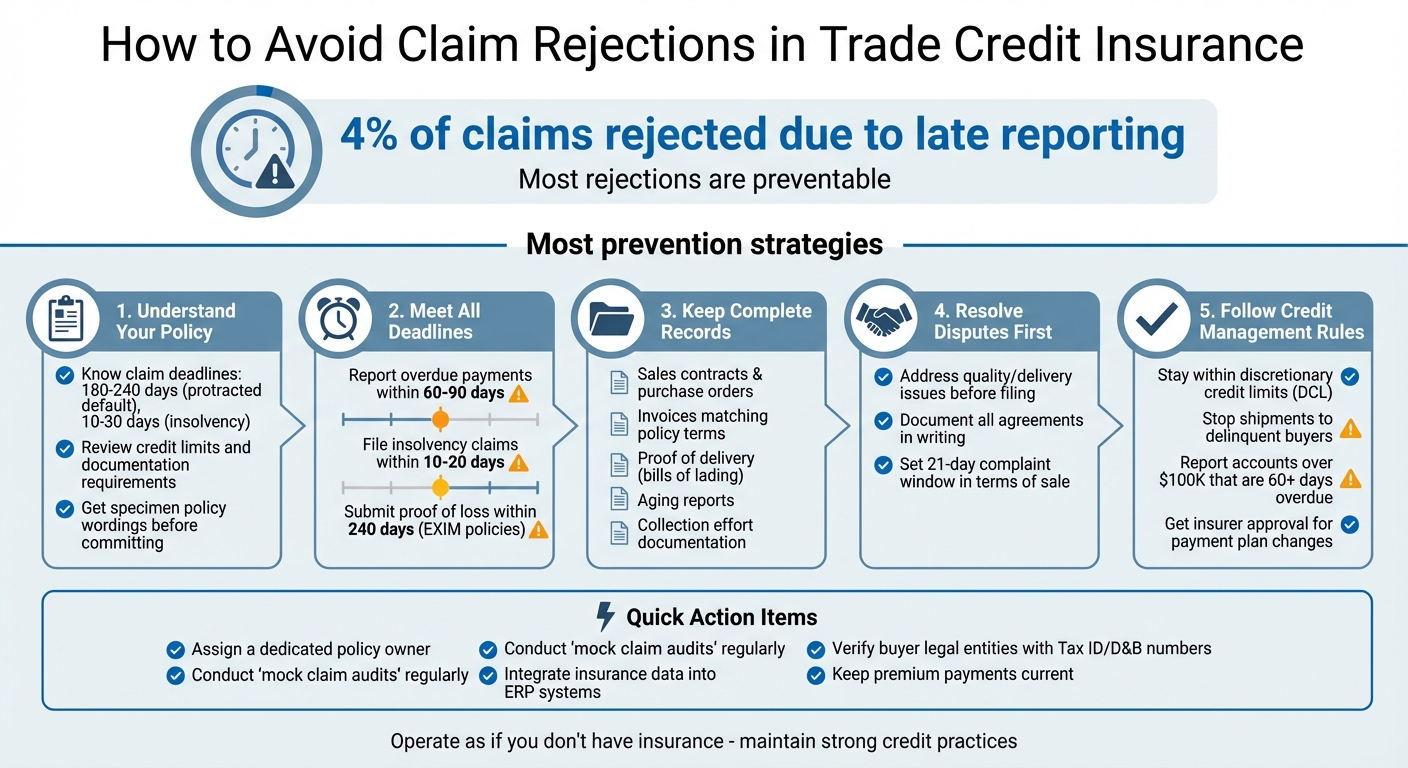

Want to avoid claim rejections in trade credit insurance? It comes down to three things: understanding your policy, meeting deadlines, and keeping documents in order. Trade credit insurance protects your business from unpaid invoices, but even valid claims can be rejected if you miss key steps. For example, late reporting of overdue payments is the top reason claims are denied – accounting for 4% of rejections. Here’s what you need to know:

- Understand Your Policy: Know claim deadlines, credit limits, and documentation requirements. For instance, insolvency claims often need to be filed within 10–30 days.

- Meet Deadlines: Report overdue payments within the required 60–90 days and file claims on time.

- Keep Complete Records: Essential documents include sales contracts, invoices, proof of delivery, and aging reports.

- Resolve Disputes First: Claims for disputed invoices won’t be processed. Settle quality or delivery issues before filing.

- Follow Credit Terms: Stay within approved credit limits and stop shipments to delinquent buyers unless your insurer approves otherwise.

Trade Credit Insurance Claim Rejection Prevention Checklist

Know Your Policy Terms

Managing claims effectively starts with fully understanding your policy terms. This is especially important for trade credit insurance, which comes with specific operational requirements that you must follow closely. Unlike other types of insurance that tend to have simpler rules, trade credit policies demand active compliance. Missing even one requirement could lead to a denied claim. It’s critical to understand these terms before diving into the details of your policy.

What to Look for in Your Policy

Here are some key areas to focus on when reviewing your policy:

- Claim Filing Deadlines: These can vary, but generally, you’ll need to file within 180–240 days for protracted defaults and within 10–30 days for insolvency cases. For example, in 2023, EXIM clarified that exporters must file within 30 days of learning that a buyer has declared bankruptcy.

- Stop Shipment Rules: Check if continued shipments without the insurer’s consent could void your coverage.

- Discretionary Credit Limit (DCL) Requirements: Make sure you provide necessary evidence, such as credit reports or trade references, to meet these conditions.

- Maximum Tenor and Terms of Sale: Coverage excludes invoices that exceed the policy’s covered periods. For instance, if your policy covers 60-day terms but your invoice terms are 90 days, those invoices won’t be covered.

- Documentation Consistency: Insurers require that buyer information, like name and address, matches exactly across all documents, including invoices, bills of lading, and sales contracts.

- Shipping Documents: Bills of lading must be issued by an unaffiliated third party, such as an ocean carrier, rather than being created internally by your company.

- Buyer Limits: Determine whether your buyer limits are cancellable or non-cancellable. Non-cancellable limits offer more stability for long-term financing but often come with higher premiums.

After reviewing these details, reach out to your insurer to clarify any uncertainties.

Get Answers from Your Insurer

The onboarding phase is the best time to address any confusing terms and ensure your policy aligns with your business practices. Pieter Van Ede, Global Head of Trade Credit at WTW, emphasizes the importance of this step:

"It starts with the onboarding and asking the right questions. And through shame, we have all learned that the onboarding process is crucial to sorting out the policy in an appropriate way".

If your business practices, like standard payment terms, differ from the policy’s requirements, contact your insurer immediately to request written agreements or policy endorsements. During the procurement process, ask for specimen policy wordings so you can compare rules on notices, overdue triggers, and cancellation rights before committing.

Assigning one team member as the policy owner can streamline compliance. This person should monitor deadlines, track policy conditions, and act as the main contact with your insurer. To stay organized, you might create "cheat sheets" that outline the process from order to invoice to due date, listing key deadlines and required actions. Another helpful approach is conducting "fake claim" audits – simulating a buyer default to gather all necessary documentation. This exercise can help pinpoint any gaps or misunderstandings before you face a real loss.

sbb-itb-b840488

Keep Complete Documentation

Having complete documentation is essential for a smooth claims process. Missing or unclear paperwork can lead to delays or even outright rejection of valid claims. Kirk Elken, Co-founder of Securitas Global Risk Solutions, summarizes it well:

"Claim settlement will be delayed if required documentation is missing or unclear".

Required Documents for Claims

To support your claim, you’ll need to provide the following:

- Legally Binding Contracts or Purchase Orders: These documents prove the buyer agreed to the transaction. According to Export Development Canada (EDC), "The most effective way to prove that a debt exists is to have a legally binding contract or purchase order". These should include the legal names of all parties, a detailed description of the goods or services, financial terms (such as price, currency, and payment terms), delivery schedules, and signatures.

- Sales Invoices: These need to align with the terms outlined in your policy and reflect the exact amounts owed. Any mismatch between your invoice and other documents can lead to delays.

- Proof of Delivery or Shipment: Documents like bills of lading, waybills, or signed customer acceptance forms confirm the buyer received the goods. For international claims, shipping documents must clearly indicate that the goods were shipped outside the domestic territory.

- Accounts Receivable Aging Reports: These reports show how long the debt has been outstanding and help quantify the loss.

- Evidence of Collection Efforts: Keep records of all your attempts to collect payment, including emails, demand letters, and phone call logs.

- Discretionary Credit Evidence: If you used a discretionary credit limit, retain the credit reports or trade references that justified that limit.

It’s critical to double-check that names, dates, and amounts match across all documents. Errors, such as listing the wrong legal entity, are a common reason for claim denials, especially when dealing with corporations that have multiple subsidiaries. Heather Smart Johnson of CreditInsurance.com emphasizes:

"Your claim will be denied if it lists the wrong entity".

Once you’ve gathered all the necessary documents, keeping them organized and accessible is key to avoiding issues.

Set Up a Record-Keeping System

Collecting the required documents is only half the battle – organizing them is just as important. Don’t wait for a default to start gathering paperwork. Many companies streamline this process by integrating trade credit insurance data into their ERP systems. This gives credit teams real-time visibility into buyer limits and aging reports. Such systems can even halt shipments automatically when buyer limits are exceeded, ensuring you’re always prepared to file claims within the required time frame.

For high-exposure accounts, it’s a good idea to maintain claim packs – folders that include the purchase order, invoice, and proof of delivery. This approach ensures you’re ready to file within the typical 30-to-180-day window.

Assigning a dedicated policy owner can also help. This person can manage documentation, monitor notice rules, and oversee overdue reporting. For bulk invoice submissions, use standardized .CSV formats that include fields like Document Number, Issue Date, Due Date, Amount (with and without tax), and Currency.

Additionally, any changes to delivery schedules or payment terms must be documented in writing and signed by both parties to remain valid for insurance purposes. If you need to adjust the terms of sale on your invoice, it’s important to consult your insurer first. As Heather Smart Johnson advises:

"The terms of sale on your invoice and other statements made on your insurance application are considered when the insurance company offers you a policy. If you need to make changes, it is best to contact the insurance company first".

File Claims on Time and Correctly

Once your documentation is organized, the next step is to file your claims promptly and with precision. Missing deadlines is one of the most frequent – and entirely avoidable – reasons claims get rejected. Late reporting of overdue payments or financial red flags can create significant issues with insurers. Kirk Elken, Co-founder of Securitas Global Risk Solutions, emphasizes this point:

"One of the non-negotiables for the insurer is late filing a claim (missing the window to file the claim)".

Timely filing is critical because delays can prevent your insurer from acting quickly to recover the debt.

Meet All Deadlines

Every type of claim comes with its own filing deadlines, so understanding these timeframes is essential. For protracted default claims – when a buyer fails to pay – policies often allow up to 180 days from the invoice date to file. Insolvency claims, on the other hand, typically have much shorter windows, requiring you to file within 10 to 20 days of being notified about the buyer’s insolvency. For EXIM Multi-Buyer policies, proof of loss must be submitted within 240 days from the date the invoice became overdue.

In addition to filing claims, you need to report adverse events, like bounced checks or other signs of financial distress, as soon as possible. Policies include a "Maximum Extension Period", which outlines the timeframe for reporting overdue payments. If a debtor requests more time and is making partial payments, you can request an extension – but only if it’s done within the original filing window.

To manage these deadlines effectively, consider using a tracking system. A shared spreadsheet can help you monitor invoice due dates, reporting deadlines, and extension periods. For companies handling a high volume of claims, integrating claims data into management systems can provide real-time alerts and ensure timely responses, such as addressing shipment holds when payments are overdue.

Submit Accurate Information

Timeliness is only half the battle – accuracy is just as important. Claims that are incomplete or contain errors can lead to delays or even denial. Gabriela Quinza, Claims Manager at Allianz Trade, explains:

"Forgetting to send something or omitting an important invoice can create otherwise avoidable delays".

Before filing, double-check that you’re submitting the claim against the correct legal entity. Use official identifiers like Tax IDs, Dun & Bradstreet numbers, or Chamber of Commerce registration numbers to verify the entity responsible for the debt. Additionally, make sure your invoice terms comply with the maximum terms allowed under your policy.

Some brokers suggest conducting a "claim audit" as a proactive measure. This involves selecting a buyer, simulating a default, and gathering all necessary documentation to identify any gaps. Sharing monthly aging reports with your broker can also help flag potential past-due accounts before a claim becomes necessary.

Lastly, confirm that your premium payments are up to date, as unpaid or underpaid premiums are a common reason for claim denials. Once your claim is submitted, respond quickly to any requests from the insurer’s assessment team. Delays in providing additional details can slow down the entire process.

Resolve Disputes with Buyers First

Before filing a claim, it’s crucial to address any disputes with buyers. Claims can only be made on confirmed receivables, and invoices under dispute don’t qualify. Pieter Van Ede, Global Head of Trade Credit at WTW, explains:

"The insurers need to have the rights to a confirmed receivable. And a disputed invoice is simply not that confirmed receivable yet".

This rule exists because insurers need the legal right to pursue the debtor for recovery after paying your claim. If the buyer contests the debt, collection becomes much harder. It’s also important to note that trade credit insurers don’t mediate disputes about product quality or delivery issues. Instead, they usually pause claim payments until disputes are settled, either through negotiation or legal channels.

Handle Quality and Delivery Issues

If a buyer raises concerns about quality or delivery, act quickly. Start by documenting and investigating the issue. Review all relevant paperwork, such as purchase orders, bills of lading, and proof of delivery, to understand what went wrong. Whenever possible, resolve disputes through solutions like product replacement, discounts, or partial refunds. Be sure to document any agreements in writing to confirm the debt’s validity.

It’s also a good idea to include a formal time limit for invoice complaints – typically 21 days – in your terms of sale. This ensures buyers raise issues promptly instead of months later. Keeping buyers informed about production delays or supplier problems can also help prevent disputes from arising in the first place. These practices not only resolve immediate problems but also lay the groundwork for stronger relationships.

Build Better Buyer Relationships

Healthy buyer relationships are your best defense against disputes. When onboarding new buyers, take the time to verify their legal identity using trusted resources like Dun & Bradstreet. Standardizing your terms of sale can prevent unauthorized payment changes, which are a common reason for claim denials.

Regular communication is another key strategy. For instance, sharing monthly aging reports with your broker can help you identify and address overdue payments before they escalate into disputes. Additionally, if a buyer proposes a repayment plan, always get written approval from your insurer before accepting it. Without this approval, your claim could be denied.

Meet Your Credit Management Duties

Trade credit insurance works hand-in-hand with solid credit management practices. As a policyholder, you’re expected to manage credit responsibly, just as you would if you weren’t insured. Export Development Canada (EDC) emphasizes this clearly:

"One of your primary responsibilities as a policyholder is to take steps to prevent and minimize losses".

This doesn’t mean you can extend limitless credit and rely on your insurer to cover all losses. Following the credit management guidelines outlined in your policy is crucial to avoid claim denials.

Follow Credit Limits and Loss Prevention Rules

Your policy includes a discretionary credit limit (DCL) – the maximum credit you can offer a buyer without prior approval from your insurer. Staying within this limit is critical. CreditorWatch explains:

"Any transaction you make over the agreed discretionary limit without approval from your insurer may mean that you’re not covered for that transaction".

If you need to exceed your DCL, you’ll need to request an individual debtor limit before shipping goods. Policies often include stop-shipment clauses as well, which require you to halt deliveries if a buyer falls behind on payments beyond a specified period. Ignoring these clauses can lead to denied claims or even policy cancellation for that buyer.

To support your claims, it’s important to keep documentation, such as signed contracts or purchase orders, and proof of delivery like bills of lading or waybills. These records help establish the validity of the debt.

Equally important is keeping your insurer updated on any potential risks or deviations from normal buyer behavior.

Keep Your Insurer Informed

Your policy likely requires you to report overdue accounts once they surpass certain thresholds. For instance, some EDC policies mandate reporting any account over $100,000 that is more than 60 days overdue.

Timely reporting is essential. Notifying your insurer about overdue accounts allows them to assist with loss mitigation efforts, such as issuing collection letters or arranging approved repayment plans. Even if an invoice hasn’t yet reached its due date, it’s wise to inform your insurer if you hear about financial instability or notice that other suppliers aren’t being paid. EDC underscores this proactive approach:

"Early attention to overdue receivables is financially prudent and has proven to be effective in avoiding losses".

Be vigilant for warning signs like delayed payments, an uptick in credit inquiries, or legal actions against your buyer. Spotting these red flags early gives you a chance to address issues before they escalate into significant losses.

Claim Rejection Prevention Checklist

Avoiding claim rejections often comes down to meticulous preparation and timely action. This checklist pinpoints the most common mistakes and offers practical steps to prevent them. Use it as a quick reference before filing any claim – or better yet, periodically run "mock claim audits" by selecting a buyer and reviewing all required documentation to uncover any gaps before an actual issue arises.

| Common Rejection Cause | Prevention Measure | Business Impact |

|---|---|---|

| Late Reporting of Past Due | Set up automated alerts for 60/90-day notification windows; share monthly aging reports with brokers. | Claim denial. |

| Wrong Buyer Entity | Verify the buyer’s full legal name and Tax ID/D&B number during onboarding; ensure they match the policy endorsement. | Denial of coverage for all shipments to that entity. |

| Missing Shipping Docs | Keep third-party bills of lading and proof of export for every transaction on file. | Inability to prove loss; claim rejection. |

| Unapproved Payment Plan | Secure written insurer consent before agreeing to reschedule any debt. | Loss of coverage. |

| Exceeding Terms of Sale | Ensure internal credit limits and invoice terms align with policy maximums. | Exclusion of specific invoices from claim settlement. |

| Non-Payment of Premium | Use a "ship and pay" reconciliation system to confirm all reported shipments are paid for. | Policy voided; no coverage for losses. |

| Material Non-Disclosure | Provide written disclosure of all known adverse buyer information and financial exceptions during underwriting. | Potential cancellation of the entire policy. |

Most of these rejections can be avoided through diligent planning and thorough documentation. Keep this checklist handy for your accounts receivable and credit teams.

As Pieter Van Ede, Global Head of Trade Credit at WTW, wisely advises:

"The client needs to continue to operate as if it doesn’t have trade credit insurance".

Use CreditInsurance.com Resources

CreditInsurance.com provides a variety of tools and expert guidance to help you navigate claim requirements and refine your credit insurance practices. With these resources, you can streamline your documentation and ensure your claims process stays on track.

Access Guides and Examples

One standout resource is The Ultimate Guide To Submitting Your Business Credit Insurance Claim & Getting Paid. This guide walks you through vital steps to take before a customer becomes delinquent, covering eligibility criteria, waiting periods, and the documents insurers typically require. Heather Smart Johnson from CreditInsurance.com underscores the importance of preparation:

"The first thing to do is actually BEFORE you have a delinquent customer. Make sure you know your policy."

Additionally, the platform’s Education section dives into advanced credit management topics like predictive analytics for defaults, customer segmentation strategies, and real-time payment tracking. A detailed FAQ addresses common questions, such as how business credit insurance differs from other types, why trade credit coverage matters, and the role brokers play in the claims process.

CreditInsurance.com also offers free tools to support your financial planning. For example, a Borrowing Calculator helps estimate your borrowing capacity based on insured receivables, and a Business Credit Report tool assists in vetting potential customers. Alongside these resources, expert advice is readily available to strengthen your claims process.

Get Expert Advice

Beyond educational materials, CreditInsurance.com connects you with credit insurance brokers who serve as your advocates throughout the claims journey. As the platform explains:

"A trade credit insurance broker is an advocate for you when dealing with the credit insurance company."

These brokers provide hands-on assistance, from evaluating quotes and implementing policies to ensuring your practices meet policy requirements. They help with mandatory reporting, review your claims for potential errors, and verify that invoice terms align with your application details. Brokers also assist in securing insurer approval for repayment plans negotiated with delinquent customers.

The best part? Using a broker doesn’t cost extra – rates remain the same whether you work with a broker or go directly to the insurer. To get started, you can reach these specialists at 800-320-7338 or through online inquiry forms.

Conclusion

Preventing claim rejections boils down to three key actions: understanding your policy thoroughly, keeping detailed records, and meeting every deadline. Late reporting is the most common reason claims are denied, accounting for about 4% of all trade credit insurance claim rejections. The good news? Most of these denials are avoidable if you follow the rules laid out in your policy and stay organized.

Documentation is your strongest ally. To protect your claims, you need a clear and complete paper trail. This includes purchase orders, signed delivery notes, bills of lading, and invoices that align with the terms of your policy. Without proof that goods were ordered, delivered, and billed to the correct legal entity, your claim won’t hold up. Pay close attention to details like ensuring the invoice customer name matches the approved legal entity exactly, including the Tax ID or registration number.

Deadlines are as critical as paperwork. Most policies require overdue payments to be reported within 60 to 90 days of the due date. For insolvency claims, you might have as little as 10 to 20 days to notify your insurer after being informed of a filing. Missing these deadlines can void your claim entirely. To avoid this, set up a notification calendar and stick to it. By combining strong documentation with strict adherence to deadlines, you’ll be well-prepared for a smooth claims process.

Insurers also expect you to operate as though you’re uninsured. This means actively chasing overdue payments, halting shipments to delinquent buyers, and staying within approved credit limits unless you’ve received explicit approval from your insurer to exceed them.

Quick Reference: How to Avoid Claim Rejections

Here’s a quick summary of the essential steps to protect your claims:

- Before a buyer defaults: Confirm that every customer has a valid credit limit, and make sure your invoice terms align with what you declared in your insurance application.

- When payments are overdue: Report them immediately – don’t wait beyond the 60–90 day reporting window.

- Before filing a claim: Collect all necessary documents and resolve any disputes related to product quality or delivery.

- Ongoing practices: Always seek insurer approval for repayment plans and stop shipments to buyers who violate payment terms.

FAQs

What should I do when a customer is late paying?

If a customer falls behind on payments, it’s crucial to act quickly. Start by checking your policy’s claim filing deadlines to ensure you’re within the allowable timeframe. Gather all the required documents, such as overdue notices and invoices, to support your claim. Then, follow your insurer’s specific claim submission process step by step. Staying organized and meeting your policy’s requirements can help you avoid potential claim denials.

How can I prove I shipped and delivered the goods?

To demonstrate shipment and delivery, it’s crucial to provide clear and thorough documentation like delivery notes, bills of lading, or shipping receipts. These documents serve as proof that the goods were sent and received. Keeping accurate and complete records is key to meeting trade credit insurance requirements and strengthening your claim. Having proper documentation helps ensure compliance with policy terms and minimizes the chances of your claim being denied.

How do I avoid filing a claim against the wrong buyer entity?

To prevent filing a claim against the wrong buyer entity, it’s crucial to ensure that the buyer’s details are consistent across all documentation. This includes invoices, bills of lading, and purchase orders. Even small discrepancies can result in claims being rejected.

Additionally, you must provide clear proof of export, demonstrating that the goods left the U.S. and were delivered to the correct buyer. This becomes especially important when third-party documents are part of the process. The key to avoiding claim denials lies in maintaining accurate and consistent documentation throughout the transaction.