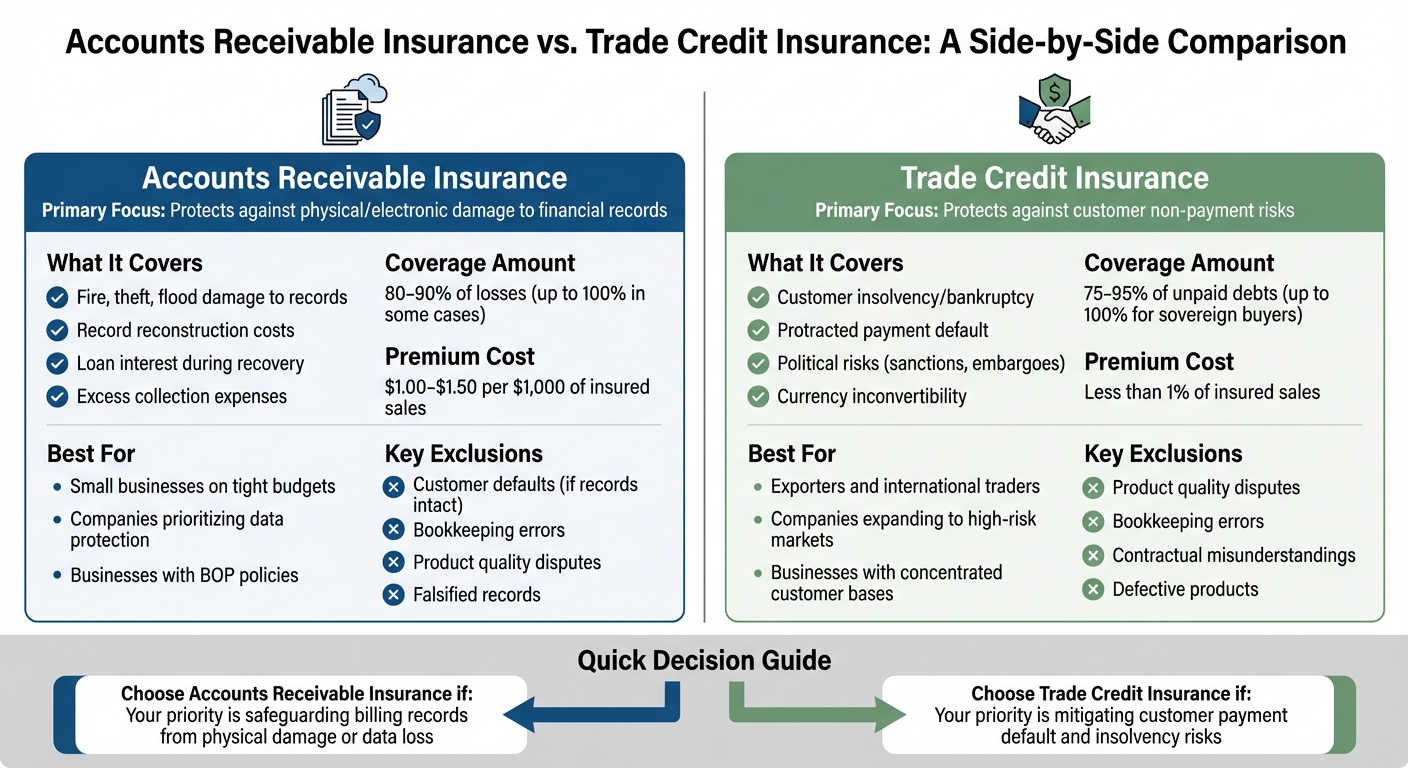

Accounts receivable insurance and trade credit insurance help businesses manage risks tied to unpaid invoices, but they address different scenarios.

- Accounts Receivable Insurance: Protects businesses from losses caused by physical or electronic damage to financial records (e.g., fire, theft, flood). It covers costs like record reconstruction, loan interest, and excess collection expenses. Premiums are typically $1–$1.50 per $1,000 of insured sales. However, it doesn’t cover customer defaults if records remain intact or losses from disputes over product quality.

- Trade Credit Insurance: Shields businesses from customer non-payment due to insolvency, bankruptcy, or political risks (e.g., sanctions, embargoes). It’s ideal for companies expanding into high-risk markets and offers coverage for up to 95% of unpaid debts. Premiums are generally less than 1% of insured sales. Exclusions include disputes over product quality and bookkeeping errors.

Key Differences:

- Accounts receivable insurance focuses on record-related risks.

- Trade credit insurance addresses customer non-payment risks, including political factors.

Choose based on your business needs: safeguard financial records or mitigate customer payment risks.

Accounts Receivable Insurance vs Trade Credit Insurance Comparison

1. Accounts Receivable Insurance

Coverage Types

Accounts receivable insurance comes in a variety of forms tailored to fit different business needs. Whole turnover policies cover your entire customer portfolio, spreading the risk across all your clients. Key account coverage focuses on protecting your largest customers, shielding your business from significant losses tied to major buyers. For companies heavily reliant on a single client, single-buyer policies provide coverage against default from that specific customer. Meanwhile, transactional coverage is designed for one-off large orders or occasional sales in high-risk markets, offering protection on a deal-by-deal basis.

Mike Libasci, President of International Fleet Sales, highlighted the value of this flexibility for his company:

"Accounts receivable insurance has allowed us to take on customers and transactions we wouldn’t have felt comfortable taking on by ourselves."

This adaptability makes it easier for businesses to manage risk while pursuing growth opportunities.

Commercial Risks

At its core, accounts receivable insurance safeguards businesses against several common commercial risks. These include customer insolvency, bankruptcy, protracted default (when payments are severely delayed), and non-payment due to contractual disputes. If a covered event occurs, the insurer reimburses a significant portion of the unpaid invoice – usually between 80% and 90%, though some policies may cover up to 100%.

Beyond covering unpaid invoices, many policies include additional benefits. These may cover costs related to recovering documents, interest on loans used to maintain cash flow, and extra collection expenses. Some insurers even offer tools to monitor customer creditworthiness. For example, Allianz Trade processes 85% of its 20,000 daily credit limit requests within 48 hours, helping businesses make quicker, informed decisions.

Premiums for this coverage are relatively affordable, typically ranging from $1 to $1.50 per $1,000 of insured sales. For instance, a small business with $700,000 in annual sales might pay approximately $700 per year for protection.

Political Risks

In addition to commercial risks, specialized accounts receivable policies can protect against political risks that might prevent a customer from paying. These policies cover scenarios like currency inconvertibility, sanctions, embargoes, and other government actions that block payments. This type of coverage is especially critical for businesses engaged in international trade, where foreign government decisions can disrupt transactions. Some policies even offer pre-shipment coverage, which protects manufacturing costs if political events halt exports. For deals involving sovereign buyers, indemnity coverage may go up to 100%.

Exclusions and Limitations

While accounts receivable insurance offers robust protection, there are exclusions and limitations to be aware of. Most policies will not cover losses caused by bookkeeping or accounting errors, falsified records, or defaults due to defective products or poor advice. Coverage for collection costs is typically limited to expenses exceeding normal operating costs.

If accounts receivable insurance is added as an endorsement to a commercial property policy, the scope of protection may be narrower. In such cases, it often only covers records damaged by physical events like fire. Additionally, defaults tied to product quality or disputes over sales contracts are generally excluded. To reduce the risk of "refusal to pay" exclusions, businesses should ensure their sales contracts are clear and well-documented.

2. Trade Credit Insurance

Coverage Types

Trade credit insurance focuses on protecting businesses from buyer defaults, unlike accounts receivable insurance, which primarily addresses physical or record-related losses. This type of insurance offers various policy options, including whole turnover, key account, single-buyer, and transactional policies, with the aim of mitigating risks tied to non-payment across both domestic and international transactions. A key distinction lies in how trade credit insurance evaluates buyer creditworthiness. Insurers like Allianz Trade rely on extensive databases, monitoring the financial health of around 85 million companies to predict defaults and set credit limits. This emphasis on assessing buyer reliability is what differentiates trade credit insurance from property-based accounts receivable insurance.

Commercial Risks

Trade credit insurance provides protection against three major commercial risks: customer insolvency (bankruptcy), protracted default (failure to pay within a specified timeframe), and refusal or inability to pay under agreed contract terms. The indemnity typically covers between 75% and 100% of the debt [5,17]. Insurers actively monitor and manage credit limits; for instance, Allianz Trade processes 85% of 20,000 daily credit limit requests within 48 hours. However, it’s important to note that these policies generally exclude payment disputes between buyers and sellers, covering only the undisputed portions of a debt. Jason Benson, Global Head of Structured Working Capital at J.P. Morgan, explains:

"If there’s a receivable for 100 products, and the buyer says only 80 were delivered, the insurer’s payment obligation may only be on the undisputed amount".

This level of monitoring helps businesses manage risks effectively and sets the stage for addressing political risk challenges.

Political Risks

In addition to commercial risks, trade credit insurance often includes coverage for political risks in international transactions – protection that standard domestic accounts receivable policies do not provide. These policies can cover events like war, civil unrest, currency inconvertibility, and embargoes. They may also extend to CEND risks (Confiscation, Expropriation, Nationalization, and Deprivation). This type of coverage is particularly valuable for businesses operating in politically unstable regions or working with foreign buyers. For example, the Export-Import Bank of the United States (EXIM) offers policies that protect foreign accounts receivable from both insolvency and political risks, reimbursing 85% to 95% of the invoice amount. Additionally, trade credit insurance allows businesses to offer competitive open account terms in high-risk markets, serving as an alternative to letters of credit or pre-payments.

Exclusions and Limitations

Trade credit insurance policies come with specific exclusions and limitations. Each buyer is assigned a credit limit, which represents the maximum insured amount for that customer, and policies usually include an annual liability cap. Insurers can adjust credit limits with 30 to 60 days’ notice, depending on risk assessments [17,19]. In the first half of 2023, insurance payouts for unpaid bills increased by 23% compared to the same period in 2022, leading to more frequent adjustments in credit limits.

It’s also important to understand what these policies do not cover. Losses unrelated to the delivery of goods or services – such as those caused by defective products, contractual misunderstandings, bookkeeping errors, or falsified records – are excluded. Additionally, defaults tied to erroneous advice or disputes over contractual terms are not covered. Despite these limitations, premiums for trade credit insurance are relatively low, typically costing less than 1% of the insured sales volume, which represents a small fraction of a company’s overall turnover [5,16]. These exclusions highlight the importance of tailoring coverage to align with the specific risks your business faces.

How trade credit insurance secures your business

sbb-itb-b840488

Pros and Cons

When deciding between accounts receivable insurance and trade credit insurance, it’s essential to weigh their benefits and limitations to determine which best suits your business needs.

Each type of insurance offers specific perks while addressing different risks. Accounts receivable insurance steps in to cover costs like data recovery, bridge loan interest, and excess collection expenses if your records are lost or damaged. However, it won’t protect you if a customer goes bankrupt while your records remain intact. On the other hand, trade credit insurance helps mitigate the risk of customer insolvency and supports expansion into higher-risk markets. That said, it requires ongoing administration and doesn’t cover disputes over product quality.

The cost structure is another key difference. Trade credit insurance premiums are typically less than 1% of the insured sales volume, while accounts receivable insurance costs range from $1 to $1.50 per $1,000 of insured sales. Factoring, by comparison, can cost anywhere from 1% to 10% of the invoice value, making insurance a more budget-friendly option. These cost variations can significantly impact how businesses manage both pricing and risk.

Both insurance types have notable exclusions, as previously discussed. Trade credit insurance, for instance, imposes strict credit limits on individual buyers and usually covers only 80% to 95% of the debt. This means businesses must still absorb a portion of any loss.

| Insurance Type | Key Advantages | Key Disadvantages |

|---|---|---|

| Accounts Receivable Insurance | Covers IT recovery costs, bridge loan interest, and excess collection expenses | Does not cover bad debt if records are intact; excludes accounting errors |

| Trade Credit Insurance | Supports market expansion, improves financing terms, and provides credit monitoring | Requires ongoing reporting, enforces credit limits, and does not cover 100% of losses |

Ultimately, the choice between these insurance types depends on your business priorities – whether you’re more concerned about safeguarding operational data or mitigating credit risks.

Conclusion

Accounts receivable insurance helps protect businesses from losses caused by physical or electronic damage to billing records, while trade credit insurance safeguards against customer defaults due to insolvency, bankruptcy, or political turmoil.

For small businesses operating on tight budgets, adding accounts receivable coverage to a Business Owner’s Policy (BOP) can be a practical solution to protect billing records. This type of coverage typically costs about $1.00 to $1.50 per $1,000 of insured sales, offering an affordable layer of protection. While this is ideal for smaller operations, larger companies often require more extensive coverage as they grow.

For businesses entering new markets or providing competitive credit terms, trade credit insurance can act as a strategic tool for growth. Larger organizations, exporters, and companies with concentrated customer bases often rely on this coverage to mitigate risks tied to commercial and political uncertainties. Businesses involved in international sales may face additional challenges, such as currency restrictions or trade embargoes, which trade credit insurance is specifically designed to address.

When deciding between these options, it’s essential to evaluate your specific vulnerabilities and customer dependencies. If the default of a single customer could seriously disrupt your cash flow, a "Key Accounts" or "Single Buyer" trade credit policy might be the right choice. On the other hand, if your primary concern is safeguarding billing data in the event of a disaster, an accounts receivable endorsement focused on property coverage would be more appropriate. Each policy has unique limitations, as discussed earlier, so careful consideration is key.

FAQs

What should businesses consider when deciding between accounts receivable insurance and trade credit insurance?

When deciding between accounts receivable (A/R) insurance and trade credit insurance, it’s essential to consider the specific risks your business needs to address. A/R insurance is designed to cover losses stemming from damaged or lost receivable records due to incidents like fire or theft. It can also help with related expenses, such as loan interest or additional collection costs. Meanwhile, trade credit insurance focuses on protecting against non-payment risks, including customer insolvency, bankruptcy, or even political unrest in a buyer’s country.

The geographic and customer profile of your receivables is another important factor. If your business deals heavily with international clients, trade credit insurance may be a better fit since it often includes political risk coverage. However, for companies that primarily operate within the U.S. and have reliable record-keeping systems, A/R insurance might be sufficient to safeguard against physical risks.

Finally, take a close look at the costs, policy limits, and how each option affects your financing opportunities. Both types of insurance can make your receivables more appealing to lenders, potentially improving your borrowing capacity. Be sure to compare premiums, deductibles, and the claims process to find a policy that fits your budget and risk tolerance. For U.S.-based businesses looking for tailored advice, CreditInsurance.com provides resources to help you make a well-informed choice.

What is the difference between political risk coverage in accounts receivable insurance and trade credit insurance?

Political risk coverage in accounts receivable insurance is generally included as part of the standard protection, focusing primarily on defaults by foreign buyers. On the other hand, trade credit insurance often includes an optional political risk endorsement. This endorsement can address specific challenges like war, government expropriation, currency inconvertibility, or other actions by sovereign entities that disrupt international trade.

Although both types of insurance aim to shield businesses from financial losses, trade credit insurance typically offers more extensive and specialized political risk coverage designed to meet the complexities of global trade.

What risks are typically not covered by trade credit insurance policies?

Trade credit insurance, often referred to as accounts receivable insurance, is designed to safeguard businesses from risks such as customer non-payment, insolvency, or even political upheaval. However, like any insurance policy, it comes with certain exclusions that businesses need to keep in mind. These typically include issues like disputes over the quality of goods or services, losses arising from fraud, and specific force majeure events such as natural disasters or war.

To fully understand what your policy covers – and what it doesn’t – it’s crucial to carefully review the complete policy details or speak with an experienced insurance professional. This step can provide clarity, ensuring you’re well-prepared to make decisions that align with your business needs.