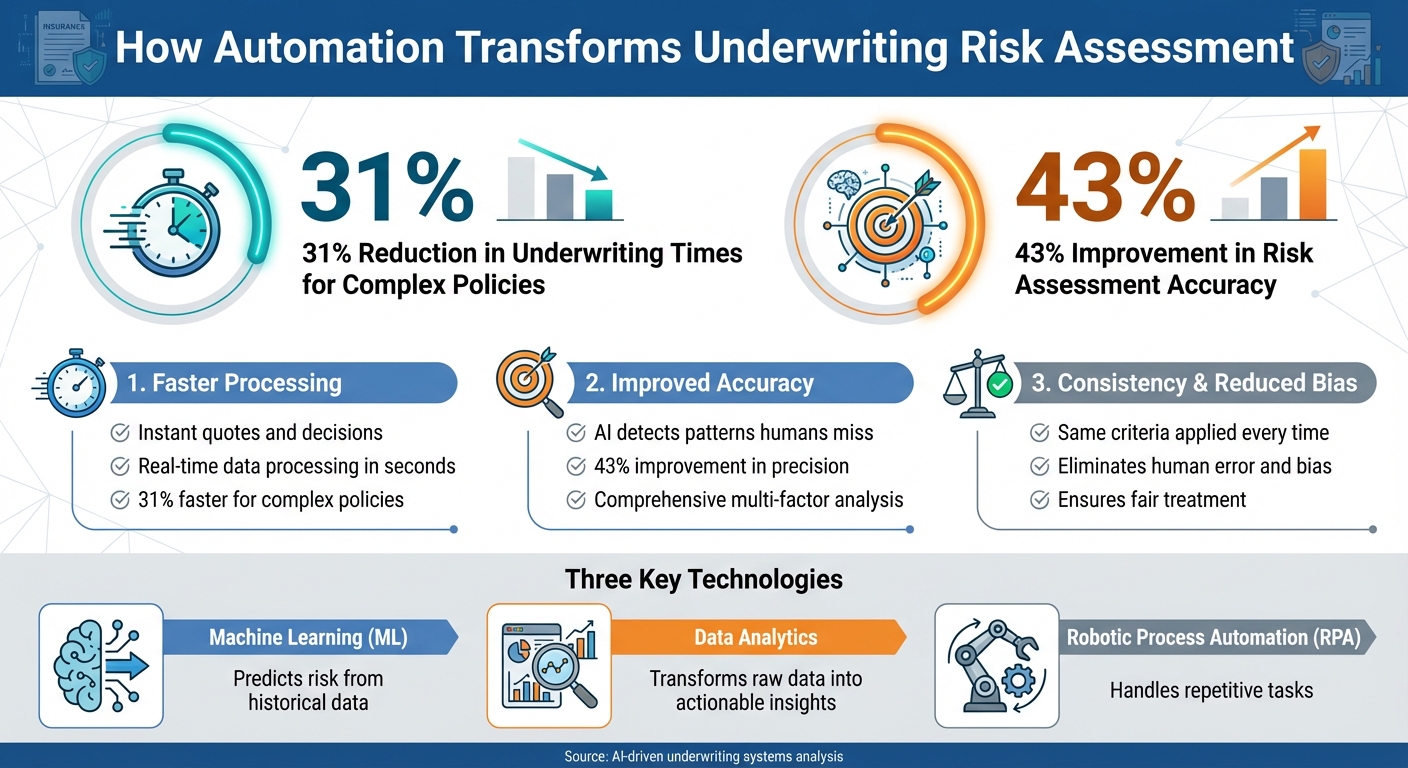

Automation is transforming underwriting by making risk assessment faster, more accurate, and consistent. Manual processes struggle to handle the growing volume of data, leading to delays, errors, and inconsistencies. Automated systems use machine learning (ML), data analytics, and robotic process automation (RPA) to process data in seconds, identify patterns, and reduce human bias. Here’s what you need to know:

- Faster Processing: Automation reduces underwriting times by 31% for complex policies, enabling instant quotes and decisions.

- Improved Accuracy: AI-driven tools improve risk assessment precision by 43%, detecting patterns humans might miss.

- Consistency: Automated systems apply the same criteria every time, reducing errors and ensuring fair treatment.

- Real-Time Data: APIs pull the latest information – credit scores, payment histories, and economic trends – for up-to-date decisions.

For U.S. credit and accounts receivable insurance, automation handles tasks like monitoring buyer portfolios, adjusting credit limits, and flagging risks in real-time, providing businesses with faster, more reliable decisions while freeing underwriters to focus on complex cases.

How Automation Transforms Underwriting: Key Benefits and Statistics

Problems with Manual Risk Assessment in Underwriting

Too Much Data to Process Manually

Underwriters today are drowning in a sea of digital data that manual methods simply can’t keep up with. Risk assessments demand sifting through a wide range of sources – credit reports, financial statements, loss runs, claim histories, and more. Many of these come in unstructured formats like PDFs and spreadsheets, making consistent and accurate analysis a real challenge. Automated systems are built to handle such complexities, but manual processes often fall short.

This issue becomes even more pronounced in commercial and specialty insurance lines. Underwriters in these areas often spend far more time collecting and cleaning data than they do actually analyzing risks. Take loss runs, for example – deciphering these documents is a notoriously time-consuming task. For U.S. businesses seeking credit insurance or accounts receivable protection, the workload can be staggering. Assessing non-payment risks involves combing through massive buyer portfolios, a task that traditional spreadsheet-based methods struggle to handle when monitoring numerous accounts simultaneously. This overwhelming amount of data increases the likelihood of mistakes when human judgment comes into play.

Human Error and Individual Bias

When underwriting relies on manual processes, errors and biases are almost inevitable. Interpreting large datasets under tight deadlines can lead to mistakes like data entry errors and inconsistent application of underwriting guidelines. Cognitive biases also come into play, causing underwriters to assess similar cases differently. This inconsistency can result in varying premiums and coverage terms for applicants who should be treated similarly.

Another major drawback is the inability to detect subtle patterns in unstructured data. Automated, data-driven systems excel at spotting these nuances, while manual methods often miss them entirely. For businesses without credit insurance, these gaps in risk assessment can translate into lengthy legal disputes and only partial recovery of owed amounts after drawn-out collection efforts. These inconsistencies not only delay processing but also undermine the reliability of manual underwriting.

Slow Turnaround Times

Manual underwriting workflows – relying on email, spreadsheets, and rekeying data from PDFs – are inherently slow. Reviewing complex financial statements and credit reports can take days or even weeks. This sluggish pace hampers businesses’ ability to seize market opportunities and meet buyers’ growing expectations for instant or same-day quotes. Each document is processed one at a time, further constrained by office hours and workload limits.

For credit and trade credit decisions, these delays directly impact sales and cash flow. Without timely risk assessments, businesses may hesitate to extend credit, leading to missed revenue opportunities and limiting their market reach. As submission volumes increase and data becomes more complex, manual processes can create bottlenecks, inflate underwriting costs per policy, and hurt profitability. These inefficiencies divert resources away from essential business functions, ultimately stifling growth and operational effectiveness.

AI Automation in Underwriting: Improving Risk Assessment Processing

Technologies That Enable Automated Risk Assessment

The way underwriters assess risk is being reshaped by three powerful technologies: machine learning, data analytics, and robotic process automation (RPA). Together, these tools form a streamlined system that delivers quicker, more precise decisions. Below, we explore how each technology contributes to this transformation.

Machine Learning for Risk Prediction

Machine learning (ML) algorithms excel at analyzing historical data – like claim histories, payment records, and behavioral patterns – to uncover trends that might go unnoticed by human underwriters. For instance, insurers leveraging ML have improved risk segmentation by spotting subtle patterns tied to higher claims rates, leading to sharper evaluations. These algorithms are particularly adept at identifying complex relationships within applicant data, something manual processes struggle to achieve. Over time, ML systems refine their predictions, creating a feedback loop that continuously enhances accuracy.

Working alongside ML, data analytics takes raw information and turns it into meaningful insights.

Data Analytics for Better Insights

Data analytics transforms data from sources like market reports, customer records, and financial statements into clear, actionable insights. A great example is CreditInsurance.com’s "Business Non-Payment Risk Analyzer", a tool that evaluates customer non-payment risk by analyzing inputs such as credit scores and payment histories, offering a risk percentage along with practical recommendations. Advanced analytics platforms also specialize in processing unstructured data, uncovering trends in buyer behavior and market dynamics that can indicate potential risks. These insights help insurers refine pricing strategies with confidence, moving beyond reliance on intuition. Additionally, AI-powered analytics has been shown to cut underwriting times for complex policies by 31%, all while improving accuracy.

While ML and data analytics enhance decision-making, RPA takes over repetitive tasks, completing the automation framework.

Robotic Process Automation (RPA) for Repetitive Tasks

Robotic Process Automation (RPA) uses software bots to handle rule-based, repetitive tasks like extracting data from documents, ensuring compliance, and entering information into systems. In underwriting, RPA automates the collection of external data through APIs, calculates initial risk scores, and logs compliance checks – all in real time. This automation allows underwriters to focus on nuanced decisions requiring their expertise. Before ML even begins its analysis, RPA manages data ingestion and routine verifications, orchestrating API calls and applying business rules automatically. The result? Fewer manual errors, faster policy processing, and consistent adherence to underwriting standards.

How Automation Improves Risk Assessment

Automation enhances underwriting by delivering improvements in accuracy, speed, and consistency. These advancements work together to create a system that surpasses manual processes in measurable ways.

More Accurate Risk Scoring

Automated systems analyze a wide range of risk factors, including demographics, credit indicators, loss histories, behavioral trends, location details, and exposure metrics – all at a scale that human underwriters simply can’t match. This comprehensive analysis allows algorithms to uncover subtle correlations and anomalies that might escape manual review. The result? More refined risk segmentation and precise premium pricing. Plus, as these systems process more data over time, they continuously improve their predictions, creating a feedback loop that sharpens risk assessment with every new input.

Faster Decisions with Real-Time Data

By leveraging APIs, automation pulls in real-time data – like recent credit events, payment histories, and economic trends – and processes it almost instantly. This means risk scores can be calculated in seconds, enabling instant quotes, quicker policy approvals, and a faster response to shifting market conditions. The result is a smoother, more efficient experience for both insurers and customers.

Less Bias Through Data-Based Decisions

Automated tools apply consistent, rules-based criteria, which helps eliminate the variability often introduced by human factors like mood, experience, or unconscious biases. By relying on objective algorithms, these systems deliver consistent and repeatable outcomes for every case. This standardization not only enhances decision transparency but also helps U.S. underwriters meet regulatory expectations for fair practices. While careful oversight is needed to ensure that historical biases aren’t inadvertently embedded in these models, well-designed systems offer a significant step toward reducing inconsistencies found in manual reviews. These benefits make automated tools an increasingly valuable part of everyday underwriting workflows.

sbb-itb-b840488

How Automation Works in Daily Underwriting Tasks

Automation has transformed underwriting, cutting the process from days to mere seconds. By leveraging APIs, it pulls essential data, calculates risk scores, and applies business rules to either issue instant decisions or route cases with prefilled files for further review. This efficient system categorizes applications based on their risk and complexity, ensuring each case gets the right level of attention. In short, automation creates workflows tailored to varying risk levels.

Instant Approval for Low-Risk Applications

Straight-through processing (STP) takes care of low-risk applications without any need for human input. Automated systems gather critical data – like business credit scores, payment history, financial ratios, and requested credit limits (in U.S. dollars) – to calculate risk scores and apply pre-established thresholds. The process follows tiered rules: applications scoring between 1–50 are approved instantly within set limits, 51–75 are flagged for review, and 76+ are either declined or adjusted. From gathering data to generating documents, this entire workflow happens in seconds, providing instant quotes and approvals. This speed not only improves efficiency but also enhances the experience for both customers and brokers.

These automated platforms handle a variety of tasks, including identity verification, pulling credit data, logging compliance activities, and drafting policy documents. For U.S. exporters and domestic suppliers, this means that online applications can immediately display approved credit limits in USD, bypassing delays caused by manual reviews or business hours.

While low-risk applications benefit from instant processing, more complex cases require the support of advanced AI tools.

AI Support for Complex Risk Cases

In high-risk scenarios, AI steps in as a powerful assistant rather than a decision-maker. These systems compile financial records, claims histories, trade flows, country risk indicators, and alternative data to detect patterns, generate preliminary risk scores, and highlight potential red flags. Instead of issuing final decisions, AI provides insights, such as stress tests on cash flow during economic downturns, to guide human judgment.

This approach is especially useful for assessing political risks and cross-border challenges. AI tools continuously analyze macroeconomic indicators, sanctions lists, political stability indices, and payment behaviors to create dynamic risk scores for countries and sectors. For instance, if a U.S. company applies for trade credit insurance for a foreign buyer, the system might flag the application due to risks like political instability or currency devaluation. It can then simulate scenarios – such as trade restrictions – and suggest adjusted credit limits or revised policy terms.

Underwriters benefit from dashboards that rank risks by country and sector, making it easier to spot risk concentrations at a glance. While AI provides valuable insights and recommendations, the ultimate decision-making authority remains with the underwriters, ensuring a balanced approach to complex cases.

How CreditInsurance.com Supports Automation in Underwriting

CreditInsurance.com simplifies the integration of credit insurance data into automated underwriting systems by offering a range of educational tools and practical solutions tailored for U.S. businesses. Acting as a free resource, the platform demonstrates how key credit insurance data – like buyer risk grades, approved credit limits, and insurer monitoring – can seamlessly integrate into underwriting workflows using APIs and regular data feeds.

Educational Resources on Risk Management

In December 2025, CreditInsurance.com introduced innovative digital tools designed to help businesses manage risk effectively. For instance, the Accounts Receivable Risk Assessment Tool allows companies to input credit scores and payment histories to generate clear risk scores, paired with actionable tips to protect cash flow. Another tool, the Business Non-Payment Risk Analyzer, calculates risk percentages based on customer data, offering valuable insights.

The platform also publishes detailed guides and articles on the technical aspects of automation. One standout piece, "How Cloud Platforms Improve Supply Chain Risk", released in December 2025, explores how cloud-based data centralization enhances real-time visibility, predictive analytics, and faster risk detection – key factors in automating underwriting processes.

Additional resources include the Credit Insurance Glossary Lookup, which breaks down essential terms like deductibles and policy limits, and tools like the Non-Payment Protection Planner and Accounts Receivable Protection Planner. These planners create tailored action plans, helping businesses adopt structured, automation-friendly risk management strategies.

These educational tools form the foundation for CreditInsurance.com’s broader solutions, which focus on embedding credit insurance data directly into automated workflows.

Custom Solutions for Credit Insurance Integration

CreditInsurance.com goes beyond education by offering hands-on integration solutions that allow businesses to incorporate credit insurance data into their automated underwriting systems. By integrating trade credit insurance, companies can streamline their processes – automatically approving applications that meet insurer-approved credit limits and internal criteria, while flagging higher-risk or uninsured cases for manual review.

The platform’s specialists ensure that policy structures align seamlessly with existing underwriting frameworks. For example, when insurers adjust coverage – such as reducing limits or withdrawing policies – automated alerts and workflow updates are triggered instantly. This integration is particularly beneficial for U.S. exporters and domestic suppliers, as it leverages global credit insurer databases to enhance internal risk scoring models. All financial data is conveniently displayed in USD, ensuring clarity and consistency for businesses.

Conclusion

Automation has reshaped underwriting risk assessment by delivering three key benefits: greater accuracy, faster processing, and consistent results. With the help of AI and machine learning, vast datasets are analyzed to detect patterns that manual reviews might overlook, leading to a 43% improvement in accuracy and a 31% reduction in underwriting times. Real-time data processing and straight-through systems now enable instant approvals for straightforward, low-risk cases, allowing human underwriters to focus on more intricate and nuanced scenarios.

These advancements ensure more dependable risk evaluations. Algorithms driven by data apply the same objective criteria to every application, removing subjective biases and maintaining uniformity, no matter the volume of applications. This standardized approach safeguards both businesses and their customers by ensuring risk is assessed and priced consistently.

Importantly, automation isn’t about replacing human expertise – it’s about enhancing it. By taking care of high-volume, repetitive tasks in seconds, automation frees underwriters to concentrate on complex cases, build client relationships, and make judgment calls that require experience and insight. It’s a partnership between machine efficiency and human expertise.

For U.S. businesses looking to reduce the risks of non-payment and customer insolvency, CreditInsurance.com offers practical solutions and guidance. Their integration support ensures that automated workflows lead to smarter, safer credit decisions – building a solid foundation for effective risk management.

FAQs

How does automation help eliminate bias in underwriting?

Automation helps reduce bias in underwriting by using data-driven algorithms to evaluate risk. These algorithms process vast amounts of information in an objective manner, eliminating personal judgment and emotional influences from the equation.

By creating a standardized approach, automation leads to consistent and precise assessments, enabling businesses to make decisions that are both fair and well-informed.

How does machine learning enhance risk assessment in underwriting?

Machine learning transforms risk assessment by analyzing vast amounts of data to detect patterns and trends that traditional methods might overlook. This leads to more precise predictions of defaults and a clearer evaluation of creditworthiness.

By cutting down on false positives and refining decision-making, machine learning simplifies underwriting processes, making them quicker and more dependable. It equips businesses with the tools to make smarter decisions while keeping financial risks in check.

What steps can businesses take to prevent biases in automated risk assessment systems?

To ensure fairness in automated risk assessment systems, businesses need to actively manage how these systems are developed and maintained. A key step is to frequently review and update the data used for training. Using diverse and representative datasets is essential to avoid perpetuating past inequalities or inaccuracies that might skew outcomes.

Another important measure is leveraging bias detection tools. These tools can pinpoint unfair patterns in decision-making, making it easier to address potential issues. Regular audits and system adjustments help maintain fairness, accuracy, and alignment with ethical principles over time.