Export credit insurance protects your business from non-payment risks when selling internationally. You can choose between public providers (like EXIM Bank) and private insurers, each serving different needs:

- Public Providers: Government-backed, cover high-risk markets, and support small businesses. Offer long-term financing and higher risk tolerance but often have content requirements and political influences.

- Private Insurers: Market-driven, focus on stable markets, and offer flexibility with fewer restrictions. Best for short-term transactions and experienced exporters.

Key Differences:

- Risk Coverage: Public providers handle riskier markets; private insurers focus on stable regions.

- Policy Terms: Public providers offer longer terms; private insurers limit to short terms.

- Requirements: Public providers often have U.S.-content rules; private insurers do not.

Which to Choose?

It depends on your target market, transaction type, and business needs. Many exporters combine both for balanced coverage. Public providers handle high-risk deals, while private insurers manage stable, high-volume transactions. Always evaluate your options with a broker to find the best fit for your strategy.

Public Export Credit Agencies: How They Work

What Are Export Credit Agencies (ECAs)?

Export Credit Agencies (ECAs) are government or independent agencies designed to promote national exports and protect domestic jobs. In the U.S., the Export-Import Bank (EXIM) fulfills this role. These agencies step in when private lenders are unable or unwilling to take on certain risks.

What sets ECAs apart from private insurers is their government backing. This allows them to take on credit and country risks that private providers might avoid. As EXIM puts it:

When private sector lenders are unable or unwilling to provide financing, EXIM fills in the gap for American businesses by equipping them with the financing tools necessary to compete for global sales.

ECAs offer support in three main ways:

- Export credit insurance: Protects businesses against nonpayment.

- Working capital loan guarantees: Secures loans from private banks.

- Foreign buyer financing: Provides loans or guarantees to international buyers.

These tools help mitigate both commercial risks, like buyer insolvency, and political risks, such as war or currency restrictions.

Benefits of Public Export Credit Providers

Government-backed ECAs specialize in covering high-risk markets where private insurers hesitate. They can insure up to 95% of sales invoices against losses due to buyer nonpayment. For large-scale projects, they provide long-term financing with terms extending up to 18 years, surpassing what private insurers typically offer.

This government support boosts the value of foreign receivables as collateral. Lenders are more likely to include ECA-insured receivables in a borrowing base, which helps businesses access more working capital and improve cash flow. This is especially helpful for small and medium-sized businesses, as EXIM is required by law to direct at least 20% of its lending capacity to small businesses.

Another advantage is the expertise ECAs bring to evaluating international buyers in unfamiliar markets. They use tools like a "Country Limitation Schedule" to assess which markets qualify for coverage based on economic and political conditions. Despite handling high-risk transactions, EXIM maintains a low default rate due to its mandate to ensure a "reasonable assurance of repayment".

Drawbacks of Public Export Credit Providers

While ECAs offer many benefits, they also come with certain limitations. For instance, they often require exported goods or services to meet minimum national content thresholds, ensuring a specific percentage of U.S.-made components is included to qualify for support.

Political influences can also shape their operations. Between 2009 and 2012, EXIM’s financing for fossil fuel projects surged from $2.56 billion to nearly $10 billion, though growing concerns over carbon emissions have since led to shifting priorities. Additionally, in fiscal year 2013, 76% of EXIM’s loans and guarantees went to its top 10 recipients, with 82% of loan guarantees in 2012 benefiting customers of Boeing, a single large exporter. This concentration of support can make it harder for smaller exporters to access the full range of resources, despite EXIM’s mandate to assist them.

Next, we’ll look at how private export credit insurers handle similar challenges.

Private Export Credit Insurers: How They Operate

How Private Export Credit Insurers Work

Private export credit insurers focus on operating profitably by assessing risks through a commercial lens. Unlike public agencies, their evaluations hinge on market conditions, factoring in the exporter’s experience, the buyer’s credit reliability, and the economic environment of the destination country. These insurers typically concentrate on short-term transactions in stable, developed markets.

One standout feature of private insurers is the discretionary credit limit (DCL) system. This allows seasoned exporters to approve credit for buyers on their own, bypassing the need for prior approval from the insurer. This streamlined process can significantly speed up sales, offering a clear advantage over the more rigid, application-heavy procedures of public agencies.

Additionally, private insurers operate with fewer restrictions compared to their public counterparts. They don’t enforce rules about foreign content percentages or prohibit coverage for military-related sales. Such flexibility is particularly appealing for businesses dealing with intricate global supply chains or niche product offerings. This operational freedom translates into practical benefits for exporters aiming to navigate complex markets.

Benefits of Private Export Credit Providers

Cost-effectiveness is a major draw. Premiums for private multi-buyer policies typically amount to less than 1% of insured sales, a stark contrast to the often higher fees associated with letters of credit. For exporters with a strong performance history, premiums can be further reduced through experience-based discounts.

Private insurers also excel in speed and adaptability. Their market-driven approach allows for quicker processing times. As highlighted by the International Trade Administration:

commercial insurance companies can usually offer flexible and discretionary credit limits

This enables businesses to seize market opportunities without delays.

Customization is another key advantage. Private policies usually cover 80% to 95% of a transaction’s value, and terms can be tailored to fit the unique needs of individual exporters. By working with specialized brokers, businesses can compare quotes and secure competitively priced coverage. Despite these advantages, exporters should also weigh the limitations of private insurance.

Drawbacks of Private Export Credit Providers

One notable drawback is limited geographic reach. Private insurers generally steer clear of higher-risk emerging markets where political instability or fragile financial systems could increase losses. Instead, their focus remains on commercial risks like insolvency or payment delays in stable regions.

Private insurers also tend to provide shorter coverage terms. Policies typically extend up to two years, whereas public providers can offer medium-term financing for up to seven years and long-term coverage for projects lasting up to 18 years. This shorter duration may not meet the needs of exporters involved in capital-intensive projects with lengthy payment schedules.

For newer exporters or those venturing into unfamiliar markets, premiums are higher, and in some cases, coverage may even be declined.

How it Works: EXIM Bank Export Credit Insurance

sbb-itb-b840488

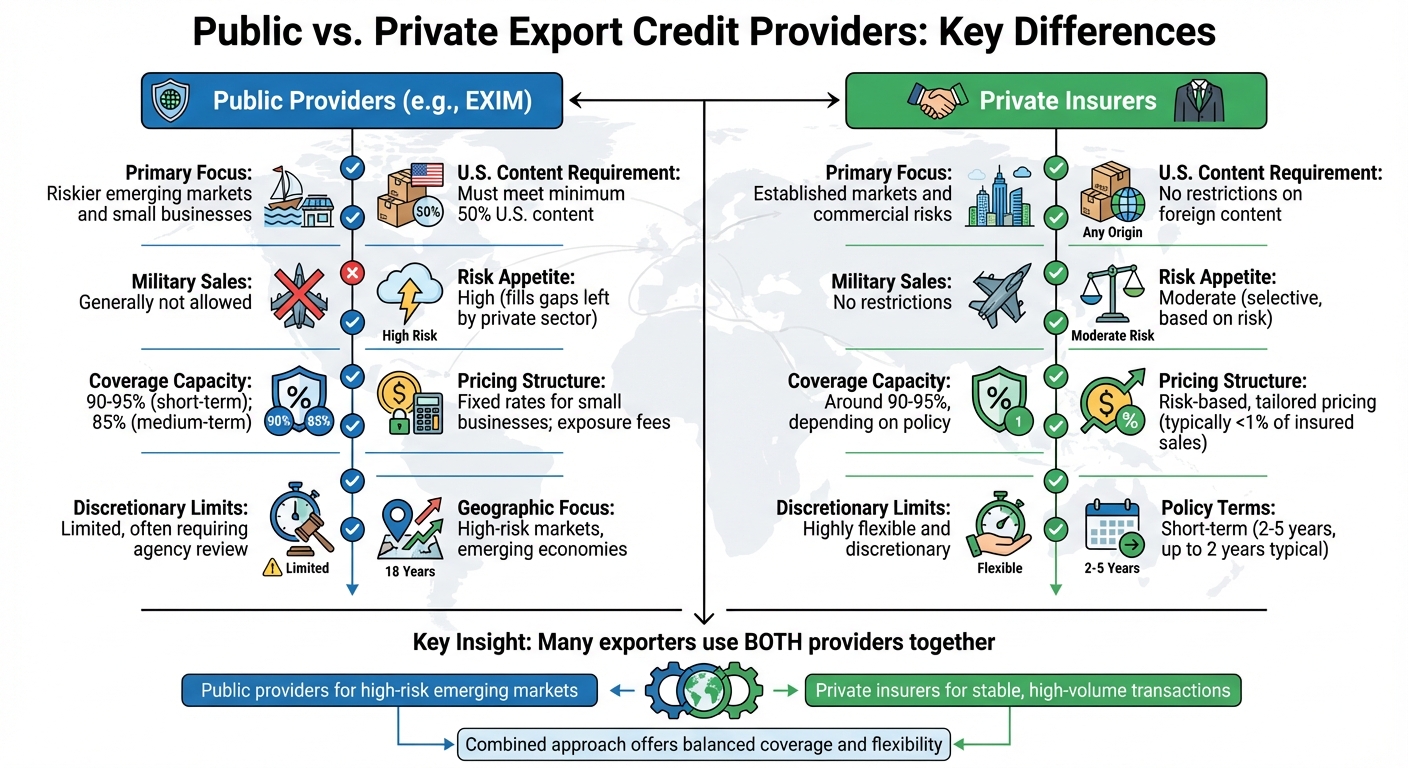

Public vs. Private Export Credit Providers

Public vs Private Export Credit Insurance Providers Comparison Chart

Coverage, Risk Appetite, and Capacity Compared

Public and private export credit providers serve distinct roles, focusing on different markets, policies, and risk profiles. Public agencies, such as the Export‐Import Bank (EXIM), prioritize riskier markets, like emerging economies, and support smaller businesses. On the other hand, private insurers typically focus on established markets and handle commercial risks.

Here’s a side-by-side comparison of their key features:

| Feature | Public Providers (e.g., EXIM) | Private Insurers |

|---|---|---|

| Primary Focus | Riskier emerging markets and small businesses | Established markets and commercial risks |

| U.S. Content Requirement | Must meet a minimum of 50% U.S. content | No restrictions on foreign content |

| Military Sales | Generally not allowed | No restrictions |

| Risk Appetite | High (fills gaps left by private sector) | Moderate (selective, based on risk) |

| Coverage Capacity | 90–95% (short-term); 85% (medium-term) | Around 90–95%, depending on policy |

| Pricing Structure | Fixed rates for small businesses; exposure fees | Risk-based, tailored pricing |

| Discretionary Limits | Limited, often requiring agency review | Highly flexible and discretionary |

Public providers typically back long-term projects, often stretching beyond 15 years, while private insurers concentrate on short-term arrangements, usually between 2 to 5 years. These distinctions highlight how the two types of providers complement each other in meeting exporters’ diverse needs.

How Public and Private Providers Work Together

While their features differ, public and private providers frequently collaborate to address gaps in the market. Public Export Credit Agencies (ECAs) often act as a safety net, stepping in when private insurers are unable or unwilling to offer coverage. This ensures that viable export deals aren’t derailed due to a lack of financing options.

As UK Export Finance (UKEF) explains:

"To ensure that no viable UK export fails for lack of finance or insurance from the private sector, while operating at no net cost to the taxpayer"

This partnership is crucial for large-scale projects that require substantial financial backing. Take the $14.4 billion Mozambique LNG Project as an example. It involved direct loans from four ECAs – US EXIM, JBIC, UKEF, and Thai EXIM – alongside contributions from 21 private financial institutions. Additionally, five ECAs provided guarantees for portions of the project financed by private banks. This blend of public and private support showcases how collaboration enables comprehensive financing for complex, high-stakes ventures.

In practice, private insurers focus on commercially viable risks, while public agencies step in to cover areas the private sector avoids. Exporters often work with specialized brokers to evaluate both options and decide whether a public, private, or combined approach best suits their transaction.

How to Choose the Right Export Credit Insurance Provider

What to Consider When Choosing a Provider

When deciding on export credit insurance, it’s crucial to weigh several factors, especially when comparing public and private providers. One key consideration is the risk level of your destination country. Public providers like EXIM Bank often step in for higher-risk emerging markets where private insurers may hesitate. For instance, EXIM’s Country Limitation Schedule can help you determine if your target market is eligible for coverage.

Another important factor is the product’s content and origin. Public providers generally require at least 50% U.S. content in the goods being insured, while private insurers are more lenient, often covering products with significant foreign components. Industry restrictions also play a role – public providers typically won’t insure military or defense-related sales, but private insurers often have fewer restrictions in this area.

Your business size and export experience also matter. Public programs, such as EXIM’s Express Insurance, cater to small businesses by offering fixed rates and higher coverage limits. On the other hand, private insurers provide more flexibility, including adjustable credit limits that can adapt to your needs.

To make the best choice, consider working with a specialized broker. Brokers can help you compare options between public and private insurers, ensuring you find the most cost-effective solution tailored to your business. For more detailed guidance, resources like CreditInsurance.com can provide additional insights. Many businesses find that combining public and private coverage offers the best balance of risk management and flexibility.

Using Both Public and Private Coverage

After evaluating these factors, many exporters decide to take a hybrid approach by using both public and private insurance. This strategy allows businesses to maximize protection while maintaining financial flexibility. For instance, public providers are often better suited for high-risk transactions in emerging markets, while private insurers can handle more stable, high-volume transactions in established markets.

Insured foreign receivables can also enhance your borrowing power. Banks are generally more willing to include these receivables in your borrowing base, especially when backed by a government guarantee, which can significantly improve liquidity. Additionally, exporters using EXIM’s working capital guarantee may qualify for a 25% premium discount on multi-buyer insurance policies, offering further cost savings when combining public financing with insurance coverage.

Conclusion

Choosing between public and private export credit insurance comes down to your business’s specific risk profile and needs. Public providers like EXIM Bank focus on addressing market gaps, especially in high-risk emerging markets where private insurers might shy away. Their mission prioritizes domestic job support, as seen in FY2024, when 86% of EXIM’s 1,424 transactions involved small businesses. On the other hand, private insurers offer more flexibility, including no restrictions on content, coverage for military sales, and adjustable credit limits that grow with your business.

These two options can work together. A hybrid strategy allows businesses to use public insurance for higher-risk markets while relying on private coverage for stable, high-volume transactions. This combination balances protection and adaptability, creating a stronger insurance strategy.

Before making a decision, consider factors like the risk level of your target markets, the origin of your products, and the type of coverage you need. As the Congressional Research Service highlights, EXIM’s mission is straightforward:

Ex-Im Bank aims to support U.S. jobs by financing and facilitating U.S. exports, chiefly when the private sector is unwilling or unable to provide financing at acceptable rates, and/or U.S. exports are competing against foreign ECA-backed exports.

For businesses wanting to dive deeper into their options, CreditInsurance.com offers resources to help you understand both public and private export credit insurance. Whether you’re a small exporter starting out or a larger company entering new markets, taking the time to assess your needs can safeguard receivables, expand borrowing potential, and drive international growth.

FAQs

What benefits do public export credit providers like EXIM Bank offer to businesses?

Public export credit providers, like EXIM Bank, play a crucial role in supporting businesses venturing into international markets. They help safeguard exporters from commercial and political risks, such as non-payment or unpredictable political conditions, giving companies the confidence to explore opportunities abroad without unnecessary worry.

These providers also make it easier for exporters to offer better credit terms to their international customers, making their products or services more appealing on a global scale. Beyond that, they assist businesses in securing financing and insurance options, which can help maintain steady cash flow and provide the financial foundation needed to grow.

Why are private export credit insurers often more flexible than public providers?

Private export credit insurers stand out by offering tailored solutions that align with a business’s unique needs. They evaluate premiums based on specific risk factors, provide adjustable credit limits, and allow businesses to customize policy terms. This approach ensures that companies can secure coverage that fits seamlessly with their operations and financial objectives.

On top of that, private insurers are known for their quicker decision-making processes and personalized support. This makes them an appealing option for businesses seeking efficient and responsive ways to safeguard against non-payment and other potential risks.

Can combining public and private export credit insurance improve my business’s coverage?

Yes, combining public and private export credit insurance can broaden your business’s protection by addressing a variety of risks. Public providers typically focus on covering political risks and other scenarios that private insurers may shy away from, while private providers often deliver tailored policies and quicker claims processing.

By using both types of coverage, you can build a more complete safety net that safeguards your business against issues like non-payment, customer insolvency, and unforeseen global challenges. This strategy helps ensure your coverage fits your unique needs while offering extensive protection.