Credit limit tools help businesses reduce payment risks by using real-time data, automation, and predictive analytics to make smarter credit decisions. Unlike manual processes that rely on outdated information and periodic reviews, these tools continuously monitor customer financial health, adjust credit limits dynamically, and flag risks early.

Key Takeaways:

- Manual credit management issues: Outdated data, delayed risk detection, and inconsistent decisions increase financial risks.

- Modern tools improve accuracy: Real-time data, predictive analytics, and automation ensure up-to-date credit assessments and faster adjustments.

- Continuous monitoring: These systems track customer behavior, send alerts for warning signs, and recommend credit limit changes.

- Integration with credit insurance: Combining tools with credit insurance creates a stronger safety net against customer defaults and unexpected losses.

By adopting these tools, businesses can better protect cash flow, reduce exposure to defaults, and offer more flexible credit terms without compromising financial stability.

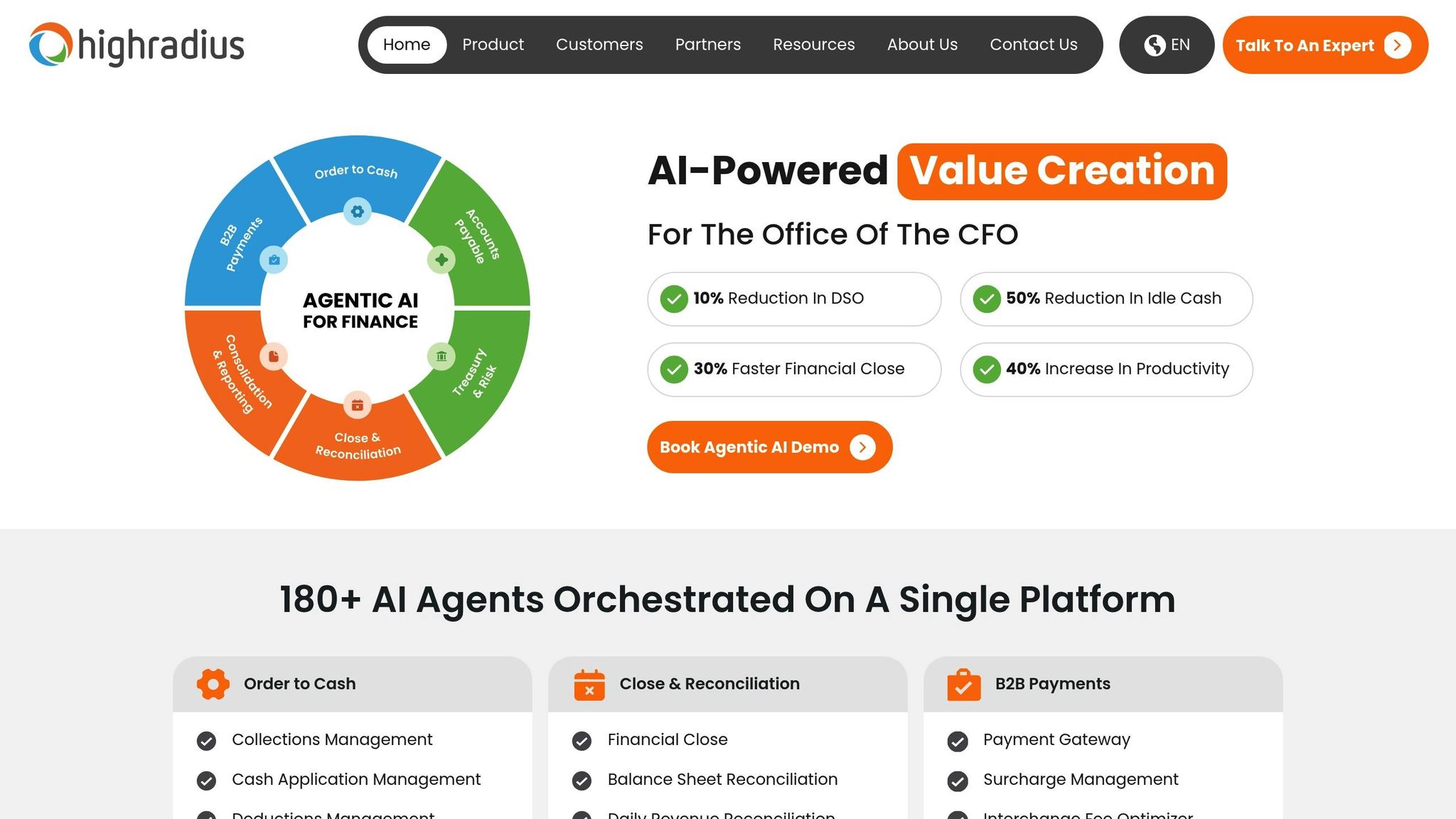

Reduce Bad-debt with HighRadius Credit Review Automation Software

Problems with Manual Credit Limit Management

Managing credit limits manually can leave businesses vulnerable to financial risks. Many companies still depend on spreadsheets and periodic reviews, which simply can’t keep up with the fast pace of today’s business environment. These outdated methods highlight why having accurate, adaptable tools for credit management is no longer optional – it’s necessary.

Wrong Credit Assessments

Relying on outdated financial statements and static data often leads to inaccurate credit decisions. Businesses might unknowingly extend too much credit to customers whose financial health has declined, or they might set overly cautious limits, missing out on potential growth opportunities.

For instance, if a company sets high credit limits based on previously positive financial data, they could be blindsided if the customer’s situation has worsened. On the flip side, setting low limits due to outdated negative information can mean turning away customers who are now more creditworthy.

Human bias and inconsistency add another layer of risk. Two credit analysts reviewing the same financial data might come to completely different conclusions, leading to uneven credit decisions. This lack of standardization undermines risk management efforts and makes it harder to enforce consistent credit policies across the board.

No Real-Time Monitoring

Without real-time monitoring, businesses often find themselves reacting to risks instead of preventing them. Manual systems typically rely on quarterly or annual reviews, leaving long gaps where significant changes in a customer’s financial health can go unnoticed.

During these gaps, a customer could face financial strain or other challenges that increase the likelihood of default. By the time the next review rolls around, it’s often too late to take proactive measures, leaving businesses exposed to unpaid invoices and continued order fulfillment for financially unstable clients.

Moreover, manual systems miss early warning signs that could signal trouble ahead. For example, shifts in payment patterns, dwindling bank balances, or rising credit usage with other vendors might all indicate a customer is struggling. However, these signs often go undetected in manual processes until they’ve already escalated into bigger problems.

Delayed Risk Detection

The delays inherent in manual reviews give risks time to grow unchecked. Traditional credit reviews often only flag issues after a customer has missed payments or racked up significant unpaid balances.

This slow detection process can magnify financial losses. Businesses may continue extending credit and shipping products to customers who are already struggling to pay. Additionally, manual systems often fail to link data from multiple sources, which could reveal hidden risks. For example, a customer might appear to be paying you on time but could be falling behind with their bank or other suppliers – critical red flags that manual processes are unlikely to catch.

Modern technology steps in to close these gaps, offering real-time updates and faster risk identification to help businesses stay ahead of potential issues.

How Technology Makes Credit Limits More Accurate

Modern tools for determining credit limits have revolutionized the way businesses assess creditworthiness. By leveraging advanced data and automation, these systems address the shortcomings of manual methods, delivering more precise and timely credit decisions.

Real-Time Financial Data Integration

Today’s credit tools gather information from a variety of sources to paint a detailed picture of a customer’s financial health. Unlike traditional methods that rely on quarterly statements, these systems access real-time payment histories, bank transactions, and credit usage, offering a more current and comprehensive view.

This real-time integration allows businesses to detect issues that might not be immediately visible. For instance, a customer who pays one supplier on time might still be struggling financially elsewhere. By pulling data from credit bureaus, banks, and trade references, these tools provide a well-rounded perspective on financial stability. If a customer’s payment habits change or their credit utilization climbs sharply, the system instantly factors this into its credit limit calculations.

Real-time data also helps businesses adapt to seasonal financial fluctuations, enabling swift adjustments to credit limits. Combined with predictive analytics, these tools go beyond the present, helping businesses anticipate potential risks.

Predictive Analytics and Machine Learning

Predictive analytics, powered by advanced algorithms, adds another layer of precision. These systems analyze vast amounts of data to uncover patterns that might escape even the most experienced analysts. By studying historical payment behaviors, they can predict which customers may pose future payment risks – even before clear warning signs emerge.

For example, a small delay in payments could hint at future financial trouble. Machine learning models pick up on such subtle indicators, refining their predictions by learning from past outcomes. If a customer defaults despite having a solid credit score, the system reviews what it missed and adjusts its algorithms to improve future assessments.

These tools don’t just flag risks – they also identify opportunities. Customers showing improved payment habits might be ready for a credit increase, allowing businesses to nurture valuable relationships while minimizing risks. This proactive approach to credit management keeps businesses one step ahead.

Automation and Faster Processing

Automation has eliminated many of the inefficiencies and inconsistencies of manual credit processes. Automated tools apply standardized criteria across the board, removing human bias and ensuring fair, objective decisions.

These systems don’t just assess credit limits – they continuously monitor and adjust them. For example, if a customer records three late payments in a row or experiences a significant drop in their credit score, the system can automatically lower their credit limit without waiting for the next scheduled review. This ability to act immediately helps businesses avoid extending credit to customers whose financial health is deteriorating.

Automation also speeds up the entire process. Evaluating new customers or adjusting existing limits can now take minutes instead of days. This responsiveness is invaluable for businesses needing to act quickly on customer requests or market shifts.

Additionally, automated tools provide detailed records of every credit decision, creating a clear audit trail. Each adjustment is backed by specific data points and reasoning, offering transparency that manual processes often lack. This documentation not only supports compliance but also helps businesses better understand their credit management strategies.

Continuous Credit Monitoring and Limit Adjustments

Setting credit limits is just the beginning. Modern credit systems take it a step further by continuously monitoring customer activity and adjusting limits in real time. Unlike outdated quarterly reviews, these systems work around the clock, adapting to changes as they happen. This ensures that credit limits stay in sync with a customer’s current financial situation, balancing risk management with customer needs.

This ongoing monitoring creates a dynamic credit system. Instead of relying on outdated data, limits are adjusted to reflect the latest payment behaviors and business conditions. For example, if a customer starts delaying payments or experiences financial shifts, the system reacts immediately. This approach not only protects businesses from risk but also helps maintain strong customer relationships.

Automatic Alerts for Risk Signs

Today’s credit monitoring tools are like early warning systems, analyzing thousands of data points to spot potential risks before they escalate. These systems track key indicators like late payments, sudden credit usage spikes, or shifts in spending patterns.

Imagine a customer who usually pays within 15 days but suddenly takes 45 days to settle invoices. The system flags this change instantly, providing detailed insights such as payment history, outstanding balances, and recent credit profile updates. Notifications are sent directly to finance teams via email, dashboards, or mobile alerts, ensuring no critical information slips through the cracks.

But these alerts don’t stop at payment delays. They also monitor broader trends, such as how customers pay other vendors. For instance, if a customer is punctual with your invoices but starts falling behind with others, the system picks up on this discrepancy and adjusts the risk assessment accordingly. This holistic view helps businesses stay ahead of potential issues.

Some systems even factor in external influences, like shifts in a customer’s industry, regulatory changes, or economic trends in their region. These insights provide a deeper understanding of why a customer’s behavior might be changing, helping businesses make informed decisions.

Flexible Credit Limit Changes

Once risks are identified, modern credit tools go beyond flagging issues – they recommend specific credit limit adjustments. These systems analyze risk profiles and business goals to calculate the most appropriate changes, ensuring that businesses are protected without harming customer relationships.

For example, if a customer’s financial health improves, the system suggests increasing their credit limit, backed by clear data. On the flip side, if warning signs appear, it recommends a reduction to minimize risk. Temporary adjustments are also possible. A landscaping business, for instance, might need higher credit limits during peak seasons like spring and summer, with lower limits in the off-season. These systems learn such patterns over time and adjust limits automatically to match business cycles.

Faster Approval Processes

Real-time assessments also pave the way for quicker credit decisions. Streamlined workflows allow businesses to make fast, data-driven adjustments to credit limits, reducing delays and improving efficiency. Recommendations are routed to the right decision-makers based on the nature and size of the change, automating routine approvals while sending complex cases to human reviewers.

For example, a 10% credit limit increase for a consistently reliable customer might be approved automatically, while a 50% increase or any decrease could trigger a manual review. Businesses can customize these thresholds to match their risk tolerance and internal policies.

Every adjustment is fully documented, creating a clear record of what data influenced the decision, who approved it, and when it was implemented. This transparency not only supports compliance but also helps businesses evaluate the effectiveness of their credit policies over time.

Integration with existing systems ensures that approved changes are applied immediately. If a credit limit increases, the sales team is notified right away and can communicate the updated terms to the customer. Similarly, if a limit decreases, order processing systems automatically enforce the new restrictions, preventing over-limit transactions without manual intervention.

The speed and efficiency of these processes enhance customer relationships. Instead of waiting days or weeks for credit decisions, customers get answers in hours – or even minutes. This responsiveness not only strengthens partnerships but also gives businesses an edge in competitive markets where quick credit decisions can make all the difference.

sbb-itb-b840488

Using Credit Limit Tools with Credit Insurance

Credit limit tools are excellent for real-time monitoring and automated adjustments, but when paired with credit insurance, they create a stronger safety net against payment risks. This combination gives businesses a powerful blend of technology-driven risk management and financial protection against non-payment issues.

Credit insurance steps in where monitoring systems might fall short. Together, these tools offer a comprehensive approach that covers both predictable and unexpected risks, helping businesses navigate potential challenges with greater confidence.

Strengthened Risk Protection

Credit insurance provides an extra layer of security against non-payment and customer insolvency risks – areas where credit limit tools alone might not suffice. Even the most advanced monitoring systems can’t foresee every scenario, such as sudden economic downturns or unexpected business failures. Credit insurance helps protect businesses from significant financial losses in these situations.

This partnership is particularly effective because credit limit tools enhance decision-making around insurance. For example, when monitoring systems flag high-risk customers or troubling payment patterns, businesses can adjust their insurance coverage for those accounts before issues spiral out of control.

The financial benefits are notable. On average, credit insurance premiums range from $0.10 to $0.20 per $100 of insured domestic sales, covering payment terms of up to 60 to 90 days. This makes it a cost-effective way to mitigate risk while maintaining financial stability.

Improved Payment Terms and Credit Policies

By combining credit monitoring with insurance coverage, businesses can confidently offer competitive payment terms without compromising security. This strategy allows companies to extend longer payment periods or higher credit limits to customers, knowing they have both early warning systems and financial safeguards in place.

This integration also supports more tailored credit policies. Instead of applying uniform terms to all customers, businesses can use insights from monitoring tools to create customized approaches. For instance, reliable customers with strong payment histories might receive extended terms backed by insurance, while higher-risk accounts could be managed with shorter terms and closer oversight.

Offering flexible and attractive payment terms can give businesses a competitive edge in the market. Insurance coverage provides the peace of mind needed for sales teams to pursue larger deals and explore new customer opportunities that might otherwise feel too risky.

Additionally, leveraging credit monitoring data can help businesses reduce insurance costs. Demonstrating strong risk management practices to insurers may lead to more favorable premium rates, making the combined approach even more effective.

Educational Support from CreditInsurance.com

Successfully integrating credit limit tools with insurance solutions requires expertise that many businesses may lack internally. That’s where CreditInsurance.com comes in. This free online resource offers unbiased guidance to help companies navigate the complexities of combining these tools and implementing effective risk management strategies.

The platform features educational content on advanced risk assessment techniques, including articles on predictive analytics and trade credit insurance trends. These resources help businesses understand how modern monitoring tools and insurance solutions can work together to provide stronger protection.

CreditInsurance.com also connects businesses with specialists who can assist in comparing insurance pricing, evaluating premium factors, and identifying tailored solutions. These experts help companies use their credit monitoring data to secure better insurance terms and design more effective risk management plans.

Beyond foundational concepts, the platform dives into practical strategies for implementation. Businesses can learn how to use monitoring data to make smarter insurance decisions, optimize coverage based on customer behavior, and seamlessly integrate both systems into their workflows.

With its mix of clear guidance and advanced insights, CreditInsurance.com equips businesses with the tools and knowledge they need to build robust, integrated risk management strategies tailored to their unique needs. This resource empowers companies to protect themselves while remaining competitive in their markets.

Conclusion: Using Technology for Risk Management

Credit limit tools are reshaping how U.S. businesses handle payment risks. By moving away from manual processes and integrating real-time data, predictive analytics, and automated monitoring, these tools empower companies to make better credit decisions and identify potential issues before they escalate into financial losses.

With continuous monitoring and machine learning algorithms, businesses can now detect warning signs in customer behavior patterns, reducing the chances of incorrect credit assessments or delayed responses to risks.

However, while these tools are powerful, they aren’t foolproof. Economic downturns, unexpected business closures, and other unforeseen events can still lead to losses, even with the best monitoring systems in place. This is where combining credit tools with credit insurance creates a more robust risk management strategy. Credit insurance acts as a safety net, stepping in to provide financial protection when digital tools alone can’t prevent every loss.

This combination allows businesses to confidently offer competitive payment terms, knowing they have both early detection systems and financial safeguards to back them up.

For companies looking to strengthen their risk management approach, CreditInsurance.com is a valuable resource. The platform offers unbiased guidance to help businesses understand how credit insurance complements monitoring tools. From educational content on coverage basics to insights on predictive analytics, the site is designed to make these concepts accessible. Its FAQ section addresses common questions about integrating these systems, while articles explore topics like digital identity in cross-border payments and trends in trade credit insurance. Businesses can also connect with specialists through the platform to compare pricing, evaluate coverage options, and create tailored solutions that match their unique risk profiles and objectives.

Success in today’s competitive landscape belongs to businesses that embrace both technological advancements and proven financial safeguards. By pairing smart monitoring tools with reliable insurance coverage, companies can not only protect themselves from losses but also build the confidence needed to grow and thrive.

FAQs

How do credit limit tools use real-time data and analytics to minimize payment risks?

Credit limit tools rely on real-time data and predictive analytics to make more informed credit decisions and lower the risk of payment issues. By keeping a constant eye on live data, these tools evaluate customer behavior, payment patterns, and creditworthiness on the spot. This means businesses can adjust credit limits as needed and act swiftly to address potential risks.

By using these technologies, companies can make better decisions, reduce defaults, and streamline their credit management processes. This not only helps protect their financial health but also provides room for growth opportunities.

How can credit limit tools and credit insurance work together to reduce payment risks for businesses?

Integrating credit limit tools with credit insurance gives businesses a smart way to manage payment risks effectively. These tools let companies adjust credit limits in real time, based on how customers behave financially. This flexibility helps lower the chances of overdue accounts or non-payment.

When paired with credit insurance, businesses get an extra layer of protection against issues like customer insolvency or payment defaults. This combination doesn’t just shield businesses from risk – it also improves cash flow and opens the door to growth. With this setup, businesses can confidently offer credit to customers while staying safeguarded.

Together, credit limit tools and credit insurance work to fine-tune credit exposure, reduce financial risks, and keep business operations steady and secure.

How do modern credit monitoring tools help businesses tailor their credit policies to reduce payment risks?

How Modern Credit Monitoring Tools Help Businesses

Modern credit monitoring tools give businesses the ability to shape credit policies that fit their needs by offering real-time insights into customer behavior, payment patterns, and risk levels. Using advanced technologies, including AI, these tools analyze data and provide practical suggestions – like adjusting credit limits or payment terms based on how a customer is performing financially.

These tools also come with features like real-time alerts and continuous monitoring, which allow businesses to spot potential payment issues early and act quickly. By aligning credit policies with a customer’s financial reliability and emerging trends, companies can lower the chances of missed payments while building stronger, more dependable relationships with their customers.