

- Political risks cover issues like war, revolution, confiscation of assets, currency inconvertibility, or the cancellation of export/import licenses.

Most policies reimburse 90% to 95% of the invoice value for both types of risks. Small business policies often offer 95% coverage without a deductible. For government buyers, coverage usually reaches 100%, while bulk agricultural exports may qualify for up to 98% coverage.

The claims process varies depending on the type of risk. For political risks, exporters can file a claim immediately, and processing is typically completed within 60 days. For commercial risks, there’s a waiting period – claims can only be filed when payment is 90 days overdue and must be submitted before the 240-day (8-month) deadline. In cases of buyer bankruptcy or receivership, the filing window shrinks to just 30 days.

Knowing these timelines and limits is crucial to navigating the claims process effectively.

Claims Processes and Exclusions

To successfully file a claim, exporters must strictly follow documentation and deadline requirements. One key requirement is providing "Proof of Export." This proof must come from third-party documentation, such as an ocean carrier’s bill of lading, to confirm that the goods left the U.S. and arrived in the buyer’s country. Additionally, the buyer’s name and address must match exactly across all documents, including the invoice, bill of lading, and purchase order.

"Export credit insurance covers commercial risks like insolvency, bankruptcy, and protracted default… However, it does not cover disputes with the buyer or physical loss or damage to the product."

– Alexis Bascombe, Business Development Specialist, EXIM

It’s important to note what ECI does not cover. Common exclusions include disputes over product quality or delivery terms, as well as physical loss or damage to goods. For example, if a buyer refuses to pay due to a disagreement about the product, ECI won’t cover the unpaid invoice. Similarly, physical damage to goods must be addressed through separate marine or cargo insurance. Exporters are also required to stop shipping to buyers with overdue payments to remain eligible for future claims.

To protect your claim, maintain detailed records, meet all filing deadlines (90-day minimum, 240-day maximum), and act quickly if a buyer declares bankruptcy. Ensuring all documentation is consistent and complete is essential for a smooth claims process.

Myth 5: Insurers Cancel Coverage When Buyers Have Problems

A common concern among exporters is the fear that their export credit insurance will disappear when buyers face challenges. However, insurers rarely cancel policies outright. Instead, they rely on proactive monitoring and risk management systems to maintain coverage and protect both parties from potential losses.

How Insurers Monitor and Adjust Risk

Insurers don’t sit back and wait for buyers to default. They use advanced tools and databases to keep tabs on buyers’ financial health in real time. This includes tracking late payments, changes in financial statements, and larger economic factors like inflation or political instability. When red flags appear – such as payment delays or a downgrade in a country’s credit rating – insurers take action by adjusting credit limits to manage risk.

"Export credit insurance is perhaps the most effective way to deal with export credit risk. In addition to providing payment in the event of a customer default, credit insurance can also provide important credit information about current and potential customers, allowing exporters to make more informed credit decisions."

– Allianz Trade

These adjustments act as a heads-up for exporters. For instance, if an insurer significantly reduces a buyer’s credit limit, it signals the need for the exporter to investigate or limit their exposure. Crucially, these changes only apply to future shipments and don’t affect goods already delivered. Insurers usually give 30 to 60 days’ notice before making these changes, allowing exporters time to prepare.

"Businesses often view this [coverage adjustment] not as a problem but as a useful alert to changes in their risk exposure, acting as an ‘early warning system’ that can help them avoid bad debt or at least prevent increasing their exposure at the wrong time."

– Nigel Birney, Head of Trade Credit UK & Ireland, Lockton

This approach not only minimizes risk but also sets the stage for alternative coverage options that can keep exporters stable, even during turbulent times.

Benefits of Non-Cancellable Coverage

To provide even greater peace of mind, insurers offer non-cancellable limits, which are especially valuable in unpredictable markets. These policies ensure that coverage remains intact for the full 12-month term, even if a buyer’s financial situation worsens. This kind of stability acts as a financial cushion during economic downturns or geopolitical upheavals.

During the COVID-19 pandemic, the EU allocated EUR 227 billion to credit insurance programs to maintain market confidence. Non-cancellable limits achieve similar stability without requiring government support. Once exclusive to large corporations, these policies are now becoming more accessible to mid-sized exporters. Some insurers even use hybrid models, where companies share real-time invoice data to secure coverage.

"The concept of non-cancellable coverage has become increasingly popular… insurers and banks who underwrite credit protection globally now do so on the basis of committing to specific, insured credit limit(s) which can not be reduced or cancelled during the insurance policy period, even if there is a deterioration of the insured customer’s credit quality."

– Marc D. Wagman, Managing Partner, Aequus Trade Credit

For exporters in high-risk areas, non-cancellable limits eliminate the fear of sudden coverage changes. This allows them to honor long-term contracts and maintain strong customer relationships, even when market conditions take a turn for the worse.

Myth 6: Self-Insurance Works Better

Some exporters opt to set aside their own reserves to handle payment risks, a practice known as self-insurance or bad debt provisioning. While this might seem like a viable strategy, it leaves businesses vulnerable in ways that formal export credit insurance can address far more effectively.

The Hidden Costs of Self-Insurance

Self-insurance ties up significant amounts of capital that could otherwise be used to support day-to-day operations or growth. As the Office of Small Business at EXIM Bank aptly notes:

"Every dollar in accounts receivables is a dollar less in cash".

This lack of liquidity can be a serious issue, especially for small exporters. A single missed payment from a major customer could spell disaster, as self-insurance offers no safety net for such scenarios. Buyer nonpayment remains the leading cause of business failures in the U.S..

"Trade credit insurance is more than just insurance; it’s a front-end risk management and credit enhancement tool in addition to a being a sales tool."

– Office of Small Business, EXIM Bank

Beyond financial risks, self-insurance brings a heavy administrative workload. Businesses must handle credit reports, evaluate foreign buyers’ financial health, monitor accounts, and manage collections when payments are overdue. On top of that, lenders often exclude uninsured foreign receivables from the borrowing base, making it harder to secure working capital. As Eugene Uhm, Business Development Specialist at EXIM Bank, explains:

"Uninsured foreign receivables are often excluded from your borrowing base, limiting your access to capital".

Another downside is the opportunity cost. To mitigate risks without insurance, businesses frequently require cash-in-advance payments or letters of credit from buyers. While these methods reduce financial exposure, they also make your offerings less attractive. In contrast, offering open account terms – enabled by export credit insurance – can lead to foreign buyers purchasing about 40% more than they would under upfront payment terms.

Why Insured Protection Makes Sense

Export credit insurance shifts the approach to risk management. Rather than reacting to problems after they arise, insurers assess the creditworthiness of foreign buyers before you even make a sale. This proactive approach reduces risks from the outset.

With premiums starting as low as $0.55 per $100 of invoice value, export credit insurance is both cost-effective and transformative. It converts receivables into secure collateral, enhancing your borrowing base and financial flexibility. For many small businesses, policies come without start-up costs, advance premiums, or first-loss deductibles – premiums are only incurred upon shipment.

Additionally, export credit insurance covers risks that self-insurance simply cannot. Political events like currency inconvertibility, war, expropriation, and the cancellation of import/export licenses are often included in these policies. These large-scale disruptions can devastate your receivables, and no amount of internal reserves can shield you from such losses.

The statistics are telling: While 80% of global trade operates on open account terms, only 10% of U.S. exporters use trade credit insurance, compared to roughly 50% of European exporters. This disparity places American businesses at a competitive disadvantage. By outsourcing credit management and collections to an insurer, you free up time and resources to focus on growing your business while ensuring the financial stability needed to thrive in international markets. This advantage becomes even clearer when insured receivables help secure financing and open doors to new opportunities.

Additional Benefits Beyond Payment Protection

Export credit insurance does more than just protect you from buyer defaults – it opens doors to better financing options, boosts your competitive position, and supports business growth. These benefits often come as a pleasant surprise to exporters after they secure coverage, but understanding them beforehand can completely transform your export strategy. Let’s dive into how insured receivables can help secure financing and enable market expansion.

Securing Financing with Insured Receivables

One of the biggest hurdles for exporters is that banks usually shy away from financing foreign receivables due to the risks involved. Export credit insurance changes the game by turning those receivables into collateral that banks are willing to accept, thanks to government-backed guarantees. By assigning the proceeds of your insurance policy to your lender, you effectively turn foreign invoices into assets that banks can fund.

With insured receivables, you can access advance rates of up to 90%. For example, a $100,000 insured invoice could provide $90,000 in working capital – money you can use to cover overhead, materials, or labor. Plus, the cost of the insurance, which typically ranges from $0.55 to $1.77 per $100 of invoice value, is tax-deductible.

"Banks otherwise unwilling or unable to lend against foreign receivables will often do so if they are insured by an EXIM policy. The foreign collection risk to the lender is mitigated by the full faith and credit of the U.S. government." – Daniel Ford, Business Development Specialist, EXIM

This ability to secure financing doesn’t just stabilize your cash flow – it also gives you the confidence to explore new markets without the fear of financial setbacks.

Expanding into New Markets with Confidence

Export credit insurance goes beyond financing by giving you a competitive edge in global markets. Offering flexible credit terms is crucial, especially in high-risk regions. Since around 80% of global trade operates on open account terms, requiring cash-in-advance can put you at a disadvantage against competitors who provide more favorable payment options.

With export credit insurance, you can confidently offer competitive terms while protecting yourself against risks. It covers both commercial risks, like buyer defaults, and political risks, such as war, currency restrictions, or political instability – issues often encountered in emerging markets.

Take Air Tractor, Inc., for example. This Texas-based agricultural aircraft manufacturer used EXIM medium-term credit insurance to expand into Central and Latin America in the late 1990s. Local banks were hesitant to finance capital goods, so Air Tractor leveraged export credit insurance to extend competitive credit terms directly to buyers. This strategy boosted their export share from 10% to 50% of annual sales. By 2015, Air Tractor had successfully used over 200 medium-term policies with zero losses, financing 20–25% of its annual sales through these insured transactions. Their story highlights how export credit insurance can mitigate risks and drive international growth.

"Export credit insurance can be a powerful marketing tool! … Offering credit terms upfront, backed by an EXIM export credit insurance policy, empowers you to control the narrative and gain a competitive edge." – Eugene Uhm, Business Development Specialist, EXIM

On top of financial protection, export insurers provide valuable credit management services. Their foreign buyer credit reports and assessments act as an outsourced due diligence process, helping you identify reliable partners before committing to large orders.

How CreditInsurance.com Helps Businesses Understand Export Credit Insurance

CreditInsurance.com makes navigating export credit insurance easier by offering a mix of educational tools, expert advice, and tailored solutions that match your business’s unique needs. Whether you’re new to international trade or looking to refine your risk management strategy, this platform connects you with the resources and coverage options you need to safeguard your global sales.

Educational Resources and Tools

To clear up confusion about export credit insurance, CreditInsurance.com provides a variety of resources like eBooks, whitepapers, and video interviews. These materials break down the basics and benefits of export credit insurance in a straightforward way. For example, you can download guides like "A Basic Guide to Exporting" or explore whitepapers that dive into the specifics of coverage options and risk management.

The platform also features an Insight Interview Series, where businesses share firsthand accounts of how credit insurance helped them expand internationally. On top of that, the blog tackles common myths and misconceptions, while the FAQ section provides practical answers to questions about costs, timelines, and eligibility. If you need more personalized help, you can schedule a free consultation with trade finance specialists who can guide you in choosing the right policy for your needs.

Customized Solutions for Businesses

CreditInsurance.com goes beyond general advice by offering coverage options tailored to your company’s size, industry, and risk profile. For smaller exporters with 10 or fewer buyers, Express Insurance includes free credit reports on up to 10 foreign buyers. If you’re handling high-value transactions, Single-Buyer Insurance offers 90–100% coverage, while Multi-Buyer Insurance can protect your entire export portfolio with up to 95% coverage. Small businesses benefit further, as no upfront premium is required for these policies.

Premium rates typically fall between $0.55 and $1.77 per $100 of invoice value, depending on your specific risk level. Businesses with fewer than 500 employees can also access policies that provide up to 95% coverage against nonpayment, with no deductible. The platform’s EXIM Online management system simplifies the process of filing claims, reporting shipments, and paying premiums, all in one user-friendly space.

Another bonus? Working with trade finance brokers through CreditInsurance.com doesn’t come with extra fees – their services are already factored into the premium. By pairing these tailored solutions with educational resources, CreditInsurance.com highlights how export credit insurance can be a cornerstone for managing risks in unpredictable markets.

Conclusion

Export credit insurance is a smart way for businesses of all sizes to manage risks, protect cash flow, and remain competitive in global markets. Unfortunately, misconceptions about this coverage often discourage companies from considering a tool that could safeguard their foreign receivables. By understanding how export credit insurance works – offering flexible options and competitive pricing – you can better position your business to thrive internationally while protecting your financial health.

With coverage that can protect up to 95% of invoice values and premiums starting as low as $0.55 per $100 of sales, this insurance provides real financial advantages. It converts uncertain foreign receivables into reliable assets that lenders are more willing to work with, helping businesses secure working capital. Experts agree that this coverage empowers exporters to access better financing, offer open account terms, and confidently explore higher-risk markets.

Considering that about 80% of global trade operates on open account terms, being able to offer those terms without exposing your business to severe losses can give you a crucial edge. This competitive advantage is further bolstered by the tailored solutions and expert assistance available through CreditInsurance.com.

CreditInsurance.com is your partner in navigating export credit insurance. The platform provides educational tools, expert advice, and customized policy options to match your business’s needs. With free consultations from trade finance specialists and solutions designed for businesses of all sizes, CreditInsurance.com makes it easier to implement the strategies discussed here. Whether you’re venturing into new markets or scaling an established operation, the right coverage can help turn potential risks into opportunities for growth.

FAQs

How do I know if export credit insurance is worth it for my business?

Export credit insurance can be a smart move, but it’s important to weigh its benefits against its costs. Ask yourself: Does it help protect against risks like nonpayment? Can it enable you to offer more flexible credit terms to your customers? Does it make entering new markets easier? For businesses working in high-risk regions or aiming to expand, the potential advantages – like boosting sales or improving financing options – might make the investment worthwhile.

What documents do I need to file a claim successfully?

To file a claim successfully, you’ll need to gather essential shipping documents that verify the goods were shipped from the U.S. and delivered to the buyer. These documents typically include the invoice, bill of lading, and purchase order or sales contract. Be sure to submit your claim within the required timeframe to prevent unnecessary delays or issues.

How do I choose between single-buyer and multi-buyer coverage?

When deciding, it all comes down to what your business requires. Single-buyer insurance focuses on protecting sales linked to one specific customer. It’s a smart choice if you’re looking to manage risks associated with a key buyer. On the other hand, multi-buyer insurance provides coverage for your entire customer base, distributing risk across multiple clients. This is a better fit for businesses with a variety of customers or high sales volumes. Think about your customer relationships and the level of risk your business faces before making a decision.