AI fraud detection software helps businesses identify and prevent fraudulent activities in real time by analyzing user behavior, transaction patterns, and device details. It uses machine learning to continuously improve and adapt to new fraud tactics, reducing false positives and enhancing efficiency.

Key Features:

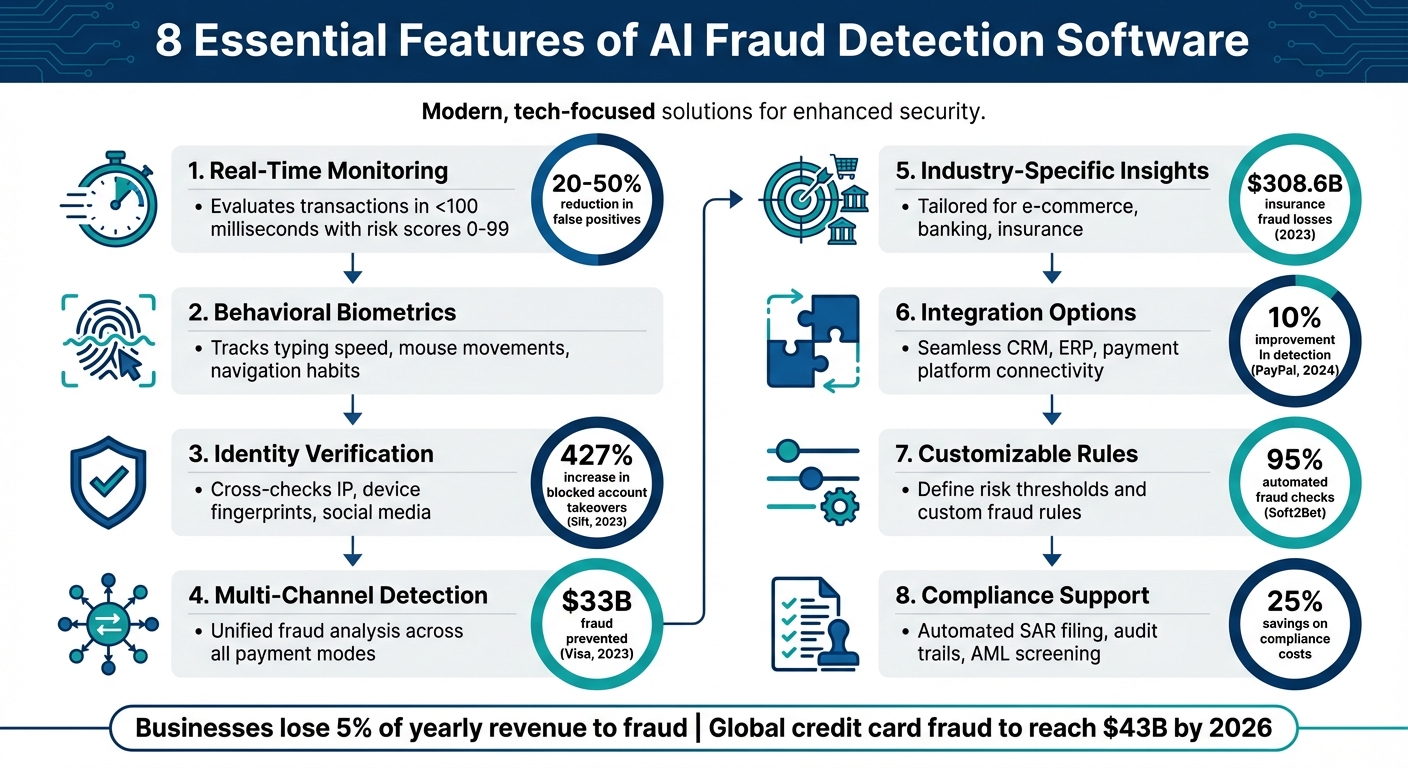

- Real-Time Monitoring: Instantly evaluates transactions and assigns risk scores to identify suspicious activity.

- Behavioral Biometrics: Tracks typing speed, mouse movements, and navigation habits to detect unusual behavior.

- Identity Verification: Cross-checks data points like IP addresses, device fingerprints, and social media to spot synthetic identities.

- Multi-Channel Detection: Consolidates data across payment modes for a unified fraud analysis.

- Industry-Specific Insights: Tailors fraud detection to unique challenges in sectors like e-commerce, banking, and insurance.

- Integration Options: Connects seamlessly with CRM, ERP, and payment platforms for streamlined workflows.

- Customizable Rules: Allows businesses to define risk thresholds and rules for tailored fraud prevention.

- Compliance Support: Simplifies regulatory processes with automated reporting and detailed audit trails.

AI fraud detection not only reduces financial risks but also improves customer trust and operational efficiency. Businesses using these tools can prevent fraud, lower false positives, and even enhance credit insurance strategies by minimizing claims due to fraud-related losses.

8 Essential Features of AI Fraud Detection Software

Core Features of AI Fraud Detection Software

Real-Time Monitoring and Analysis

Top-tier AI fraud detection software evaluates transactions instantly, assigning a risk score – usually between 0 and 99 – based on hundreds of data points. This process happens in under 100 milliseconds, ensuring legitimate customers don’t experience any noticeable delay. When anomalies are detected, the system takes immediate action, such as blocking payments, freezing accounts, or requiring additional verification steps like a fingerprint scan.

These systems create user baselines and flag unusual activity, such as unexpected purchase amounts, irregular transaction frequencies, or logins from unfamiliar locations. Unlike older systems that rely on fixed thresholds, modern AI uses dynamic rules that adapt automatically as new fraud tactics emerge. This adaptability has reduced false positive alerts by 20% to 50% compared to traditional rule-based systems. As a result, fewer legitimate transactions are mistakenly flagged or blocked.

Additionally, behavioral biometrics add another layer of security by analyzing how users interact with their devices.

Behavioral Biometrics for Enhanced Security

Behavioral biometrics focus on identifying unique patterns in user interactions – like typing speed, keystroke rhythm, mouse movements, and navigation habits – to detect unusual behavior that might signal a compromised account. By continuously scoring risk throughout a session, the system can catch subtle changes. For example, if someone suddenly types much faster or slower than usual or navigates in an unfamiliar way, the system flags it as a potential account takeover.

"AI revolutionizes fraud detection by… flagging deviations such as a sudden change in typing speed or device usage that could indicate account takeover." – Visa

This technology is particularly effective at spotting synthetic identities – fake personas that may look legitimate on paper but exhibit bot-like behavior during activities like account creation. In the credit insurance space, these tools are crucial for confirming that applicants are genuine and have a legitimate history, rather than being fraudsters using stolen or fabricated credentials. By modeling behavioral patterns, AI can differentiate between sophisticated bot-driven activity and actual human behavior, which is especially important during high-volume digital onboarding processes.

In addition to analyzing behavior, AI systems also verify identities to combat synthetic fraud.

Identity Verification and Synthetic Identity Detection

Comprehensive identity verification goes beyond behavior to cross-check a range of data points, including addresses, IP locations, device fingerprints, and even social media activity. This helps uncover inconsistencies that might indicate identity theft. AI-powered systems can detect "Frankenstein" identities – those pieced together from both real and fake data – by analyzing whether a digital footprint aligns across credit records and online activity.

Biometric authentication methods like facial recognition, fingerprint scans, and voice prints ensure that a real person is physically present, replacing traditional PINs and passwords. Liveness testing adds another layer of security by confirming that the user isn’t a deepfake or simply a photo held up to a camera. For example, in 2023, Sift‘s AI-driven identity trust solutions reported a 427% increase in blocked account takeovers for its global clients by analyzing patterns across its extensive data network [Source: Sift Blog, 2024].

For businesses offering credit insurance, these tools help minimize the "customer insult" rate, where legitimate applicants are mistakenly denied due to outdated fraud detection methods. By combining device fingerprinting, behavioral biometrics, and document verification, AI creates a multi-layered defense system. This approach eliminates single points of failure, ensuring smoother onboarding and more accurate risk assessments for policyholders.

sbb-itb-b840488

Scalability and Multi-Channel Fraud Detection

Fraud Detection Across Payment Channels

AI has become a game-changer in fraud detection by integrating real-time insights with behavioral analytics, creating a unified view across multiple payment methods. Businesses today handle payments through various channels, each carrying its own fraud risks. Instead of treating these channels as separate silos, AI platforms consolidate data from sources like IP addresses, device fingerprints, and behavioral patterns, offering a single, cohesive "source of truth" for real-time fraud analysis.

This multi-channel approach is especially important for B2B transactions. For instance, AI scrutinizes ACH and wire transfers by cross-verifying vendor details with global intelligence databases, helping to prevent schemes like invoice manipulation and Business Email Compromise (BEC). In 2021 alone, BEC-related losses reached a staggering $2.4 billion. Advanced tools like Graph Neural Networks (GNNs) expose fraud rings by mapping relationships between accounts, devices, and entities. Additionally, AI leverages behavioral biometrics, such as recognizing typing speeds on desktops or swipe patterns on mobile devices, to establish an "invisible" security layer that seamlessly adapts to customers’ payment preferences.

Beyond monitoring payments across channels, AI fine-tunes its fraud detection capabilities to address the unique challenges faced by different industries.

Industry-Specific Fraud Pattern Recognition

One of AI’s strengths lies in its ability to adapt to the distinct fraud patterns of various industries. For example, e-commerce platforms often grapple with chargeback fraud and "friendly fraud", where customers falsely claim items were not delivered. Meanwhile, banking and fintech firms must counter threats like account takeovers and synthetic identity theft. Insurance providers face their own challenges, such as fraudulent claims and inflated asset values, which cost the U.S. insurance industry an estimated $308.6 billion in 2023.

In credit insurance, AI tools analyze elements like spending behavior, transaction speed, document metadata, and even font irregularities to spot anomalies. These tools are particularly effective at detecting first-party fraud, where applicants alter documents to inflate coverage or hide risk factors. Businesses also benefit from customizable risk thresholds, allowing them to tailor fraud detection based on their margins and tolerance for risk. For example, industries with high transaction volumes and low profit margins may focus on minimizing false positives to avoid rejecting legitimate customers, while higher-margin sectors can afford stricter scrutiny.

AI platforms further enhance protection through consortium-based learning. This method pools anonymized fraud signals from multiple merchants, enabling even newly onboarded businesses to benefit from fraud patterns identified across a vast network. A standout example is Visa’s Decision Manager, which in 2023 screened 3.2 billion transactions and helped prevent an estimated $33 billion in potential fraud losses. Impressively, 98.7% of these transactions were resolved automatically. This collective intelligence ensures that businesses – regardless of their size or experience – gain immediate and robust protection without needing extensive historical data.

Integration and Customization Options

Data Integration Capabilities

AI fraud detection software needs to seamlessly connect with your existing systems and external data sources. The top platforms bring together structured and unstructured data from both cloud and on-premise environments, enabling real-time, large-scale risk analysis. One standout feature is bi-directional data sharing, which ensures systems can instantly communicate and block fraudulent transactions before they’re completed.

Integration with tools like CRM and ERP systems provides a unified view of customer behavior and embeds fraud detection directly into workflows such as accounts payable or customer onboarding. For e-commerce businesses, plug-and-play connectors for platforms like Shopify, Magento, and WooCommerce make deployment quick and easy, without requiring extensive technical expertise. Additionally, linking to external intelligence sources – such as global blacklist databases, cyber intelligence networks, and consortium fraud signals – enhances your internal data by incorporating patterns observed across billions of transactions worldwide.

For example, in 2024, PayPal’s AI systems monitored transactions around the clock across their global network by integrating real-time behavioral models. This approach led to a 10% improvement in fraud detection capabilities. Similarly, American Express used advanced LSTM AI models to analyze transaction patterns, achieving a 6% increase in fraud detection accuracy.

These integration capabilities provide a solid foundation for businesses to implement tailored risk management strategies through customizable rules engines.

Customizable Rules Engines

While AI is excellent at identifying patterns, businesses still need to define rules that align with their specific risk profiles. Customizable rules engines allow companies to set "if/then" conditions to approve, review, or block transactions based on their risk tolerance. These systems often use scoring rules that assign weights to different risk indicators. For instance, a disposable phone number might add 10 points to a risk score, while an IP-country mismatch could add 15 points, creating a more nuanced risk assessment instead of an automatic block.

Dynamic friction is another effective tool. It instantly blocks clear cases of fraud while sending borderline cases for manual review, ensuring that legitimate customers experience minimal disruption. Velocity checks, which monitor actions over time – like flagging more than three login attempts within five minutes – help catch account takeover attempts that single-point checks might miss.

Take Soft2Bet, an iGaming provider, as an example. They used SEON‘s customizable rules engine to automate 95% of their fraud checks, cutting fraudulent registrations by 90%. The ability to set thresholds tailored to their industry – such as different velocity limits for deposits versus withdrawals – freed up compliance teams to focus on other priorities. Tools like Stripe‘s Radar Assistant even allow fraud teams to write rules using natural language prompts, which the AI then converts into executable code. This makes customization more accessible, even for teams without deep technical expertise.

Compliance and Regulatory Considerations

Case Management for Compliance

U.S. financial institutions collectively spend around $25 billion each year on anti-money laundering efforts, while global fines for failing to prevent money laundering topped $6 billion in 2023. With stakes this high, it’s clear that AI fraud detection tools must simplify and strengthen compliance processes.

The most effective platforms offer a centralized case management system, bringing together alerts, evidence, and customer profiles – including Know Your Customer (KYC) and Customer Due Diligence (CDD) data – into one streamlined interface. This setup not only simplifies investigations but also ensures detailed audit trails, which regulators expect during examinations.

In 2024, a multinational bank implemented Oracle‘s AI-powered transaction monitoring system and saw a dramatic improvement. Within just six weeks, the bank reduced alert volumes by 45–65% while maintaining a 99% rate of Suspicious Activity Report (SAR) generation, significantly improving investigator efficiency.

Modern case management tools go a step further by automating KYC and CDD processes. These systems can scan IDs, verify beneficial ownership, and cross-check customers against international sanctions lists and Politically Exposed Person (PEP) databases. By automating these workflows, financial institutions reduce manual errors and ensure compliance with the Bank Secrecy Act (BSA).

Strong case management systems also lay the groundwork for more efficient SAR processes, which are critical for regulatory compliance.

Suspicious Activity Reporting (SAR) Support

Filing SARs has traditionally been a time-intensive process, with 90–95% of alerts proving to be false positives and closed before reaching the SAR stage. AI-powered tools are changing this dynamic. By leveraging Generative AI and natural language processing, these platforms can automatically draft SAR narratives, transforming complex transaction data and investigation details into clear, human-readable reports.

Advanced systems also integrate directly with the Financial Crimes Enforcement Network (FinCEN), allowing for seamless, one-click filing of SARs and Currency Transaction Reports (CTRs). These tools automatically generate XML files and maintain comprehensive audit trails, saving financial institutions an average of 25% on annual compliance costs.

"GenAI copilot makes your analysts more efficient by converting text into SQL rules, and writing SAR narrative and activity reporting summaries." – Sardine

As regulatory bodies like the SEC and DOJ increasingly demand transparency, the shift toward explainable AI has become essential. Compliance officers must be able to justify why specific transactions were flagged or cleared. Look for software that offers algorithmic audit trails and real-time decision logs to meet these requirements.

For credit insurance providers, these advanced compliance tools not only enhance regulatory readiness but also minimize operational disruptions, ensuring smoother processes across the board.

Choosing the Right AI Fraud Detection Software

Key Takeaways for Business Owners

When selecting AI fraud detection software, look for a solution that combines cutting-edge technology with smooth day-to-day functionality. Real-time monitoring and instant alerts are crucial to catching suspicious activity as it happens. Opt for platforms that use machine learning models capable of adapting to new fraud tactics, rather than relying solely on static rules.

Features like identity verification and behavioral biometrics are must-haves, as they help identify fraud across various payment channels and detect patterns unique to your industry. If your business operates across multiple channels, ensure the software integrates effortlessly with your existing systems – such as CRM, payment gateways, and ERP – via strong APIs.

Compliance support is another critical factor. With U.S. businesses losing around 5% of their yearly revenue to fraud and global credit card fraud losses expected to hit $43 billion by 2026, tools like automated SAR filing, comprehensive audit trails, and AML screening are indispensable. Before fully deploying the software, use historical data to test its ability to detect past fraud cases and ensure it meets your expectations.

A well-designed fraud prevention system doesn’t just save you money – it also strengthens your credit insurance strategy by reducing risks tied to fraudulent activities.

How AI Fraud Detection Supports Credit Insurance

Integrating AI fraud detection with credit insurance creates a stronger shield for your business’s financial health. While credit insurance protects against customer non-payment or insolvency, AI fraud detection ensures fraudulent transactions are stopped before they impact your receivables. Together, these tools safeguard your risk profile and can even lead to better insurance terms.

The connection is straightforward: fewer fraudulent transactions mean fewer claims on your credit insurance policy. This not only protects your cash flow but also lowers the frequency of claims, which can benefit your insurance premiums. For businesses using credit insurance through platforms like CreditInsurance.com, pairing it with AI fraud detection software enhances your overall risk management by addressing both legitimate credit risks and fraud before they harm your bottom line.

Fraud Detection with AI: Ensemble of AI Models Improve Precision & Speed

FAQs

How does AI-powered fraud detection minimize false positives compared to traditional methods?

AI-driven fraud detection takes accuracy to a new level by using machine learning models that adjust to changing transaction patterns. Unlike older systems that depend on fixed, rule-based methods, AI continuously learns from live data. This allows it to better differentiate between genuine and fraudulent activities.

With this adaptive method, businesses can spot fraud more effectively while cutting down on the hassles caused by mistakenly flagged transactions. The result? Less wasted time and smoother operations.

How do behavioral biometrics help prevent account takeovers?

Behavioral biometrics focus on how people interact with their devices – things like typing speed, mouse movements, or how they swipe on a touchscreen. These patterns are unique to each user, creating a behavioral profile that’s hard to fake. AI-driven fraud detection systems tap into this data to keep an eye on user activity and flag any unusual behavior that could signal an account takeover.

For instance, if someone logs in but their typing rhythm is off or they’re using a device that hasn’t been seen before, the system can step in. It might flag the activity as suspicious and trigger actions like asking for extra verification or even locking the account temporarily. Because these behavioral traits are so personal and tough to replicate, they add a strong layer of protection without making things more complicated for legitimate users.

By catching threats as they happen, businesses can stop unauthorized access in its tracks, protect sensitive accounts, and maintain both financial security and customer confidence.

How does AI fraud detection software work with existing business systems?

AI fraud detection software is built to work smoothly with your existing business systems, eliminating the need for a major system overhaul. These tools typically connect using APIs, webhooks, or SDKs, making it easy to integrate with platforms like ERP, CRM, accounting, or payment systems. This setup allows the software to access transaction, customer, and behavioral data in real time, analyze it using machine learning models, and deliver actionable outcomes – like approving, flagging, or blocking transactions – directly within your current systems.

Many platforms also provide plug-ins or modules that can be embedded into the tools your team already relies on. This approach simplifies workflows and minimizes any disruption to day-to-day operations. For businesses involved in credit insurance, these integrations can improve policy management, streamline accounts receivable processes, and enhance reporting. They deliver real-time fraud alerts and automate case management, all while ensuring your existing data governance and user experience remain intact.