AI is transforming credit insurance by making risk assessment faster, fraud detection smarter, and pricing more precise. These platforms use real-time data like transaction histories and payment behaviors to automate underwriting, detect anomalies, and tailor policies for businesses of all sizes. Here’s what you need to know:

- Faster Decisions: AI evaluates credit applications in seconds using live data, helping businesses avoid delays.

- Fraud Detection: Tools like device analysis and anomaly detection catch fraudulent claims early, saving billions.

- Dynamic Pricing: Premiums adjust in real-time based on updated risk assessments, ensuring fairer rates.

- Improved SMB Access: AI leverages alternative data to score businesses with limited credit histories, boosting approval rates.

- Compliance Support: AI ensures adherence to evolving regulations with transparent, explainable decision-making.

Data-Driven Revolution in Underwriting: AI meets Credit

AI Technologies Used in Credit Insurance Platforms

Fintech credit insurance platforms rely heavily on machine learning (ML), predictive analytics, and natural language processing (NLP) to streamline risk evaluation and decision-making in real time. These technologies serve as the foundation for advanced functions like risk assessment, fraud detection, and customer insights, transforming how credit insurance operates.

Machine learning (ML) plays a central role in AI-driven credit insurance. By analyzing massive datasets, ML models go beyond traditional credit bureau reports. They incorporate internal data, alternative credit sources, and even unstructured data such as news feeds. This approach allows for more precise evaluations, especially for businesses with limited credit histories.

"Applying machine learning models can increase accuracy and effectiveness, allowing lenders to make better decisions. When applied to credit decisioning, lenders see a Gini uplift of 60 to 70 percent compared to a traditional credit risk model" – Julie Lee, Experian

Currently, 75% of banks use machine learning for tasks like credit scoring, early warnings, and pricing.

Building on ML, predictive analytics enhances risk evaluation by combining historical claims data with market trends to project future liabilities. These tools can simulate potential claim scenarios and adjust risk scores in real time, enabling more precise policy pricing. Unlike outdated quarterly reviews, predictive analytics continuously refreshes risk profiles using live data streams. This enables early warning systems (EWS) to flag potential defaults six to eight months before they occur.

Natural Language Processing (NLP) and generative AI simplify the handling of unstructured documents, including financial reports, contracts, policy applications, and market news. NLP tools can extract critical data, identify policy violations, flag missing information, and even generate complex documents like credit memos or legal contracts. For example, NLP has reduced climate risk inquiry times from over two hours to under 15 minutes – a 90% time savings. Additionally, these systems can analyze annual reports, calculate financial ratios, and summarize findings with 90% accuracy.

"GenAI is now emerging as a reliable complement, streamlining the loan process by making application interactions smarter and more comprehensive" – Deloitte

Together, these technologies enable credit insurance platforms to function with unprecedented speed and efficiency. They don’t just refine existing processes – they are redefining the entire credit insurance landscape.

AI in Risk Assessment, Underwriting, and Pricing

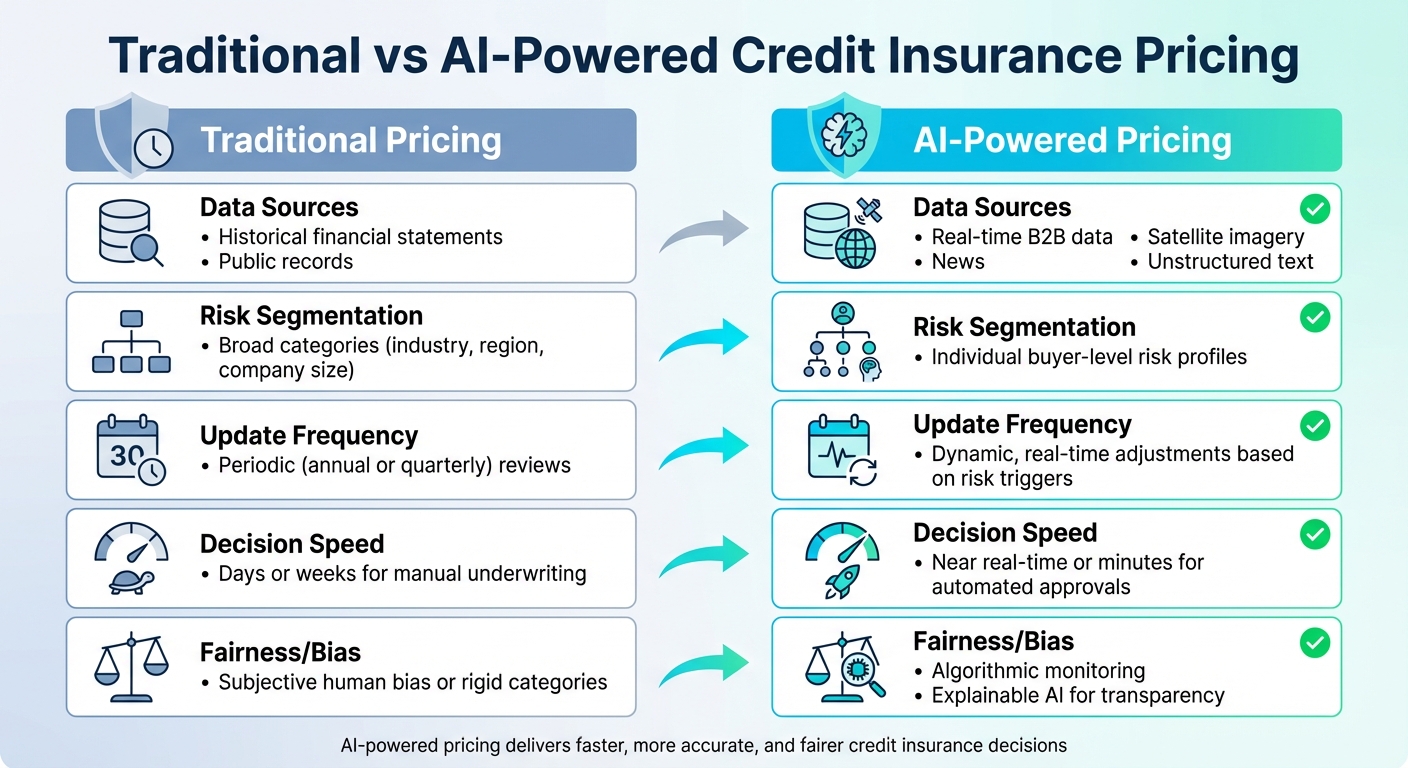

Traditional vs AI-Powered Credit Insurance Pricing Comparison

AI has transformed how credit insurers evaluate risk, approve policies, and determine premiums. By leveraging real-time data and autonomous decision-making, these systems achieve a balance of speed and accuracy that was once unattainable using traditional methods.

Automated Risk Assessment and Buyer Segmentation

Machine learning integrates a variety of data sources – credit bureau reports, transaction histories, news articles, social media activity, and cybersecurity evaluations – to create detailed buyer profiles in just minutes. Unlike older methods that sort businesses into broad "low", "medium", or "high" risk categories, AI provides nuanced profiles that capture subtle variations in creditworthiness.

"Machine learning models can now quickly incorporate your internal data, alternative data, credit bureau data, credit attributes and other scores to give you a more accurate view of a consumer’s creditworthiness." – Julie Lee, Experian

This level of detail allows insurers to confidently approve more reliable accounts while identifying those with higher default risks. AI also enables early warning systems through sentiment analysis, flagging credit stress six to eight months before major defaults occur. These early alerts give insurers time to adjust coverage or pricing strategies.

This precise segmentation creates a strong foundation for dynamic underwriting practices.

Dynamic Underwriting and Coverage Adjustments

With granular risk profiles in hand, dynamic underwriting enables insurers to continuously adjust credit limits and coverage terms. Traditional underwriting, which relies on fixed review cycles, often fails to account for rapid changes in a buyer’s financial health. AI changes the game by supporting continuous monitoring. Automated systems use incoming risk data to refine underwriting guidelines in real-time.

For instance, if a buyer’s credit profile shifts due to market volatility, regulatory changes, or operational challenges, the system recalculates credit limits and coverage terms instantly. In December 2025, Deutsche Bank implemented an autonomous AI system for corporate underwriting. This system performs near real-time analyses of financial and business-model risks. According to Chief Risk Officer Marcus Chromik, the system improved consistency by capturing insights from seasoned credit officers, freeing them to handle complex cases requiring human expertise. By early 2026, 82% of insurance carriers had plans to adopt similar AI systems within three years.

These AI-driven tools don’t just process applications; they proactively identify missing information and reach out to applicants to resolve gaps before underwriting begins. This reduces delays and ensures that coverage aligns with actual risk exposure.

Risk-Based Pricing Models

AI has revolutionized pricing by analyzing risk across buyers, policies, and entire portfolios. Instead of relying on static pricing models based on industry averages or company size, AI dynamically adjusts premiums in response to real-time risk indicators. This approach helps insurers avoid underpricing while ensuring policyholders pay premiums that reflect their actual risk.

The impact of AI on pricing has been substantial. Companies leading in AI adoption within the insurance sector have achieved 6.1 times the Total Shareholder Return compared to competitors over five years. Moreover, implementing AI in pricing and underwriting has resulted in a 10% to 15% increase in premium growth. In 2024, UK insurer Aviva saved over £60 million ($82 million) in its motor claims division by deploying more than 80 AI models, which improved routing accuracy by 30% and reduced liability assessment times by 23 days.

Modern AI pricing systems also include "fairness agents" – specialized tools that monitor algorithms for bias and ensure compliance with regulations in real-time. This addresses a key concern, as 79% of executives have cited data quality and algorithmic transparency as top challenges for AI-driven risk models.

| Feature | Traditional Pricing | AI-Powered Pricing |

|---|---|---|

| Data Sources | Historical financial statements and public records | Real-time B2B data, news, satellite imagery, unstructured text |

| Risk Segmentation | Broad categories (industry, region, company size) | Individual buyer-level risk profiles |

| Update Frequency | Periodic (annual or quarterly) reviews | Dynamic, real-time adjustments based on risk triggers |

| Decision Speed | Days or weeks for manual underwriting | Near real-time or minutes for automated approvals |

| Fairness/Bias | Subjective human bias or rigid categories | Algorithmic monitoring and Explainable AI for transparency |

AI for Fraud Detection and Compliance

AI is doing more than just refining underwriting and pricing processes – it’s also playing a pivotal role in protecting credit insurance platforms from fraud and ensuring compliance with U.S. regulations. Fraudulent claims make up about 10% of property and casualty insurance cases, costing the industry a staggering $122 billion annually. This makes insurance fraud the second-costliest white-collar crime in the U.S., just behind tax evasion. With the fraud detection technology market expected to grow from $4 billion in 2023 to $32 billion by 2032, AI’s role in combating fraud is only set to expand.

Fraud Detection and Prevention

AI leverages its ability to process vast and varied data types – like claim form text, image metadata, and B2B transaction records – to uncover patterns that might escape human review. This helps flag anomalies such as manipulated invoices, reused photos, and overbilling schemes.

One powerful tool in AI’s arsenal is network link analysis, which maps relationships between entities to identify fraud rings. These rings often involve coordinated schemes among medical providers, repair shops, and buyers engaging in circular trading or operating shell companies. Additionally, simulation modeling allows insurers to replicate typical industry behaviors in virtual environments, making it easier to detect deviations such as unnecessary services or suspicious spending patterns among smaller businesses.

"By deploying AI-powered multimodal technologies to detect fraudulent behavior across the claim life cycle, insurers can help vanquish a multibillion-dollar drain on consumers." – Deloitte

This shift from traditional rules-based systems to predictive models enables real-time analysis of unstructured data, such as news reports and market trends, further enhancing fraud detection capabilities.

Claims Validation and Loss Mitigation

AI simplifies claims validation by scoring millions of claims in real time, prioritizing those that require further investigation based on risk levels. Using natural language processing, AI extracts key details from claim documents, incident descriptions, and emails to detect suspicious language or inconsistencies. Meanwhile, computer vision and image analytics assess damages with precision, spotting irregularities in photo metadata or signs of tampering.

Roughly 35% of insurance executives have identified fraud detection as one of the top areas for generative AI applications within the next year. By integrating AI-driven tools throughout the claims process, property and casualty insurers could save between $80 billion and $160 billion by 2032.

Generative AI also accelerates the process of reviewing commercial policy terms and conditions, quickly determining claim validity and cutting down processing times significantly. However, even with these advancements, human oversight remains essential for handling complex cases that require expert judgment.

In addition to improving operational efficiency, AI ensures that insurers remain compliant with the latest regulatory requirements.

Regulatory Compliance and Audit Support

AI’s capabilities extend beyond fraud detection to streamline regulatory compliance, particularly as U.S. standards evolve. By June 2025, 24 states will have fully adopted the NAIC Model Bulletin on the "Use of Artificial Intelligence Systems by Insurers", effectively creating a national standard for AI governance. This requires insurers to maintain a documented AI Systems (AIS) Program, approved by senior management and boards, that adheres to the FACTS principles – Fairness, Accountability, Compliance, Transparency, and Security.

AI systems continuously monitor regulatory changes at both federal and state levels, interpret new requirements, and update reporting workflows automatically. Under laws like the Equal Credit Opportunity Act (ECOA) and Fair Credit Reporting Act (FCRA), AI models must remain "explainable", ensuring creditors can provide clear reasons for credit denials rather than hiding behind complex algorithms.

"A creditor cannot justify noncompliance with the ECOA and Regulation B’s [adverse action] requirements based on the mere fact that the technology it employs is too complicated or opaque to understand." – Consumer Financial Protection Bureau (CFPB)

Multiagent AI systems now include compliance and fairness agents that autonomously review underwriting and pricing processes to ensure adherence to regulations. These systems also enhance Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) efforts by analyzing massive datasets to detect patterns of illicit financing that traditional methods might overlook. Moreover, AI offers traceable, auditable decision-making through real-time dashboards, ensuring transparency for every data point influencing credit or claim decisions.

The Colorado AI Act (SB 24-205), effective February 1, 2026, mandates regular bias audits and centralized AI inventories to prevent discriminatory risk flagging. Additionally, a December 2025 Executive Order aims to establish a unified national policy framework, minimizing conflicts among state AI regulations and moving toward a consistent baseline for AI governance.

sbb-itb-b840488

Customer Insights and Portfolio Management

As risk management continues to evolve, gaining a deep understanding of customer profiles has become essential for adjusting credit insurance strategies in real time. AI is revolutionizing how fintech credit insurance platforms analyze customers and manage portfolios. Instead of relying on broad categories, these platforms now leverage internal, alternative, and credit bureau data to craft highly accurate customer profiles. This shift can boost Gini accuracy by 60% to 70% compared to traditional methods, enabling platforms to identify creditworthy businesses that might otherwise be deemed "unscorable". By combining advanced risk assessments with dynamic pricing, AI-driven insights help create more personalized strategies for customers.

Policyholder and Buyer Segmentation

AI takes customer segmentation to a new level by focusing on behavior patterns, risk profiles, and growth potential rather than just demographic data. Machine learning models analyze transaction histories, payment behaviors, and B2B spending trends to group policyholders into meaningful segments. This level of precision allows platforms to allocate resources more effectively – assigning relationship managers to high-value accounts while automating interactions for lower-risk segments.

Agentic AI systems maintain up-to-date profiles across all customer touchpoints, offering underwriters real-time insights into each policyholder’s changing risk status. Tools like "Talk to My Data" enable users to query complex datasets in plain language, making it easier to identify trends and adapt strategies swiftly.

For example, in 2024, UK-based insurer Aviva implemented over 80 AI models within its claims operations, improving claims routing accuracy by 30% and saving more than £60 million ($82 million) that year. This approach, which focuses on comprehensive transformation rather than isolated pilots, has also led to 10% to 20% increases in new-agent success rates and 10% to 15% growth in premiums.

This precise segmentation opens the door to customized product offerings that align closely with customer needs.

AI-Driven Product Development

AI is reshaping credit insurance by enabling flexible, usage-based products tailored to U.S. businesses. Instead of offering generic policies, platforms can now provide dynamic coverage that adjusts premiums and terms based on real-time risk evaluations. Specialized AI tools, such as "Pricing and Product Agents", recommend policy adjustments – like adding riders or modifying coverage limits – based on a business’s unique profile.

"AI has changed consumer expectations to the point that customers now expect higher accuracy and reliability during the consumer journey, human-like conversations with AI bots… hyperpersonalized offers and communication, and on-demand products." – McKinsey & Company

Machine learning models also incorporate alternative data – such as utility payments, rent records, and cybersecurity risk metrics – to evaluate previously "unscorable" segments. This allows platforms to broaden their customer base without taking on unnecessary risk.

"Optimal Coverage Recommendation Agents" further enhance this process by identifying gaps in a client’s current coverage and suggesting solutions to address those risks before they lead to losses. With 82% of insurance carriers planning to adopt agentic AI within the next three years, the trend toward smarter, autonomous product development is rapidly gaining momentum.

Improved Customer Experiences

AI is also transforming customer interactions by streamlining processes and providing real-time insights. Policyholders now have access to live dashboards that display their current risk exposure, claims updates, and coverage details – eliminating the need to wait for quarterly reports. These systems even process unstructured data, such as news articles and market trends, to keep risk assessments up to date.

Natural language processing makes it easy for customers to ask questions in plain English and receive instant, accurate answers. This omnichannel consistency allows users to switch seamlessly between desktop and mobile platforms without losing their progress in applications or claims. Additionally, AI-driven tools have cut onboarding costs by 20% to 40%, all while enhancing the overall customer experience.

Generative AI is now automating routine tasks like drafting performance reports and summarizing portfolio optimization options. This frees up relationship managers to focus on more strategic discussions with clients. These advancements in customer insights directly contribute to ongoing improvements in fraud detection and underwriting, ensuring credit insurance platforms remain agile and dependable.

Implementing AI in Credit Insurance Platforms

Bringing AI into credit insurance platforms requires careful planning, a solid data foundation, and strong organizational backing. While having perfect data or unlimited resources might be ideal, they’re not mandatory to get started. Many successful implementations begin with focused pilot projects that highlight measurable results before expanding further. The goal is to strike a balance between ambition and practicality, ensuring every step builds on the last while adhering to strict governance. This approach sets the stage for a phased rollout of AI capabilities.

Phases of AI Implementation

The process starts with aligning AI adoption to your business strategy and pinpointing areas where it can make the most impact. Tasks like drafting credit memos, setting up early-warning systems, and enhancing customer engagement often deliver quick, tangible results. A critical step here is organizing unstructured data into a centralized, searchable format – especially since 79% of credit risk executives identify data quality as a major concern.

Next, implement a secure, cloud-based, modular technology stack. By separating the user interface, business logic, and infrastructure, teams can work simultaneously and reuse components across different portfolios or regions, cutting deployment time by 30% to 50%. Start with a Minimum Viable Product (MVP) in a specific area, such as financial risk analysis, to validate the concept before scaling.

For example, in December 2025, Deutsche Bank’s Chief Risk Officer Marcus Chromik described how the bank used agentic AI to automate corporate credit reviews. The system tackled financial and business model risk analyses, allowing credit officers to focus on more nuanced, judgment-based tasks. This rollout was driven by multidisciplinary teams comprising data scientists, engineers, and credit experts, with built-in controls to ensure accuracy during the drafting process. Once the MVP delivers results, use Machine Learning Operations (MLOps) to handle ongoing model updates, release cycles, and integration into underwriting and claims systems.

During the MVP phase, agentic AI can help address data gaps. Starting with simpler tasks like internal bots or document summarization can build trust among stakeholders before advancing to customer-facing applications.

Governance and Risk Management

After implementation, effective governance becomes essential to ensure accuracy and fairness. Use challenger models and back-testing protocols to validate outcomes and catch errors before they affect decisions. Avoid black-box models that lack transparency – regulators and policyholders need clear explanations and reasoning for credit decisions.

"Keeping humans in the loop and actively learning from technology – these are very important for safeguarding responsible risk management and building trust with regulators and clients." – Marcus Chromik, Chief Risk Officer, Deutsche Bank

Human oversight should remain a priority, particularly for complex or high-stakes credit reviews. Embed control agents within the AI workflow to confirm compliance with company policies and document all actions for regulatory purposes. To address potential bias, track impacts on protected groups using diverse training data and real-time monitoring dashboards.

A November 2023 class-action lawsuit against UnitedHealth Group (Estate of Lokken v. United Health Group) highlights the risks of over-relying on AI. Plaintiffs alleged that claims personnel leaned too heavily on the nH Predict AI model for medical necessity decisions, sidelining human judgment. This case serves as a cautionary tale about the importance of maintaining human oversight in AI-powered insurance processes.

Organizational Readiness and Training

With technical systems and governance in place, preparing the organization itself is crucial for long-term success. Build cross-functional teams that include data scientists, engineers, UX designers, and credit experts to lead AI efforts. Ensure alignment at the executive level by assigning clear responsibilities, such as appointing a Large Language Model (LLM) owner for each business unit.

Invest in company-wide training to familiarize employees with the potential and limitations of AI, fostering both confidence and critical oversight. Currently, 87% of financial institutions are hiring technology experts to support AI adoption, and 60% are training leadership teams to understand AI applications.

Consider setting up a Center of Excellence (CoE) to centralize AI management and share best practices across teams. While only 33% of financial institutions have formalized such structures, those that have report faster scaling and more consistent outcomes. With 67% of institutions citing a lack of internal AI expertise, targeted hiring and training programs are essential for sustained success.

Conclusion

AI-powered credit insurance platforms are reshaping how U.S. businesses manage risk, detect fraud, and understand customer behavior. By using machine learning and predictive analytics, these systems process unstructured data from sources like news, market trends, and social media to provide real-time risk scoring and forecast potential losses. Impressively, early warning systems can now flag major credit events as far as six to eight months in advance, offering businesses valuable time to adapt their strategies.

In addition to risk scoring, AI is changing the game in fraud detection and customer insights. These systems can spot irregularities in B2B transactions and application data, helping to prevent financial losses. At the same time, they analyze customer behavior to deliver insights that allow businesses to personalize their offerings and communication, creating more meaningful customer interactions.

The benefits of AI extend well beyond just risk management. Automation powered by AI has slashed the time needed to address complex risk-related questions by 90% – cutting response times from two hours to under 15 minutes. Furthermore, more than 65% of professionals in claims and underwriting are planning major AI investments. Companies leading the charge in AI adoption have seen remarkable results, achieving 6.1 times the Total Shareholder Return compared to those lagging behind over the past five years.

As part of this transformation, CreditInsurance.com supports businesses in moving away from outdated systems toward agile, AI-driven solutions. The platform offers educational tools to help businesses understand how machine learning can automate risk assessments, analyze documents, and forecast losses. It also provides clear guidance on protecting against risks like non-payment, insolvency, and political instability. By simplifying AI’s role in credit insurance, CreditInsurance.com equips businesses with the knowledge they need to make confident, forward-thinking decisions.

This shift to AI isn’t just about keeping up – it’s about building resilience and making smarter, faster decisions. With 20% of senior credit risk executives already applying generative AI and another 60% planning to follow suit within a year, the momentum is undeniable. Companies that adopt these tools today are setting themselves up to thrive in a world increasingly driven by data and technology.

FAQs

How does AI enhance risk assessment in credit insurance?

AI is reshaping how risk is assessed in credit insurance by using machine learning and advanced data analytics to handle massive amounts of real-time information. This technology makes it possible to predict risks – like payment defaults or customer insolvencies – with greater speed and accuracy.

By spotting patterns and uncovering anomalies, AI enhances fraud detection and enables more accurate underwriting decisions. These advancements empower businesses to make smarter, data-informed decisions, safeguarding against financial risks while fine-tuning their credit policies.

How does machine learning help detect fraud in credit insurance?

Machine learning is reshaping fraud detection by sifting through massive amounts of structured and unstructured data to pinpoint unusual patterns and anomalies. Unlike traditional rule-based systems, it allows insurers to flag potentially fraudulent claims faster and with greater accuracy.

Using advanced algorithms, machine learning doesn’t just enhance precision – it evolves over time, becoming more adept at identifying threats. This evolution helps credit insurers minimize financial losses while making the claims review process more efficient.

How does AI improve customer experience in credit insurance?

AI-powered credit insurance platforms are transforming how businesses manage their policies, making the entire process faster, clearer, and more user-friendly. By analyzing key data – such as payment habits, supply chain performance, and economic indicators – these platforms can evaluate risks and generate quotes in just minutes. This efficiency not only simplifies underwriting but also enables businesses to secure coverage almost immediately.

Fraud detection is another area where AI shines. By identifying unusual patterns, these systems reduce false alarms and help prevent issues before they escalate. On top of that, intelligent chatbots and virtual assistants are available around the clock to assist with policy inquiries, claims, and tailored coverage suggestions. They communicate in a conversational, human-like manner, enhancing the overall experience. Businesses also benefit from proactive alerts, like notifications about a buyer’s weakening credit profile, allowing them to act early and make risk management a more collaborative and strategic effort.

For companies interested in leveraging these advantages, CreditInsurance.com offers tools and resources to safeguard receivables, minimize financial risks, and support growth through smarter credit insurance solutions.