Understanding Trade Credit Insurance Costs for Your Business

Running a business often means extending credit to customers, but what happens when they don’t pay? That’s where trade credit protection comes in—a vital shield against financial losses. If you’re exploring options to safeguard your revenue, estimating the cost of this coverage is a smart first step.

Why Estimate Your Premiums?

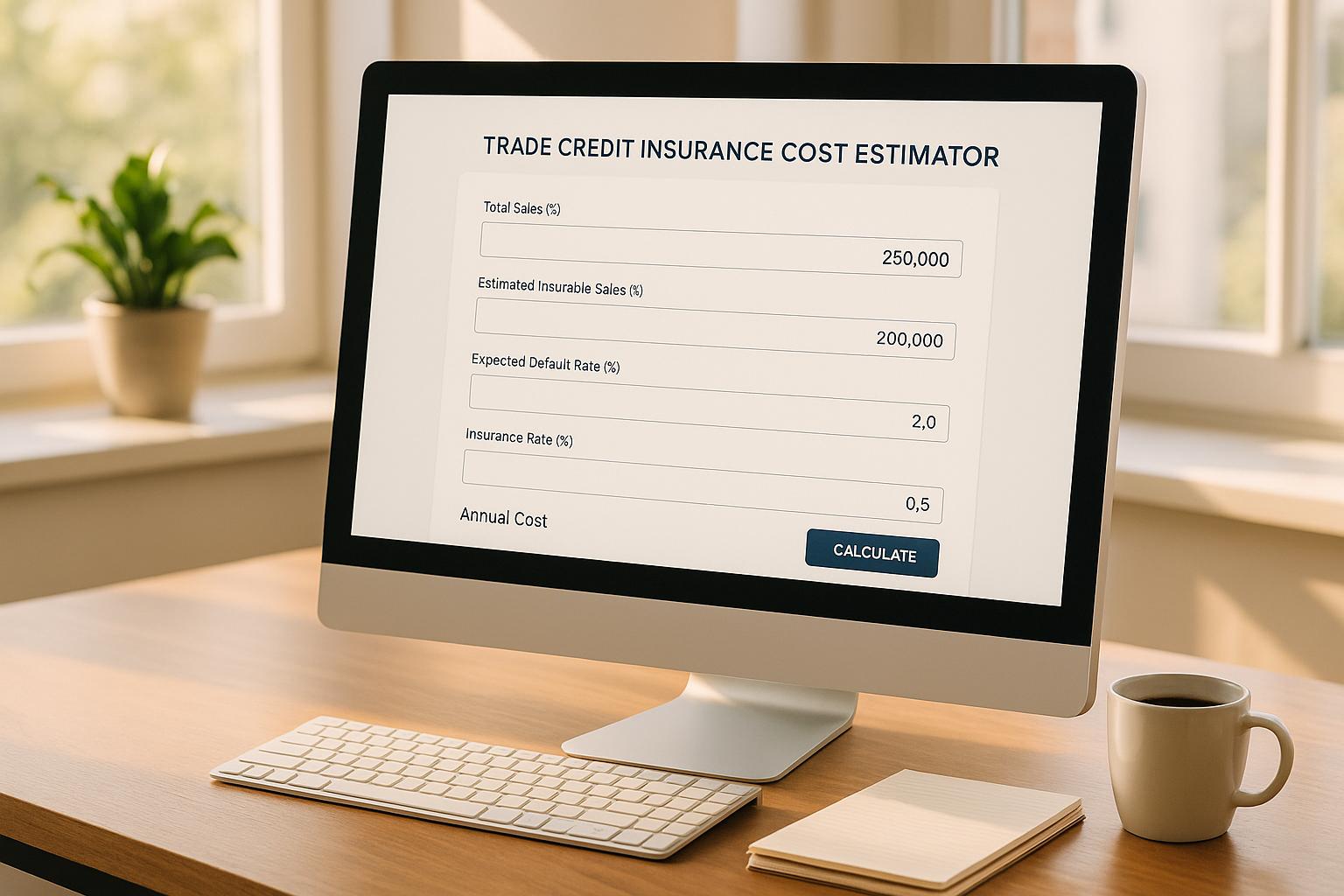

Every business is unique, with factors like annual revenue, credit sales volume, and industry risks playing a big role in determining insurance expenses. A tool that calculates potential premiums can demystify the process, helping you budget for protection against unpaid invoices. Whether you’re in a low-risk sector or a more volatile market, knowing the ballpark figure for coverage empowers you to make informed decisions.

Beyond the Numbers

While tools provide a helpful starting point, they also highlight the value of securing your cash flow. Non-payment risks can disrupt operations, especially for small businesses. By exploring protective measures, you’re not just crunching numbers—you’re investing in stability. Curious about your specific situation? Try a quick calculation to see how affordable peace of mind can be for your company.

FAQs

What exactly is trade credit insurance?

Trade credit insurance protects your business if a customer fails to pay for goods or services you’ve provided on credit. Think of it as a safety net—it covers losses from unpaid invoices due to insolvency or other issues. This can be a game-changer for businesses that rely heavily on credit sales, giving you peace of mind to focus on growth instead of chasing payments.

How accurate is this cost estimator?

Our estimator gives you a solid ballpark figure based on standard industry rates and risk factors. We use a base premium of 0.5% of your credit sales, adjusted for your industry’s risk level and the coverage you want. Keep in mind, though, that actual quotes from insurers might vary based on specific underwriting criteria or additional details about your business. It’s a great starting point to understand potential costs!

Why does industry risk level affect the cost?

Not all industries carry the same level of risk when it comes to unpaid invoices. For example, sectors like construction might face higher default rates compared to, say, retail. Insurers adjust premiums using risk multipliers—low risk gets a 1.0x rate, medium is 1.5x, and high jumps to 2.0x. This reflects the likelihood of claims and helps balance the cost of coverage for everyone.