Credit Insurance Coverage Planner

Estimate your credit insurance needs with our free planner. Protect against customer defaults by calculating the right coverage for your business!

How to Handle Disputes in Credit Insurance Policies

Learn effective strategies for resolving credit insurance disputes, including common issues, resolution methods, and key steps to take.

Business Risk Assessment Tool

Assess your business risks with our free tool! Evaluate financial, market, operational, and regulatory risks to get a clear risk score and actionable insights.

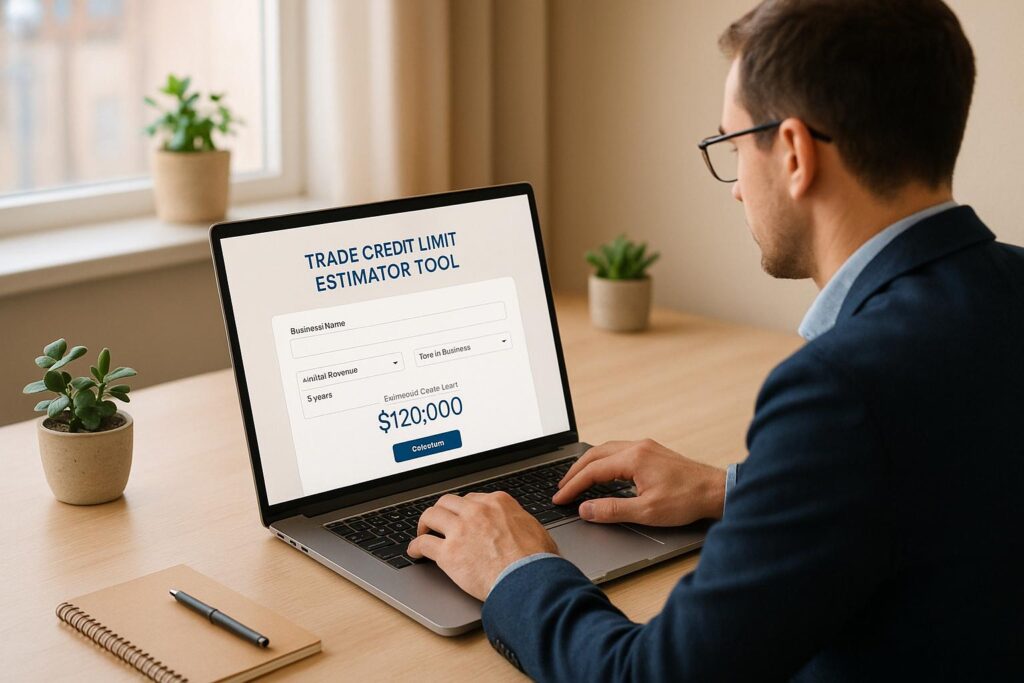

Trade Credit Limit Estimator Tool

Estimate safe credit limits for customers with our free Trade Credit Limit Estimator. Input revenue, credit score, and risk level for instant results!

Accounts Receivable Turnover Calculator

Calculate your accounts receivable turnover ratio easily with our free tool. See how efficiently you collect payments and improve cash flow!

Credit Risk Calculator for Businesses

Assess client creditworthiness with our free Credit Risk Calculator. Input financial data and get instant risk scores to make smarter decisions!

Digital Tools in Credit Insurance: What to Expect

Explore how digital tools are revolutionizing credit insurance, enhancing efficiency, risk assessment, and customer experience.

Credit Insurance Benefits Analyzer

Discover how credit insurance can save your business from bad debt losses. Use our free analyzer to see tailored financial benefits now!

Business Insolvency Risk Checker

Worried about your business’s financial health? Use our free Insolvency Risk Checker to get a quick risk score and actionable tips!

How Credit Insurance Mitigates Risk in Regulated Sectors

Credit insurance mitigates financial risks in regulated sectors by covering non-payment, facilitating compliance, and enhancing cash flow stability.