Investing in emerging markets can be risky, but Political Risk Insurance (PRI) helps protect businesses from losses caused by political instability.

Here’s what you need to know:

- PRI covers risks like expropriation, political violence, currency restrictions, and breach of contract.

- Real-world examples, like Caterpillar’s $2.64 million expropriation claim in Libya, show PRI’s role in financial recovery.

- Multilateral agencies like MIGA and IDA provide added protection, as seen in Turkey’s hospital project and Ghana’s infrastructure initiatives.

- PRI not only compensates losses but also improves credit profiles, making high-risk projects more attractive to investors.

Whether it’s safeguarding assets in unstable regions or securing funding for major projects, PRI turns unpredictable risks into manageable financial outcomes.

Case Study 1: Expropriation Claim in Libya

Claim Details and Triggers

In February 2011, Libya plunged into civil war after reports surfaced that Muammar Gaddafi’s military had launched airstrikes against rebel forces. Responding to the escalating crisis, the UN Security Council adopted Resolution 1970 on February 26, 2011. This resolution introduced measures like an arms embargo, travel bans, and asset freezes targeting the Gaddafi family and key government officials. Shortly after, Resolution 1973 was passed, authorizing the use of "all necessary means" to protect civilians, which led to a NATO-led intervention lasting from March 19 to October 31, 2011.

The NATO operation was extensive, involving 26,500 sorties over eight months, including 7,000 bombing missions. These missions resulted in the destruction of around 1,000 military assets, including 600 tanks or armored vehicles and 400 artillery or rocket launchers. The conflict culminated in the collapse of the Libyan government in October 2011, following Gaddafi’s death. This chaos brought international business operations to a standstill. For Caterpillar Financial Services Corporation, the combination of UN-imposed asset freezes and the government’s collapse led to an expropriation claim, as they were effectively cut off from accessing their funds and assets in Libya. This situation demanded a swift response from their insurer.

Policy Coverage

Caterpillar held Political Risk Insurance (PRI) through the Overseas Private Investment Corporation (OPIC). This insurance specifically covered expropriation, offering protection against government actions that stripped the company of essential rights to their assets. The policy came into play when the UN sanctions and Libya’s government collapse rendered Caterpillar unable to access or control their assets in the country. In response, OPIC compensated Caterpillar with a payout of $2.64 million, showcasing how PRI can translate political turmoil into measurable financial recovery.

Resolution and Lessons

After the claim was settled, Caterpillar transferred its rights to OPIC through a standard subrogation process. This allowed OPIC to seek recovery from the Libyan government or any future successors. The case underscores a key takeaway: even large, established companies operating in emerging markets are not immune to sudden and severe political instability. The rapid shift from stable operations to complete governmental breakdown in less than nine months highlights the importance of PRI as a safeguard for businesses navigating volatile environments.

Case Study 2: Hospital Project in Turkey

Project Background and Challenges

In the mid-2010s, Turkey was grappling with a significant healthcare shortage, offering just 2.6 hospital beds per 1,000 people – a stark contrast to the OECD average of 4.8 beds. To address this pressing issue, the Turkish Ministry of Health launched an ambitious €15–20 billion Health PPP program aimed at building approximately 30 integrated health campuses nationwide.

One standout example from this initiative is the Elazig Integrated Health Campus, a 1,038-bed facility designed to serve 1.6 million residents in Eastern Anatolia [9,11]. However, the project faced numerous challenges. Despite its investment-grade rating, global investors were hesitant due to the perceived risks associated with emerging markets. Turkey’s sovereign credit rating further complicated matters, acting as a ceiling that prevented individual projects from achieving the ratings required to attract institutional investors. On top of that, as a greenfield project, the hospital faced additional hurdles, such as operational and completion risks, along with political concerns like expropriation, currency transfer restrictions, and civil unrest [12,13].

These challenges underscored the importance of tailored Political Risk Insurance (PRI) in making such projects viable. Without effective risk mitigation, securing the €288 million in funding required for the project would have been an uphill battle. This scenario called for innovative solutions to address the risks, which are detailed below.

MIGA and EBRD Risk Mitigation

In December 2016, a consortium led by Meridiam and Rönesans Holding successfully reached financial close using a dual-layered protection strategy [9,10]. The Multilateral Investment Guarantee Agency (MIGA) played a key role by offering a 20-year political risk guarantee worth €306.4 million ($326 million). This guarantee protected the project against non-commercial risks, such as transfer restrictions, expropriation, and contract breaches [9,11]. At the same time, the European Bank for Reconstruction and Development (EBRD) stepped in with a liquidity facility to further enhance the bond’s credit profile.

Thanks to these measures, the bond received a Baa2 rating from Moody’s – two notches higher than Turkey’s sovereign debt rating [9,10]. This structure effectively separated the project’s credit risk from the country’s overall risk, overcoming the sovereign ceiling that had previously deterred similar investments. Additionally, the bond was certified as a "green and social bond" by Vigeo EIRIS, marking its first use in financing a greenfield hospital PPP in Turkey [9,10].

"Our political risk coverage for this bond, with the rating from Moody’s, brought in capital market participants to finance this infrastructure PPP project." – Keiko Honda, Executive Vice President and CEO, MIGA

This improved credit profile attracted a diverse group of institutional investors, including FMO, IFC, ICBC, Intesa Sanpaolo, MUFG, Siemens Financial Services, and Proparco. The combination of political risk insurance and liquidity support helped secure better credit terms and boosted investor confidence.

Results and Takeaways

The Elazig hospital project, financed with €288 million, achieved several important milestones. It created over 7,000 direct and indirect jobs during its construction and operational phases, while addressing critical healthcare needs in a region with aging infrastructure. The 25–27-year contract structure provided sufficient returns to attract private capital, ensuring sustainable healthcare delivery over the long term [10,12].

This project also set a precedent for financing infrastructure in emerging markets. It demonstrated how credit enhancement mechanisms can expand the pool of potential investors and unlock new funding sources – providing a model for similar initiatives within Turkey’s Health PPP program. The case showed that well-designed PPP frameworks, coupled with clear revenue mechanisms, can overcome sovereign credit constraints when paired with solutions like political risk insurance and liquidity support. Multilateral organizations such as MIGA and EBRD played a pivotal role in turning what might have been an unworkable project into one that appealed to ESG-focused institutional investors [9,10].

This example highlights how targeted risk mitigation strategies can transform high-risk projects into viable, investment-grade opportunities.

Case Study 3: Infrastructure Projects in Ghana, Indonesia, and Brazil

Risk Events and Coverage

Infrastructure projects in Ghana, Indonesia, and Brazil faced risks that were closely tied to their sovereign credit ratings, ranging from B– to BBB. In Ghana, the Sankofa Gas Project emerged as a response to severe energy shortages and unstable commodity prices. With the support of World Bank guarantees, the project successfully attracted nearly $8 billion in private investment, making it the largest foreign direct investment in Ghana’s history. This initiative tackled several political risks, including currency inconvertibility, transfer restrictions, and the possibility of a government contract breach.

Additionally, Ghana utilized a Policy-Based Guarantee (PBG) from 2015 to 2024 to address a separate financial crisis. Confronted with high debt levels and limited international market access in 2015, the Ministry of Finance secured a $1 billion Eurobond series, backed by an IDA guarantee for $400 million covering both principal and interest. When Ghana declared a debt moratorium in December 2022, IDA fulfilled its obligations by making guarantee payments in April 2023, October 2023, and April 2024. This demonstrated the strength of political risk insurance (PRI) in providing dependable protection when political risks arise.

In Brazil (rated BB) and Indonesia (rated BBB), while the risks were less severe compared to Ghana, they still required careful management. Both countries sought PRI coverage to guard against political violence, expropriation, and currency transfer restrictions, especially for investments with long-term horizons of 10 to 20 years. In these cases, PRI served as a critical safeguard against unpredictable risks.

This tailored approach to risk coverage not only minimized potential losses but also improved the credit profiles of the projects involved.

Credit Rating Improvements and Capital Access

The financial advantages of PRI varied significantly depending on each country’s starting credit profile. For example, in Ghana, PRI reduced the risk premium by 4.07 percentage points, lowering it from 6.30% to 2.23%, and elevating the project’s credit rating from B– to BBB. In Brazil and Indonesia, the reductions were also notable, with premiums dropping from 2.91% to 1.41% and 1.84% to 1.05%, respectively, resulting in A– ratings. Ghana’s refinancing of its debt through the IDA guarantee achieved even greater benefits, cutting interest rates from 25% to 10.75% and extending debt maturities from less than two years to an average of 15 years.

"The reduction [of the country risk premium] alone can more than justify the cost of PRI, without even taking into account the benefits of claim payments if an insured event happens." – Julie Martin and Kenneth Hansen, Marsh McLennan and Norton Rose Fulbright

These credit improvements directly enhanced access to capital. By lowering discount rates, projects that once seemed financially unfeasible became viable, allowing them to meet investors’ internal hurdle rates. With PRI pricing ranging between 50 and 300 basis points, the cost of coverage was easily offset by the substantial reduction in borrowing costs. This underscores how customized PRI solutions not only boost market confidence but also make high-risk projects attractive to investors. These tailored interventions highlight the transformative role of PRI in turning potentially risky ventures into investment-grade opportunities.

Political Risk Insurance Amid Unrest: WTW‘s Laura Burns

sbb-itb-b840488

Comparison of Claim Outcomes

Political Risk Insurance Case Studies Comparison: Libya, Turkey, and Ghana Infrastructure Projects

Key Metrics Comparison Table

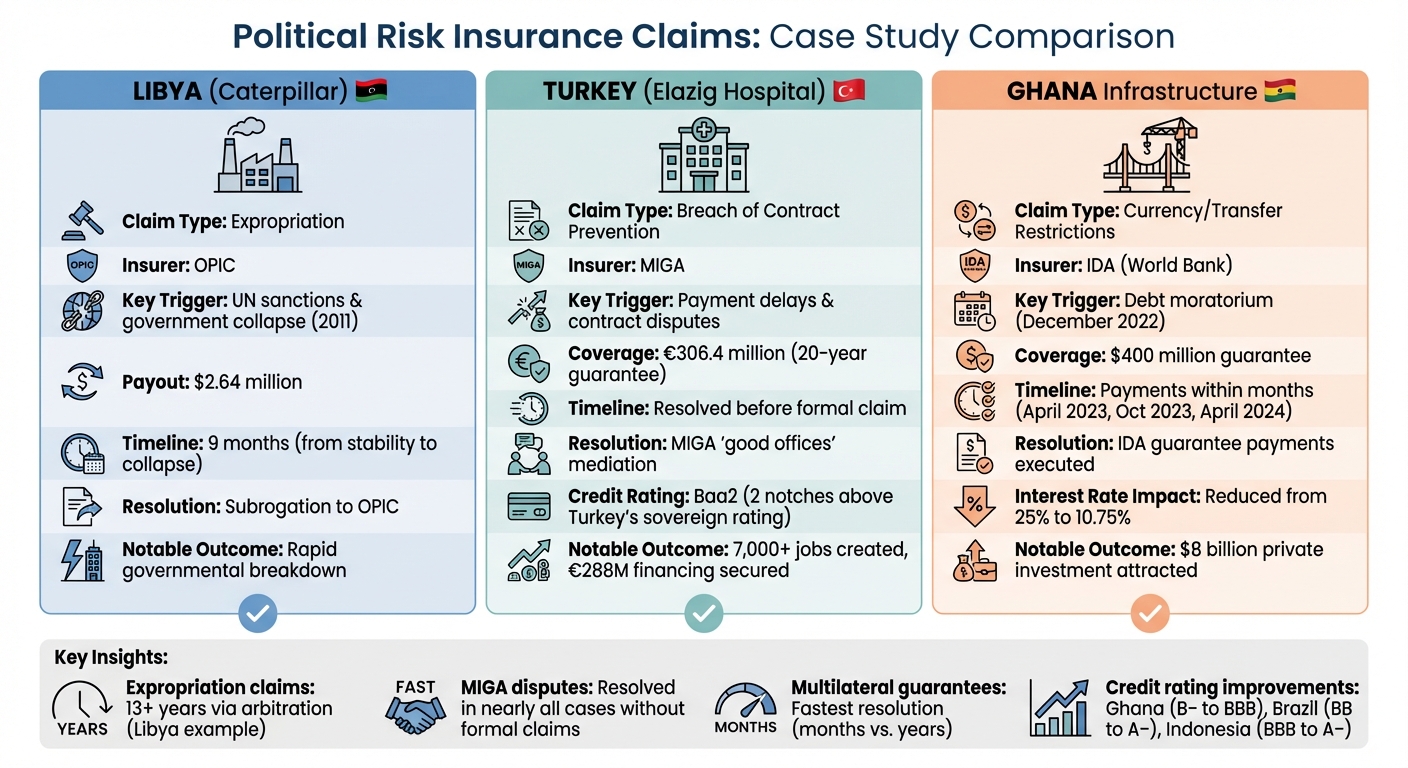

When analyzing political risk claims in emerging markets, the three case studies highlight distinct variations in triggers, resolution methods, and timelines. Each case underscores the unique hurdles posed by different risk types, the insurers involved, and the host country’s ties to multilateral institutions.

| Case Study | Claim Type | Insurer | Key Trigger | Resolution Approach | Timeline | Notable Outcome |

|---|---|---|---|---|---|---|

| Libya (Olin Holdings) | Expropriation | International Arbitration (Cyprus-Libya BIT) | Government eviction order (Decision No. 241) issued right after 2006 factory completion | International arbitration proceedings | Over 13 years (2006–2019+) | Lengthy process, damages report published July 2019 |

| Turkey Hospital | Breach of Contract | MIGA | Government contract disputes and payment delays | MIGA "good offices" mediation and deterrence | Resolved before formal claim | Dispute resolved without formal claim escalation using World Bank Group leverage |

| Ghana, Indonesia, Brazil Infrastructure | Currency/Transfer Restrictions | World Bank (IDA)/MIGA | Debt moratorium (Ghana 2022), currency restrictions, political violence risks | IDA guarantee payments; preventive coverage | Within months | Ghana received $400 million guarantee coverage; interest rates dropped from 25% to 10.75% |

These cases reveal significant contrasts in how claims are handled. For example, expropriation claims, like Libya’s, often require drawn-out arbitration under bilateral treaties. Libya’s case spanned over 13 years, with a damages report only emerging in 2019. On the other hand, MIGA’s strategy in Turkey focused on early intervention. By leveraging its "good offices" function, MIGA resolved the issue without escalating to a formal claim. According to MIGA, it has successfully resolved disputes that could have resulted in claims in nearly all cases, with only two exceptions.

Ghana’s infrastructure case illustrates the efficiency of multilateral guarantees. When Ghana declared a debt moratorium in December 2022, the IDA guarantee enabled payments within months, quickly providing liquidity to investors.

The role of deterrence also varied. In Turkey and Ghana, the involvement of World Bank Group entities (MIGA and IDA) acted as a strong incentive for host governments to fulfill their obligations, as non-compliance could harm their relationships with key development partners. In contrast, Libya’s reliance on bilateral treaty arbitration lacked the leverage of a multilateral insurer, leading to a slower and less predictable process. These comparisons offer valuable insights for shaping political risk insurance strategies in trade credit insurance.

Lessons for Tailored PRI in Trade Credit Insurance

Customizing PRI for Emerging Markets

Emerging markets come with unique challenges that demand customized Political Risk Insurance (PRI). Standardized policies often fall short in addressing the specific risks these markets present. Take Libya, for example – businesses there required coverage against creeping expropriation and contract cancellations. In Ghana, on the other hand, the focus was on mitigating risks like currency inconvertibility and restrictions on fund transfers.

Different industries also face varying threats, making it essential to align coverage with sector-specific needs. Private insurers, such as Lloyd’s syndicates, excel in offering tailored solutions, while public entities like the U.S. International Development Finance Corporation (DFC) can provide coverage up to $1 billion. However, DFC policies often come with stricter requirements, such as nationality stipulations. Whether the concern is confiscatory taxation, forced abandonment, or delays in currency exchange approvals, the key lies in crafting policies that reflect the actual risk landscape. This approach sets the stage for integrating PRI with trade credit insurance.

Trade Credit Insurance and PRI

When combined, PRI and trade credit insurance create a robust safety net, addressing risks ranging from geopolitical disruptions – like currency controls or canceled export/import licenses – to commercial non-payment caused by insolvency.

For businesses like custom manufacturers, pre-shipment endorsements can protect production costs, ensuring smoother operations even when disruptions occur. The Export-Import Bank of the United States (EXIM) further strengthens this framework by processing claims within 60 days, offering a faster alternative to lengthy arbitration processes. Together, PRI and trade credit insurance allow companies to recover losses tied to unpaid invoices, whether the cause is a domestic financial failure or a foreign policy crisis. For more detailed guidance, businesses can explore practical resources available through CreditInsurance.com.

Using CreditInsurance.com for Solutions

To navigate the complexities of PRI and trade credit insurance, companies need actionable insights – and that’s where CreditInsurance.com comes in. The platform offers tools and resources to help businesses integrate PRI with trade credit insurance effectively. It provides guidance on addressing risks like non-payment, customer insolvency, and political disruptions.

For example, the platform helps businesses assess coverage options for issues like currency inconvertibility or breached contracts. It also assists in structuring policies that address nuanced risks across multiple countries. Companies can explore coverage limits – for instance, AXIS offers up to $50 million for political risks and $40 million for credit risks – and understand key policy details, such as the standard 10% deductible. Additionally, CreditInsurance.com supports coordination with claims teams to handle political events that might disrupt transactions. For businesses entering high-risk markets, these resources simplify complex insurance concepts, turning them into practical strategies for risk management.

Conclusion

Political risk insurance has evolved far beyond being a mere safety net – it’s now a key strategic tool for businesses operating in emerging markets. The case studies discussed, such as the expropriation claim in Libya and infrastructure challenges in Ghana, Indonesia, and Brazil, highlight an important trend: expropriation often occurs through gradual regulatory hurdles rather than abrupt nationalization. These examples underscore the importance of proactive, customized strategies to manage risks effectively.

To navigate volatile markets, businesses should prioritize securing documented government guarantees, closely monitor local legal developments, and ensure they have appropriate coverage in place before committing to high-risk regions. With 74% of multinational companies identifying geopolitical risk as one of their top five concerns, combining political risk insurance with trade credit insurance provides a robust framework. This dual approach addresses both payment defaults and broader disruptions caused by political instability.

"Political risk insurance is no longer just a safety net. It’s a strategic enabler." – Laura Burns, Head of Political Risk, North America at Willis Credit Risk Solutions

CreditInsurance.com builds on these insights by offering tools and resources to help businesses explore tailored insurance options. From structuring multi-country policies to managing claims during political upheavals, the platform ensures companies are equipped to protect major projects and mitigate risks tied to sovereign defaults. By leveraging the right mix of political risk and trade credit insurance, businesses can turn high-risk markets into opportunities worth pursuing.

FAQs

How does Political Risk Insurance enhance credit profiles in emerging markets?

Political Risk Insurance plays a key role in improving credit profiles for businesses operating in emerging markets. It does this by lowering the country-risk premium often tied to borrowers in these regions. This reduction can boost internal rates of return, making borrowers more appealing to both lenders and investors.

By addressing risks such as political instability, expropriation, or challenges with currency conversion, this insurance offers businesses a layer of financial protection. It also opens doors to improved financing options, making it an essential resource for companies aiming to navigate the uncertainties of expanding into emerging markets.

How do multilateral agencies support infrastructure projects in high-risk countries?

Multilateral agencies, like the World Bank Group’s Multilateral Investment Guarantee Agency (MIGA), play a key role in supporting infrastructure projects in markets that are considered high-risk or unstable. They offer political-risk insurance and credit-enhancement tools to shield investors from challenges such as expropriation, currency inconvertibility, war, civil unrest, or breach of contract. By reducing these risks, these agencies make it easier and more affordable for private investors to secure financing.

Take the Azura-Edo power plant in Nigeria, for instance. This project successfully secured a $900 million financing package, thanks in part to MIGA guarantees. Similarly, in the Democratic Republic of Congo, a solar-hybrid mini-grid project, backed by MIGA, brought electricity to underserved areas. These examples highlight how such guarantees not only protect investments but also ensure stability and promote economic growth in difficult environments.

For businesses looking to safeguard their cross-border investments or learn more about political-risk insurance, CreditInsurance.com offers valuable resources and customized solutions.

How can businesses tailor Political Risk Insurance to address industry-specific challenges?

Businesses can shape political risk insurance to fit their needs by pinpointing the specific risks their industry faces and selecting coverage that directly addresses those challenges. For instance, a manufacturing exporter might focus on insuring against contract interruptions or the unfair calling of bonds. Meanwhile, a mining company might prioritize coverage for risks like expropriation, embargoes, or political violence.

Customizable policies give businesses the flexibility to insure against the threats that matter most to them, adjust coverage periods to align with project timelines, and manage costs to fit their budgets. By taking advantage of these options, companies can build a political risk insurance plan that addresses their most pressing concerns. CreditInsurance.com provides resources to guide businesses in understanding and applying these strategies effectively.