For U.S. exporters, accurate customs valuation is critical to avoid penalties, ensure smooth trade operations, and align with credit insurance policies. Customs valuation determines the value of exported goods, which importing countries use to calculate duties and taxes. The transaction value method, based on the price paid or payable, is the primary approach. Exporters must include costs like packing, royalties, and commissions while excluding post-importation costs and duties when declaring value.

Export credit insurance protects against buyer non-payment due to insolvency, defaults, or political risks and supports cash flow by enabling advance rates up to 90%. However, discrepancies between declared customs value and insured amounts can cause issues. Proper documentation, such as invoices and contracts, is essential for both compliance and insurance claims.

Key updates in 2025, like the suspension of the duty-free de minimis exemption for most shipments under $800, add new compliance challenges. Exporters must maintain precise documentation and valuations to meet customs and insurance requirements. Visit CreditInsurance.com for detailed guidance.

U.S. Customs Value Explained

Transaction Value as the Primary Valuation Method

The transaction value method stands as the primary approach for customs valuation. It relies on the "price actually paid or payable" for goods sold for export to the United States. In essence, this method reflects the actual sales price agreed upon between the buyer and seller.

"The Agreement stipulates that customs valuation shall, except in specified circumstances, be based on the actual price of the goods to be valued, which is generally shown on the invoice. This price, plus adjustments for certain elements listed in Article 8, equals the transaction value, which constitutes the first and most important method of valuation referred to in the Agreement." – World Trade Organization

This method captures the total amount paid or payable, which includes all payments made as a condition of sale. These payments can be direct, indirect, or even involve settling debts owed by the seller. The final price may also reflect negotiated discounts or pricing formulas agreed upon by the parties involved. Before diving into the components of this method, it’s essential to grasp how these factors shape the transaction value.

Components of Transaction Value

The transaction value isn’t simply the price listed on an invoice. Specific additions must be included in the actual sales price if they are not already factored in.

These additions include:

- Packing costs incurred by the buyer.

- Selling commissions paid by the buyer.

- The value of any "assist" provided by the buyer, such as materials, tools, molds, or engineering work performed outside the U.S..

- Royalties or license fees related to the imported goods that the buyer is obligated to pay as a condition of sale.

- Proceeds from the resale, disposal, or use of the goods that benefit the seller.

On the other hand, certain costs are specifically excluded from the transaction value if they are itemized separately. These exclusions include:

- Construction, assembly, or maintenance costs incurred after the goods are imported into the U.S.

- Transportation costs after importation.

- Customs duties and federal taxes payable on importation.

- International transportation and insurance costs, provided they are separately identified.

- Foreign inland freight and related charges occurring after the goods are sold for export and placed with a carrier for through shipment.

Accurate transaction values play a critical role in financial protection, especially under credit insurance policies. Undervaluing goods – even unintentionally – can leave a gap between actual losses and insurance payouts. Credit insurance only covers buyer non-payment, not shipping losses, making precise valuation crucial.

Documentation Requirements for Transaction Value

Customs authorities require thorough documentation to verify transaction values. U.S. Customs and Border Protection typically requests commercial invoices, contracts, and purchase orders to confirm the sale for export. A through bill of lading or similar document is also needed to establish that goods were sold for export and placed for through shipment. This documentation is especially important when excluding foreign inland freight from the transaction value.

Proper documentation isn’t just about value calculation – it’s also key for compliance and insurance purposes.

"Customs valuation based on the transaction value method is largely based on documentary input from the importer. Article 17 of the Agreement confirms that customs administrations have the right to ‘satisfy themselves as to the truth or accuracy of any statement, document or declaration.’" – World Trade Organization

Exporters should keep detailed records showing how the transaction value was determined, including all additions and exclusions. These records not only ensure compliance with customs regulations but also provide critical support for credit insurance claims in cases of buyer non-payment. The declared value on customs documents must accurately reflect the true transaction value to secure proper coverage under both shipping and credit insurance policies.

Adjustments and Deductions in Customs Valuation

Knowing which costs can be adjusted or deducted from the customs value is crucial for managing duty payments and ensuring the accuracy of credit insurance coverage. Mistakes in these calculations can lead to penalties from CBP or gaps in credit insurance. To avoid these issues, it’s essential to understand what should be included, what can be excluded, and to maintain thorough documentation to back up your declarations. These adjustments help reconcile invoice amounts with the final customs valuation, ensuring alignment with credit insurance policies.

Freight, Insurance, and Post-Importation Costs

Costs related to international freight and insurance can be excluded from the dutiable value, but only if they are clearly identified and occur after the merchandise is sold for export to the U.S. and handed over to a carrier for through shipment. This exclusion can lower duty payments, but it requires proof, such as a through bill of lading, showing the sale for export and the placement for shipment.

Other post-importation expenses, like construction, assembly, maintenance, technical assistance, or further transportation, should also be excluded from the transaction value. Additionally, customs duties and federal taxes on imported goods must be separated and excluded from the customs valuation.

For exporters relying on credit insurance, maintaining consistent values between customs declarations and insurance documentation is critical. Undervaluing goods might reduce duties but can lead to CBP penalties or re-appraisals, potentially complicating credit insurance claims if the declared value deviates too much from the actual transaction value. On the flip side, overvaluing goods can result in unnecessarily high duties and disagreements with insurers if the insured amount is based on an inflated customs value.

Assists, Royalties, and Commissions

In addition to freight and post-importation costs, adjustments may also involve assists, royalties, and commissions. Assists – such as materials, components, tools, dies, molds, and engineering work provided to the foreign producer but not included in the sales price – must be added to the customs value.

"The transaction value of imported merchandise is the price actually paid or payable for the merchandise when sold for exportation to the United States, plus amounts equal to… any royalty or license fee related to the imported merchandise that the buyer is required to pay." – U.S. Code

Royalties and license fees must be added to the customs value if they are a condition of the sale for export to the U.S.. Typically, royalties tied to manufacturing processes are dutiable, while those related to U.S. copyrights or trademarks are not. Similarly, any selling commission paid by the buyer must also be added to the customs value.

Accurate customs valuations are more than just a regulatory requirement – they’re essential for ensuring your credit insurance coverage aligns with your actual transactions. This consistency helps support accurate duty assessments and strengthens your credit insurance protection. For more guidance on aligning customs valuation practices with credit insurance needs, explore the resources available at CreditInsurance.com.

sbb-itb-b840488

Alternative Valuation Methods

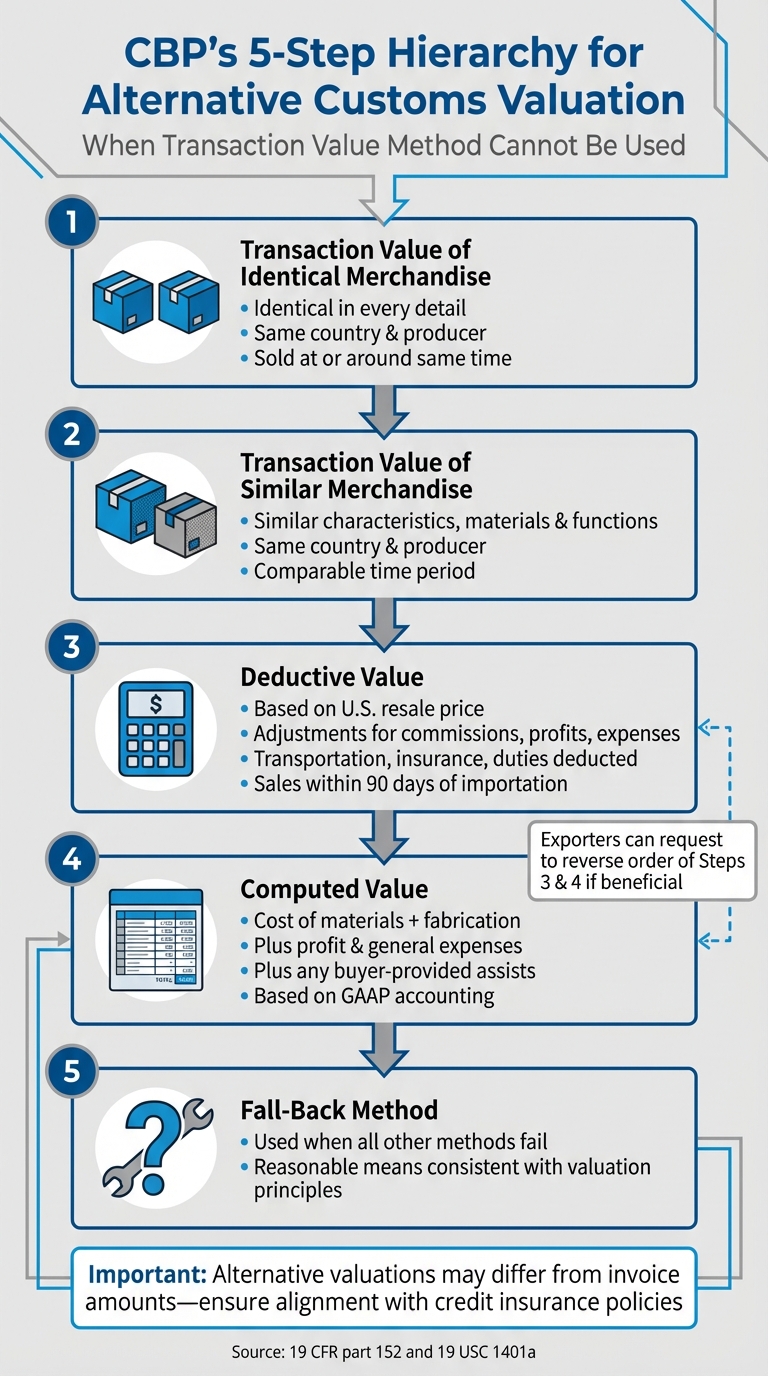

CBP Alternative Customs Valuation Methods Hierarchy

When the transaction value method cannot be used – due to factors like related-party transactions, consignment sales, barter arrangements, or missing documentation – U.S. Customs and Border Protection (CBP) follows a structured process outlined in 19 CFR part 152 and 19 USC 1401a. CBP applies these alternative methods in a specific order to establish a valuation that meets requirements for both customs declarations and credit insurance.

Sequential Methods for Determining Customs Value

CBP uses a five-step hierarchy to determine the customs value of imported goods:

- Transaction Value of Identical Merchandise

This method is used when the imported goods are identical to merchandise sold for export to the U.S. The items must match in every detail, be made in the same country by the same producer, and sold at or around the same time. - Transaction Value of Similar Merchandise

If no identical merchandise is available, CBP evaluates similar goods. These are items that share key characteristics, materials, and functions with the imported goods and are made in the same country by the same producer. - Deductive Value

When neither identical nor similar goods are available, CBP determines value based on the unit price at which the imported goods (or similar/identical ones) are sold in the largest quantity to unrelated buyers in the U.S. Adjustments are made for commissions, profits, general expenses, transportation, insurance, customs duties, federal taxes, and any additional processing costs. Sales made up to 90 days after importation may also be considered. - Computed Value

This method calculates value by summing the cost of materials and fabrication, adding an amount for profit and general expenses typically seen in export sales, and including any assists provided by the buyer. Exporters can sometimes request to reverse the order of deductive and computed value methods if it better suits their circumstances. - Fall-Back Method

If none of the above apply, CBP uses the fall-back method, which relies on reasonable means consistent with valuation principles.

Understanding these methods is essential for ensuring that customs values align with credit insurance requirements.

How Alternative Methods Affect Exporters with Credit Insurance

Using alternative valuation methods can create discrepancies between the customs value declared to CBP and the transaction value listed on your credit insurance policy. For example, under the deductive or computed value methods, the customs value may differ significantly from the invoice amount. This is particularly important because credit insurance policies typically cover the agreed transaction value – not CBP’s calculated valuation.

Proper documentation is critical when using these alternative methods. For the computed value method, you’ll need detailed records of production costs, materials, fabrication expenses, and profit margins, all prepared according to generally accepted accounting principles (GAAP). Similarly, the deductive value method requires comprehensive documentation of unit pricing, sales data, and deductions. During audits, customs authorities may review financial records, invoices, contracts, and transfer pricing agreements to verify declared values. Proactively addressing potential valuation issues or seeking advance rulings from CBP can help avoid disputes that could complicate credit insurance claims.

These potential valuation differences highlight the importance of staying informed about regulatory developments that affect both customs practices and credit insurance. For more detailed guidance on aligning customs valuations with credit insurance policies, visit CreditInsurance.com.

2025 Regulatory Updates for Exporters

Changes in Customs Valuation Rules

In 2025, President’s Executive Order 14324 brought a significant change by suspending the duty-free de minimis exemption. This means low-value shipments – those previously valued at $800 or less – are no longer exempt from duties and tariffs when entering the U.S. The only exception is for goods shipped through the international postal network, which still qualify for duty-free treatment.

Additionally, U.S. Customs and Border Protection (CBP) has proposed updates to the administrative exemption rules under 19 U.S.C. 1321(a). According to these proposals, merchandise tied to specific trade or national security measures – such as those under Sections 232, 201, or 301 – would no longer qualify for the administrative exemption for shipments valued at $800 or less. However, the primary customs valuation methods, as outlined in 19 USC 1401a, remain unchanged as of December 16, 2025. These regulatory shifts not only influence how duties are assessed but also place greater emphasis on documentation, which is critical for exporters relying on credit insurance.

How These Changes Affect Insured Exporters

For exporters with credit insurance, these changes introduce new compliance challenges. The removal of the de minimis exemption means that shipments previously duty-free now require full customs declarations and payment of duties. This makes accurate and thorough documentation more important than ever – not just to meet U.S. Customs and Border Protection standards but also to comply with credit insurance requirements.

The proposed restrictions on administrative exemptions for goods affected by Sections 232, 201, or 301 add another layer of complexity. Exporters must ensure meticulous record-keeping and precise valuation of goods to avoid compliance issues. For tailored guidance on aligning your documentation practices with credit insurance policies, visit CreditInsurance.com.

Conclusion

Customs Valuation Essentials

For U.S. exporters, understanding customs valuation rules is a cornerstone of staying compliant and maintaining financial stability. The transaction value method – calculated based on the price actually paid or payable – serves as the primary approach for determining customs duties in destination countries. At the heart of this process is your commercial invoice, which foreign customs authorities rely on to assess duties and taxes. This makes accuracy absolutely essential. Separating costs correctly not only ensures compliance but also safeguards your insurance coverage. On the flip side, errors in documentation can lead to delays, penalties, and cash flow disruptions. By adhering to precise valuation practices, exporters can effectively manage risks and secure strong credit insurance protection.

Using Credit Insurance for Export Success

Accurate customs valuation lays the groundwork for leveraging export credit insurance, a financial tool that provides much more than protection against non-payment. This type of insurance covers both commercial risks – like buyer insolvency or extended payment delays – and political risks, including war, currency restrictions, and sudden regulatory changes. The cost of credit insurance is modest compared to the value of insured sales, making it an investment that enables exporters to offer competitive open account terms and improve their borrowing potential. With this coverage, businesses can confidently extend favorable payment terms to international buyers, explore new markets, and use insured receivables to strengthen their position with lenders. For personalized advice on export credit insurance, check out CreditInsurance.com.

FAQs

What costs are included in the transaction value for customs purposes?

The transaction value represents the total price paid or owed for imported goods, with certain additional costs factored in. These costs often include freight, insurance, packing, commissions, royalties, license fees, and any assists (like materials or services provided by the buyer to aid production). It also accounts for charges tied to transporting goods to the U.S. port of entry.

Grasping these elements is crucial for accurate customs valuation. For U.S. exporters, especially those using trade credit insurance, proper valuation helps ensure compliance with regulations and minimizes the risk of penalties or shipment delays.

What impact do the 2025 customs updates have on exporters using credit insurance?

Starting May 14, 2025, U.S. exporters will need to adapt to updated customs regulations requiring more detailed and accurate transaction data on invoices. Key changes include adjustments such as "tariff unstacking", expanded limits on the number of HTS codes allowed per entry, and updates to the Global Business Identifier enrollment process.

These changes are set to influence credit insurance processes by tightening how underwriting and claim verification are handled. Insurers will use the more detailed customs documentation to evaluate risks and confirm claims, making it crucial for exporters to maintain precise and compliant records under the new guidelines.

Why is accurate documentation important for customs compliance and credit insurance claims?

Accurate documentation plays a crucial role in meeting the requirements set by U.S. Customs and Border Protection (CBP). This includes providing detailed information such as product descriptions, quantities, values, and other essential details. Having the right paperwork not only ensures compliance but also helps you steer clear of customs delays, penalties, or fines.

When it comes to credit insurance claims, keeping thorough records is equally important. These documents act as essential proof in cases of non-payment or disputes. By maintaining well-organized and precise documentation, you safeguard your business from financial risks while making customs procedures and insurance claims more efficient.