Climate change is reshaping trade credit insurance. Businesses face two main risks: physical damage from extreme weather and financial pressures from climate policies. Here’s what you need to know:

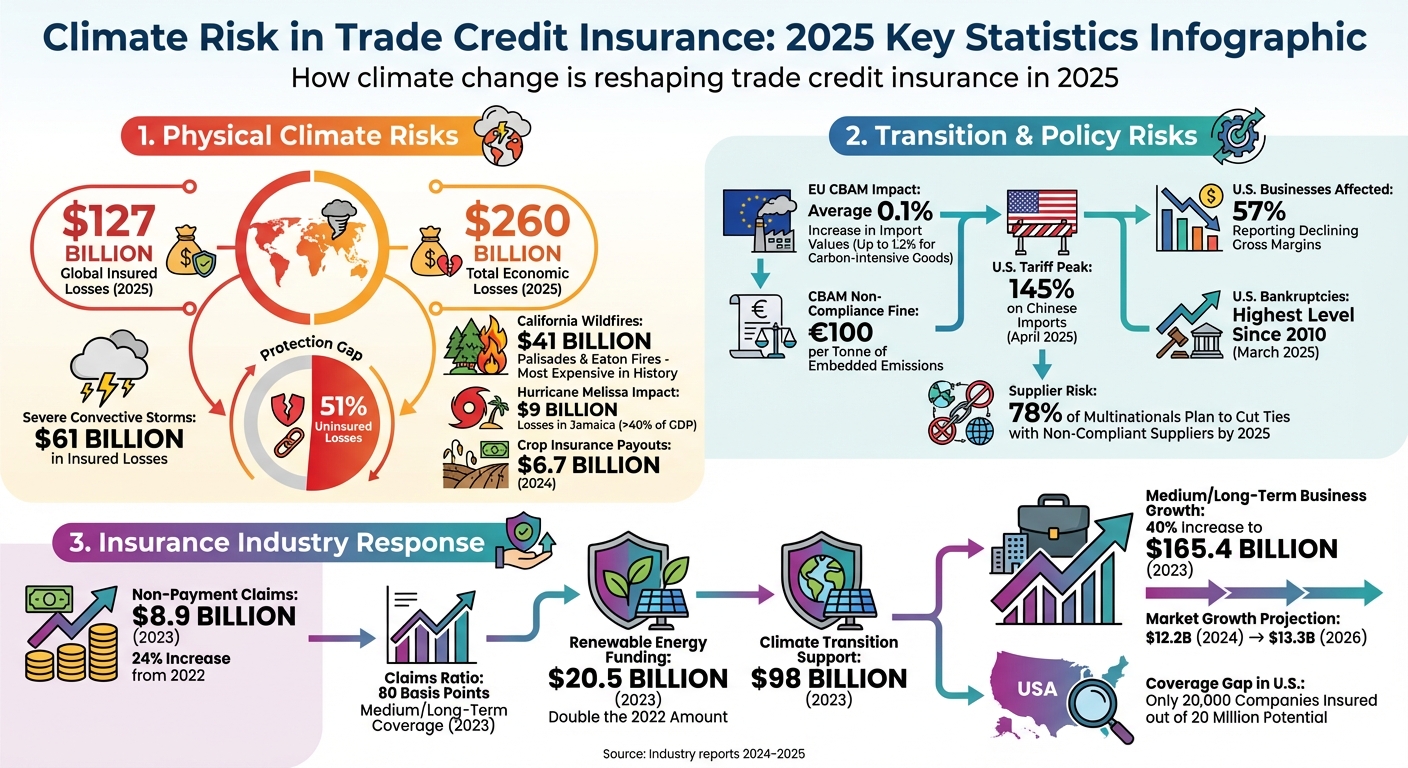

- Physical Risks: Hurricanes, floods, and wildfires disrupt supply chains and increase defaults. In 2025 alone, global insured losses reached $127 billion, with many businesses left uninsured.

- Transition Risks: Stricter climate regulations like the EU’s Carbon Border Adjustment Mechanism (CBAM) are raising costs, especially in carbon-heavy industries, increasing the risk of payment defaults.

- Insurance Industry Response: Insurers now assess Environmental, Social, and Governance (ESG) factors, adjust premiums, and offer tailored products like green bonds to support climate-conscious businesses.

- Key Takeaway: Companies without strong climate strategies may face higher premiums, reduced coverage, or no protection at all. Addressing climate risks is crucial for securing affordable trade credit insurance.

To stay competitive, businesses must prepare for rising climate-related costs and ensure they have the right insurance coverage to protect their cash flow.

2025 Climate Risk Impact on Trade Credit Insurance: Key Statistics

Physical Climate Risks and Trade Credit Insurance

Natural Disaster Data and Financial Losses

Natural disasters reached unprecedented levels in 2025, with global insured losses hitting $127 billion and total economic losses climbing to $260 billion. These figures highlight how climate events can disrupt business operations and jeopardize trade credit obligations.

The Palisades and Eaton Fires in California set a new benchmark as the most expensive wildfires in history, resulting in $41 billion in insured losses. Beyond the immediate property damage, these fires disrupted critical supply chains by slowing operations at the Los Angeles port and forcing mass evacuations, creating ripple effects for businesses far beyond the affected area. Similarly, severe convective storms contributed to $61 billion in insured losses globally, making it the third-highest annual total ever recorded for such events.

Despite these staggering losses, the protection gap – the difference between total economic losses and what was insured – remained at 51% in 2025. This gap underscores how much of the economic damage from climate events goes uninsured, leaving businesses, especially in emerging markets, exposed to financial instability and the risk of default. Without adequate coverage, a single disaster can deplete cash reserves and disrupt trade credit relationships.

The examples below provide a closer look at how these risks play out in real-world scenarios.

Examples of Physical Risk Impacts

Hurricane Melissa serves as a stark example of how a single climate event can destabilize an entire economy. In 2025, the hurricane caused $9 billion in losses in Jamaica, equivalent to over 40% of the country’s GDP. This economic shock left local businesses struggling to meet their trade credit obligations, significantly increasing default risks for suppliers and creditors.

Flooding in the agricultural sector also amplified payment risks. In Bangladesh, the floods of August and September 2024 led to 19% of the affected population losing their jobs and 53% reporting income losses. This sharp drop in earnings for agricultural workers and businesses created widespread payment defaults across the region. Extreme weather events like droughts and floods resulted in nearly $6.7 billion in crop insurance payouts in 2024 alone.

"By providing coverage and support to farmers, the insurance industry can help with recovery efforts after events, managing supply chain risks and stabilizing costs." – Liz Henderson, Global Head, Climate Risk Advisory, Aon

Climate unpredictability also caused sharp commodity price increases. Central American coffee yields, for example, dropped by 10% due to extreme weather, leading to a 40% year-over-year increase in coffee prices. These price surges strained buyers’ liquidity, particularly those lacking financial safety nets, making it harder for them to meet payment deadlines and increasing the risk of trade credit defaults.

sbb-itb-b840488

Outlooks 2026: How Costly Natural Disasters Reshape Credit Risk

Transition Risks from Climate Policies

Unlike the sudden impact of natural disasters, regulatory changes gradually chip away at financial stability. Climate-related policies are reshaping how businesses operate, introducing new credit risks that trade insurers need to address.

Effects of Tariffs and Carbon Policies

One key driver of these changes is the EU Carbon Border Adjustment Mechanism (CBAM). Starting in January 2026, CBAM will transition from a reporting phase to requiring importers to pay for the carbon content of goods such as steel, aluminum, and cement. The cost of carbon certificates will align with the weekly average price of EU ETS allowances.

CBAM is expected to increase EU import values by an average of 0.1%, with carbon-intensive goods facing spikes of up to 1.2%. For companies already operating with tight profit margins, these added costs could strain cash flow and heighten the risk of payment defaults. Non-compliance comes with hefty fines – €100 per tonne of embedded emissions, with intentional evasion penalties reaching as much as three to five times that amount.

Meanwhile, U.S. companies are grappling with tariff volatility. Fluctuations in tariffs on Chinese imports, reaching a peak of 145% in April, have led 57% of surveyed U.S. businesses to report declining gross margins.

"If a company has to pay 15% to 20% more for raw materials, the financial impact can be severe. Trade credit insurance helps solve this dilemma by covering the risk of unpaid invoices caused by a customer’s insolvency." – Jerry Paulson, Senior Vice President, HUB International

The combined effects of carbon policies and tariff instability are creating prolonged operational challenges. By March 2025, U.S. bankruptcies hit their highest level since 2010, partly driven by these external pressures. In response, companies are rerouting supply chains to avoid high tariffs, introducing new risks as original suppliers lose revenue and face potential insolvency.

These policy-driven cost increases are amplifying default risks, especially in industries sensitive to regulatory changes.

Higher Default Rates from Climate Regulations

Stricter climate regulations are raising default risks in carbon-intensive industries. Sectors like iron, steel, aluminum, cement, fertilizers, and hydrogen, all targeted by CBAM and similar policies, are particularly vulnerable. While the broader economy remains steady, these industries face mounting costs that threaten their financial health.

Trade credit insurers are adapting by factoring these risks into their underwriting processes. Coverage limits are being reduced in high-risk sectors as compliance costs rise and customer stability weakens.

Beyond direct costs, 78% of multinational enterprises plan to cut ties with suppliers that hinder their carbon transition goals by 2025. This creates a "green" barrier to market entry, where businesses that fail to meet environmental standards risk losing key partnerships. Middle- and low-income countries reliant on EU exports – particularly in North and Sub-Saharan Africa – are disproportionately affected compared to more diversified, wealthier economies.

"The trade credit market should expect to see more losses overall than normal… For us, our loss ratio is increasing." – Julie Potter, Senior Vice President, Export Development Canada (EDC)

As climate regulations tighten and enforcement ramps up in 2026, insurers anticipate rising loss ratios due to non-compliance and escalating regulatory costs. This could lead to reduced capacity and higher premiums for sectors deemed high-risk.

How Insurers Are Responding to Climate Risks

Insurers are taking a more strategic approach to address the increasing risks posed by climate change. Instead of relying solely on sweeping premium hikes, they are combining traditional underwriting practices with insights from climate science and ESG (Environmental, Social, and Governance) metrics. These efforts aim to protect their financial stability while encouraging businesses to transition toward a low-carbon economy.

Premium and Coverage Changes

Rather than blanket rate increases, insurers are fine-tuning their underwriting by examining sector-specific climate risks. Businesses without credible net-zero commitments are facing stricter terms. For example, some insurers are declining to issue new policies or renew contracts for companies in coal, oil sands, and methane-heavy industries unless they commit to achieving net-zero emissions by 2050.

At the same time, insurers are actively supporting green initiatives. In 2023, Berne Union members allocated a record $20.5 billion to renewable energy projects – double the amount funded in 2022. Additionally, $98 billion was directed toward broader climate and energy transition-related deals that year. Commenting on this surge, Maëlia Dufour, President of the Berne Union, stated:

"The business results reported by Berne Union members demonstrate huge growth in volumes with rapid growth in support for energy and climate transition".

Insurers are also investing premiums into sustainable finance. Allianz Trade, for instance, has incorporated certified green bonds into its investment strategy. In April 2025, Allianz Trade introduced "Specialty Credit" and "Surety Green2Green" products, focusing on climate-conscious projects. Soenke Schottmayer, Head of Commercial – Global Surety, explained:

"If it meets our criteria, the premiums we earn from this transaction are… held as investments in certified green bonds".

The company has also contributed £150 million to the International Finance Corporation to boost funding for climate-related projects and small businesses in emerging markets. To manage risks in volatile sectors, insurers are turning to tools like co-insurance, facultative placements, and noncancelable limits. These methods are helping insurers embed ESG factors into their underwriting processes more effectively.

ESG Factors in Underwriting

Building on these targeted premium adjustments, insurers are now integrating ESG metrics into their risk assessments. This involves factoring in climate risks alongside traditional credit analysis. For example, underwriters evaluate how climate events might disrupt a buyer’s revenue or increase costs due to supply chain interruptions. They also consider liquidity risks, such as the challenge of selling assets located in high-risk areas. Weiling Lin from Tinubu highlighted this shift:

"A climate-conscious lens could also be applied to the classic credit analysis factors in determining a company’s creditworthiness".

Transition risks are also gaining attention, particularly in trade receivables. Insurers are assessing whether a buyer’s customers might stop paying for goods that become obsolete due to new climate regulations. This is increasingly relevant as mandatory climate disclosures are introduced. In Singapore, for example, listed companies will need to disclose Scope 1 and 2 emissions starting in FY2025, with Scope 3 disclosures required by FY2026. Large non-listed companies with annual revenues of SGD 1 billion or more must comply by FY2027.

The industry is also focusing on resilience-oriented products that reward climate adaptation efforts. Beyond product innovation, insurers are steering their portfolios away from high-risk or poorly aligned ESG sectors and toward sustainable finance opportunities. They are incorporating climate science and scenario modeling into premium calculations to better account for long-term risks. Advanced technologies like AI and data analytics are playing a key role in this transformation, enabling faster and more precise underwriting decisions.

As the EY 2026 Global Insurance Outlook emphasized:

"Unlocking enterprise-level value requires redesigning key customer experiences, embracing dynamic underwriting, and establishing faster, more agile decision-making processes".

Market Data and Financial Trends

Loss Ratios and Market Changes

Recent market data paints a clearer picture of the financial strain on trade credit insurance, particularly as climate risks continue to escalate. In 2025, natural disasters accounted for $260 billion in global economic losses, with insured losses totaling $127 billion. This gap highlights the growing challenge of managing risks tied to extreme weather events.

Claims have surged significantly. Non-payment claims across all coverage types reached a historic $8.9 billion in 2023, reflecting a 24% increase from 2022. Medium and long-term trade credit insurance saw a claims ratio of 80 basis points that same year, underscoring the dual pressures of climate disruptions and economic uncertainty. Insurers are preparing for tougher times ahead, anticipating a rise in corporate insolvencies and claims over the next 12–24 months as climate-related risks intensify and credit conditions tighten.

Despite these challenges, pricing has remained steady. Insurers are focusing on selective underwriting and structured capacity strategies. Moody’s highlighted the shifting dynamics, noting:

"Rising costs from extreme weather events are shifting credit risk across the economy"

While claims and loss ratios reflect growing pressures, the gaps in coverage point to areas that require innovative approaches.

Coverage Gaps and New Solutions

Coverage gaps remain a critical issue, particularly in emerging markets and for specific climate-related events, such as severe flooding in South and Southeast Asia. In the U.S., the gap is striking – only 20,000 companies out of a potential 20 million currently utilize trade credit insurance. This reveals an enormous opportunity to expand coverage and address unmet needs.

New approaches, particularly those tied to sustainable finance, are beginning to address these gaps. In 2023, Berne Union members committed a record $20.5 billion to renewable energy projects, doubling the amount from 2022. Additionally, medium and long-term trade credit business grew by 40%, reaching $165.4 billion, largely driven by infrastructure and energy transition initiatives. Maëlia Dufour, President of the Berne Union, remarked:

"2023 has been an exceptional year for the export credit industry… with a skyrocketing acceleration in support for energy and climate transition"

These developments signal a shift toward targeted solutions that aim to bridge the gaps in coverage while supporting critical global transitions.

2026 Outlook for Climate Risk and Trade Credit Insurance

Capacity and Coverage Forecasts

By 2026, the ongoing impact of tariff shocks and trade disruptions is expected to drive increased demand for trade credit insurance. According to DAC Beachcroft, this type of insurance will play an essential role in helping businesses navigate the uncertainties of tariff volatility.

At the same time, insurers are tightening capacity due to rising premiums and reduced coverage availability, largely driven by the increasing frequency of severe weather events. Surprisingly, even catastrophe-exposed insurance lines are seeing rate reductions, despite the heightened risks linked to climate change. Martin Burke, Chief Underwriting Officer at MS Amlin, highlighted the compounding nature of this issue:

"When rates fall as risk rises, there’s an accelerated effect. What might appear modest softening in any single year, can become material when compounded with growing exposure".

To address these challenges, insurers are expected to adopt more selective underwriting practices and structured capacity strategies. This includes greater reliance on tools like non-cancellable limits, co-insurance arrangements, and facultative placements to manage risk while maintaining market presence. Despite these pressures, rate adjustments for 2026 are projected to remain between –5% and flat, as insurers balance competitive pricing with risk management.

In the face of constrained capacity, new financial instruments are being developed to help mitigate risks and close gaps in coverage.

Sustainable Finance Opportunities

Sustainable finance is emerging as a key area of growth for 2026, building on the challenges and opportunities within the insurance market. Global issuance of sustainable bonds is predicted to hit $900 billion, with $530 billion allocated to green bonds, $190 billion to sustainability bonds, and $40 billion to transition bonds. Key growth sectors include renewable energy, green construction, energy efficiency, and social infrastructure. Notably, credit and political risk insurance portfolios now have greater exposure to renewable energy than to oil and gas for the first time.

Moody’s Corporation underscored the importance of resilience in maintaining credit quality in this evolving landscape:

"Adaptation and resilience increasingly central to credit quality. As extreme weather events become more frequent and severe, investment in adaptation and resilience will be key to mitigate risk and support credit strength".

To bridge the protection gap, innovative risk transfer mechanisms are gaining traction. Tools like catastrophe bonds, climate-linked debt clauses, and parametric insurance are becoming essential for providing rapid emergency funding in response to disasters. These market-based instruments work alongside traditional insurance solutions, offering flexible and timely financial support for climate-related exposures.

These advancements in financial tools complement earlier changes in underwriting and coverage practices, which were implemented to address both physical and policy-driven climate risks. As demand rises and insurers refine their capacity management strategies, the integration of sustainable finance positions 2026 as a transformative year for the industry.

Businesses aiming to protect their operations against climate-related challenges can explore practical resources and expert guidance at CreditInsurance.com (https://creditinsurance.com).

Conclusion

The growing impact of climate risks is transforming the landscape of trade credit insurance. Natural disasters, regulatory changes, and increasing insolvencies are pushing insurers to adopt advanced AI tools, refine underwriting practices, and incorporate ESG-focused strategies. With nearly half of international trade receivables – around $1.1 trillion – located in regions marked by "Very High" or "Severe" collection challenges, businesses face significant financial pressures.

For companies, the priority is clear: preserve liquidity and safeguard cash flow in an unpredictable world. As Marc Wagman, Managing Director of Credit and Political Risk at Gallagher, explains:

"Typically, receivables – the lifeblood of a company fueling cash flow – are the largest uninsured asset on the balance sheet. Having the insurance facilitates global trade".

Insurers are adapting by using technology and financial tools to redefine how they assess risks. Predictive data analytics now allow them to identify potential threats 6–8 months ahead, enabling businesses to act proactively rather than reactively to climate-related disruptions.

Trade credit insurance should be seen as a growth enabler, allowing businesses to extend credit with confidence, access better financing options, and manage the varied effects of climate policies across industries and regions. The rising demand for this coverage is reflected in the global market’s projected growth – from $12.2 billion in 2024 to $13.3 billion by 2026.

To navigate the uncertainties brought on by climate change, businesses must embrace trade credit insurance as a key part of their strategy. Combining this with ESG initiatives and sustainable financing options can strengthen resilience against climate risks. Companies looking to protect their receivables and bolster their financial stability can find valuable resources and expert support at CreditInsurance.com.

FAQs

How does climate risk affect trade credit insurance premiums?

Climate risks have a direct impact on trade credit insurance premiums, primarily because they heighten the likelihood of payment defaults and financial instability for businesses. When climate-related events disrupt supply chains, damage assets, or cut into revenue, companies often find it harder to meet their financial commitments, which increases their credit risk.

In response, insurers adjust premiums to reflect the added uncertainty, especially in industries that are more vulnerable to climate change. For businesses, this underscores the importance of evaluating their exposure to climate risks and exploring strategies like credit insurance to safeguard their financial stability.

How do climate regulations impact trade credit insurance?

Climate regulations are pushing the trade credit insurance industry toward stricter standards in disclosure and risk management. For instance, the U.S. Securities and Exchange Commission (SEC) now requires companies to report their greenhouse gas emissions and climate-related financial risks. This directly affects how insurers evaluate and handle these risks. In California, new laws force large companies to disclose their emissions and vulnerabilities tied to climate change, adding another layer of complexity for insurers.

Globally, frameworks like the IFRS Sustainability Disclosure Standard highlight the importance of transparency and accountability in climate-related reporting. Meanwhile, regulatory bodies such as the Federal Reserve and the Bank of England have issued guidance to address climate-related risks. These directives encourage insurers to strengthen their strategies for managing both physical risks, like extreme weather events, and transition risks tied to shifting toward a low-carbon economy. Together, these measures aim to enhance risk management practices and help insurers navigate the financial challenges posed by a rapidly changing climate.

How can businesses manage climate risks to reduce default exposure?

Businesses can lower their vulnerability to climate-related default risks by weaving climate factors into their overall risk management approach. This means evaluating physical risks, such as severe weather events, and transition risks, like shifts in regulations, to gauge how these might affect creditworthiness. Tools like scenario analysis and ESG scoring are particularly useful for pinpointing sectors and clients that may be at higher risk.

Taking a proactive stance on climate risks might also involve keeping a close eye on a firm’s exposure and tweaking credit policies to reflect potential threats. Collaborating with trade credit insurance providers can add an extra layer of security, as these insurers often consider climate risks when structuring their coverage. By incorporating climate-focused strategies into planning, credit assessments, and insurance decisions, businesses can better protect themselves from financial setbacks tied to climate change.