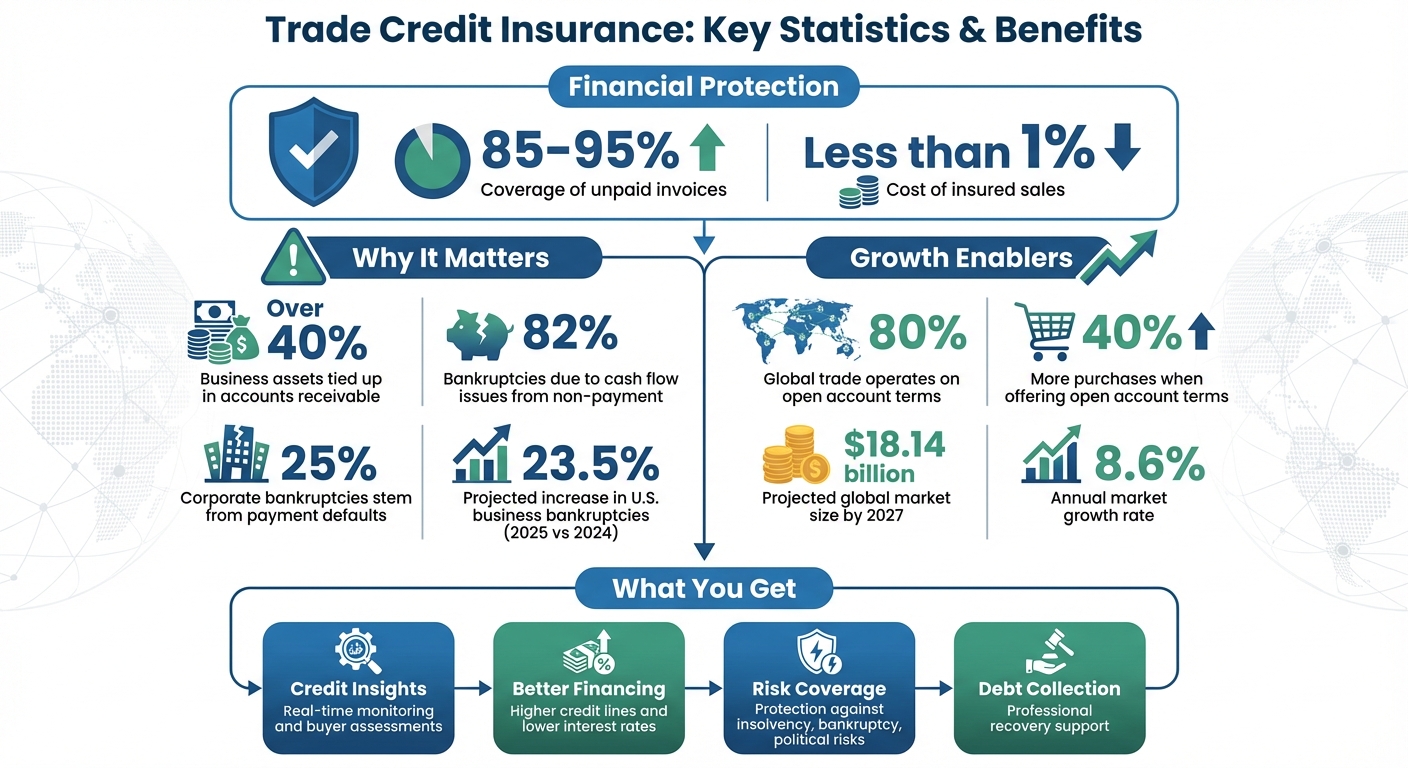

Trade credit insurance isn’t just about protecting your business from unpaid invoices – it’s a tool for growth. It safeguards your cash flow when customers fail to pay, covering up to 95% of the loss, and costs less than 1% of insured sales. But the real value lies in how it helps you expand. With this protection, you can confidently offer better payment terms, increase credit limits, and explore new markets without taking on unnecessary financial risks. Plus, insured receivables improve your standing with lenders, unlocking higher credit lines and better terms.

Key Highlights:

- Protects against non-payment due to insolvency, bankruptcy, or political risks.

- Covers 85%-95% of unpaid invoices.

- Costs less than 1% of insured sales.

- Provides credit insights and real-time monitoring to reduce risks.

- Improves access to financing by making receivables secure collateral.

Trade credit insurance turns accounts receivable into an opportunity rather than a liability, giving you the confidence to grow your business safely.

Trade Credit Insurance Key Statistics and Benefits

How Trade Credit Insurance Enables Business Growth

What Is Trade Credit Insurance?

Trade credit insurance – also known as accounts receivable insurance, debtor insurance, or export credit insurance – provides protection against losses when customers fail to pay for goods or services already delivered. This coverage extends to commercial risks like insolvency, bankruptcy, or prolonged defaults, as well as political risks such as currency restrictions, war, expropriation, or sudden trade embargoes [2,3,12].

Most policies combine three essential services: access to real-time business and buyer risk insights, professional debt collection support, and financial reimbursement for losses. Together, these services transform credit insurance from a mere safety measure into a tool that drives business growth. Whether your focus is domestic sales or international exports, this coverage gives you the confidence to explore opportunities that might otherwise feel too risky. With this robust protection in place, businesses can make more informed credit decisions, backed by deeper insights from insurers.

How Insurers Provide Credit Information and Buyer Assessments

Beyond just offering coverage, trade credit insurers equip businesses with actionable financial insights. One of the standout benefits of this insurance is access to extensive global databases and credit monitoring tools. Insurers continuously assess the financial stability of your current and prospective customers, establishing credit limits based on their solvency [3,12,4].

Christian Bürger, Senior Editor at Atradius, explains, "With a credit policy backed by an insurer’s credit ratings, businesses can avoid ad hoc assessments or credit decisions being made based on the mood of the day. This speeds up the sales funnel."

Insurers don’t just set credit ratings – they actively monitor them. If a customer’s financial health starts to decline, you’ll receive timely alerts. This proactive system allows you to adjust credit terms or payment expectations before a potential problem escalates into a financial loss. In essence, insurers handle the complex task of international credit analysis, leveraging their resources to give you an edge.

Why Insured Receivables Improve Financing Options

Trade credit insurance doesn’t just shield against risks – it also enhances your financial standing. Insured receivables are viewed as high-quality collateral by banks and lenders because the risk of non-payment is transferred to the insurer [5,7]. This shift in risk can unlock benefits like lower interest rates, higher credit limits, and improved borrowing capacity [5,2].

Jason Benson, Global Head of Structured Working Capital at J.P. Morgan, highlights, "Trade credit insurance may also enhance a company’s access to financing, as banks may view insured receivables as lower risk".

Using Trade Credit Insurance to Build Your Growth Plan

Increasing Credit Limits for Current Customers

Using real-time customer credit data can help you confidently extend higher credit limits to your most rapidly growing clients. This approach ensures that you can support their growth without needing to rely on prepayments or stricter payment terms.

Trade credit insurance provides financial protection by covering up to 95% of an invoice’s value if a customer defaults due to insolvency or prolonged non-payment. Additionally, some policies include non-cancelable limits, which guarantee coverage for the entire policy period, even if a buyer’s financial situation changes.

By working closely with your insurer and regularly reviewing your portfolio, you can secure your receivables while freeing up capital. This allows you to safely extend higher credit limits to lower-risk customers and reduce your exposure to higher-risk accounts. The increased credit capacity can directly support your market expansion efforts.

Selling to New Markets and Customers

Expanding into new or international markets comes with both opportunities and uncertainties. Trade credit insurance helps manage these risks by covering commercial issues like insolvency and default, as well as political risks such as government interference, currency restrictions, or conflicts. Considering that 80% of global trade operates on open account terms, offering competitive payment options can be a key factor in winning new business.

Data shows that foreign companies offered open account terms purchase, on average, 40% more than those required to use other payment methods. Insurers can provide valuable regional insights, such as local business practices and regulations, and send automated alerts about changes in buyer solvency. This allows you to adjust credit limits proactively to avoid potential defaults.

For businesses expanding across multiple regions, consolidating coverage under a global master agreement can simplify policy management and reduce administrative costs. Additionally, many insurers evaluate how you underwrite your customers when determining policy rates and coverage.

Using Insured Receivables to Increase Borrowing Capacity

Securing receivables with trade credit insurance not only builds customer confidence but also strengthens your financing options. Banks often view insured receivables as secured collateral, which shifts the risk of non-payment to the insurer. This improved risk profile can result in benefits like higher credit lines, lower interest rates, and the inclusion of foreign receivables and inventory in your borrowing base.

Take the example of Specialty Forest Products, which faced a cash flow gap due to mills requiring payment within 10 days while customer payments were delayed by 30–60 days. By using an Allianz Trade AA-rated policy to secure receivables, the company was able to expand its bank credit line and improve liquidity. CFO Doug Konop explained:

"Having trade credit insurance allows us to have an entirely different – and much more comfortable – conversation with our financial partner".

Moreover, trade credit insurance is often a cost-effective solution, typically priced at less than 1% of insured sales volume. Presenting your policy as a risk-reduction tool can help you secure larger borrowing bases. Additionally, the capital freed from reduced bad debt reserves can be reinvested into working capital, fueling further growth and expansion.

Balancing Risk Management with Growth Goals

Prioritizing High-Risk Customers and Markets

To effectively manage risk, start by identifying areas where your exposure is greatest. Focus on high-risk segments like new export markets, customers in politically volatile regions, or key accounts that make up a significant portion of your receivables. This approach helps address both commercial and political risks.

During the application process, pinpoint your top 15–20 customers for a detailed review by underwriters. This analysis helps define your risk profile and allows insurers to tailor coverage recommendations specifically for your needs. Insurers combine global economic insights with local expertise to evaluate unfamiliar markets while considering the legal and business dynamics of those regions. This blend of global perspective and local understanding equips you with the confidence to explore growth opportunities in areas you might otherwise avoid.

Adhering to Policy Terms to Protect Claims Eligibility

Once you’ve addressed high-risk exposure, it’s critical to safeguard your portfolio by strictly adhering to policy terms. Following these terms ensures your claims remain valid. For instance, insurers assign specific credit limits for each customer, and any losses that exceed these limits won’t be covered. If a customer’s credit starts to weaken or they fail to pay on time, continuing to sell to them on credit could jeopardize your future coverage.

Jason Benson, Global Head of Structured Working Capital at J.P. Morgan, underscores this point:

"If a customer’s credit begins to deteriorate or they’re not paying, and you continue to sell to them, that may be a potential issue [for policy coverage]."

Additionally, overdue accounts must be reported promptly. Delays in reporting could result in the loss of indemnification.

Leveraging Insurer Data for Smarter Customer Selection

Enhance your risk management strategies by utilizing insurer-provided data to make more informed customer decisions. Insurers offer tools like real-time financial solvency ratings and automated alerts that notify you of changes in a client’s creditworthiness. These resources allow you to actively monitor your exposure and adjust credit limits before defaults occur, shifting decision-making from subjective judgment to objective, data-driven criteria.

However, insurers also expect businesses to conduct their own due diligence. Jason Benson explains:

"Sellers should know their clients better than anybody. If a company isn’t doing its due diligence, it may be purchasing more insurance than is otherwise needed, or its insurance may be more expensive than it should be."

Incorporate insurer data into your sales processes to focus on prospects with stable financial health and a strong history of timely payments. Regular portfolio reviews with risk experts can help you fine-tune your coverage as global trade patterns and sector risks evolve. Considering that approximately 25% of corporate bankruptcies stem from payment defaults, proactive monitoring is essential to safeguard your growth investments.

sbb-itb-b840488

How to Implement Trade Credit Insurance in Your Business

Evaluating Your Current Risks and Growth Targets

Start by analyzing how much of your assets are tied up in accounts receivable. For many businesses, this can account for over 40% of total assets, making it a critical area to safeguard. Pay close attention to customer concentration – if your revenue relies heavily on just a few customers, your cash flow is at greater risk.

Next, review your current credit management processes. Can your team handle the reporting requirements that come with a trade credit insurance policy? This is crucial, especially when you consider that 82% of bankruptcies are due to cash flow issues stemming from non-payment by customers. With business bankruptcies in the U.S. projected to increase by 23.5% in 2025 compared to 2024, the need for protection is more pressing than ever.

James Daly, CEO and President of Euler Hermes, offers a compelling perspective:

"Rather than have capital in your balance sheet doing nothing but waiting for bad debt, why not purchase Trade Credit Insurance and then invest that excess capital into growth or new products?"

To make the most of trade credit insurance, identify your growth priorities. Are you aiming to expand into new markets, handle larger orders, or offer more flexible payment terms to remain competitive? Conduct a cost-benefit analysis comparing the premiums for trade credit insurance against the cost of maintaining reserves for bad debt. Additionally, consult your banking partners to see if insured receivables can help you secure better borrowing terms or increase your credit lines.

This thorough evaluation not only highlights your current risks but also sets the stage for selecting the most relevant policy features to support your business goals.

Choosing Policy Features That Match Your Business Goals

Decide whether you need to insure your entire receivables portfolio or focus on specific high-value transactions. For businesses with a high volume of sales, whole turnover coverage simplifies administration by protecting all eligible sales. On the other hand, key account coverage is a cost-effective option if you want to insure only large or higher-risk customers.

Look for a policy with an indemnity rate between 85% and 95% and premiums that typically stay under 1% of insured sales. This rate determines how much risk you’ll retain versus what the insurer will cover. Premiums often depend on factors like your historical losses, industry standards, and the creditworthiness of your customers.

Consider selecting policies with discretionary credit limits, which allow you to set credit terms for smaller accounts without needing approval from the insurer for every transaction. Keep in mind that most trade credit insurance policies exclude disputes over payment – if a customer claims issues like partial delivery or quality concerns, the insurer will typically only cover the undisputed portion.

Once you’ve tailored a policy to your needs, the next step is to integrate it into your daily operations for maximum impact.

Adding Credit Insurance to Your Daily Operations

To make your policy work seamlessly, align its reporting requirements with your existing sales and collections processes. Use the insurer’s buyer ratings as a tool to guide your credit decisions. This allows you to confidently offer favorable terms to low-risk customers while identifying and addressing higher-risk accounts early.

Set up automated alerts to track changes in your customers’ credit profiles. This real-time monitoring shifts your decision-making from guesswork to data-driven insights, enabling you to adjust credit limits before a problem arises.

If a customer fails to pay an invoice, notify your insurer right away. Many policies include debt collection services, and if the debt remains unrecoverable after the waiting period specified in your policy, the insurer will reimburse you based on your agreed indemnity rate. For businesses operating across multiple countries, a global policy can simplify administration by standardizing coverage terms.

Once integrated into your operations, trade credit insurance becomes a powerful tool for sustainable growth. Regularly review your portfolio with your insurer’s risk experts to ensure your policy adapts to changes in global trade and sector-specific risks. This ongoing partnership ensures your coverage evolves alongside your business, keeping you protected and primed for growth.

Protect the Future of your Business & Drive Growth Through Trade Credit Insurance

Conclusion

Trade credit insurance transforms how businesses approach growth by turning accounts receivable from a potential liability into an asset that works for you. Instead of setting aside funds to cover bad debts, you can redirect that capital into growth initiatives – whether it’s expanding into new markets, offering more attractive payment terms, or confidently accepting larger orders.

The global trade credit insurance market is expected to hit $18.14 billion by 2027, with an annual growth rate of 8.6%. This shows that more businesses are viewing it as a proactive tool for growth rather than just a safeguard. Considering that non-payment is one of the leading causes of bankruptcies, protecting your receivables is a critical step for ensuring long-term success.

But the advantages don’t stop at risk protection. Trade credit insurance also gives you access to real-time insights through ongoing monitoring. These insights help you make informed decisions, speed up your sales cycle, and identify high-value customers. Plus, insured receivables can serve as top-tier collateral, enhancing your standing with lenders and often leading to improved borrowing terms and larger credit lines .

To maximize the benefits, aligning your policy with your business strategy is key. Whether you’re growing domestically or venturing into international markets, trade credit insurance provides the financial stability to seize opportunities without taking on unnecessary risk. As Atradius aptly states:

"Trade credit insurance does more than protect against risk, it unlocks opportunities for growth".

With the right policy, you can offer better terms to customers, explore untapped markets, and scale your operations while keeping cash flow intact. This shift not only minimizes risk but also opens doors to new opportunities for growth.

FAQs

How can trade credit insurance help my business secure better financing options?

Trade credit insurance can help turn your accounts receivable into a powerful asset for securing financing. By acting as secured collateral, it often allows businesses to negotiate higher credit limits and better financing terms, like reduced interest rates.

With the added protection against non-payment, lenders feel more assured about your financial stability. This increased confidence can open doors to the funding you need to grow and scale your business with greater ease and security.

What risks does trade credit insurance protect against?

Trade credit insurance acts as a safety net for businesses, shielding them from risks that could disrupt cash flow and financial health. It provides protection against commercial risks, like when a customer becomes insolvent, delays payment, or fails to pay invoices altogether. On top of that, it also covers political risks, such as non-payment caused by government actions, trade restrictions, currency complications, conflicts, or other geopolitical challenges. With this protection in place, businesses can extend credit with greater confidence and pursue growth opportunities in new markets without unnecessary worry.

How does trade credit insurance help businesses expand into new markets?

Trade credit insurance supports business growth by safeguarding companies from the risk of customers failing to pay. With this protection in place, businesses can confidently extend competitive credit terms and access higher credit limits. This confidence opens the door to exploring new markets without the looming worry of financial setbacks.

Beyond protection, credit insurers often offer insights into the creditworthiness of potential customers, particularly in less familiar regions. These insights help businesses pinpoint trustworthy buyers, minimize risks, and simplify their sales processes. As a result, expanding into new markets becomes a more secure and efficient endeavor.