How Credit Insurance Supports Business Loans

Credit insurance enhances business loan opportunities by reducing lender risk and ensuring stable cash flow, making receivables more attractive as collateral.

How Policy Customization Impacts Credit Insurance Costs

Explore how customizing your credit insurance policy can reduce costs while enhancing financial protection against payment risks.

Accounts Receivable Risk Calculator

Evaluate financial risks in your accounts receivable with our free calculator. Get a risk score and actionable tips to protect your business!

Credit Insurance Quote Estimator

Need credit insurance for your business? Use our free estimator to get a quick quote range based on your revenue and industry. Try it now!

Business Credit Limit Expansion Planner

Plan safe credit limit increases for customers with our free tool. Input payment history, revenue growth, and more to get tailored suggestions!

Credit Insurance Policy Comparison Guide

Compare credit insurance policies easily! Input revenue and priorities to find the best coverage for your business with our free guide.

Accounts Receivable Valuation Estimator

Estimate the value of your outstanding invoices with our free tool. Gauge recoverable amounts and understand risks in just a few clicks!

Trade Credit Risk Assessment Tool

Assess the risk of extending credit to customers with our free tool. Input revenue, payment history, and more to get a detailed risk score!

Cyber Risk Assessment: Steps for Credit Insurers

Explore essential steps for credit insurers to conduct effective cyber risk assessments and safeguard sensitive data against evolving threats.

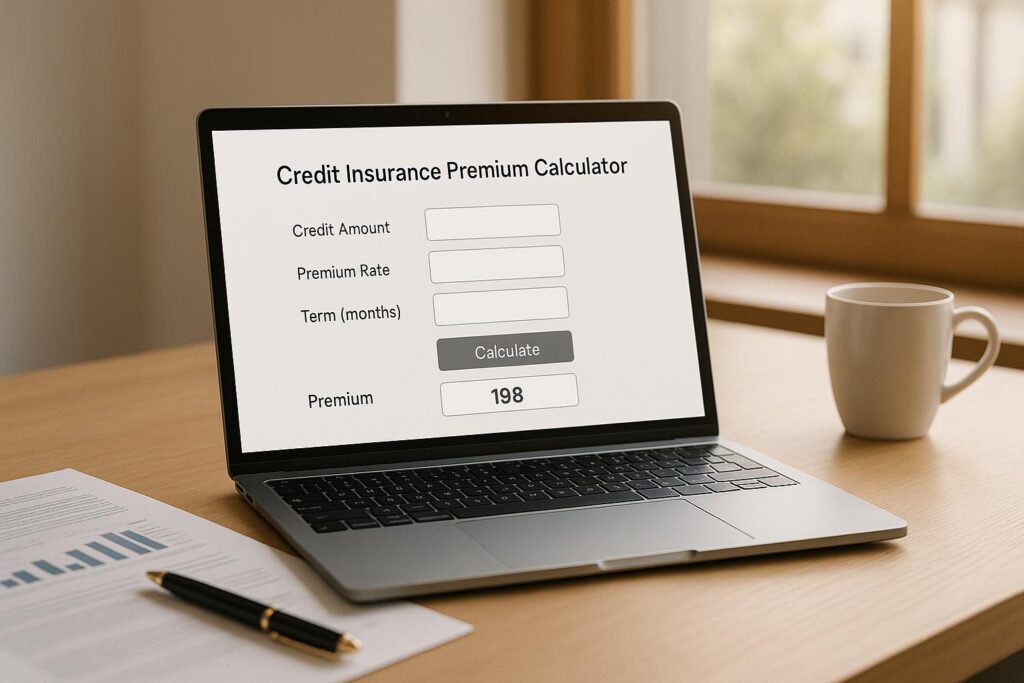

Credit Insurance Premium Calculator

Estimate your credit insurance premium easily with our free tool. Input revenue, industry, and more to get a detailed cost breakdown!