Wholesale businesses often face financial risks from unpaid invoices. Credit insurance can help protect against these losses – but successfully filing a claim requires precision.

Here’s what you need to know to improve your claim success rate:

- Timely Reporting: Notify your insurer of overdue payments within the required 60-90 day window.

- Accurate Documentation: Keep detailed records, including invoices, purchase orders, and delivery confirmations.

- Stay Within Credit Limits: Ensure shipments don’t exceed insurer-approved credit limits.

- Understand Policy Rules: Follow guidelines, such as stopping shipments to delinquent buyers and securing insurer approval for repayment plans.

- Monitor Buyers: Regularly track payment behavior to spot potential risks early.

Common Problems with Credit Insurance Claims

Credit insurance is designed to shield businesses from financial losses, but even with this safety net, a 4% claim rejection rate can translate into substantial setbacks. Many of these rejections stem from preventable issues like administrative mistakes or failing to comply with policy requirements.

Why Claims Get Denied

One of the biggest reasons claims are denied is late reporting. Most insurers require notification of overdue invoices within a strict 60- to 90-day window. Missing this deadline – even by just a few days – can result in an automatic denial. Pieter Van Ede, Global Head of Trade Credit at WTW, highlights this issue:

"The untimely notification element of an overdue invoice is one of the key potential reasons for an insurer to decline a claim".

Allianz Trade echoes this sentiment:

"The top reason why we reject claims is late reporting of an overdue payment or adverse information".

Other common reasons for denial include:

- Exceeding approved credit limits: For example, if a wholesaler ships goods that exceed the insurer-approved credit limit for a buyer, any amount above that limit won’t be covered.

- Incorrect buyer identification: Filing a claim under the wrong entity, such as a parent company instead of the covered subsidiary, can void the claim.

- Documentation gaps: Missing key paperwork – like purchase orders, signed delivery notes, or complete contracts – can derail even legitimate claims.

- Unapproved repayment plans: If a wholesaler agrees to a repayment plan with a struggling buyer without the insurer’s written consent, the claim may be invalidated.

| Common Denial Reason | Primary Cause | Prevention Strategy |

|---|---|---|

| Late Reporting | Missing the 60-90 day notification window | Use automated alerts for overdue invoices |

| Documentation Gaps | Missing signed delivery notes or POs | Maintain a digital record of all transactions |

| Limit Breaches | Shipping beyond the approved credit limit | Integrate credit limits into ERP systems |

| Entity Errors | Filing against the wrong legal entity | Confirm legal names and tax IDs during onboarding |

| Unapproved Plans | Unauthorized repayment agreements | Always consult the insurer before making repayment deals |

These procedural missteps, while avoidable, often stem from larger administrative challenges wholesalers face.

Administrative Challenges for Wholesalers

For wholesalers managing hundreds or even thousands of buyers, the administrative workload can be overwhelming. Keeping tabs on payment terms, tracking overdue invoices, and ensuring proper documentation for every transaction requires robust systems and processes. Gabriela Quinza, Claims Manager at Allianz Trade in France, explains:

"Forgetting to send something or omitting key invoices can create otherwise avoidable delays".

Things get even trickier when wholesalers offer extended payment terms – such as 120 days – to remain competitive. If their insurance policy only covers standard 90-day terms, those extended invoices fall outside coverage, often leaving wholesalers unaware until a claim is filed.

Another challenge is disputed invoices. While disputes don’t automatically void claims, they do delay the process. Insurers typically hold off on payment until the dispute is legally resolved, as they require a "confirmed receivable" to proceed with recovery efforts. During this time, cash flow remains tight, adding more strain to the wholesaler’s operations.

sbb-itb-b840488

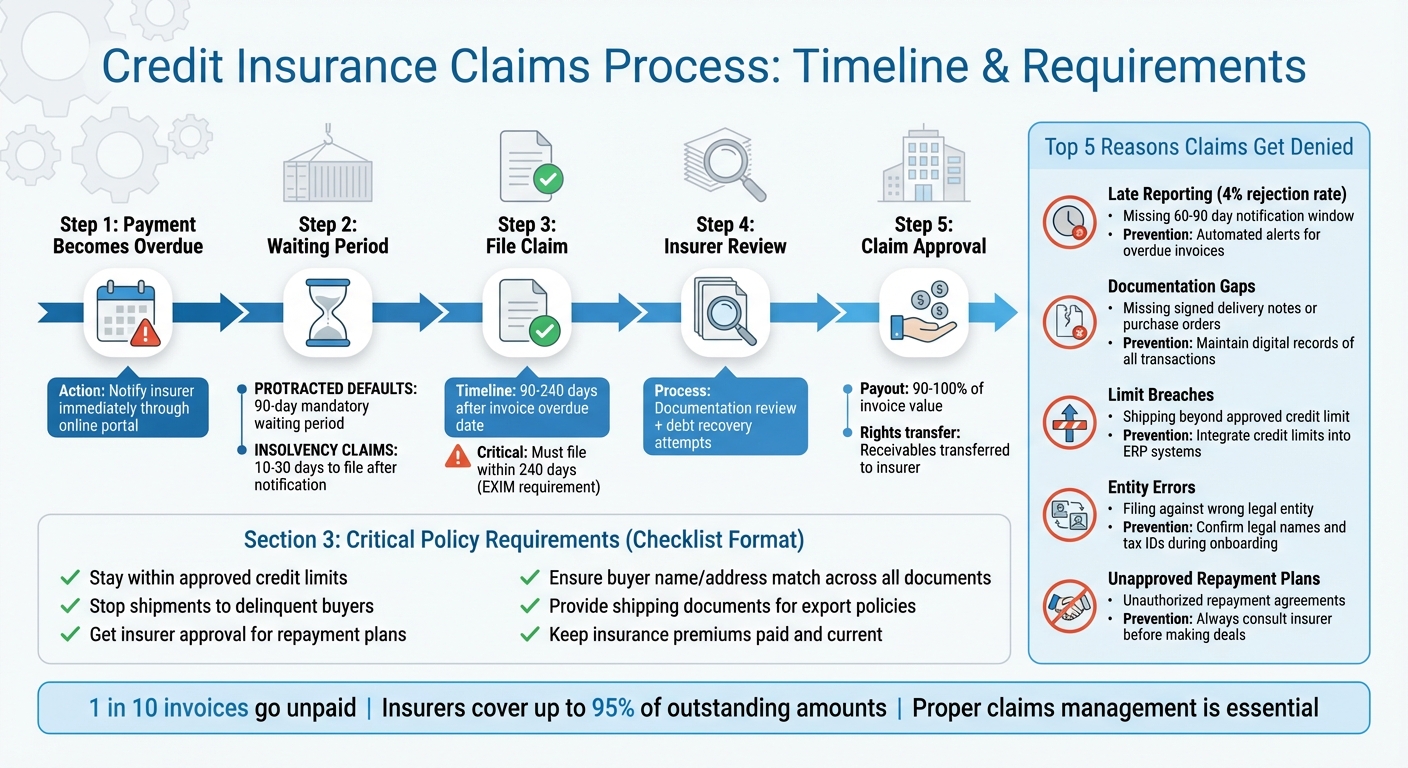

Steps in the Credit Insurance Claims Process

Credit Insurance Claims Process Timeline and Requirements for Wholesalers

Understanding the claims process step by step is essential for wholesalers to avoid mistakes and meet all necessary requirements when filing. While specifics can vary slightly between insurers, the core steps are generally consistent.

How the Claims Process Works

The process kicks off as soon as a buyer’s payment becomes overdue. Your first move is to notify your insurer about the overdue account, typically through an online portal. This notification is crucial because it sets the timeline for everything that follows.

For protracted defaults, most insurers require a mandatory 90-day waiting period before you can officially file a claim. This period allows for collection efforts and gives the buyer a chance to resolve the debt. Beyond this, the actual claim filing window is broader – typically 90 to 240 days after the invoice becomes overdue. For instance, EXIM mandates that loss documentation be submitted within 240 days of the invoice’s overdue date.

On the other hand, insolvency claims have a much tighter timeline, often requiring filing within 10 to 30 days of receiving notification of the buyer’s insolvency. Kirk Elken, Co-founder of Securitas Global Risk Solutions, stresses the importance of filing on time:

"One of the non-negotiables for the insurer is late filing a claim (missing the window to file the claim)".

Once you’ve submitted your claim along with all necessary documentation, the insurer reviews it and may attempt to recover the debt from the buyer. If approved, the insurer will pay out the claim, typically covering 90% to 100% of the invoice value. As part of this process, you’ll transfer the rights to the receivables to the insurer, enabling them to pursue recovery efforts.

Following these steps and adhering to policy guidelines are key to ensuring your claim gets approved.

Policy Requirements You Must Meet

After starting a claim, staying compliant with your policy’s rules is critical. Timely notification is just the beginning – there are several other requirements to keep in mind throughout your relationship with the buyer.

Stick to approved credit limits for each buyer. If you ship goods exceeding the insurer-approved credit limit, the excess amount won’t be covered.

Additionally, most policies mandate that you stop shipments to buyers with overdue invoices. Shipping to delinquent customers could jeopardize your claim for those unpaid invoices.

If you’re considering offering a repayment plan to a struggling buyer, always get the insurer’s approval beforehand. Heather Smart Johnson from CreditInsurance.com highlights this risk:

"If the payment plan was not approved by the insurance company, your claim may be denied".

Accuracy in documentation is another critical factor. Ensure the buyer’s name and address match perfectly across all documents, including purchase orders, invoices, and bills of lading. Filing a claim against the wrong legal entity – such as mistakenly listing a parent company instead of the specific subsidiary that owes the debt – is a common reason for claim denial. For export policies, you must also provide shipping documents proving the goods were sent outside the U.S., or meet the requirements for domestic shipment endorsements.

Lastly, make sure your insurance premiums are fully paid and up to date. Missing payments can invalidate your coverage and derail your claim.

How to Improve Your Claim Success Rate

Boosting your claim success rate starts with following these practical strategies.

Report on Time and Meet Deadlines

Filing late is one of the easiest ways to have a claim denied, but it’s completely avoidable. Set up internal reminders to track key deadlines. For payment defaults, file your claim once a payment is 90 days overdue but no later than 240 days past due. For insolvency cases, the timeline is much shorter – usually between 10 and 30 days after receiving notice of the buyer’s bankruptcy.

The Office of Small Business at EXIM emphasizes the importance of timeliness:

"In order to be paid in full under the policy, you must file your claim on time. We must receive your proof of loss (i.e., your claim form) within 240 days from the date that the invoice is overdue".

If you’re working on a repayment plan but approaching the deadline, request an extension before time runs out.

After meeting filing deadlines, the next step is managing your credit limits to minimize exposure.

Stay Within Approved Credit Limits

Shipping more than your insurer-approved credit limit can leave you without coverage for the excess amount. To avoid this, regularly check and update your buyer credit limits as your business relationships evolve. If you need a higher limit, submit a formal request to your insurer rather than making assumptions.

Integrating buyer credit limits into your ERP system is a smart move. This allows for real-time tracking and helps prevent accidental over-shipments. Remember, your shipment volumes should align with policy limits, not just sales goals. If you use discretionary credit limits, maintain thorough documentation, such as credit reports and trade references, to support your decisions.

Monitor Your Buyers Regularly

Even with strict adherence to credit limits, continuous monitoring of your buyers is essential. Keeping an eye on payment behaviors helps you spot potential issues early, giving you time to adjust coverage before losses occur. Use tools like Days Sales Outstanding (DSO) and aging reports to set up automated alerts for overdue accounts. For example, if a buyer who usually pays within 30 days starts taking 60, it’s time to investigate.

Before filing a claim, figure out why payments have stopped. Is it a simple quality dispute, or is the buyer struggling financially? Heather Smart Johnson from CreditInsurance.com explains:

"The insurance company does not act as a mediator between you and your customer in regards to the dispute".

Insurers generally won’t pay out on debts that are under dispute, so you’ll need to resolve these issues through negotiation or legal means.

Strengthen Your Internal Credit Controls

Strong internal credit controls not only reduce the chances of claim denial but also improve the overall quality of your claims. Assign a dedicated member of your credit team to manage the policy, including limit requests, reporting, and claims. This ensures no details are overlooked.

Implement stop-shipment protocols to pause deliveries when an account becomes overdue. The EXIM Office of Small Business advises:

"each transaction as if it is going to result in a claim – don’t assume".

This means keeping accurate records, promptly securing proof of delivery, and avoiding documentation mistakes. Train your sales team on these procedures so they understand that shipping to delinquent accounts can void coverage for unpaid invoices.

Using Educational Resources from CreditInsurance.com

If you want to improve your chances of successfully filing a claim, it’s crucial to understand your policy inside and out while taking advantage of expert guidance. CreditInsurance.com is designed to help wholesale businesses navigate the often-complicated world of credit insurance and avoid the common mistakes that can lead to claim denials.

Learn Policy Terms and Claims Procedures

Terms like "Aggregate Limit", "Protracted Default", and "Subrogation" can feel overwhelming. That’s where CreditInsurance.com steps in with a detailed glossary and a step-by-step guide to walk you through these concepts and the critical pre-filing requirements. These resources are invaluable when dealing with unpaid invoices, ensuring you know exactly when and how to file a claim. They also outline how long you might need to wait and emphasize the importance of keeping your documentation aligned with the insured entity.

By mastering these basics, you’ll be better prepared to apply practical lessons from real-world experiences.

Review Case Studies and Best Practices

Learning from others’ experiences can save you time and headaches. CreditInsurance.com offers case studies and educational articles that highlight effective risk management strategies. These examples show how other wholesale businesses have successfully filed claims and avoided common pitfalls.

Additionally, the platform connects you with specialist brokers who can help evaluate quotes, navigate mandatory reporting requirements, and review claims before submission – all at no extra cost. As Heather Smart Johnson from CreditInsurance.com notes:

"A trade credit insurance broker is an advocate for you when dealing with the credit insurance company".

This kind of support ensures you’re never left guessing during the claims process.

Select the Right Coverage for Wholesale Operations

Understanding policy terms and learning from case studies is just the beginning. To truly protect your business, you need to align your coverage with your specific risks. Tailoring your policy to your wholesale operations reduces the chances of complications when filing a claim.

For example, wholesalers can customize their policies to cover their entire portfolio, focus solely on domestic or export sales, or target specific accounts like their largest customers or those exceeding a set dollar amount. This flexibility allows you to avoid paying for unnecessary coverage while ensuring you’re adequately protected.

The application process itself is straightforward, typically taking about 45 minutes to an hour. Brokers can usually provide quotes from multiple carriers within two to three weeks. CreditInsurance.com also offers tools like a Borrowing Calculator to estimate your credit capacity and Business Credit Reports to assess potential buyers before extending credit. These resources help you understand how different policy structures – such as those based on annual insured sales versus specific coverage – affect both your premiums and claim eligibility.

Conclusion

Main Points for Wholesale Businesses

Filing a credit insurance claim successfully hinges on three priorities: meeting deadlines, maintaining thorough documentation, and fully understanding your policy. Deadlines are especially critical for protracted default and insolvency claims, as missing them is a common reason valid claims are denied.

Your documentation must be airtight and consistent. As Kirk Elken, Co-founder of Securitas Global Risk Solutions, puts it:

"The documentation has to be consistent, meaning it’s clear that the debtor ordered the products/services… the product was delivered… the insured invoiced the debtor… the debtor is past due".

This means keeping detailed and organized records that leave no room for doubt. Any inconsistencies or missing pieces can delay or even derail your claim. Additionally, identifying the correct legal entity responsible for the debt is crucial. For example, if a subsidiary owes the money but you list the parent company, your claim could be invalidated.

Adhering to payment terms outlined in your invoices and insurance applications is equally important. Any changes – like entering a repayment plan with a customer – require prior approval from your insurer to safeguard your claim rights if the customer defaults again.

External resources can also make a big difference. Platforms like CreditInsurance.com offer educational tools, case studies, and broker connections to help you navigate policy requirements and avoid common mistakes. With approximately 1 in 10 invoices going unpaid and insurers covering up to 95% of outstanding amounts, proper claims management is an essential step in protecting your financial stability. By prioritizing these practices, wholesale businesses can improve their chances of successful credit insurance claims.

FAQs

When should I notify my insurer about a late-paying buyer?

When it becomes evident that a buyer is delaying payment, it’s important to notify your insurer right away. Make sure to do this within the claim filing deadlines specified in your policy – these are often up to 180 days from the invoice date. Acting quickly not only ensures you stay within the policy’s terms but also increases the likelihood of your claim being processed successfully.

What documents are needed to validate an insured invoice?

To confirm the validity of an insured invoice, you’ll need to have the right documentation on hand. This includes the invoice, bill of lading, and the international purchase order or sales contract. Make sure these documents align with each other and accurately represent the specifics of the sale and shipment. Consistency is key to avoiding any issues.

What actions can void my coverage before I file a claim?

There are certain missteps that can jeopardize your credit insurance coverage before you even file a claim. For instance, if you withhold critical details during the underwriting process – like the financial health or payment history of your customers – it could lead to disputes over misrepresentation. Insurers rely on this information to assess risk, so accuracy is key.

Another common oversight is failing to notify your insurer about significant changes in your customers’ financial status or payment behavior. These updates are often required under the terms of your policy, and neglecting them could put your coverage at risk.

To safeguard your protection, always ensure the information you provide is accurate and up-to-date. Open and consistent communication with your insurer is essential for maintaining your policy.